Coty shares surged yesterday after the US beauty products group posted above expectations profits for its second quarter, ended 31 December.

Importantly, the cosmetics-to-fragrances company said that the coronavirus outbreak will have a relatively small impact on its earnings. Coty stock surged as much as +22% on the results before closing up +14.47% at US$12.18.

Chief Financial Officer Pierre-Andre Terisse told Reuters the company would take a hit from the coronavirus but that it would be less significant than for its competitors. China accounts for just 3% of Coty’s overall sales, while its fragrance-led travel retail portfolio is less vulnerable to a Chinese downturn than competitors such as The Estée Lauder Companies or L’Oréal.

“Investors have been on edge with beauty and personal care companies because of the impact of the coronavirus, and specifically the impact it will have to sales in the greater China area and travel retail channel,” CFRA Research analyst Arun Sundaram told the news agency. “The tone and commentary today gives investors a bit more confidence that COTY will fare better than its peers.”

Coty is one of the world’s leading beauty companies with approximately US$9 billion in annual net revenues. It is the global number one in fragrances, #2 in salon hair, and #3 in colour cosmetics.

The company is now two quarters down the road of a four-year roadmap to return to revenue growth, expand margins to 14-16%, and delever to 4x.

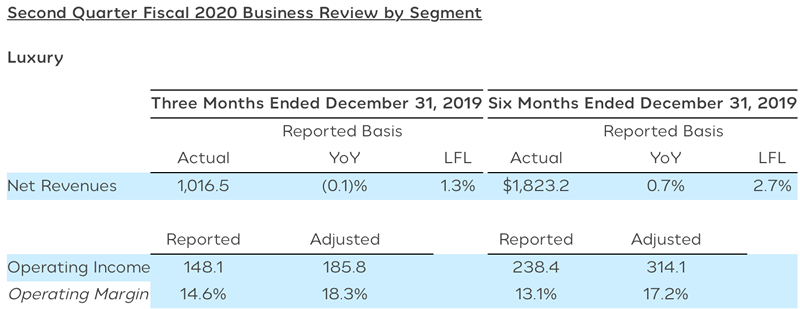

Q2 net revenue decreased -6.6%, with a -1.4% organic, like-for-like decline. However, the luxury sector (see panel at foot of the page), key to the company’s travel retail activities, saw a +1.3% like-for-like rise in net revenues (off a high +10% gain in the equivalent quarter last year), fuelled by growth in travel retail, ALMEA, and Europe. Gucci makeup was a standout performer.

“In Q2, we launched the second pillar of our Tiffany fragrances called Tiffany & Love, which performed incredibly well in market” – Coty CFO Pierre-André Terisse

Travel retail also played a lead role in the company’s key European region, which generated net revenues of US$1,172.9 million, or approximately 50% of total net revenue. While the region’s revenues were down -2.4% on a reported basis, they rose +1.5% like-for-like, a strength driven by growth in luxury, particularly travel retail, and professional beauty.

For 1H20, adjusted operating income grew +8.5% on a constant currency and scope basis.

Coty CEO Pierre Laubies said: “Our turnaround plan has now been underway for two quarters, and we are confident that the actions we are taking will build a much healthier business and growth. We saw momentum across many of our priority luxury brands, including Burberry, Gucci, Tiffany and Hugo Boss, while continuing to grow our footprint in luxury colour cosmetics.

“Our global sell-out trends continue to improve in key mass beauty categories, and brands like Sally Hansen and Rimmel are gaining share in several core countries. The organisation remains vigilant in driving strong gross margin improvement, activating the levers at the centre of our strategy: mix management, select price increases, more disciplined promotions, and forgoing low value sales.

“This has allowed us to continue to increase the working media investments behind our brands. Although we are in the early stages of deploying our strategy and much work remains ahead, we continue to be very enthusiastic about the business we are building and our growth prospects.”

CFO Pierre-André Terisse said: “Our second quarter results were in-line with our expectations and underpinned by strong results in our gross margin and free cash flow generation. This makes me confident in our ability to achieve our targets for the year. In the second half, we will start implementing restructuring and supply chain improvement, as per our turnaround plan. Additionally, we are progressing as planned with our strategic review, with strong interest from multiple parties, and continue to target a decision by this summer.

“Last, we have now commenced a strategic partnership with Kylie Jenner, and we look forward to building a high growth, digitally native beauty brand. In sum, we are continuing to execute on the three pillars of our roadmap, including implementing our turnaround plan, refocusing on our core fragrances, cosmetics and skincare businesses in conjunction with a substantially improved leverage profile, and amplifying our growth potential.”

People, products and planet

Coty also announced a new sustainability strategy titled “Beauty that Lasts”, with updated targets focusing on three pillars: people, products and planet. The sustainability strategy is part of the company’s turnaround plan to build a better business for all stakeholders while making a positive contribution towards achieving a more sustainable and equitable world.

This strategy reinforces Coty’s continued support of the UN Global Compact Ten Principles which was announced five years ago.

| Luxury a key growth driver In 2Q20, Coty reported luxury net revenues of US$1,016.5 million, down -0.1% versus the prior year. On a like-for-like basis, however, those revenues increased by +1.3% from a high base, with travel retail playing a key role. Second-quarter results were supported by strength in Burberry, Gucci, Tiffany, Hugo Boss, and Lacoste, fuelled by strong innovation. In particular, the Q2 launch of Tiffany & Love broadened the brand reach to both female and male fragrances, driving market share gains in core markets, Coty said. In an earnings call, CFO Pierre-André Terisse said: “In Q2, we launched the second pillar of our Tiffany fragrances called Tiffany & Love, which performed incredibly well in market. This launch confirmed the appeal of the Tiffany brand for both males and females and has driven market share gains for the overall Tiffany brand across the US, the UK, Germany, Canada and Italy. “Our continued support and activation behind Marc Jacobs’ Daisy has now firmly placed the iconic fragrance pillar into the top four fragrances in the US, in the UK, and Canada. And we continue to drive growth across our focus brands, Burberry and Hugo Boss.” Terisse added, “Our sell-out will be supported by a strong innovation pipe with CK Everyone coming in Q3, as well as Hugo Boss Alive, both fragrances for women; and later in the year the expansion of the Gucci makeup branch and other innovations, including Burberry, Marc Jacobs and Hugo Boss. So, luxury More colour coming soon The company’s early stage expansion into luxury cosmetics continued to progress well, with Gucci lipstick gradually broadening its distribution – including a very successful launch in China in November – setting the stage for the broadening of the cosmetics range in the coming quarters. The Coty teams have prepared a number of innovations which will be launched from Q3 onwards, the company said. “In parallel, with a view to strengthen the quality of our business, we have been cutting low value sales since January, which will temporarily drive weak sell-in trends in Q3,” it said. The luxury division delivered reported operating income of US$148.1 million, an increase of +30% year-on-year. 2Q20 adjusted operating income was US$185.8 million, reflecting solid +5% growth from the prior year. |