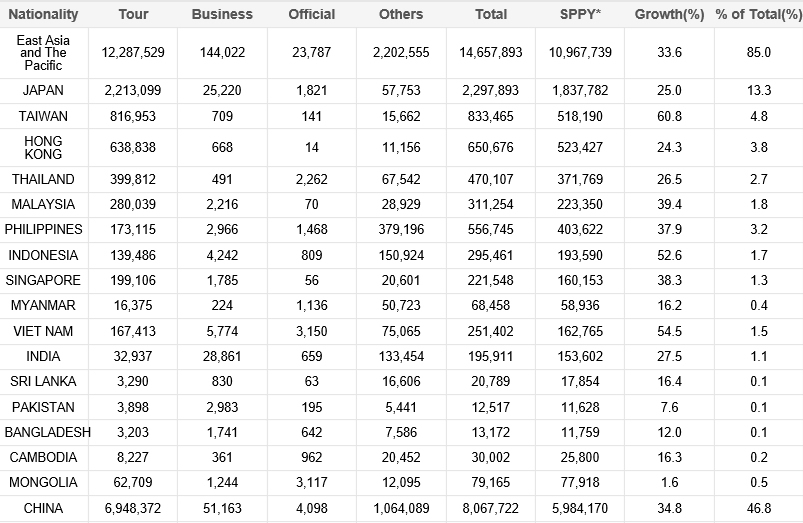

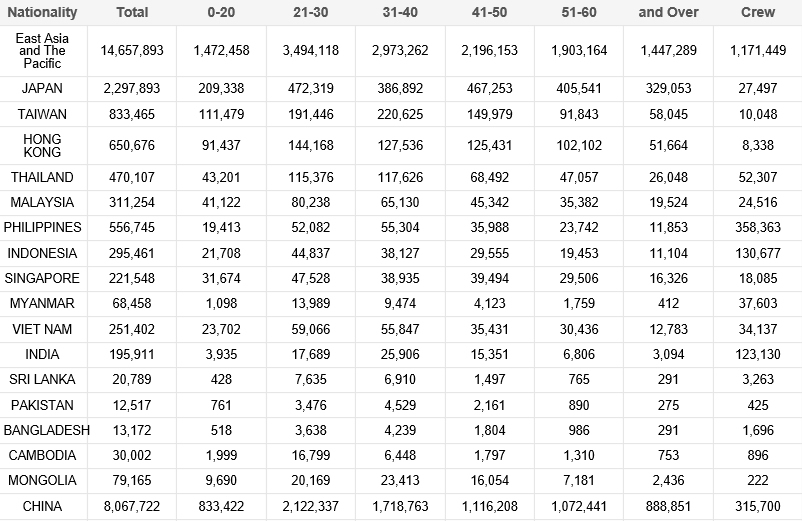

SOUTH KOREA. Chinese arrivals rose +34.8% year-on-year in 2016 to 8,067,722, according to Korea Tourism Organization figures, a 46.8% share of total visitors. But despite that healthy result, one reflected in record duty free sales nationwide*, tourism and travel retail executives are deeply concerned about 2017 prospects in the wake of deteriorating relations between South Korea and China.

According to a report in best-selling Joongang Daily, the Jeju Special Self-Governing Provincial Tourism Association estimated a -16.5% slump in Chinese tourists during this year’s Lunar New Year holidays. That pattern has been worryingly reflected on the Korean mainland. The same report said that the southern city of Busan received 80,000 fewer Chinese tourists in January.

Chinese online travel platform Ctrip revealed that South Korea had slipped to seventh, from third a year ago, on the list of preferred New Year holiday travel destinations for Chinese tourists. The Korea Times, quoting an unnamed agency official, said that Chinese group travel might be down by over -30% during the peak 27 January-2 February holiday period.

Travel to Korea, and to Jeju in particular, was hard hit by the Chinese government’s recent rejection of planned South Korean chartered flights slated for the holiday period.

Even the strong 2016 tourism numbers have to be viewed in the dual context of a MERS-hit 2015 and a late-2016 slowdown in Chinese growth, largely linked to the political issues between China and South Korea.

South Korea’s proposed deployment of the US anti-missile system Terminal High Altitude Area Defense (THAAD) later this year has outraged the Chinese authorities. It prompted a strong backlash against Korean entertainers and businesses, notably Lotte Group which owns the land on which the powerful radar installation will be placed. Lotte owns South Korea’s biggest travel retailer, Lotte Duty Free.

According to a well-sourced report in Pulse (Maeil Korea Business News), Lotte’s Chinese business have suffered a series of raids from the Chinese authorities since the THAAD controversy erupted, prompting several shop closures.

New US Defense Secretary James Mattis visited Seoul earlier this month and reiterated Washington’s stance, saying THAAD is necessary to protect America’s allies and its own troops. The Chinese and Russian authorities vehemently disagree and the fall-out, especially from the former, could be profound.

In December, Chinese arrivals rose just +15.1% to 535,536, a 39.9% share of total visitors and well short of the +23.4% increase in Japanese visitors to 197,209. December’s increase in Chinese visitors, though well short of the year’s average, was a sharp improvement on the worrying +4.7% and +1.89% monthly gains in October and November.

Japanese arrivals increased sharply in 2016, up +25% to 2,297,893, a 13.3% share of total visitors. Korean departures rose +15.9% in the year to 22,383,190. Departures by Koreans rose +12.6% year-on-year in December to 2,007,035, contributing to a +15.9% increase for 2016 to 22,383,190.

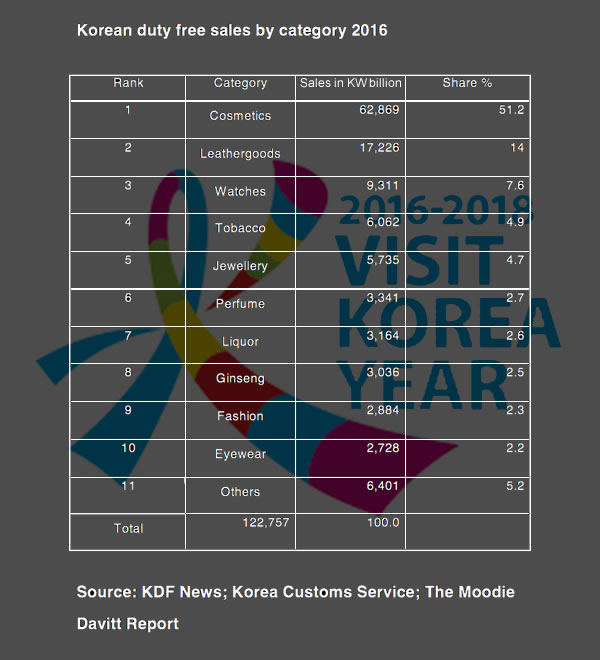

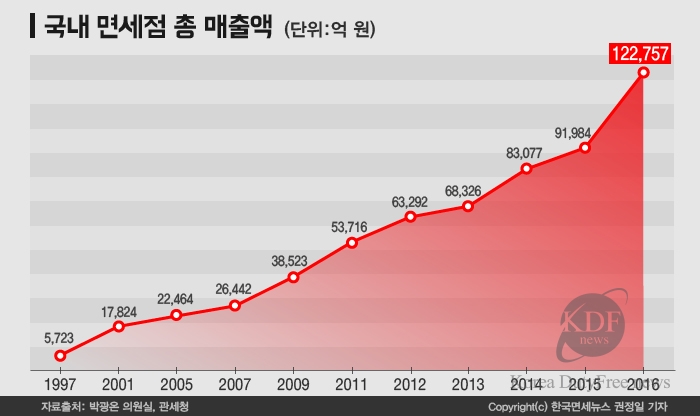

*DUTY FREE MARKET POSTS RECORD HIGH

As reported, the strong tourism growth drove a +44.1% increase in duty free sales to international visitors last year, to KW8.8 trillion (US$7.5 billion). Total Korean duty free market revenue grew +33.5% year-on-year to KW12.2 trillion (US$10.5 billion), according to Korea Customs Service.

Cosmetics, driven by booming sales of skincare (particularly Korean brands to Chinese shoppers), accounted for 51.2% of turnover.

As reported, Lotte Duty Free stretched its lead as the dominant force, racking up a +26% increase in sales to KW5.973 trillion (US$5.1 billion), a powerhouse performance given that the retailer had to close down its Lotte World Tower Duty Free store in late June.

Lotte’s sales by outlet were:

– Seoul flagship store: KW3.160 trillion (US$2.7 billion)

– Incheon International Airport: KW1.145 trillion (US$980.1 million)

– Jeju KW0.489 trillion: (US$418.6 million)

– Coex, Seoul: KW0.387 trillion (US$331.3 million)

– Lotte World Tower (closed from 26 June 2016): KW0.347 trillion (US$297 million)

– Busan: KW0.3458 trillion (US$296 million)

![[LDF]Main Store 12F_1](https://moodiedavittreport.com/wp-content/uploads/2023/07/LDFMain-Store-12F_1.jpg)

Fast-rising Shinsegae Duty Free posted sales of KW0.9608 trillion (US$822.4 million). Its new store in Myeong-dong, Seoul, which only opened on 1 May, generated sales of KW0.349 trillion (US$298.7 million). Its downtown Busan store (relocated in March to Centum City) posted revenues of KW0.336 trillion (US$287.8 million). Dongwha Duty Free in Seoul posted sales of KW0.3547 trillion (US$306 million)

*NOTE: The Moodie Davitt Report and KDF News have a highly successful, exclusive information-sharing partnership.