INTERNATIONAL. Dufry CEO Julián Díaz has outlined the potential impact of the war in Ukraine on the retailer’s key business in Russia and with Russian travellers in other locations.

Speaking during a combined in-person and online presentation call after Dufry’s full-year results yesterday, Díaz said, “We are monitoring very carefully the developments around the war in Ukraine. While our hopes are with the Ukrainian people, and especially our colleagues in Odessa and their families, we do not have visibility regarding the future developments in that regard.”

Russians represented Dufry’s second-highest spend by customer (behind the Chinese) in 2019, Díaz said. The total impact of sales to Russians in 2019 was 2% [of sales], he added. In addition, the total impact of Russian destinations was between 3% and 3.5%. “Now, it’s too early to assess the full impact of the current political turmoil in Ukraine” he said.

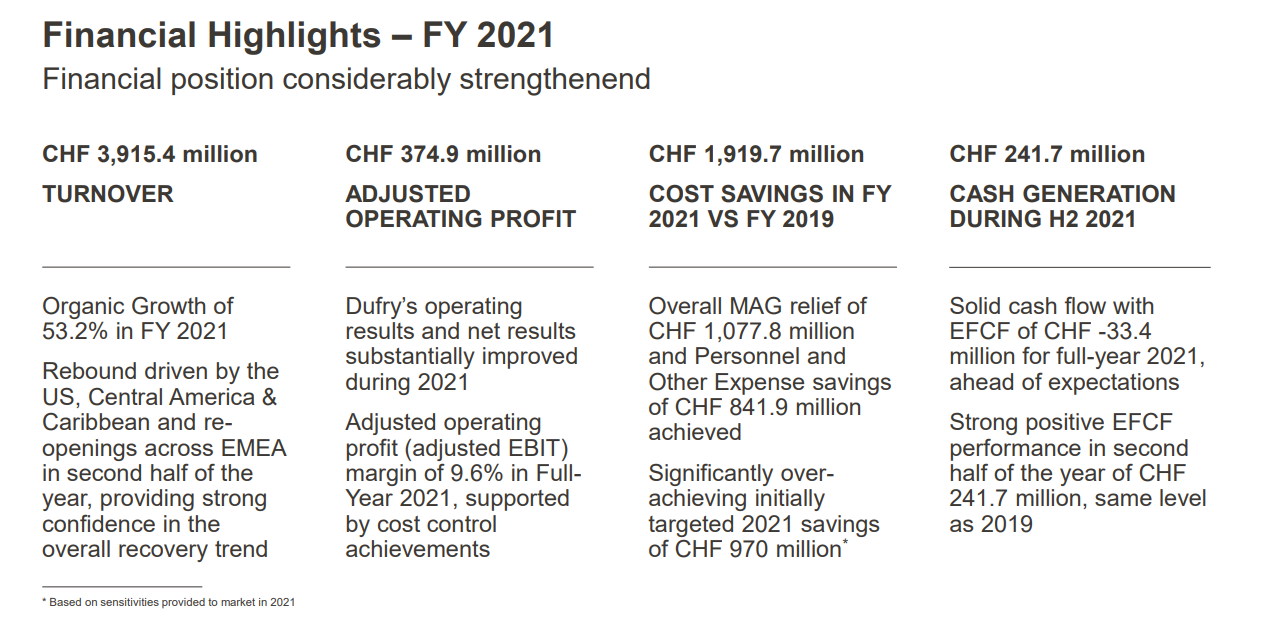

Commenting more broadly on the company’s accelerating recovery from the crisis, Díaz said: “Organic growth increased by +53.2% compared with 2020, providing confidence in the overall recovery. I think this is the critical point. What happened in 2021 is something that is very important for the future. Every time that restrictions or limitations to travelling, especially quarantines, are released, the situation improves very quickly.”

Lessons of a pandemic

Díaz said that Dufry had “learned a lot” during the pandemic, learnings that have prompted key changes in its product mix. “We have investigated new assortments and in fact most of these assortments are already on display in the shops. Shops are displaying today more sustainable products, more local products and wellbeing products.”

Díaz revealed that the company had resumed an in-person interview programme involving some 9,300 respondents. The findings showed that gifting and an attractive value proposition are the main drivers for travel retail purchases, at around 30% and 29%, respectively, both showing increased share versus 2019. The company has responded with an enhanced focus on local and sustainable products.

“Passengers currently travelling tend to be younger… and more leisure and visiting family and friends oriented,” Díaz added. “However, we already see significant progress in intra-regional and intercontinental travel as well as in the resuming of business travelling. With our highly flexible commercial offer, I think we can provide the best alternative to current demands and drive recovery accordingly.

Fulsome tributeDufry Executive Chairman Juan Carlos Torres paid warm tribute to his long-time, soon to depart CEO yesterday, saying: “I would like to express to Julián our eternal gratitude from both the Dufry Board and myself for the outstanding job that he has done for our company. Under his leadership… Dufry went from being a small company… from CHF600 million in revenues to CH9 billion in 2019. And from being the number seven among the duty free companies to be recognised as the number one duty free company in the world.  “The coordinating accomplishment is Dufry’s 2021 results. Julián has transformed Dufry into a more competitive, efficient and profitable company during the worst possible historical period for this industry.”  Incoming CEO Xavier Rossinyol also attended the presentation, commenting to Díaz, “I can assure you, I feel a strong responsibility to follow on your amazing legacy. We will work on the new phase always based on that.” He added: “Everything we’re going to do going forward, we’re going to do it together as a team. We are going to hopefully define a new cycle of success. “Success defined as, one, value creation for shareholders. Two, value creation for customers. And three, value creation for the communities where we are in. We will work for the long term. Of course, any modern company needs to focus on the short term to have a long term, but our focus will be at least on a cycle of five years. “We will build on the strengths the company has. But we will not be shy to change what needs to be changed to address the challenges we have as a company as in the industry.” |

Díaz also noted the creation of a global marketing digitalisation initiative with Alibaba (the two companies share a joint venture based out of Hong Kong and work closely with Hainan Development Holdings’-owned Global Premium Duty Free (GDF) Plaza in Haikou, Hainan province, see below). “The mini application that we have opened in one of their platforms will continue in the future to provide opportunities to our customers worldwide and specifically Asian customers,” he said.

He noted the positive impact of Brexit on sales to UK-bound passengers from European Union countries who can now buy duty free.

On Asia Pacific, the region currently most-affected by travel restrictions, Díaz highlighted three locations which are seeing a “significant step-by-step” recovery – Macau, China domestic travel retail and Australia, which recently reopened its international borders.

The company’s supply business with GDF Plaza at the Mova Mall in Haikou is a “tremendous” success, he said, with sales per square metre now ranking only behind market leader China Duty Free Group on the island. Early 2022 sales are up around +50% year-on-year. Dufry (49%) has a Hong Kong-based joint venture company with Alibaba (51%). Most supply to Hainan during 2022 will be transferred to the joint venture.

Fast forward in food & beverage

Dufry’s acquisition of Hudson in the US paved the way for what Díaz says is a clear growth path in the food & beverage sector.

“The best way to grow in the US is to really invest in food & beverage for Dufry,” he said. “We are the leaders in travel retail – duty paid and duty free. And the assumption is that for accelerating growth we need to invest in two different businesses – one is food and the other one is management of concessions.

“The second one is a longer-term strategy. Food & beverage is something that we can increase and improve daily because there are [regular] tenders and RFPs.

“In 2019, before the pandemic, 65% of the [airport] business in the US was food & beverage. Within the remaining 35%… almost two-thirds is duty paid. And we are the leaders in duty paid. The remaining part is the smallest part – duty free. And we are the leaders in duty free too.”

Note: The Moodie Davitt Report has recently relaunched its FAB Newsletter. This regular newsletter features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com to subscribe.