SOUTH KOREA. CityPlus Duty Free (City Duty Free) has written to Incheon International Airport Corporation (IIAC) warning of possible monopoly issues if the airport company awards its vacant Terminal 1 perfumes & cosmetics to The Shilla Duty Free.

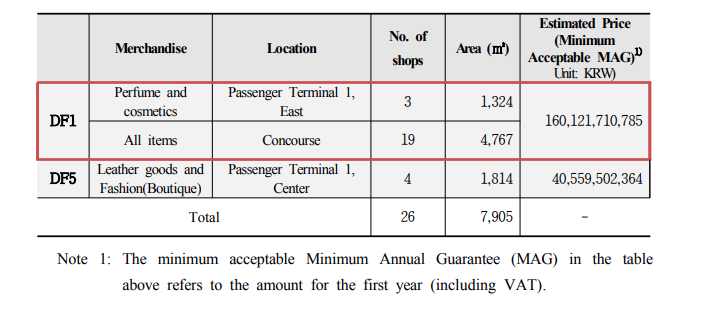

As reported, the IIIAC has put the three T1 concessions resigned by Lotte Duty Free in February out to bid. But it has restructured them into just two contracts (see table immediately below). And there lies the nub of small & medium enterprise (SME) player CityPlus’s complaint.

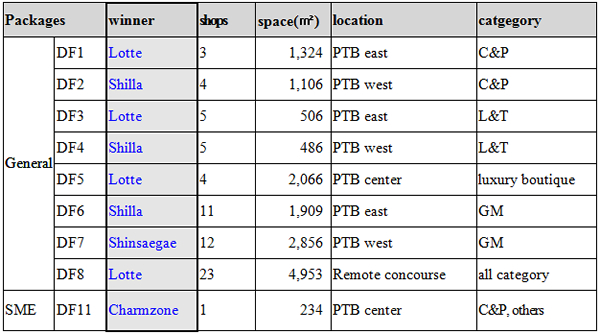

Lotte resigned its DF1 (perfumes & cosmetics), DF5 (leathergoods & fashion) and DF8 (miscellaneous categories). The concessions, which Lotte Duty Free was awarded in early 2015 after a series of blockbuster bids, were due to run from September 2015 to August 2020.

Lotte Duty Free cited the excessive cost of the contracts, having failed to renegotiate its terms. The retail giant claimed that its Incheon stores (hit by the THAAD-related collapse in Chinese tourism, proliferating downtown competition and excessive airport fees) had posted losses of KW200 billion (US$184 million) since 2016.

The contracts would run up a deficit of KW1.4 trillion (US$1.3 billion), the retailer said, if the stores continued to operate for the full term in 2020.

The new tender combines DF1 and DF8 into one package. DF5 remains a separate opportunity. By combining DF1, which has higher potential spend per passenger (SPP) and sales volume, with DF8’s lower potential SPP and sales, IIAC hoped to create a more attractive proposition for bidders.

Hong noted that since 2001 IIAC has always offered twin concessions for the all-important perfumes & cosmetics category. But if Shilla, which already runs DF2 (beauty products), is awarded the new combined DF1 contract, its market share for for the category will be 90% or more at T1 – and 95% for T1 and T2 combined.

This situation would be an “absolute category monopoly”, Hong said. Such a situation would cause “severe damage” to consumer welfare and threaten the survival of smaller competitors, he claimed.

“We cautioned IIAC to review this issue and preclude the retailer [Shilla] from winning the DF1 concession,” said Hong. “If IIAC will not propose the proper measures to prevent a monopoly, we are willing to bring this issue to the Fair Trade Commission.”

Disagreement with CityPlus claim

While The Shilla Duty Free declined to comment, the company will certainly disagree with CityPlus’s claim. The Fair Trade Commission will not have a problem with the proposed structure, sources close to the company believe. The company could reasonably point to many other international airports too which have a single retailer for one category (or in fact for all categories).

The Shilla Duty Free is unlikely to be the only bidder, however. Shinsegae Duty Free and sector newcomer Hyundai Duty Free (which is preparing to open a downtown store in Gangnam, Seoul, later this year), have both indicated their interest to The Moodie Davitt Report.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.

The Moodie Davitt Report will continue to bring you details on this important tender process as they are announced.