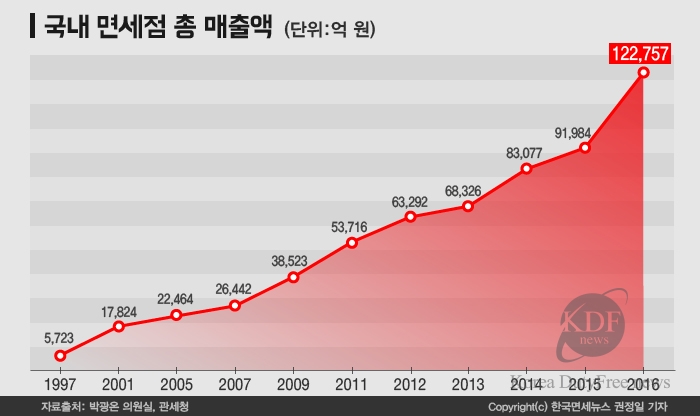

SOUTH KOREA. The Korean duty free market surged by 33.5% year-on-year in 2016 to KW12.2 trillion (US$10.5 billion), according to new figures from Korea Customs Service.

The results, first unveiled by our close colleagues at KDF News*, reflect a strong bounce-back from the MERS-ravaged 2015, allied to booming Chinese visitor numbers last year.

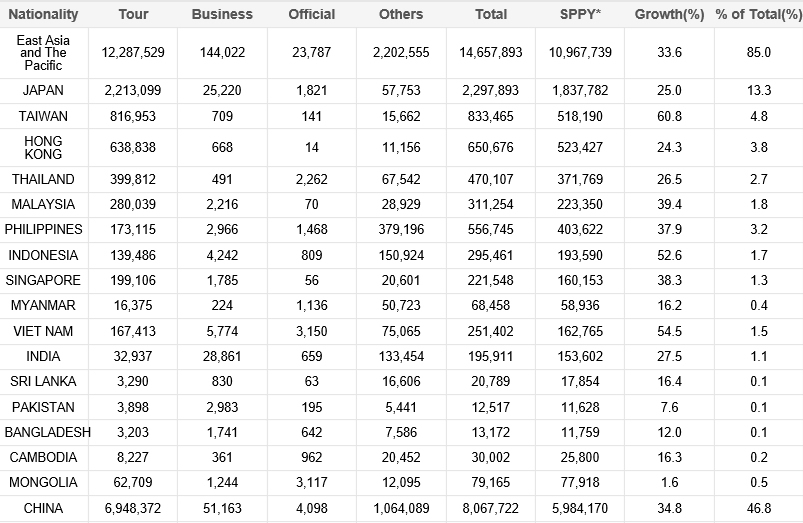

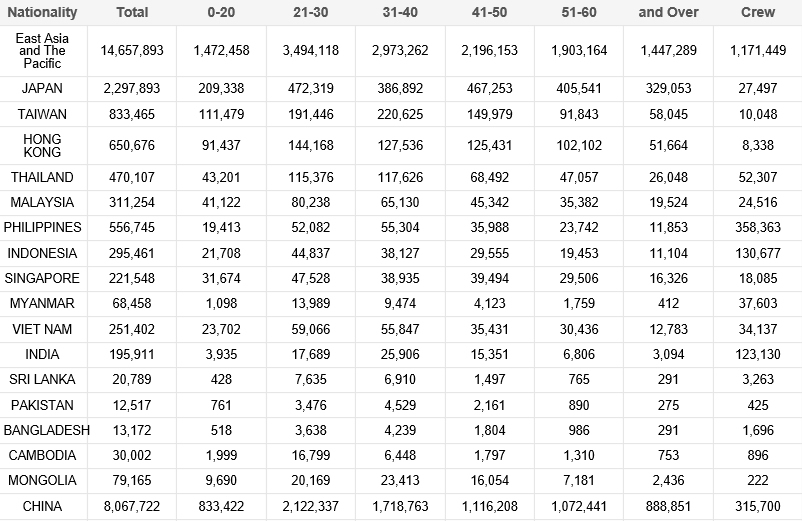

Chinese arrivals for 2016 rose +34.8% to 8,067,722, according to Korea Tourism Organization figures published today, a 46.8% share of total visitors. Japanese arrivals also rose sharply, up +25% to 2,297,893, a 13.3% share of total arrivals. Korean departures rose +15.9% in the year to 22,383,190

Chinese arrivals for 2016 rose +34.8% to 8,067,722, according to Korea Tourism Organization figures published today, a 46.8% share of total visitors. Japanese arrivals also rose sharply, up +25% to 2,297,893, a 13.3% share of total arrivals. Korean departures rose +15.9% in the year to 22,383,190

Duty free sales to foreigners (dominated by the Chinese followed by Japanese) rose +44.1% to KW8.8 trillion (US$7.5 billion)

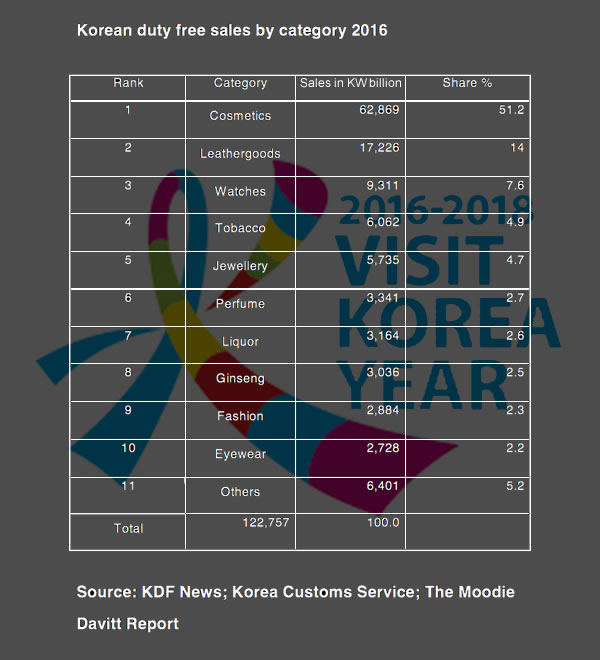

Cosmetics, driven by booming sales of skincare (particularly Korean brands), accounted for 51.2% of turnover. Here are the leading categories:

Lotte Duty Free stretched its lead as the dominant force, racking up a +26% increase in sales to KW5.973 trillion (US$5.1 billion), a stunning performance given that the retailer had to close down its Lotte World Tower Duty Free store in late June.

Lotte’s sales by outlet were:

– Seoul flagship store: KW3.160 trillion (US$2.7 billion)

– Incheon International Airport: KW1.145 trillion (US$980.1 million)

– Jeju KW0.489 trillion: (US$418.6 million)

– Coex, Seoul: KW0.387 trillion (US$331.3 million)

– Lotte World Tower (closed from 26 June 2016): KW0.347 trillion (US$297 million)

– Busan: KW0.3458 trillion (US$296 million)

![[LDF]Main Store 12F_1](https://moodiedavittreport.com/wp-content/uploads/2023/07/LDFMain-Store-12F_1.jpg)

Fast-rising Shinsegae Duty Free posted sales of KW0.9608 trillion (US$822.4 million). Its new store in Myeong-dong, Seoul, which only opened on 1 May, generated sales of KW0.349 trillion (US$298.7 million). Its downtown Busan store (relocated in March to Centum City) posted revenues of KW0.336 trillion (US$287.8 million). Dongwha Duty Free in Seoul posted sales of KW0.3547 trillion (US$306 million)

Of the recent sector newcomers HDC Shilla generated sales of KW0.3971 trillion (US$340 million); Galleria 63 Duty Free reached KW0.224 trillion (US$191.7 million), Doota Duty Dree KW0.111 trillion (US$95 million) and SM (Hana Tour) KW0.056 trillion (US$47.9 million).

Other results of interest included the Dufry ThomasJulie alliance at Gimhae International Airport in Busan with sales equating to US$68 million, while JTC’s domestic duty free operation at Jeju Airport (for Korean passengers) posted impressive sales of US$450.1 million.

*NOTE: The Moodie Davitt Report and KDF News have a highly successful, exclusive information-sharing partnership.