The Moodie Davitt Report introduces the latest feature in The Analyst series, written by The Mercurius Group Founder & President Ivo Favotto*. Here the long-time travel retailer, now Sydney-based consultant assesses the continued growth of tax free shopping in Australia following the release of new government figures, and explores the impact of the daigou phenomenon.

The Moodie Davitt Report introduces the latest feature in The Analyst series, written by The Mercurius Group Founder & President Ivo Favotto*. Here the long-time travel retailer, now Sydney-based consultant assesses the continued growth of tax free shopping in Australia following the release of new government figures, and explores the impact of the daigou phenomenon.

The views expressed in this column are not necessarily those of the publisher.

Following on from my piece in The Analyst in July about the growth of tax free shopping in Australia since 2008/09, the Australian Department of Immigration and Border Protection has released new figures highlighting the phenomenal growth of this sector – growth that shows no signs of slowing down.

The Australian tax free shopping system, called the Tourist Refund Scheme (TRS), allows both visitors to Australia and – quite unusually – departing Australians to claim back the Goods & Services Tax (GST), or in some countries Value-Added Tax (VAT), from purchases made during their stay – albeit with some conditions.

In 2015/16, claims for GST refunds (the amount of tax revenue foregone by the Australian government) increased by A$32.5 million (US$24.7 million) to A$199.4 million (US$151.7 million) – an impressive growth rate of +16.5%. That’s on top of even more impressive growth rates of +33.8% and +30.6% in the previous two years.

Since the depths of the global financial crisis in 2008/09, sales of tax free goods through the Australian TRS scheme have now increased by some +269% at a compound annual growth rate of 17.4% as highlighted in the table below.

Source: Australian Customs and Border Protection Service Annual Report and The Mercurius Group analysis

With the Australian GST rate sitting at 10%, these latest figures suggest annual tax free sales of more than A$2 billion (US$1.52 billion), dwarfing duty free sales at airports by a factor of more than two (and increasing the gap further in relative terms each year).

The average tax refund was A$235 (US$179) per claim, suggesting an average transaction value through the TRS of more than $2,000 – a figure likely to be more than ten times the average transaction value in duty free stores around the country.

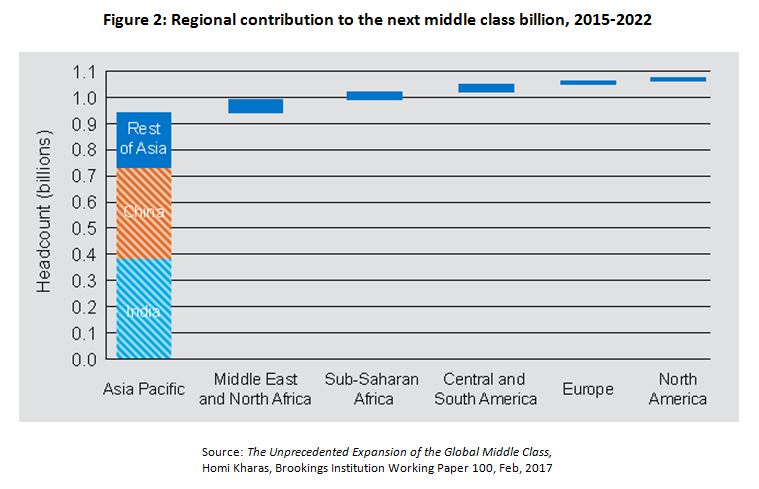

While little information is released by the department on tax refunds by airport, by nationality or by product category, anecdotal evidence suggests it is no coincidence the growth of the TRS has come at the same time as an explosion in the growth of Chinese visitors to Australia.

As highlighted in the table below, China is now the second highest source of visitors to Australia with 1.1 million visitors in 2015-16. Since 2010-11, Chinese visitors have grown at an annual compound rate of 18.2% and just over the past year have grown by +22.2%. And these figures do not take into account Australians of Chinese origin or heritage, which is a significant market in its own right.

According to Tourism Research Australia analysis, Chinese visitors should overtake New Zealand visitors as the number one source of visitors to Australia for the first time ever in 2017. They already have at Australia’s leading gateway – Sydney Airport – which now boasts nine airlines offering direct services: Qantas, Air China, Cathay Pacific, China Airlines, China Eastern Airlines, China Southern Airlines, Hainan Airlines, Sichuan Airlines and Xiamen Airlines.

In the past year, strong growth in visitors to Australia has also occurred in the South Korea, Japan, Hong Kong and Singapore markets, each registering strong double-digit growth, with India and Malaysia not far behind.

Source: International Visitor Survey, Australian Bureau of Statistics and The Mercurius Group Analysis

At the same time, The Sydney Morning Herald – a respected mainstream newspaper in Australia – reported on 27 September about the emergence of the daigou phenomenon in Australia. Daigou are people who buy goods in Australia for resale through private family and friends networks in China – a form of arbitrage for goods that are not well distributed in China or that have higher prices in China than elsewhere – either due to regional pricing or market factors.

According to the report, there are 40,000 daigou in Australia buying an estimated A$4 billion (US$3.04 billion) of product to be shipped back to China or carried by travellers. The newspaper intimated that Australian tax authorities are investigating a potential A$1 billion (US$760.7 million) in tax losses from undeclared income. Daigou demand is mainly for dairy, general produce and health items – competing directly with products that are typically sold at Australian airport duty free and destination outlets.

While the growth of Chinese visitors to Australia has fuelled sales to travellers through the TRS and daigou, they have also helped boost sales at airport duty free stores, even if not at the same rate.

According to Sydney Airport’s latest Investor Day presentation (17 October 2016), retail now generates around A$285 million (US$217 million) per annum in revenue for the airport (this is a Mercurius Group estimate based on first half results), around 60% of which (approximately A$170 million) is paid in rent by the duty free operator, Gebr Heinemann. This suggests Heinemann’s sales at Sydney are around A$340-380 million (US$259-289 million) depending on their rent structure – a healthy increase on previous years no doubt influenced by the influx of Chinese passengers. Again, according to Sydney Airport, spend by Chinese passengers is around five times higher than the average spend, with residents of secondary cities such as Xiaman and Chongqing contributing more than residents of the big three cities – Beijing, Shanghai and Guangzhou.

Most economic analyses conclude, based on econometric modelling, that tax free shopping and schemes like the TRS make a positive contribution to the Australian economy. This is largely based on an assumption that tax free shopping drives incremental visitation (i.e. more people will come to Australia because they can shop tax free).

While the level of GST refunds via the TRS remained modest, there were few challenges to this (and other) assumptions. But as the amount of refunds has grown exponentially and the size of transactions increases, seemingly without limit, more and more questions are being asked about benefit versus cost. A key question seems to be whether Australian residents – some of whom are of Chinese origin and potentially participating in daigou activities – should be allowed to claim GST refunds. Local residents are not allowed to claim GST/VAT refunds in most jurisdictions.

One thing is for sure, traditional airport shopping in Australia has a very large and increasingly powerful competitor that grows stronger year-on-year.

Please visit The Mercurius Group website for more information and analysis.

Previous articles by The Analyst:

Does providing a free parking period give you social licence to charge more for car parking?

Car parking spots becoming like airline seats

Australian downtown tax free shopping outstrips airport duty free

‘Brexit’ and the five stages of grief

What does ‘Brexit’ spell for European travel retail?

Australia bucks retailer consolidation trend

*About Ivo Favotto

Ivo Favotto has a long and distinguished record in the airport and travel retail sectors. A trained economist, he entered the airports/infrastructure sector with Australia’s Federal Airports Corporation in 1992 as GM – Planning & Economics.

He later built a highly successful international airports/infrastructure consulting practice, working with three firms – Bach Consulting, Arthur Andersen and URS Corp – and advising many of the world’s leading airports, governments and investors in the areas of retail planning, master planning and privatisation/transaction support.

In 1998 he established the market-leading Airport Retail Study, selling it to Moodie International so he could join The Nuance Group (now owned by Dufry) as Executive Vice President – Strategy & Business Development in Zürich. He later returned to his native Australia as Director – Sydney Airport before being named Executive General Manager of Duty Free & Luxury, Pacific for Lagardère Travel Retail.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com