INDIA. Airport companies, investors and travel retailers are becoming increasingly alarmed over proposed drastic cuts to the arrivals duty free allowance.

As reported, the Indian Ministry of Commerce & Industry has proposed the reductions on alcohol, cigarettes and the total value of duty free goods that passengers can buy when returning from overseas.

Numerous media reports say the Ministry wants to halve the liquor allowance from two litres to one and eliminate the cigarettes allowance (currently 100 sticks).

A reduction in the value allowance from the current INR50,000 (US$703) is also proposed. Any move to cut allowances would have a sharp impact on the dominant arrivals channel in airport duty free.

“Such a shift in buying to foreign airports will kill the Indian duty free industry” – Association of Private Airport Operators

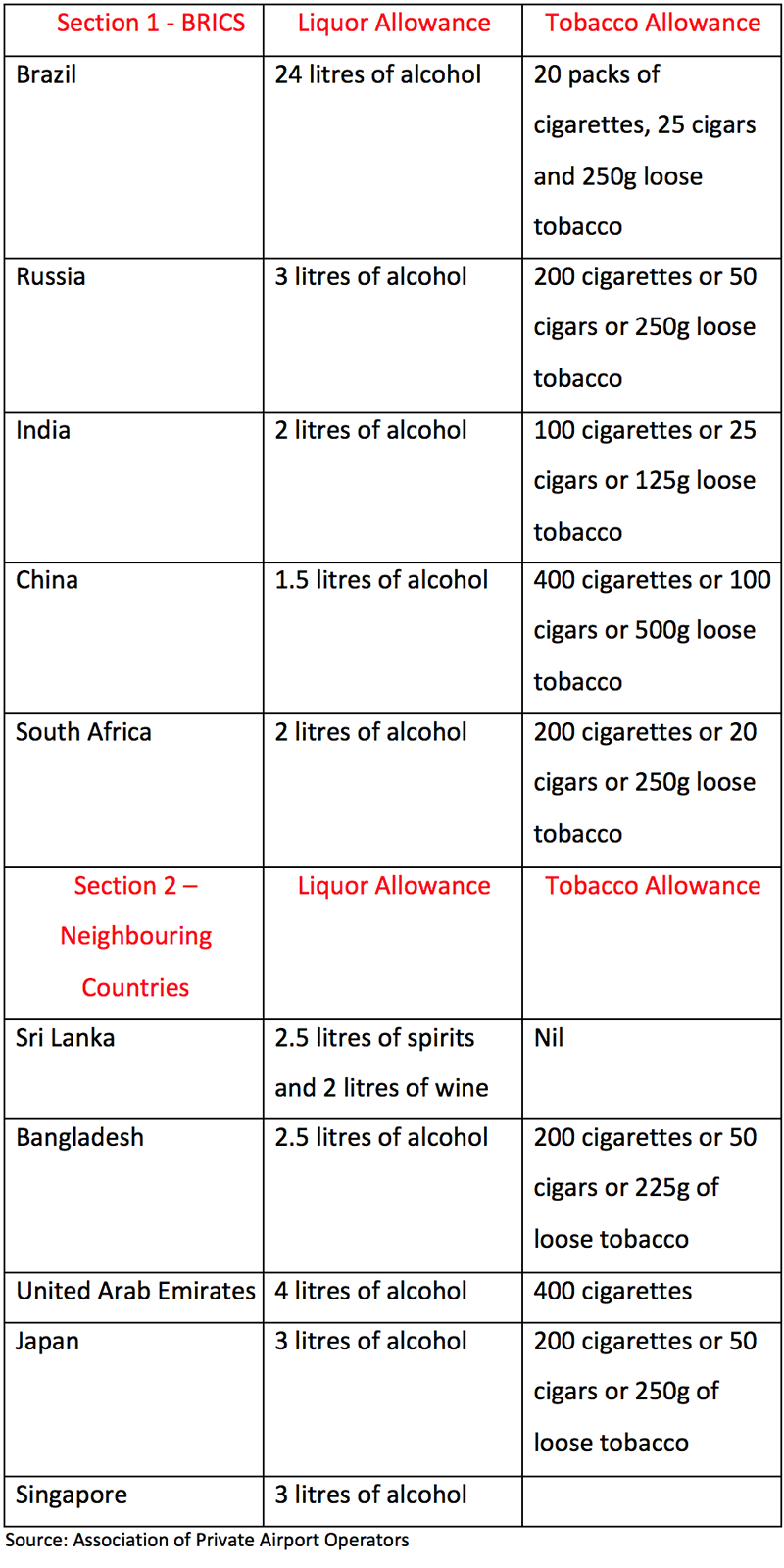

A leading Indian travel retail executive told The Moodie Davitt Report that while he doubted that the measure would ultimately be adopted, concerns were growing over the Ministry’s intent. The push to slash the allowance flies in the face of the Ministry of Civil Aviation’s recent call to increase the allowance and a demand to double it by the Association of Private Airport Operators in order to bring India in line with the UAE.

A position paper produced by the association obtained by The Moodie Davitt Report warns that any allowance reduction will hit the owners of India’s privatised airports hard, particularly if they have committed to payments on a per passenger basis to Airports Authority of India (AAI). “Suddenly amounts quoted by them could become unviable. Further privatisation efforts of AAI would get dented. This will hit hard the policy of [the] present government to privatise more and more airports,” the association warned.

It continued: “The reduction of the liquor allowance will induce passengers to buy liquor from foreign countries, on departure, to avoid restrictions which have to be observed by duty free operators in India. It will lead to a herculean task for Customs Authorities to check each and every passenger and there will be a shift in focus from contraband import of gold [and] narcotics to liquor. Such a shift in buying to foreign airports will kill the Indian duty free industry.

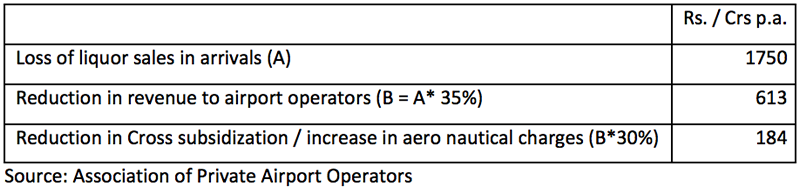

“Ultimately passengers will bear the brunt in form of higher ticket prices,” the association warned. The report said that reducing the liquor allowance would also see aeronautical charges rise by some INR184 crores (US$25.86 million) per annum due to the erosion of cross-subsidisation.

“[The] viability of airports will get further eroded,” the note continued. “Most of the airports are operating at a loss. Revenue share of AAI from airports leased by it on a revenue share basis shall get reduced, thereby reducing AAI resources to develop remote and small-town airports.”

The association warned that future privatisation of AAI airports would be imperiled and that 8,000-10,000 people would lose their jobs directly and indirectly across sales, logistics, warehousing, transportation, shipping and finance.

“There will be a huge hit to an already stressed banking sector due to exposure of banks to duty free operators becoming non-profitable assets.”

“Ultimately passengers will bear the brunt in form of higher ticket prices”

Kreol Group CEO Lal Arakulath (a partner with Dufry in Cochin Duty Free) told The Moodie Davitt Report earlier this week that any cut in the duty free limit would bring a “very negative vibe” to Indian duty free. He added: “Departing airports in other countries will benefit by introducing such a law. Today arrivals duty free is doing well in India thanks to better pricing and services.”

A senior AAI spokesman told Indian media Business Standard: “Who is gaining from this decision? No one. The government and airports — all will lose revenue.”

“It will be a big blow to duty free companies and airports. Duty free sales are an important component of non-aeronautical revenues for airports and 30% of the non-aero revenue is used to cross-subsidise aeronautical charges,” added an unnamed CEO of a private airport.