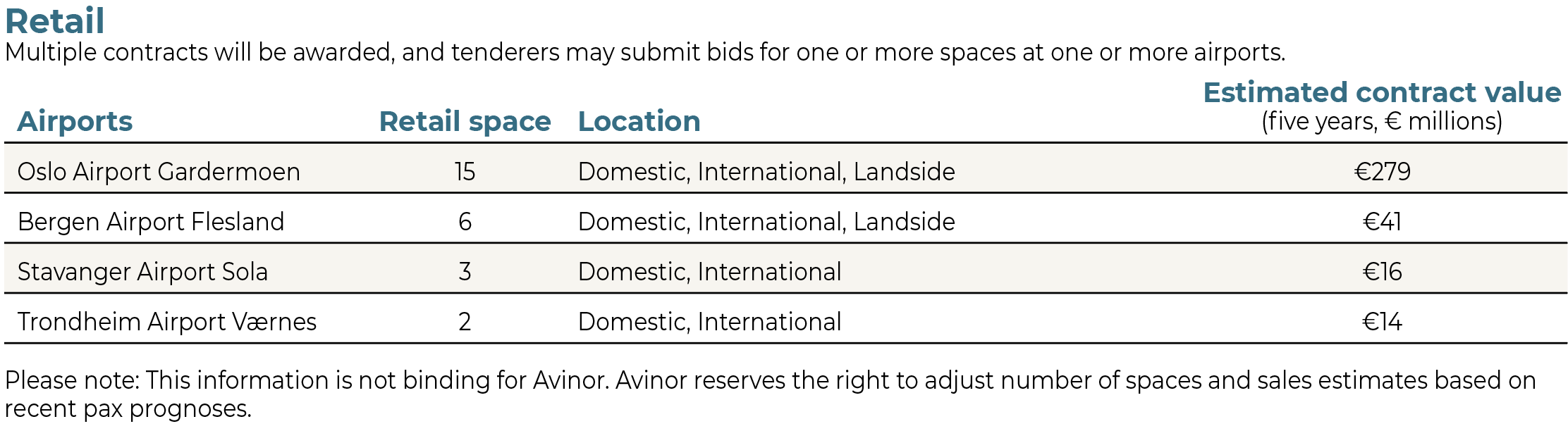

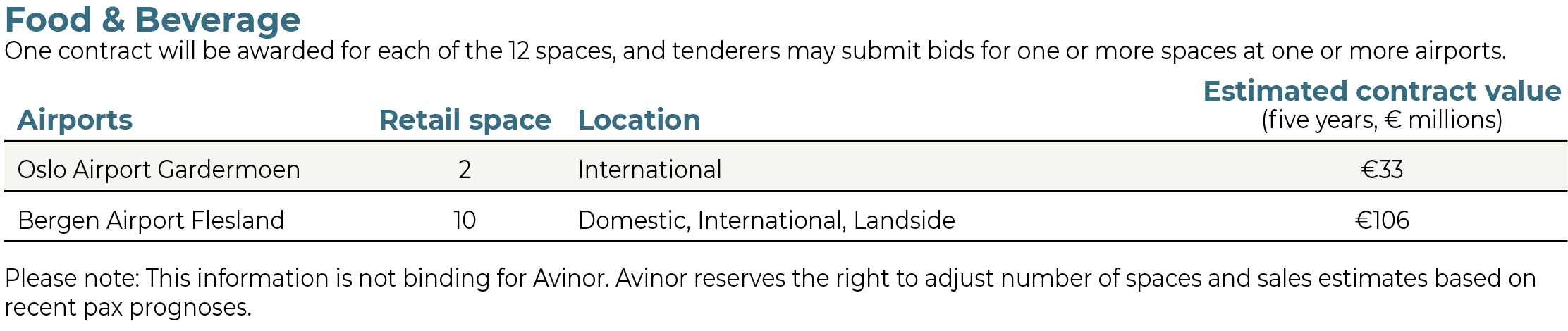

Introduction: Norwegian airports operator Avinor has just launched a major tender covering 62 speciality retail, convenience and food & beverage outlets that has sparked strong interest from potential partners in Norway, Europe and around the world. The contract packages on offer include outlets at Oslo, Bergen, Stavanger and Trondheim airports, as well as all F&B locations at Bergen Airport.

Avinor estimates sales of around €830 million over the five-year term, starting from January 2023, and is marketing this valuable opportunity through a campaign in partnership with The Moodie Davitt Report (as it did last year when launching its core category duty free tender).

In this interview, Avinor Executive Vice President for Commercial Areas Joachim Lupnaav Johnsen and Bergen Airport Head of Commercial Aina Tysse discuss the opportunities, explain why bidders should be attracted by flexibility in the contract model and assess the potential for market recovery and growth in Norway.

Strong categories and a healthy proposition for bidders

“This is a big tender for us. €830 million in sales is a lot of money. We are bringing the biggest airports in the Avinor network into play, and we are launching 38 contracts across multiple categories simultaneously.” Avinor Executive Vice President for Commercial Areas Joachim Lupnaav Johnsen outlines the opportunity associated with a major tender launched by Norway’s state-owned airports company for retail and dining outlets across its largest airports.

Avinor says it is seeking “local and international partners with inspiring and sustainable concepts within retail and F&B that elevate the travel experience for our passengers”.

This is the latest major commercial bid process issued for Norway’s airports in the past year. In January 2021 Avinor tendered its duty free & Travel Value stores at 11 airports, with Travel Retail Norway and Airport Retail Norway capturing the key contracts.

Now the focus turns to convenience, fashion & accessories, consumer technology, destination merchandise and food & beverage (principally in Bergen). Each of these represents a sizeable business in its own right, made more attractive by a simultaneous launch of 38 concessions across multiple categories, allowing partners to choose whether they want to bid for one or more contracts in one or more airports.

Johnsen notes: “These are strong categories for our business and a healthy proposition for our vendors, and together these will help improve the offer to our passengers.”

Convenience at the core

With over €340 million in estimated sales over the term, convenience and travel essentials represent the biggest opportunity among these categories by turnover. “During the pandemic we have seen that convenience is the backbone of commercial activities, especially when other services were closed,” says Johnsen. “They are also an important part of the service expected by customers who are seeking immediate essentials such as snacks on the go.

“What is crucial here is fast, efficient service, value for money and a good selection of products, which these days also includes food.”

Books & news at around €83 million is another category that responds to core consumer needs. “These stores are part of the bread and butter of the offer but now we want to find new ways to sell this category. How can make it more interesting, use different styles of layout and so on? These are questions we have been discussing with various vendors,” notes Johnsen.

The future for fashion

Fashion & accessories at around €100 million in projected sales is led by locations at Oslo Airport, where a new central square layout (more on this below) will see stores integrated into space around the core duty free shops run by Travel Retail Norway, alongside F&B and other channels.

Avinor says that the multi-brand fashion concept it has favoured down the years will remain a focus. “We want vendors who can bring a high-class shopping experience with good business,” says Johnsen. What we found is that mono-brand stores were really too small and too specialised for this market, meaning they had to put all the emphasis on marketing, and multi-brand shops have been shown to work well for our airports.”

There will still be opportunities for innovative or inspiring concepts or brands that address emerging consumer needs. “We have five lifestyle stores where we are flexible on what the final concept will be,” says Johnsen. “We estimate sales of €49 million from these, and they could be an opportunity for an emerging trend to be represented, for example outdoor or activewear which is a growing area.” Johnsen says that Avinor has not been overly prescriptive in its category demands, rather that it wants to listen to the market, especially in areas such as fashion and lifestyle where matching prevailing consumer trends is vital. “Rather than a set of absolute criteria we have set out what we think are interesting areas to pursue. We have put the questions but we believe there are different answers and we look forward to hearing what those might be.

Johnsen says that Avinor has not been overly prescriptive in its category demands, rather that it wants to listen to the market, especially in areas such as fashion and lifestyle where matching prevailing consumer trends is vital. “Rather than a set of absolute criteria we have set out what we think are interesting areas to pursue. We have put the questions but we believe there are different answers and we look forward to hearing what those might be.

“Not only that but some of these categories lend themselves to click & collect, which has grown a lot during the pandemic. You could order a dress and collect on return or even have it home delivered. It’s also about trying to expand the assortment through digital spaces by using the logistics capabilities that we have put in place, and extending the shopping experience.

“That also comes down to why you are at the airport, as a brand especially – and we have been talking to brands too, not only retailers. Some are there for classic marketing purposes, others to shift volume. There are different aims here, and it is going to be interesting to see how this falls out in the competition. I am actually quite excited to see what is going to come back to us, especially on the fashion side.”

Also of strong relevance in fashion is the addition of more pop-up spaces for trial and testing at the airports.

Johnsen says: “Through separate tenders on pop-up spaces, it may be possible to combine a physical, permanent location with a pop-up space to host launches or do seasonal campaigns. That could be pretty cool. With our new square concept at Oslo this layout could help take advantage of promotional spots and add a new experience.”

| Tender timeline Launch date: January 2022 |

In consumer tech, valued at around €91 million in five-year sales, Oslo and Bergen are the two locations included in the tender. Johnsen says: “We have had strong interest in this category, which is an important one. We see increasing demand for on the go electronics and accessories.”

Beyond this, other concessions include two pharmacies (in Oslo and Bergen) as well as two souvenir shops.

The food & beverage opportunity – estimated at around €140 million with most of the business on offer under this tender at Bergen Airport – continues to evolve.

Johnsen says: “This is where we have a real opportunity to include a Norwegian touch, feel and local flavour. We want more choice and offers that represent good value for money, which is very important to regain the traction we had before in F&B.”

A point of difference in Bergen

While the largest units across these contracts are available at the key gateway of Oslo, Bergen Airport also represents a big opportunity.

There, all ten F&B concessions go to market, alongside two at Oslo [other contracts at Oslo will go to market later -Ed]. That is in addition to all non-duty free retail.

Bergen Airport Head of Commercial Aina Tysse says: “With all dining and retail this is a very important tender for us. Overall we will have the same area plan as today but because we need to add more retail we are converting some spaces. One F&B space for example will become an activewear concept. Many of our visitors want to experience nature for which our region is well known. That in turn has led to demand for travel gear, so we look forward to seeing the concepts that are put forward for this.

“We will also build the electronics offer and we need to include a souvenir store in the international area of the terminal. This will also serve demand from the many tourists visiting our region.”

F&B is a core component in driving passenger satisfaction, notes Tysse, who says it remains a “big part of the travel experience”. She adds: “We must have diversity, on the one hand for those who want a quality meal with a glass of good wine when time permits, but also on the other to serve a quick coffee and snack to the business traveller heading to Oslo or elsewhere. The mix must be right and the price must be right.”

Bergen Airport has identified a need for an enhanced fast casual food offer, says Tysse, while Asian and healthy food concepts are also in demand and could be options.

“Seafood is well known for its freshness and quality in Bergen so that remains appropriate for us, and adds Sense of Place,” she says. “Also important is a catch-all restaurant with pizza, pasta and burgers so we will keep that type of concept.

“But we didn’t have a branded fast food outlet over the past five years, so that has been added to the area plan. How we present healthy food is something we have been discussing a lot and we will address this in the tender.”

More generally, she adds, Bergen Airport requires a sound blend of local and international concepts in its commercial mix. “We have a high number of travellers from the region and also a strong international traffic base. It’s important to us to fulfil the wishes of both those target groups. Sense of Place matters in store design and in the offer, which we will emphasise in the tender documents. We hope the partners will use the information we present and show what they can do to offer a great experience and enhance passenger satisfaction.”

Structuring the tender

Johnsen says: “We currently have a good mix of operators and we still want to have that in the future set-up. We aim to trigger international interest in building scale and volume. But we also must ensure we encourage local players with niche, high-quality opportunities. We all know that competition is good, and important to ensure a wide offering that meets the travellers’ demands.

In announcing the tenders, Avinor says that it aims to attract the widest possible field with contracts that are “based on variable rent, risk-reducing measures and competitive terms”.

Elaborating on this, Johnsen says: “We are taking a similar approach to what we did for duty free. In practical terms there is no fixed rent at all on sales premises (other than operating costs), only on back office space and storage.

“We will put a simplified MAG (minimum annual guarantee) threshold in place as part of the deal and the bid element will be the variable concession fee, not the MAG. So in short, if the passenger numbers skyrocket, both parties benefit. If numbers fall we both face the same challenge. Worst case, if passenger numbers are -50% less than estimated, it may be possible for the bidder to exit the contract.”

Johnsen says that the big question that potential bidders put to Avinor is around risk in an uncertain time that may stretch into the early part of the contract, and this approach addresses this issue, he says.

“We believe they appreciate the path we are taking, but they also see the opportunity, and the dynamics in the market. For example, as soon as the restrictions are eased we see sales volumes rising sharply.

“Not only that but it’s important to note that the fundamentals of the core Norwegian market are very robust. We see this in the domestic market and that translates to travel retail. There is also high interest in Norway from visitors. The airlines are making plans to extend frequencies, we now have a direct New York to Bergen air route, and we have high expectations for the Summer season ahead.”

The outlook for the years ahead is also solid, even with the recent downturn related to Omicron and the possibility of new COVID variants emerging. Avinor is budgeting for a weak first quarter of 2022 – with international travel around 30% of 2019 numbers – but in the key period from June to August the company is forecasting a recovery to around 87% of 2019 traffic.

That optimistic view mirrors the sharp recovery that occurred last Summer and Autumn, when Norway’s domestic and regional traffic surged back. At Bergen Airport, says Tysse, calendar week 45 (during November) saw volumes reach 85% of 2019 levels. “When we speak with the airlines they are now talking about a return to high levels of traffic once restrictions loosen,” she notes.

Those healthy projections put the wider Avinor network it well on track for full recovery by 2024 including a further year of growth in 2023 – all with the assumption that further variants don’t halt the return of travel for prolonged periods.

| A new ‘stage’ for travel retail at Oslo The introduction of a central square concept at Oslo Airport (depicted below) will represent a “completely new stage for travel retail in Norway,” says Avinor’s Joachim Lupnaav Johnsen – and is the focus of much of the planned investment in commercial infrastructure in coming years. By the time new contracts begin in January 2023 around half the square will be complete, with the final additions before the Summer season next year.

“Integration is the key word here,” says Johnsen. “That means the integration between food & beverage, retail, pop-up concepts, entertainment, all within a nice, comfortable environment. We want to provide the travellers with choices. You can spend time there and be entertained and inspired, or else you can walk through to your gate. “We are leaving behind the classic funnel thinking, which forces customers through the space to get them to buy something. This will be a much more open space where you can choose to buy your duty free or a book or a jacket, where you can relax and have a coffee or a beer, or do both in adjacent spaces. All of that means tearing down walls, tearing down barriers that traditionally channel travellers though the space. It will be a big change. It is an experiment for us but that freedom of choice is something we believe in.” Johnsen adds: “With new contracts, we open up for more flexible operations. You can flex some of the interior space, you can try new ways to dress your front window, use your own logos, and we are changing retail guidelines to make it all look less regimented and stiff. We want to facilitate the best possible customer experience, and we want the retailers and the concepts behind them to be the heroes.” |

Encouraging international interest

The Avinor team has also been working to attract as wide as possible a spread of candidates from overseas to complement the expected interest among local players for the key concessions. That also means understanding their requirements to come and bid in what for some will be virgin territory, and for contracts that don’t include duty free.

Johnsen says: “For some, they missed out on duty free but they are taking a longer view and see this as a stepping stone into the market in five years’ time. But there are also great commercial opportunities in the other concessions, and the simultaneous launch of 38 contracts across multiple categories opens interesting opportunities for large, international players. We want to welcome them to Norway, and hope they will want to stay for the long run. The key question for them is the pandemic and contractual concerns. But we know that Norway is attractive for them with our travellers’ high spending power and income per passenger.

“We have also made concrete moves to attract the local players and we need the competition, including from local champions, to offer quality concepts that also create interest for the consumer.

“For now we have seen good levels of interest, and visits from potential partners, but the proof will come when we open the documents in March.”

Co-creating the future

Looking ahead, and to facilitate what it terms ‘next generation travel retail’, Avinor plans to develop an enhanced customer data and analysis platform, which will aid its partners. Customer insights will be continuously gathered and shared with them, it says, “to enable optimisation of operations and store offerings, as well as customisation of marketing and customer communication”.

Building on this message, Johnsen says: “We need to be present along the customer journey, and take advantage of the digitalisation wave. With that in mind we want to increase the operational and commercial capabilities of our partners. With a new data-sharing programme we aim to deliver the best insights into our customers that help our partners maximise revenues.

“This can take two forms. What can we do on data-sharing that helps our tenants to become more efficient? And on the commercial excellence side how do we make them sell more?

“The types of solutions can range from early signals on bookings, security control, waiting times, customer flow, all elements that help them plan or react better. And it’s also about trying to use data sources to create better consumer offers. Why shouldn’t you for example be able to buy a fast track through security and a breakfast at the same time?

“Our job is to facilitate this business so we’ll be doing a lot of work in the next year on data and digitalisation.”

To summarise the tender opportunity, Johnsen says: “This is a high value market, and these are high-value contracts. When everything goes as it should, there is huge sales volume in the Norwegian airport industry.

“The pandemic is temporary and there is going to be a scenario where we get through this at some stage, and after that we will rely on the power of the consumers. The travel appetite is there and we have seen how fast the market recovers already.

“Alongside this we have some flexible, attractive contractual elements, where you basically don’t pay if there are no passengers in the terminal. All of that combined makes this a big opportunity for potential partners.”

Note: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly, The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. We embrace all commercial revenues, including duty free and other retail, food & beverage, property, passenger lounges, hotels, car parking, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.