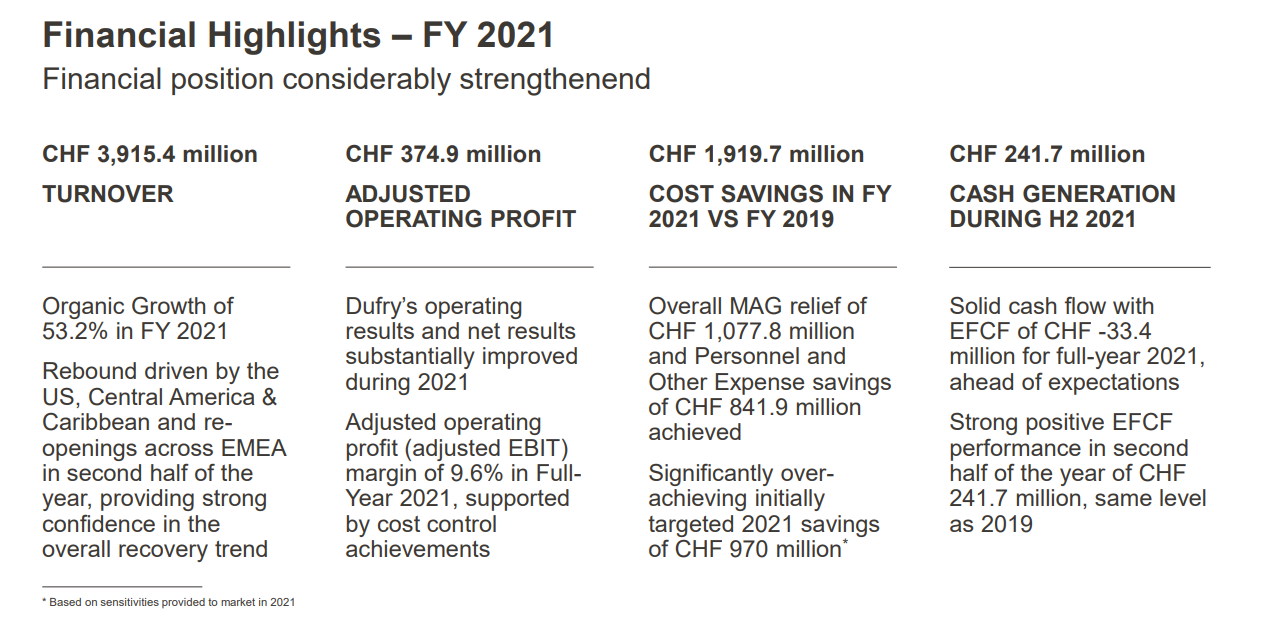

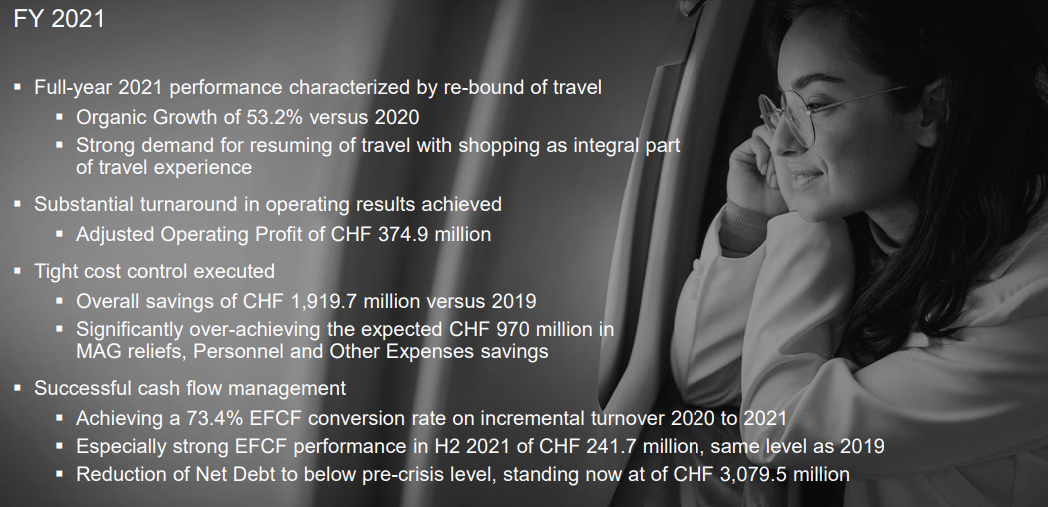

SWITZERLAND. Dufry Group today posted a +53.2% year-on-year rise (organic and +52.9% reported) in full-year revenue to CHF3,915.4 million, providing what the travel retailer described as “strong confidence in the overall recovery trend” [CHF1 = US$1.08].

Encouragingly, Dufry reported solid Equity Free Cash Flow (EFCF) of CHF-33.4 million for the full year, buoyed by higher than expected cost savings. This represented a 73.4% conversion rate on incremental turnover 2020 to 2021.

Adjusted Operating Profit (Adjusted EBIT) reached positive CHF374.9 million in 2021 versus a loss of CHF -1,561.6 million in t2020. Dufry generated positive cash flows in the months May to October 2021 and reached the same level in H2 2021 compared to H2 2019, namely CHF241.7 million and CHF242.9 million respectively.

The travel retailer said that its full-year 2021 performance was characterised by a rebound of travel, predominantly in the Western hemisphere.

Outgoing CEO Julián Díaz commented: “In an environment of gradual recovery for the industry and with travel resuming at different speeds in individual countries and regions, Dufry has continued to flexibly adapt its ways of working to the ever-changing requirements.

“Supported by the resilient willingness of our customers to travel and their ongoing propensity to visit our stores, our turnover saw a reassuring acceleration through the course of the year.”

Díaz said that the company had already defined initiatives in 2020, such as negotiating MAG reliefs and tightly controlling personnel and other expenses, and continuously applied these in 2021. “This allowed us to save CHF1,919.7 million in total in 2021, well ahead of the expected levels.

“We achieved a remarkable Equity Free Cash Flow (ECFC) of CHF -33.4 million for the full year 2021, and even a strong positive performance of CHF241.7 million in the second half of the year, same as 2019 levels, thus underpinning the resilient Cash Flow generation capability. We also reached a very solid liquidity position at year-end of CHF2,243.9 million.

“We see encouraging signs for the ongoing recovery of the industry and our business performance as vaccination levels increase, passenger traffic accelerates, and our sales improve – also supported by higher spend-per-passenger compared to before the pandemic,” Díaz continued.

“The overall trends to ease cross-country and domestic air travel continued and were gradually extended.”

He added: “With the successful re-financing measures implemented in 2021, the consolidation of our company organisation and the further enhanced financial and managerial flexibility to engage in strategically relevant initiatives and growth opportunities, Dufry is well positioned to drive recovery and accelerate growth going forward.”

Commenting on his recently announced departure from the company, Díaz commented: “On a more personal note, as communicated on 21 February 2022, I will step down from my position as CEO on May 31, 2022. I would like to express my gratitude to all our stakeholders and particularly to the Board of Directors and all colleagues at Dufry for the support I have received during the past eighteen years.

“Without the strong dedication for execution and tireless commitment of every single employee, we could not have built the leading player of our industry. I am immensely grateful for the opportunity I had to lead and contribute to the development of this great company, and I wish the Dufry family a prosperous future.”

Financial summary

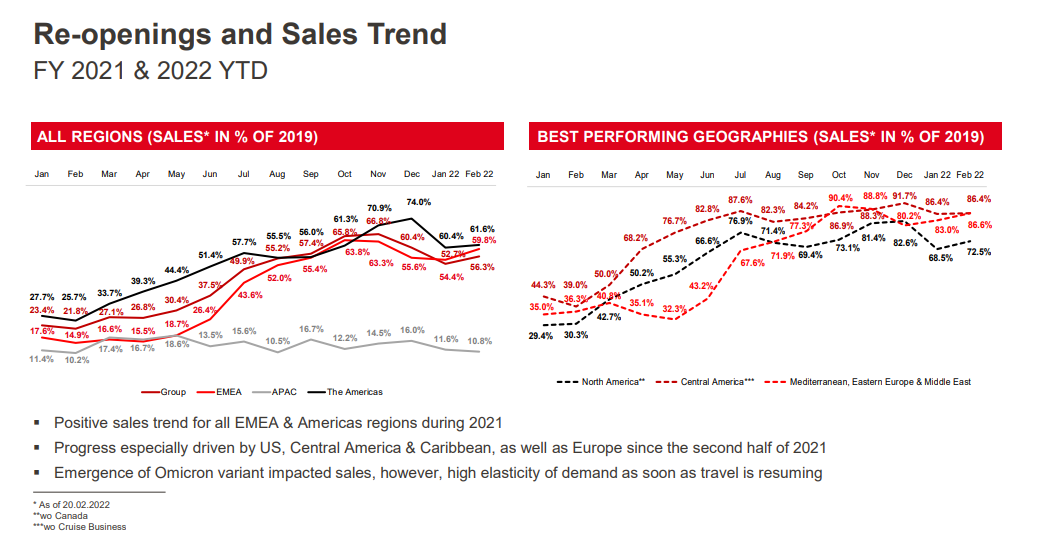

Dufry said that it had witnessed gradual improvements in nearly all its operations through 2021 as travel started to resume, with a significant pick up in the second half of the year. Buoyed by that recovery, the company’s performance was “significantly improved” across all performance indicators. The translational FX effect versus 2020 was -0.3%, mainly related to neutralising effects of weaker USD and stronger GBP.

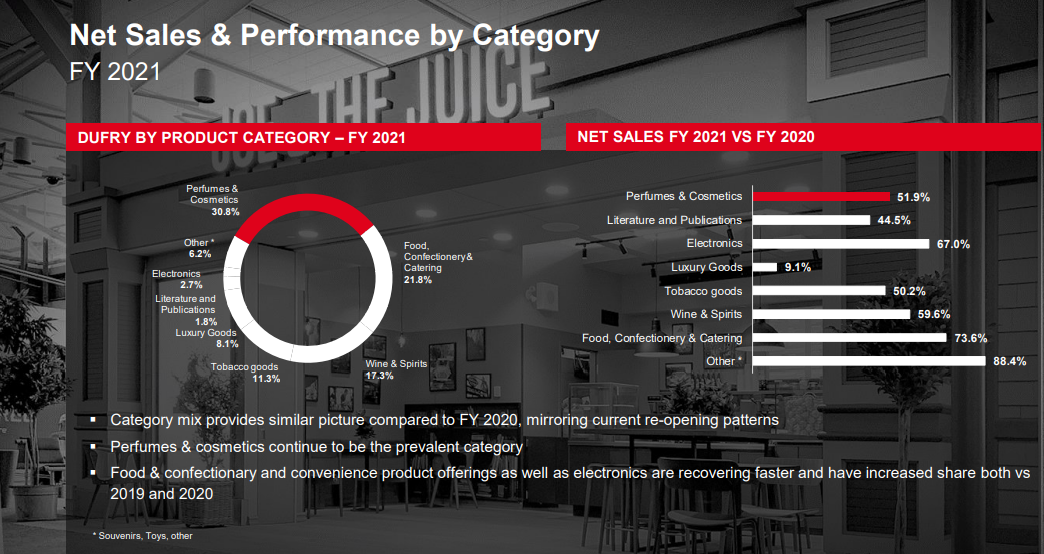

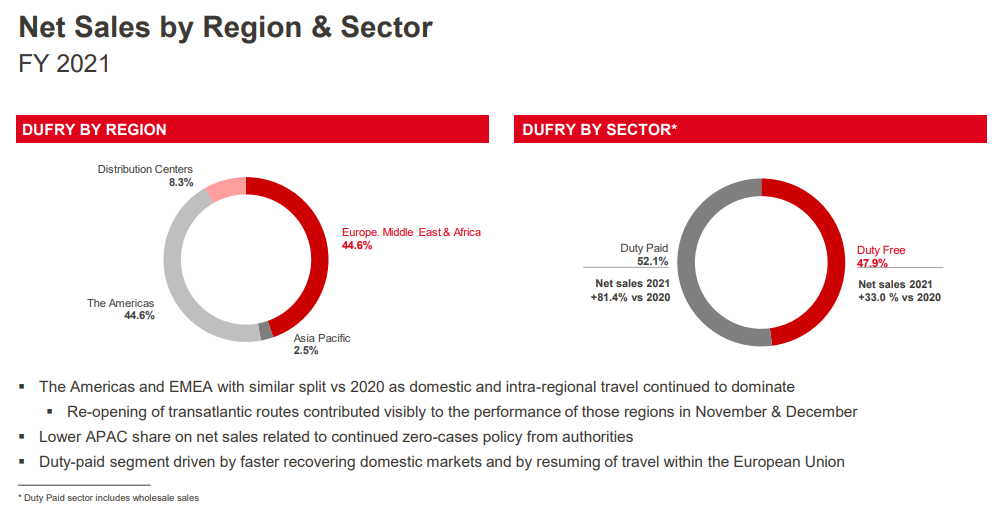

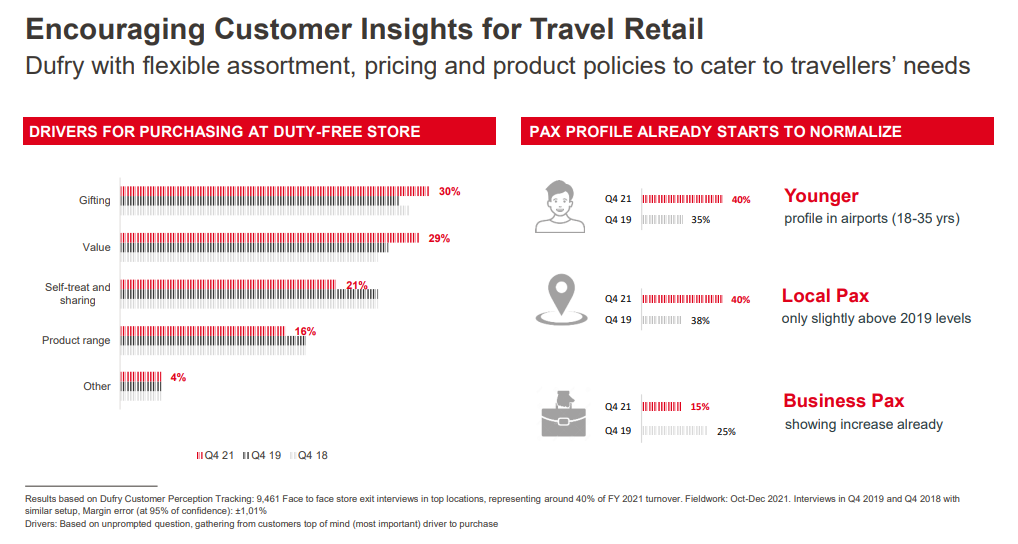

The category mix mirrors the current travel and store re-opening patterns, with the duty paid segment being driven by currently faster recovering domestic and intra-regional flights. Perfumes & cosmetics continued to be the prevalent category, followed by food & confectionery and convenience product offerings.

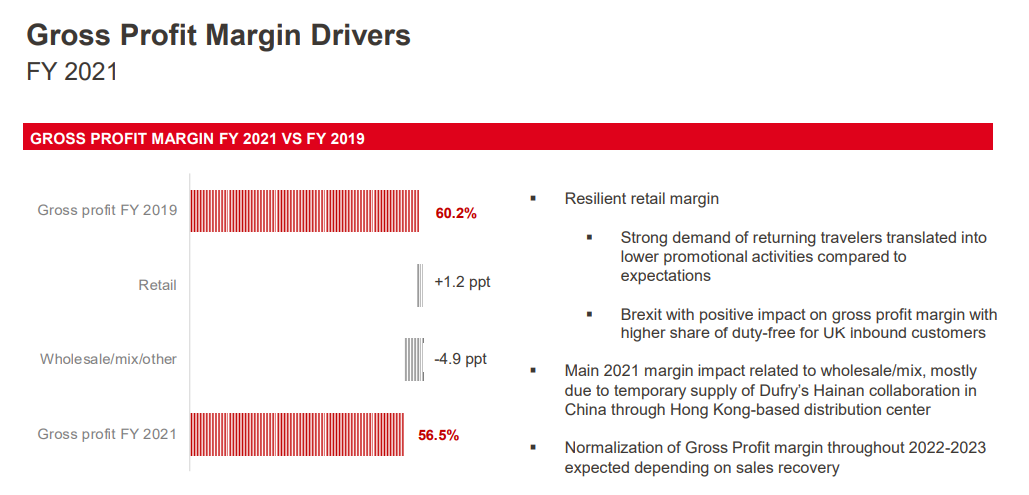

Gross profit margin stood at 56.5% for the year. Dufry said that a further normalisation is expected in line with business recovery. Retail margin proved to be very resilient and saw an increase of 1.2% compared to 2019 due to strong demand of returning travellers and supported by the higher share of duty free for UK inbound customers.

During 2021, margin was mainly impacted by the temporary supply of Dufry’s Hainan collaboration in China through its Hong Kong-based distribution centre.

Regional performance

Europe, Middle East and Africa

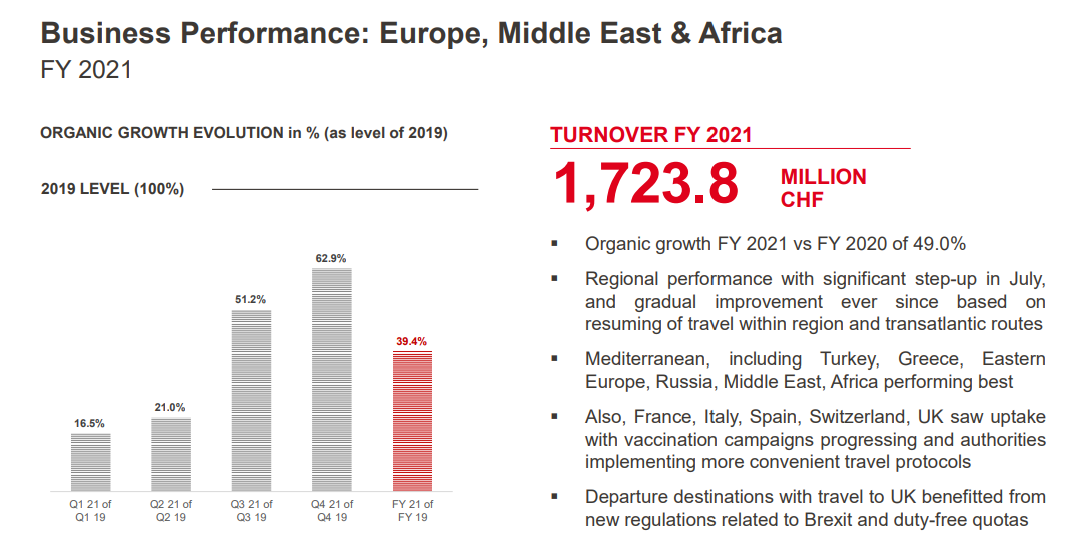

Turnover in Europe, Middle East and Africa was CHF1,723.8 million (US$1,861 million) in 2021, up by +50.6% year-on-year (+49% in organic terms). Sales saw a “significant step-up” from June and gradual improvement since as travel resumed. Best performers by sub-region included including Turkey and Greece, Eastern Europe, Russia, Middle East, and Africa, which benefited from leisure demand and more flexible travel protocols compared to other countries.

France, Italy, Spain, Switzerland, and the UK saw an uptick from June as vaccination campaigns progressed and travel rules eased. Departure destinations with inbound travel to UK benefited from new regulations related to Brexit and duty free allowances. Towards the end of the year, re-imposed restrictions, and limited alignment between governments around the emergence of the Omicron variant, resulted in a slight slowdown, said Dufry.

Asia Pacific

Turnover reached CHF99 million (US$107 million), down by -38.1% year-on-year (-38.9% in organic terms). The region remained heavily affected by the zero-COVID approach of some governments, with locations such as Hong Kong closed or operating at low levels in line with flights and passenger movements.

Since the end of 2021, Australia, Cambodia, Singapore, Malaysia and Macau began to release restrictions. Once more restrictions are lifted, demand is expected to show “a fast rebound” said Dufry.

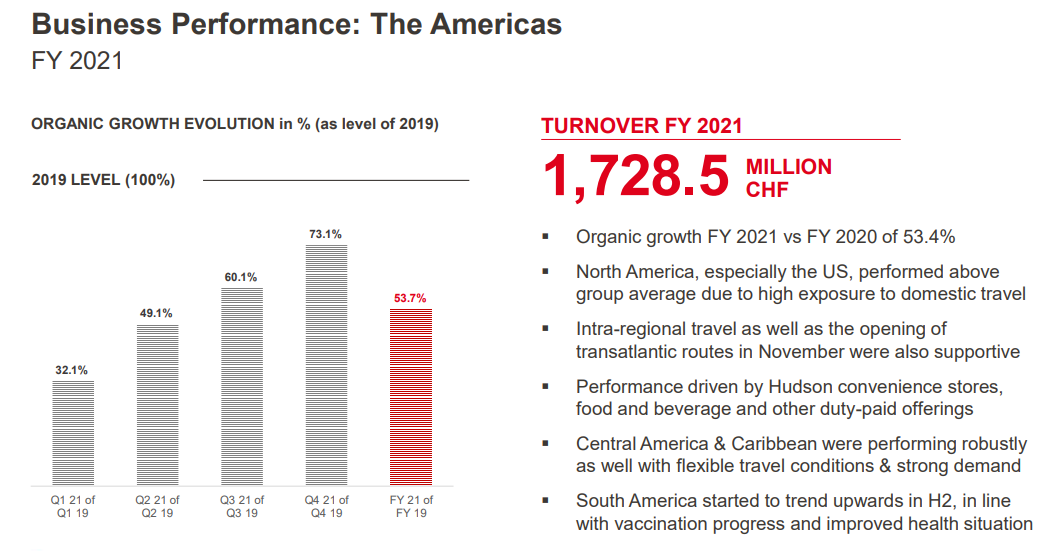

The Americas

Turnover reached CHF1,728.5 million (US$1,866 million) in 2021, up +51.4% year-on-year (+53.4% in organic terms). North America, especially the US, performed above group average due to higher exposure to domestic travel. Intra-regional travel from the US to Central America as well as the opening of transatlantic routes in November supported growth. The performance was driven by Hudson convenience stores, food & beverage and other duty paid offerings.

Central America and Caribbean, including Mexico, Dominican Republic, and the Caribbean Islands, performed “robustly”, said Dufry, driven by intra-regional travel from the US and South America as well as international travel as more flexible travel conditions met continued demand.

The cruise business continued to be impacted by restrictions. South America started to trend upwards in the second half of 2021, with solid growth in Argentina, Colombia, and Ecuador, in line with vaccination progress and an improved health situation.

MAG relief drives cost savings

Dufry achieved continued cost savings in personnel and other expenses of CHF841.9 million compared to 2019, overachieving the initially expected CHF670 million for the year. Main drivers were continued cost discipline in addition to variable savings and some continued furlough. The company also achieved MAG relief of CHF1,077.8 million in 2021, related to the period affected by the pandemic.

Net debt amounted to CHF 3,079.5 million at the end of December 2021 compared to CHF3,343.9 million in December 2020 and reached a lower level compared to pre-crisis December 2019 (CHF3,102.0 million). Dufry’s liquidity position amounted to CHF 2,243.9 million as of December 31, 2021. Dufry agreed with its lending banks on an extension of the covenant holiday until June 2023.

Outlook better but global uncertainty means no 2022 guidance

In line with easing of travel restrictions by governments and resuming of operations by airports and other landlords, Dufry is reopening its retail businesses gradually, following what it termed single-location productivity scenarios.

As per end-December, around 1,900 shops globally were open, representing around 88% in sales capacity compared to full-year 2019. At the end of March, Dufry expects to be operating more than 1,970 shops, representing above 90% of sales capacity.

The emergence of the Omicron variant and related restricted measures re-imposed by selected governments caused some slowdown in January and February, but all regions have started to trend upwards already in line with the easing of restrictions in many countries.

“Dufry sees strong demand for the resuming of travel with shopping as an integral part of the overall travel experience,” the group said. However, given limited visibility and information currently available to management regarding the geo-political environment, pandemic-related developments, government responses and timeline for lifting of measures, the company is not providing guidance for 2022.

In the current environment, the company is focused on the protection of its liquidity while engaging in organic growth opportunities with a mid-term focus on deleveraging, opportunistic M&A if accretive, and a re-initiation of dividend payments depending on the recovery trajectory. As a result, the Board of Directors will propose to the 2022 Annual General Meeting to keep the dividend payment for the business year 2021 suspended.

Dufry continues to focus on strengthening its sustainability approach and has defined science-based-targets (SBT) to achieve climate neutrality by 2025 for scopes 1 + 2 and to considerably reduce carbon footprint of scope 3 emissions by cooperating with suppliers and logistic partners by 2027 and 2030 respectively.

Dufry also launched a new sustainable product identification initiative across 128 airports and 171 shops globally, and evolved its diversity & inclusion engagement, among other major initiatives.

Promising pipeline

In 2021, Dufry succeeded in winning several attractive new concessions and expanding important contracts across all regions, adding to the resilience of the business.

Key new wins included:

– Teesside International Airport (UK) for 12 years, further consolidating the footprint in the UK

– New concessions at Martinique Aimé Césaire International Airport for ten years and at Cayenne Felix Eboué International Airport in French Guiana for five years

– New contracts at Sangster International Airport in Montego Bay, Jamaica, for five and six years for the duty free and the duty paid concessions respectively

– Salgado Filho International Airport in Porto Alegre for six years.

Extensions of existing contracts included:

– Santiago International Airport, Dominican Republic, for ten years;

– Cardiff Airport (UK) for 12 years

– Phnom Penh, Siem Reap and Sihanoukville airports in Cambodia for five and a half years.

At the end of 2021, Dufry’s pipeline included projects covering 38,700sq m of potential additional retail space.

Refurbishment and new opening highlights included:

– Rio Galeão Dufry Shopping Megastore (

– Several shops at Pulkovo Airport in St. Petersburg

– Extensive redesign at Milano Linate International Airport

– Completely renewed Brookstone shop concept in the US.

Fostering food & beverage and technological advances

With the opening of Plum Market, the group’s first full-seated restaurant concept at Dallas Fort Worth International Airport, Dufry enhanced its airport F&B footprint in the US.

Dufry has also launched the new Hudson Nonstop shop concept in the US, which allows customers to enter the shop by tapping their credit card, choose from a selection of the traditional travel convenience product assortment and leave without going to the till and without any human interaction.

Hudson Nonstop uses Amazon’s Just Walk Out technology, which is currently in operation at Chicago Midway International Airport and at Dallas Love Field Airport. In 2021, Dufry accelerated the deployment of self-check-out tills, which are now deployed in five countries with over 100 units in operation across 31 shops. “Both new developments are testimony to our ongoing focus to drive the company’s digitalisation to simplify processes and generate efficiencies,” the company said.

In total, Dufry opened 9,800sq m of new shops and refurbished 19,250sq m of sales space in 2021, corresponding to 2% and 4% of total space respectively. The company was also involved in the early 2021 opening of the Global Premium Duty Free (GDF) Plaza at the Mova Mall in Haikou, Hainan – in collaboration with Alibaba and Hainan Development Holdings.