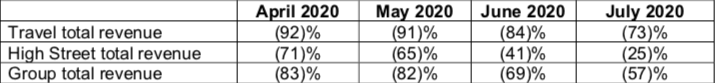

UK. WHSmith today issued a trading update, reporting that Travel division revenue fell by -73% year-on-year in July, after a decline of -84% in June.

The group also forecast a pre-tax loss of £70-75 million for the year ended 31 August, and announced a proposed restructure of its UK business that could result in 1,500 job losses (see below).

The Travel division is continuing to reopen stores across the UK and overseas. In the UK, WHSmith is trading at 246 of its largest stores across air and rail, which have historically represented around 75% of annual revenue. It noted: “We now have 53% of our UK Travel store estate open and we remain focused on increasing average transaction value in these locations.”

On operations elsewhere, it added: “In the US, where approximately 85% of passengers are domestic, we anticipate a faster recovery versus the rest of the world. Overall revenue is down -80%, although we have seen an encouraging performance from the 147 stores that we have reopened to date with sales in these stores down -50%. During the second half, we accelerated the integration of the InMotion head office into Marshall Retail Group.

“Outside the UK and the US, we are seeing broadly similar trends to UK air with passenger numbers significantly down year on year and an increase in average transaction value. We now have 153 stores open across the rest of the world.”

Because of lower passenger numbers in Travel and lower High Street footfall, WHSmith said it is reviewing its operations across the UK. “We are now starting a collective consultation on a proposed restructure which could lead to up to c.1,500 roles becoming redundant.

“This has been a very difficult decision and we are committed to supporting all our colleagues throughout this process and ensuring it is conducted fairly. Based on our initial assessment, we believe that the costs associated with the restructure will be in the region of £15-19 million, reflecting the group’s enhanced redundancy policy.”

As at 4 August, WHSmith had cash of about £63 million with a revolving credit facility of £200 million and an additional committed bank facility of £120 million, both of which are undrawn. In addition, it has secured eligibility for the Government’s Covid Corporate Financing Facility (CCFF). In July, monthly cash burn on an underlying trading basis was between £15 million and £20 million.

The company noted: “Taking into account the group’s current financing arrangements, combined with a variety of operational actions, the Board is confident that the group has sufficient funds to allow it to operate throughout a prolonged downturn in our markets.”

Chief Executive Carl Cowling commented: “In our Travel business, while we are beginning to see early signs of recovery in some of our markets, the speed of recovery continues to be slow. At the same time, while there has been some progress in our High Street business, it does continue to be adversely affected by low levels of footfall.

“As a result, we now need to take further action to reduce costs across our businesses. I regret that this will have an impact on a significant number of colleagues whose roles will be affected by these necessary actions, and we will do everything we can to support them at this challenging time.

“While we are mindful of the continuing uncertainties that exist, we are a resilient and versatile business. The operational actions we are taking along with the financing arrangements that are in place, put us in a strong position to navigate this time of uncertainty and we are well positioned to benefit in due course from the recovery of our key markets.”