The Moodie Davitt Report introduces the latest feature in our new series, The Analyst, written by The Mercurius Group Founder & President Ivo Favotto*. Here the long-time travel retailer, now Sydney-based consultant examines potential repercussions for the travel retail sector should the British people vote on 23 June to leave the European Union.

The views expressed in this column are not necessarily those of the publisher.

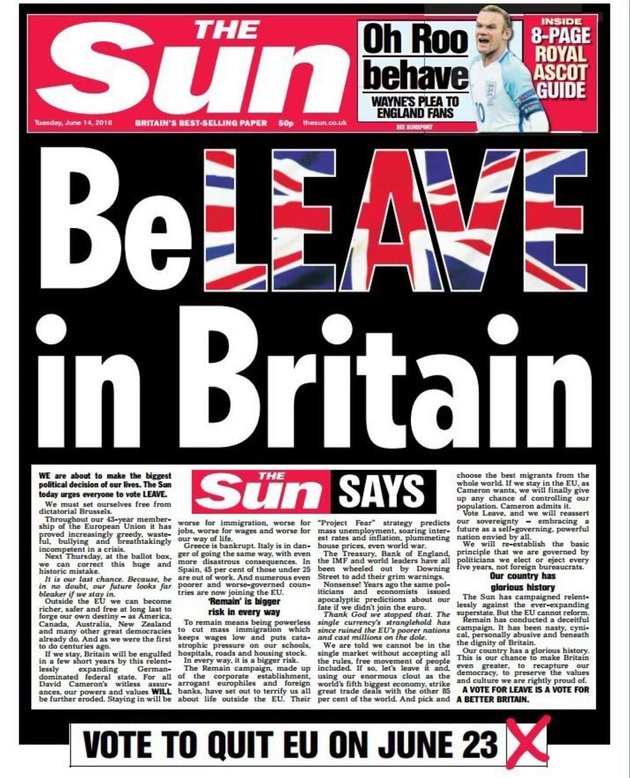

There are just a few days to go until the Brexit (shorthand for British exit from the European Union) referendum in the UK to be held on 23 June.

With the Leave campaign starting to edge ahead of the Remain campaign in many polls, it’s time to assess the potential travel retail implications of a Leave win (and the UK eventually leaving the European Union).

Now, I will say it before you do. What the heck would an Aussie living 16,000 kms away from the UK know about Brexit? Even if he is of Italian extraction. And even if he lived in Zürich for five years? And even if he has travelled to Europe at least once every year for the past 25 years! Fair point.

So, let me say from the outset, I intend to offer no opinion on whether Brexit means that the sky will fall on 24 June or whether Britannia will once again rules the waves thereafter.

I have no idea if the £ will crash. I am not really sure if travel between the UK and Europe will fall. And who knows about the onset of economic Armageddon? Every other pundit seems to have a view on all of these things and there are plenty of experts on both sides. Who knows what to believe? So I will leave you to make up your own mind on these imponderables.

And I know, I know, that there are so many uncertainties at the moment on how things will pan out should the Leave campaign be successful. Certainly in that event, it might take a while (maybe a long while) for the boffins in the UK Government to get around to thinking about duty free.

But let me make a few simplifying assumptions (those of us with an economist’s training are good at that) about Brexit actually happening, just so that we can start to think about the travel retail implications.

Let me assume for a moment that if the Leave vote prevails the sky will not fall on 24 June and that things will carry on more or less as normal in the broader economy – and people will still travel like they used to. Big assumptions I know but stay with me here.

In this ‘Leave’ scenario, there are six topics that come immediately to mind for me:

(1) Duty free sales in the UK and in some other key locations should rise – sometimes materially.

Passengers travelling between the UK and European Union countries will be able to purchase duty free in the same way as passengers travelling between Switzerland and Europe, or Norway and Europe – even if limited by inwards duty free allowances.

Remember Zürich Airport’s and Nuance Switzerland’s marketing strap line, Duty Free Paradise, which positions Switzerland like a duty free island in the middle of a tax paid sea? In the UK’s case it will literally be an island (or at least a collection of them) – the proverbial duty free paradise!

The number of passenger movements between the UK and the European Union is huge. The top five country pairs between the UK and the European Union alone account for around 76 million passenger movements (UK:Spain, 33m; UK:Germany, 12m; UK:Italy, 11m; UK:France, 11m; UK:Ireland, 9m). And the impacts by airport are big too. Around 42% of Heathrow’s traffic is to Europe (albeit not all of it to the European Union). It would be a much higher percentage for smaller or regional airports with fewer long-haul routes.

(2) Brexit opens the door to Arrivals duty free in the UK.

And I mean proper arrivals duty free, not the less than inspiring tax-paid stores currently in place in some UK airports. And why not? Switzerland introduced Arrivals duty free in 2011 and reported an immediate boost to sales. And in Norway’s Oslo Airport, Arrivals duty free accounts for 58% of total duty free sales (see The Moodie Davitt Report, July 20, 2011).

Arrivals duty free is common in the Asia Pacific region. At big airports in Australia, it accounts for around 35% (and sometimes more) of total duty free sales. And in New Zealand, where inwards duty free allowances are amongst the most generous in the world, arrivals can account for around 50% of the business. Liquor duty free allowances in New Zealand are 4.5 litres of wine or beer plus three bottles of spirits (up to 3.35 litres in total).

(3) Generous duty free allowances could be introduced.

One of the UK consumers’ biggest bellyaches about Brexit has been the potential loss of the current generous rules for bringing in reasonably large quantities of tax paid goods from European Union countries. This can be circumvented by generous inwards duty free allowances – similar to what the Kiwis enjoy. Combined with allowing Arrivals duty free, this should be a boost to airports, travel retail operators and the economy.

(4) Airports in the UK – and to a lesser degree elsewhere in Europe – may need to rethink their duty free space allocations.

After 17 years without intra-European Union duty free, many terminals have been designed and built with these rules in mind. Obviously Brexit would change all that. And that is just for departures. Handling 30 or 40 million more passengers in your duty free store will likely require space than currently allocated. Will airports have the space to easily expand?

Arrivals of course is a whole new ball game for UK airports, and there may well be serious incentives for UK airports to find (or create) 1,000-2,000 square metres of retail floor space in arrivals in the major terminals as counterpart airports in the Pacific have done very successfully.

(5) If Brexit has a material (positive) impact on sales in countries such as the UK and Spain, there will be knock-on impacts – for example on the economics of various concessions.

Some concessions previously stuck in Minimum Annual Guarantee (MAG) might not look so bad. Some airports could expect a windfall if they have concession agreements where duty free percentage rentals per category are higher than the tax paid ones.

(6) The airport and travel retailer investor community will be watching Brexit closely.

Brexit may bring material changes in value for some airports and some retail operators. Dufry’s share price for example has experienced some softness since 2014. Could Brexit change all that?

So now you can overlay on top of this travel retail view your personal macro-economic view of Brexit. Will Brexit be good or bad for the UK economy and for travel between Europe and the UK? And then you can come to a net view on the positives or negatives for travel retail.

The bears among you might think that a decline in passenger traffic may outweigh an increase in duty free sales. While you bulls might start buying shares while the uncertainty is shaking stock prices.

Please visit The Mercurius Group website for more information and analysis.

*About Ivo Favotto

Ivo Favotto has a long and distinguished record in the airport and travel retail sectors. A trained economist, he entered the airports/infrastructure sector with Australia’s Federal Airports Corporation in 1992 as GM – Planning & Economics.

He later built a highly successful international airports/infrastructure consulting practice, working with three firms – Bach Consulting, Arthur Andersen and URS Corp – and advising many of the world’s leading airports, governments and investors in the areas of retail planning, master planning and privatisation/transaction support.

In 1998 he established the market-leading Airport Retail Study, selling it to Moodie International so he could join The Nuance Group (now owned by Dufry) as Executive Vice President – Strategy & Business Development in Zürich. He later returned to his native Australia as Director – Sydney Airport before being named Executive General Manager of Duty Free & Luxury, Pacific for Lagardère Travel Retail.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com