Investment firm JAB Holdings, which is already the largest shareholder in Coty Inc, is set to make a tender offer that would give it control of the beauty company.

JAB is set to make a tender offer worth around US$1.75 billion for 150 million shares at a price of US$11.65 per share in cash.

JAB said this represents a premium of around 38% on the 90-day volume-weighted average share price as of yesterday, a premium of 51% to the 30-day volume-weighted average share price, and a 21% premium to yesterday’s closing share price. If accepted, the offer would give JAB control of around 60% of the issued and outstanding shares of common stock in Coty.

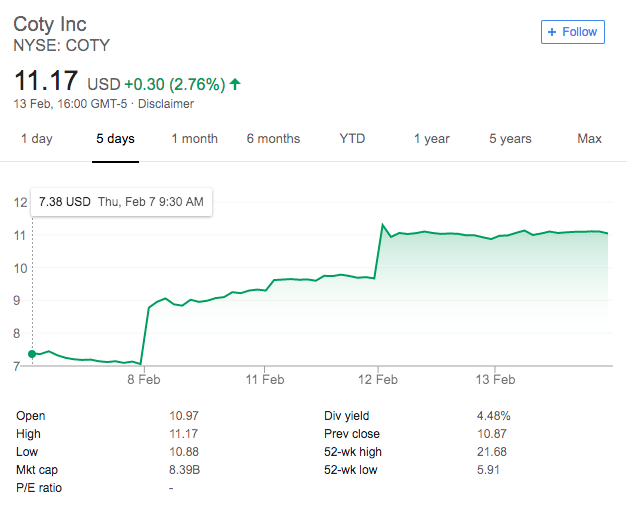

The proposal has underpinned a surge in Coty’s share price in recent days, which had fallen by more than half in the past year against a backdrop of weak sales and missed financial targets.

JAB Holdings is a long-term investor in consumer goods and services. As well has owning a stake in Coty for almost 30 years, it owns a controlling share in luxury goods company Bally as well as a minority stake in Reckitt Benckiser, which sells health, hygiene and home products. JAB also has stakes in coffee, beverage and food companies, including Keurig Dr Pepper, Pret A Manger, Krispy Kreme Doughnuts and Jacobs Douwe Egberts.

JAB said it was making the move to address the company’s recent performance, in which senior management changes, as reported recently, were “an important first step”.

In a letter to the Coty Board of Directors, JAB said: “If shareholders tender more than 150 million shares of Common Stock, we will purchase such shares on a pro rata basis. We at JAB have been investors in the company for almost three decades and expect to remain so. We believe that the company has the potential to address its challenges and prosper over the long-term.”

The offer is subject to certain conditions, including that the independent directors of the company approve it and recommend that shareholders accept.

JAB said it has sufficient financial resources to back its offer, with debt commitments from BNP Paribas, HSBC Bank and UniCredit Bank.

Coty’s major brands in travel retail include Calvin Klein, Marc Jacobs, Hugo Boss and Gucci.