Incheon to retender Lotte concessions Incheon International Airport Corporation (IIAC) will retender the T1 contracts that Lotte Duty Free is exiting, The Moodie Davitt Report can confirm. In a statement, IIAC confirmed the move to re-tender, saying it would do so in a way that would “minimise passenger inconvenience and disruption to the airport operation”. It is likely that the new tenders will be held in mid to late March. “We are very sorry to hear that Lotte Duty Free is leaving,” a senior source told The Moodie Davitt Report. However, Lotte will be permitted to retain its liquor & tobacco business at T1 despite its selective resignation of other concessions. At stake will be some high-profile beauty, fashion and luxury and multi-category stores. In particular, Lotte’s DF5 luxury concession currently features a 550sq m Louis Vuitton boutique, which, when opened in September 2011 (in association then with The Shilla Duty Free) was the brand’s first airport store. Incheon’s current Louis Vuitton store is relatively new and it seems likely that a new concessionaire would pick up that investment and fulfil the remainder of the contract term (or a full new term). An informed source said that the transfer of such assets from Lotte to another retailer will be complex. “When you consider the capital investment Lotte has recently made in Terminal 1, there would need to be some sort of negotiated settlement for the transfer of assets and I cannot imagine that happening within the 120 days,” he commented. IIAC noted Lotte Duty Free’s aggressive bids for the T1 contracts in 2015, when it snapped up four of the eight contract packages available to bigger companies. IIAC also highlighted that the duty free business has grown last year at the airport. “International passengers at Incheon grew by +7.6% last year due to increased passenger demand, except on China routes. Incheon Airport’s total duty free sales rose by +4.1% In addition, sales of the four business entities [licences] operated by Lotte Duty Free also increased by +0.2% in the year.” IIAC said that it regretted its tenant’s exit from the business without completing its contract term. It said that it planned to “supplement the contract procedure so that such cases will not recur when selecting a commercial facility operator in the future”. The March tenders will be evaluated by the country’s new – and controversial – dual assessment involving not only IIAC but Korea Customs Service. Given that the latter’s criteria includes proven commitment to the Korean economy and society, it looks certain that the only bidders will be local ones. The relentless drama of South Korean travel retail over recent year goes on and on. |

SOUTH KOREA. Lotte Duty Free is to exit several of its Incheon International Airport Terminal 1 duty free concessions, but will maintain its core liquor & tobacco business. The company cited the “burden of rent increases” following the sharp downturn in Chinese tourists in 2017 amid the THAAD dispute with China.

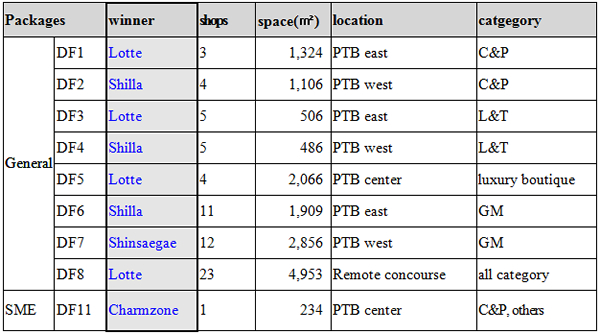

The retailer sent a letter today to Incheon International Airport Corporation giving notice on licences DF1 (P&C), DF5 (leathergoods & fashion) and DF8 (all categories). These cover spaces of 1,324sq m, 2,066sq m and 4,953sq m respectively. The concessions, which it won in early 2015, were due to run from September 2015 to August 2020.

Lotte Duty Free said it decided “to continue its operation of the liquor & tobacco concession at Terminal 1 despite the deficit, to minimise the damage for IIAC and the inconvenience of passengers”. The liquor & tobacco licence (DF3) covers five stores.

If the notice of termination is accepted by the airport (expected in March), Lotte Duty Free’s contract will run for 120 more days beyond that point before operations cease.

Lotte Duty Free said that its stores at Incheon Airport have recorded losses of KW200 billion (US$184 million) since 2016. The contracts would run up a deficit of KW1.4 trillion (US$1.3 billion), it claimed, if the stores continued to operate for the full term in 2020.

In a statement, Lotte Duty Free said it had calculated its 2015 bid for the Incheon T1 concessions on a sharp rise in Chinese tourism, which at the time was surging at a rate of close to +50% per year.

“However,” it added, “since the Chinese government’s sanctions on group tour visits to South Korea due to the deployment of the THAAD anti-missile system last March, Lotte Duty Free has experienced severe economic hardships. The number of Chinese tourists has dropped by half [see table below for confirmation -Ed].

“In addition, the duty free industry in South Korea became more competitive as the South Korean government issued four additional downtown licences and three of those operators will open their stores by the end of this year.” A rise in licence fees related to its downtown business, imposed last February, has also resulted in higher costs, Lotte noted.

As reported, last November Lotte Duty Free filed an unfair trade practice complaint with the Fair Trade Commission over its duty free concessions at Incheon International. The company had been seeking rent relief on its contracts, but this was rejected by IIAC. A Lotte Duty Free spokesperson told The Moodie Davitt Report today that the case has now been referred to Korea’s Fair Trade Mediation Agency, but said it is not clear when a result will emerge.

Lotte Duty Free said it plans to reassign all staff (around 100) in the affected stores to other Lotte Duty Free branches, mainly at Incheon T2 and in its downtown stores. It will hold a meeting with workers in March and complete its reassignment plan by May. It said it would work closely with the incoming retailer to ensure a smooth transfer of brand owners’ staff.

Lotte Duty Free said the move would result in an “improved profit structure”, allowing the company to focus on “reinforcing its downtown business and expanding its overseas business”.

In its statement, Lotte Duty Free emphasised the growth opportunity in Vietnam. It opened its first airport store in Da Nang last year and will open a further outlet in Nha Trang Airport in April, through its joint venture Phu Khanh Duty Free. The company said it planned to build on its presence in the country.