USA. Global beauty house Coty – whose brands include Gucci, Calvin Klein and Hugo Boss – has announced a far-reaching turnaround plan for the next four years.

The plan’s implementation will incur one-time cash costs of approximately US$600 million spread over FY2020 through to FY2023, in addition to US$160 million connected to previous programmes.

The market reacted negatively to the announcement yesterday, with Coty’s share price dropping from Monday’s opening of US$13.53 to US$11.59 at close. The company’s value perked up earlier this year after a downward trend going back to 2016. This followed the news that its biggest shareholder, JAB Holdings, wanted to take a controlling stake in the company.

The core reason for the prior extended fall was the difficulty in merging P&G Beauty, a project that has now been completed and which has helped push annual revenue to US$9.4 billion. “With the merger, Coty has built a platform whose quality is often overlooked. It is now ready for an inflection,” Coty CEO Pierre Laubies told analysts yesterday.

The company’s plan has three strategic aims: to ‘rediscover’ growth, to regain operational leadership, and to build a culture of pride and performance. Combined, they are expected to steadily improve gross margin and operating margin “more in line with Coty’s peer group” the company said in a statement.

“Strategic effort on fewer brands”

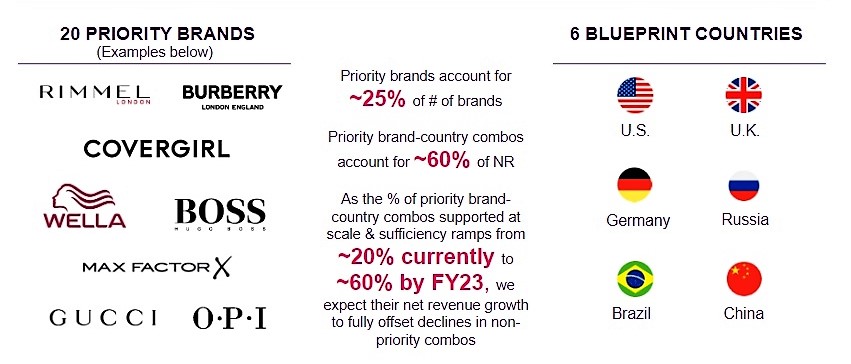

Laubies added: “We will focus our strategic effort and investments on fewer brands globally while simplifying our operations and organisation. At the same time, we will make our cultural transformation agenda a key building block. We are fortunate to have a strong brand portfolio and talented and engaged people around the world, and we will provide the right framework to enable their success.” Among the brands to have extra focus are Boss, Burberry, Gucci, OPI and Rimmel, the first three of which are prominent in travel retail.

From a financial perspective, Laubies said that his priorities were to improve profitability “and we are intent on setting realistic targets and delivering them”. Coty Chief Financial Officer Pierre-André Terisse concurred: “We have built a realistic four-year plan focused on restoring our profitability and deleveraging our balance sheet. We will recover competitiveness by strengthening our brands, expanding our gross margins and methodically reducing our costs.”

Coty believes this will give it the flexibility to step up commercial investments, expand its operating margin and enable the company to achieve a leverage ratio of net debt to EBITDA below 4x by FY2023. Terisse added: “Our new company-wide incentive system will be aligned to these financial objectives. We are confident we can deliver them.”

Prioritise ‘brand-country’ combinations

From a retail perspective, Coty will prioritise brand-country combinations and “invest at scale”; improve shelf productivity by optimising assortment choice while simplifying product range and brand architecture; improve the portfolio structure and optimise promotional tactics for higher-margin pillars; and build an innovation pipeline to support expansion.

Operationally, Coty expects to reduce complexity and costs through improvements in Coty’s supply chain; rationalisation of SKUs and sub-ranges; and cut fixed costs such as organisational layers and positioning all key markets closer to the Executive Committee.

Commercial and marketing responsibilities are being split which Coty says will “create scale in markets”. As such, Coty expects to move from its current organisational structure into two regional commercial teams: Europe, Middle East & Africa (EMEA), Americas & Asia Pacific; and brand marketing units for Luxury and Consumer Beauty. Professional Beauty is expected to remain a distinct business unit due to its unique salon channel focus. All markets will be supported by shared functions.

In connection with this new organisation, the following changes to Coty’s Executive Committee will be effective by 1 January 2020: Edgar Huber will be appointed President of Americas & Asia Pacific; Gianni Pieraccioni will become President of EMEA; Fiona Hughes will be appointed President of Consumer Beauty Brands; and Simona Cattaneo will become President of Luxury Brands. All other members of the Executive Committee will remain in their current roles.

Coty intends to create a centralised management headquarters in Amsterdam where most of its executive team and corporate functions will be based. “Amsterdam is a cost-efficient and tax-stable location, conveniently located to Coty’s main markets and has a strong base of FMCG talent,” the company stated.

The full structure implementation and consolidation of management headquarters are expected to be completed by 1 July 2020, subject to legal processes where required.

For FY2020 (versus FY2019) Coty expects a moderate decline in net revenue but constant currency adjusted operating income to be up between 5% and 10%.