USA. New York-based beauty house Coty this week announced largely flat like-for-like sales (+0.4%) for its full year ending June, but generated a strong +22.8% increase in reported revenue to US$9,398 million.

USA. New York-based beauty house Coty this week announced largely flat like-for-like sales (+0.4%) for its full year ending June, but generated a strong +22.8% increase in reported revenue to US$9,398 million.

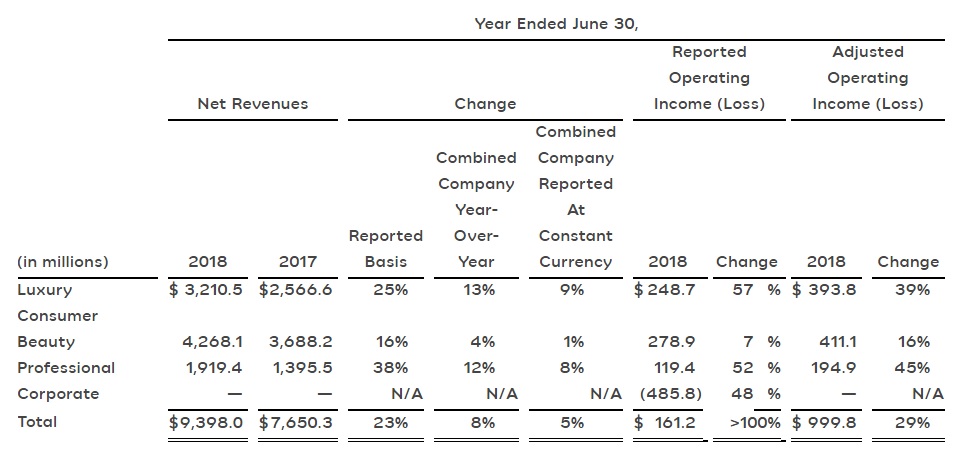

The reported revenue hike was mainly “driven by a very strong performance in the Luxury division” said Coty, citing “strong momentum” in travel retail.

The group also noted that Executive Vice President and Global Chief Financial Officer Patrice de Talhouët will leave the company mid-September to pursue other opportunities and that a cost-saving programme is being started. A search for de Talhouët’s successor is underway.

Luxury delivered like-for-like growth of +6.0% while Professional Beauty produced a +1.7% like-for-like rise. Both divisions helped to offset a -4.0% like-for-like decline in Consumer Beauty revenue (the company’s biggest division).

Reported operating income for FY2018 improved to US$161.2 million from a loss of US$437.8 million in the prior year, helped by a decrease of restructuring and acquisition-related costs mainly related to the integration of the P&G Beauty business.

Earning per share also substantially improved but were still negative at US$(0.23). The share price slipped off Monday’s close of US$12.40 to hover at the US$11.10 mark at midday (EST).

CEO Camillo Pane said: “Coty made good progress in fiscal 2018, although much remains to be done. We delivered our target of modest like-for-like net revenue growth and, importantly, a very healthy improvement in adjusted operating margin in the second half.

“Transformation after an immensely complex merger takes time. We are building and streamlining back office processes, upgrading systems, optimising our manufacturing and logistics, and overall, simplifying our operations.

“In parallel, we are investing in our brands and starting to transform our digital capabilities to fuel sustainable growth. While we work on the full turnaround of the new Coty, we are pleased with the significant progress we have made in under two years and expect the integration to be largely completed by the end of FY2019.”

US$250 million cost-savings programme

Coty also reflected on its lack of like-for-like growth and noted: “With the contraction of the business in FY2017 and flattish results in FY2018, we need to right-size our fixed-cost base to align with our current top line reality and are thus announcing a new US$250 million cost-savings programme. This is being run independently from our P&G integration efforts and the previously communicated one-off cost programme.”

The aim of this restructuring – together with other synergy commitments – is meant to drive simplicity and generate flexibility in Coty’s P&L to fuel strategic investments in areas such as digital and e-commerce. The company expects to deliver up to US$150 million in total gross savings in the next three years as a result.

Interim CFO stand-in

Meanwhile, as Talhouët departs, Coty’s Senior Vice President, Group Controller Ayesha Zafar will serve as an interim CFO from 15 September, until a successor is found. Zafar has been Coty’s principal accounting officer for more than two years.

Commenting on de Talhouët’s role, Coty CEO Camillo Pane said: “Patrice has made a significant contribution during his time as CFO. I am thankful for his valued service and personal commitment. His leadership was especially important during Coty’s integration of the P&G Specialty Beauty Business, which is now largely complete.”

Performance by division

Luxury – Net revenue reached US$3,210.5 million, an increase of +25.1% versus the prior year (+6.0% like-for-like) “fuelled by strong momentum in all regions and travel retail”. Growth was powered by Gucci Bloom and Tiffany, strong performances from Calvin Klein and philosophy, and innovative executions across other global brands such as Chloé Nomade and Marc Jacob’s Daisy Love, each gaining share in 4Q18, claimed Coty.

The company said: “We remain excited about the prospects for Burberry. While not fully finished, we have made significant progress in reducing Burberry trade inventory since acquiring the business in October 2017.

Consumer Beauty – Net revenue totalled US$4,268.1 million, growing +15.7% (-4.0% like-for-like) an improvement on -10% in FY2017. Coty said “recovery is taking longer than expected” not helped by the decline of the mass beauty market in Europe and North America, stronger competition, and a retail environment shifting towards speciality retailers and e-commerce.

“While FY2018 was a step in the right direction, we are not satisfied with our results and will continue to drive for a better outcome in FY2019, in particular by targeting revenue growth in ALMEA, overall e-commerce, and Younique,” Coty said. Younique is an online peer-to-peer social selling platform. Brands in the division include CoverGirl, Max Factor, Rimmel, Wella and Clairol

Professional Beauty – Net revenue reached US$1,919.4 million, up by +37.5% (+1.7% like-for-like) driven by good growth from hair brands and mid-single digit growth of the OPI nail brand. Wella Professionals had a strong year.

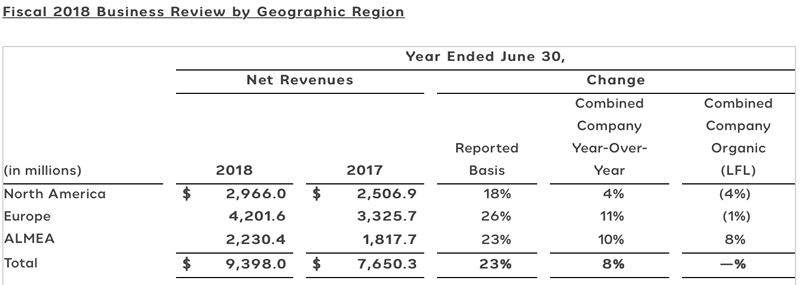

Performance by region

North America – Net revenue hit US$2,966.0 million, up +18% (-4% like-for-like) driven by Tiffany and Gucci in Luxury, and Professional Beauty, but unable to offset pressure in Consumer Beauty amid the relaunches of CoverGirl, Rimmel and Clairol.

Europe – Net revenue reached US$4,201.6 million, an increase of +26% (-1% like-for-like) with growth in Luxury and stable performance in Professional Beauty managing to largely balance out declines in Consumer Beauty due to market pressure, gradual relaunch progress, and recent supply chain disruption.

ALMEA (Asia, Latin America, Middle East, Africa and Australia) – Net revenue rose to $2,230.4 million, up +23% (+8% like-for-like) fuelled by strong momentum in Luxury and Professional Beauty. A flat performance in Consumer Beauty reflected declines in Brazil but were offset by growth in all other markets.

Looking ahead

Pane said: “We view FY2019 as an important step to achieve our medium-term ambitions. For FY2019, we are targeting well over 100 bps of adjusted operating margin expansion which, combined with our target of flat to modest like-for-like net revenue growth, would deliver mid-teens adjusted operating income growth.”

He added that impacts related to the P&G integration “will be largely over by the end of first half 2019 and our FY2019 targets take these disruptions into consideration”.

With integration entering its final stages by then, Pane said the focus would be “on rejuvenating core business and amplifying our growth potential by supporting and strengthening our brands, developing a stronger innovation pipeline, advancing our end-to-end digital transformation, and expanding our presence in the faster-growing emerging markets”.