SOUTH KOREA. Lotte Duty Free yesterday sent a letter to Incheon International Airport Corporation (IIAC) formally requesting a “rational” adjustment to its rent burden in light of the collapse in Chinese spending prompted by the THAAD political crisis. The country’s travel retail giant proposed switching from a Minimum Annual Guarantee (MAG) model to a percentage of sales by category payment basis.

The letter follows Lotte Duty Free’s threat earlier this month to withdraw from its Incheon contracts because of the financial pressure it faces. As reported, Chinese tourism has slumped since South Korea deployed the US-backed anti-missile system earlier this year. This prompted a furious backlash from China. Tourism and travel retail have been in the front line of the retaliation, with Chinese tourism in South Korea collapsing.

“This is an attempt to negotiate with Incheon International Airport Corporation and to avoid the worst-case scenario of the full withdrawal of Lotte Duty Free from Incheon Airport” – Lotte Duty Free

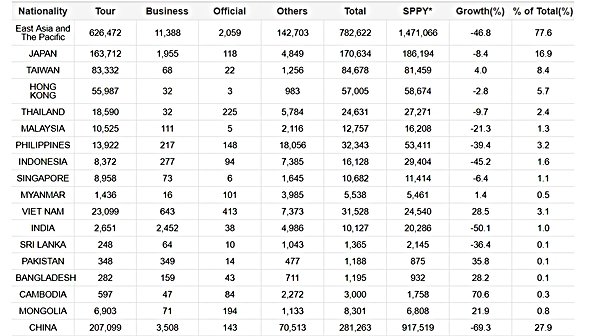

On 15 March, China imposed an unofficial ban on group tours to South Korea, prompting a -40% year-on-year fall in Chinese arrivals in March, a drastic -66.6% decline in April, a -64.1% slump in May, a -66.4% decrease in June and a -69.3% crash in July, according to Korea Tourism Organization statistics. Given the current warmongering tone of North Korean leader Kim Jong-un, any South Korean pull-back in the deployment of THAAD seems unlikely and many in the Korean travel retail community fear the crisis will last a long time.

Chinese arrivals in July represented just 27.9% of all visitor arrivals. This compares to a 53.9% share in July 2016, a percentage that was much higher (65-70%) in terms of share of duty free purchasing.

The CEOs of three leading Korean travel retailers, Lotte Duty Free, The Shilla Duty Free and Shinsegae Duty Free, met Incheon International Airport senior management on 1 September to seek rent relief from their heavy loss-making contracts. But an IIAC spokesman told The Moodie Davitt Report that rent relief was not being considered at this point. The IIAC does not believe that high airport rents are solely to blame for Lotte’s woes, pointing to the retailer’s heavy cost base and falling sales downtown as another factor.

Shilla Duty Free is not mirroring its arch-rival’s position. “Shilla’s position is quite simple,” a spokesman told The Moodie Davitt Report earlier this month. “Shilla is not considering withdrawal from Incheon International Airport.”

Lotte Duty Free revealed today that its CEO, Jang Sun-wook, wrote yesterday to the IIAC requesting “a rational adjustment” of its rent burden. In the letter, Lotte offered the airport company an alternative fee structure. This involves setting the amount payable to the IIAC on a category by category basis (see table) according to a percentage of sales, as opposed to the minimum guarantee.

On liquor, for example, Lotte Duty Free would pay 35% of sales; on perfumes & cosmetics 30%. If nothing changes, Lotte Duty Free would be paying around 60% of sales under its contract, the company said.

“We paid KW515 billion (US$457.2 million) in the second year (16.9~17.8) of this contract, when the MAG took up approximately 40-50% of our monthly sales in the airport,” a source said. “According to the current rent model, for the third year (17.9~18.8), the MAG increases to KRW774 billion (US$687.2 million) and it will be about 60% of our monthly sales.”

The retailer commented: “This is an attempt to negotiate with Incheon International Airport Corporation and to avoid the worst-case scenario of the full withdrawal of Lotte Duty Free from Incheon Airport.” The retailer has requested a consultation schedule within one week due to the urgency of the situation.

Lotte Duty Free Shop has operated at Incheon International Airport since March 2001. The company said that the rents it has offered over subsequent concession periods have been in line with continuous sales growth. However, due to the THAAD-driven collapse in Chinese tourism, shortened (five-year) licences, and investment in new shops, the business has become highly unprofitable.

As revealed, Lotte Duty Free posted an operating loss of KW29.7 billion (US$26.1 million) in the second quarter ended 30 June – its first quarterly loss since the SARS crisis of 2003.

If the Incheon rent model remains unchanged, Lotte Duty Free would pay approximately KW4.1 trillion (US$3.6 billion) to IIAC – regardless of market conditions – from September 2015 to August 2020 is. The company said that spells a deficit of over KRW200 billion (US$177 million) this year and a minimum of KRW1.4 trillion (US$1.24 billion) during the five-year contract period.

According to Lotte Duty Free, Korea Airports Corporation which owns Jeju Airport, has agreed a variable rent per category to ensure the early return of its duty free retailer, Hanwha Galleria, which as reported was planning to quit the business at the end of August due to heavy losses [Contacted by The Moodie Davitt Report, a Hanwha Galleria spokesperson said that the company, in agreement with Korea Airports Corporation, has decided to keep the shop open on a temporary basis until 31 December.]

A Lotte Duty Free Shop official said, “Lotte Duty Free has been striving to satisfy travellers by offering shopping services that match the international reputation of Incheon International Airport. With a suitable rent agreement, Lotte Duty Free hopes to be able to continue to cooperate with Incheon International Airport Corporation.”