Prologue: French drinks company Pernod Ricard is a powerhouse of the travel retail sector, boasting a star-studded portfolio straddling multiple categories and incorporating a glittering roll-call of brands from Absolut to Ballantine’s to Beefeater to Chivas, from Jameson to Martell to Mumm to Royal Salute and The Glenlivet and many more in between.

Travel retail has long been viewed as a ‘must win’ channel by group CEO Alexandre Ricard but along with all its peers Pernod Ricard has been heavily buffeted in the channel by the pandemic’s impact on travel since early 2020.

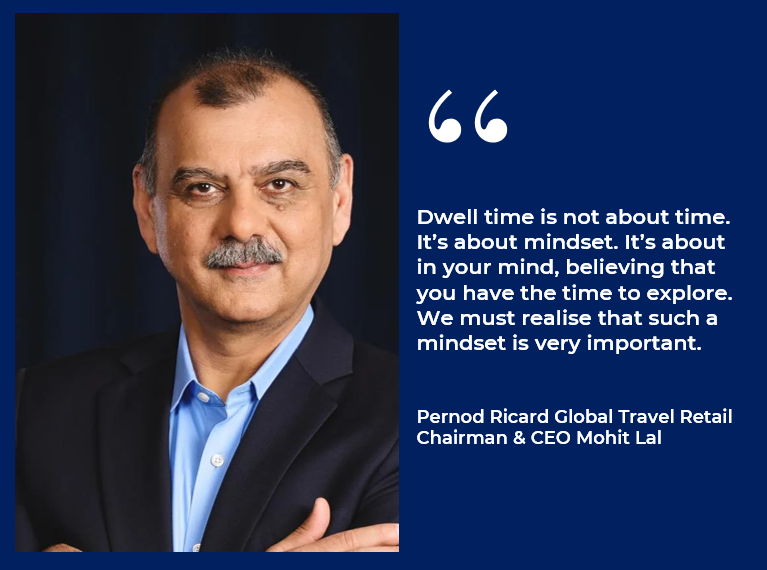

Against the backdrop of a resurgent though volatile and often problematic travel market, how does the group evaluate the channel’s performance and potential? And how have the experiences and lessons of the pandemic shaped its approach to the sector? The Moodie Davitt Report Chairman Martin Moodie caught up with Pernod Ricard Global Travel Retail Chairman and CEO Mohit Lal and Vice President of Marketing Liya Zhang recently to find out the answers.

Martin Moodie: Mohit, let’s start please by assessing travel retail’s state of health. As Doctor Lal, if you like, in analysing what has been a very sick patient for the last couple of years, what’s the prognosis today?

{Click on the Podcast icon to hear Mohit Lal talking to Martin Moodie}

On the record with Mohit LalOn uncertainty: In today’s world, you have to live with uncertainty and your ability to adapt to it will drive success. On putting crisis to good use: What the crisis allowed was the liberty of time. All the great ideas and initiatives we had that we couldn’t bring to the fore because of paucity of time were something that we used the crisis to build on and accelerate. On value not volume: The capacity of a traveller to pay is not driven by the size of his wallet but is driven by the quantity restrictions on how much alcohol you can buy in duty free. Therefore, a big lever is not to get more bottles sold – which is always a challenge – but how can you maximise the value of each bottle sold? On the health of the Trinity: The one thing that the crisis has taught us is if the Trinity did not exist a lot of people would have gone out of business. The roots of Trinity are alive and well and thriving. We’ve got to now build on the fact that we’ve tested the roots and realised that they’re very strong. On a post-COVID reboot: So you have a perfectly finely built automobile that you have used over the years and perfected it to make sure all its parts work in absolute smooth unison. And then you ignore it and put it away for two years. Then you wish to restart it. But you don’t know which parts will not mesh with which other parts and which parts are rusted. On lessons of crisis: What the industry needs to learn is that the capacity to talk and discuss the hard topics exists – the courage that you got to do it during the crisis is courage you should not lose now. On luxury packaging: We tend to get our mindsets fixed on the fact that certain brands need secondary packaging and certain brands don’t. Whereas we have to understand what value the secondary packaging is delivering to the consumer. The moment we are willing to shift that mindset and take some courageous decisions, you will begin to see the changes that you want. On leading change: If short-term success may therefore need sacrifice, then it’s something that we will definitely consider because one of the key things about leaders is courage. If you don’t have courage, it doesn’t matter which position you hold or how big you are, you’ll never be the leader. |

Mohit Lal (ML): Its state of health is firmly back in recovery. But there will be a few ups and downs. If I elevate the discussion to the world of travel, then I’d say that it’s a strong flight upwards but you’re going to see a little bit of turbulence and bumpiness as you get that strong upwards trajectory.

And therefore, rather than just saying we are very sure what will happen in the future, we must remain agile. Because what we have been dealing with was a unique crisis that hasn’t ever been faced before. It was global in scale – and travel retail is the only business that is global in scale from an operational standpoint.

So you don’t expect everywhere in the world to be on exactly the same trajectory. You will get bumpiness and you don’t know where and when it will appear. Therefore, you have to stay agile in terms of how you tackle the recovery and how you tackle the challenges of that recovery.

For example, who would have ever anticipated that an airport would come out and put a cap on the number of passengers that they want to travel through their facility? If in 2019, someone had said that an airport will mandate a cap on the number of passengers, we would have just said someone’s not got it right. This can never happen.

Especially after those passengers have been taken away from you during much of the past three years. And now they’re being turned away.

ML: Correct. We have to recognise that the capacity to be certain about the future doesn’t exist. So your capacity to deal with uncertainty is going to be your key lever of success. We as leaders, as managers, have been trained to anticipate the future with certainty, and then target that future with certainty. In today’s world, you have to live with uncertainty and your ability to adapt to it will drive success.

One also has to recognise that the truth today is not uni-dimensional. It depends which side you want to emphasise. You could emphasise the side that creates challenges. Or you could say, “I want to look at the side that creates opportunity.” It’s like the old [Joni Mitchell] song that you need to look at clouds from both sides now, from up and down.

That’s the way I see it. When the crisis started, I said within this crisis would lie huge opportunity. And I said within this recovery will lie a few crises! But there will always continue to be opportunity because the human desire to travel is stronger now than ever before.

You mentioned before we started that travel is an indulgence. So I indulge myself when I travel. What the pandemic has taught us very simply is that if I don’t travel, I don’t live my life. Which means travel is no longer indulgence, it’s an integral part of my life. And if I don’t travel, something’s been taken away.

And if you take something away from someone…

ML: … they want it so much more.

I think other human factors come into it as well. The fragility, if you like, of life has been reinforced. People have lost people during the pandemic, or they haven’t seen people for a long, long time. I was talking to Paul Griffiths, CEO at Dubai Airports. He just felt there is a ‘here and now’ about mankind now. And travel is integral to that here and now.

ML: The whole thing about waiting for tomorrow was because before you could say “Tomorrow is certain.” In today’s world, there is no certainty of tomorrow. So waiting for tomorrow is a huge risk; earlier, it was not seen as one. And therefore the ‘now’ is a lot more important to people than it ever was before.

If one looks at this global channel in late 2022, as opposed to how things were flying along in December 2019, how do you think the sector has changed? And how has your consumer changed?

ML: We have to understand this from what I call the concept of momentum. So you have a perfectly finely built automobile that you have used over the years and perfected it to make sure all its parts work in absolute smooth unison. And then you ignore it and put it away for two years.

Then you wish to restart it. But you don’t know which parts will not mesh with which other parts and which parts are rusted. You will discover that as you go along. We have to recognise the fact that the restart is never going to go back easily to what we were doing within the industry in the past. You will come across a number of unforeseen bottlenecks. And rather than see them as a problem, you have to see them as reality and say, our job is to try to overcome them.

If we expect everything to go back exactly and smoothly to what it was pre-COVID, it’s not going to happen. The challenges are going to be new. As I said, the world is now in a lot more uncertain place.

It’s not just to do with COVID. Whoever thought there’d be a war that would be fought for so long? Whoever thought that post-COVID when demand was shrinking, the US would have inflation of the nature that you’re beginning to see? So the world’s been seeing volatility of a nature it’s never seen before. And your ability to adapt to the volatility is important and I think that’s one thing that the industry needs to start to develop the ability to do.

Sharpening the sword

In terms of the elements that you can control though, how has Pernod Ricard Global Travel Retail changed as a result of the learnings of the past two years? And what are those learnings?

ML: The big change for us is how do we use the crisis to actually come out a lot stronger internally in terms of how we address the channel?

We always had good ideas. We always had great intentions because this is a channel that’s dynamic. The number of first-time travellers is quite high and the way you wish to engage with those first time travellers is different from how you engage with other travellers.

The travel ecosystem is beginning to change. And as an organisation, these great ideas and great intentions didn’t necessarily see the light of day because of time and because your ongoing day to day captures so much of your time.

What the crisis allowed was that liberty of time. All the great ideas and initiatives we had that we couldn’t bring to the fore because of paucity of time were something that we used the crisis to build on and accelerate. And not to do it individually, but to share it with our customers. So that by the time we were getting out of the crisis, we had the ability to start putting things into place quickly.

To give you a simple example, the world of travel retail has got more digital in-store, which means media in-store has moved from static to digital. We always knew we had the ability to manage the digital content remotely, but we had no bandwidth to begin the project.

But we started the project [during the pandemic] and now it’s well advanced. So we can start changing visuals and brand identities and switch from one brand to another digitally in a store through remote mechanisms.

This is the kind of opportunity that the crisis has thrown up. The ability to leverage technology; to leverage digital; to bring insights and usable insights to the fore; to elevate the quality and impact of training that we provide to in-store staff. All of that has changed.

I often say, we use the crisis to sharpen the sword. Normally, when you are in business you are using the sword day in and day out, so you have no time to sharpen it. The crisis is the perfect time to sharpen the sword.

Digital acceleration

Besides what you as a company have done digitally, we’ve seen the acceleration of digital across all generations and all geographies during the pandemic. I would say digitalisation in both commerce and communication terms has accelerated more during the last three years than in the previous ten. Where are you at in terms of your digital journey?

Liya Zhang (LZ): The past three years certainly saw COVID hit travel retail badly. But I believe the rebound of the travel retail world is bigger from a marketing perspective based on how we can now engage the traveller and what we can offer to them.

Why do I say that? As we are basically one channel, in the past I would say we were two dimensional. But today in terms of travel retail marketing, I feel we are able to connect with those travellers before they travel. And there are many ways to reach them after they travel, all facilitated by digital and also because of changing traveller habits.

These habits are not naturally created. They are triggered by needs, especially knowing that travel is now quite stressful a lot of the time. So the traveller wants to plan in advance; they now use the digital devices much more to do so. All this is triggered by needs.

The future development needs to be facilitated by the platforms. And when I say platforms, we see that our retailer partners have all developed very quickly [during the pandemic]. They have been trying to catch up. Compared with the other ecommerce platforms, in the past they were quite a way behind.

This is one side – technology platform development. But don’t forget, brands will also play a very active role in how we can talk to the travellers in terms of both content and products.

I can give one example, which is Royal Salute. The brand has developed so fast and now has a much wider portfolio, including a lot of limited editions. It is not possible to display everything in the physical space, but in the digital world we have created a programme called The Kingdom Club. We have collaborated with Lotte Duty Free in Korea and now in Singapore.

I believe that in Korea this online Kingdom Club – as the ecosystem and local regulations allow – together with the ecommerce development is critical to taking things to the next level.

In Singapore, we have a pop-up space. On its own, pop-up space could be an expensive exercise. But today we see pop-up as just one touch point. It’s linked to our Kingdom Club programme on the Lotte Duty Free website. And we have the digital screens with JCDecaux. Pernod Ricard just struck a strategic data alliance with JCDecaux to explore the potential of how to jointly release the power of data in terms of traveller engagement.

So for us, digital acceleration has the ability to connect all the touch points – including the online programme and the airport store – while being able to create a meaningful offer to the consumers.

What I find really interesting in what you say is that brands always talked historically about the travel retail shop window or showcase. But really the showcase was confined to the number of people that went in and out of the store. That was the showcase and it was a great one.

I think the pandemic and digitalisation that we have been speaking about have enhanced the showcase enormously. Your Royal Salute project is a classic example. You can reach millions, not just the people that are going through Incheon or Changi. It’s a fantastic amplification.

ML: Yes. So there’s content and there’s the consumer, and then the need of the consumer to connect with the content. One of the things we have to understand that the world of travel creates – and one of the key drivers of travel retail historically – is around dwell time.

Dwell time is not about time. It’s about mindset. It’s about in your mind, believing that you have the time to explore. We have to realise that such a mindset is very important. If it’s a mindset issue as opposed to a physical time issue, then it is about the mindset as you think about travel and as you think about shopping when you are travelling.

And that’s where the connection that Liya spoke about with The Kingdom Club becomes so much more relevant to a traveller as opposed to just an ordinary consumer. a consumer. Because the mindset of the traveller when they approach the Kingdom Club is very different from what the mindset of a classic consumer will be. We have to leverage that mindset of “I’m in a mode where I’m not short of time.” And that gives you the opportunity to explore.

The other thing is we have to recognise that digital is not just about digital marketing. Our recent pop-up at Changi from the final ‘go’ to installation took six weeks. Four years back, it would have been six months.

What’s enabled six months to go to six weeks is, again, technology. Technology on the design side, to your fabricators, and to the people who are installing it. It just shortens the time span so much. So your ability to be agile, especially in times of uncertainty and volatility, has been multiplied so much because of the adoption of the right kinds of technology.

From a group point of view, you’ve always talked about travel retail as a must-win channel. Has the group’s perception changed as a result of the pandemic?

ML: No. If anything, if I was a person who lays bets, I would lay a bigger bet on travel retail today than I did in 2019.

There are a couple reasons for that. The first is that, as mentioned, travel’s no longer an indulgence. If I don’t travel, I’m not living my life, right? Secondly, I’m not going to put it off for tomorrow, because I don’t know what tomorrow could bring. I’m going to do it today.

More and more, people will travel as the travel ecosystem starts to create capacity for travel. So you’re going to see a much stronger momentum in terms of the number of people travelling. The trips may be shorter, but that doesn’t impact the travel retail industry.

Yes, people may get a little more conscious of the carbon footprints of long flights; of the problems of transit and baggage being lost etc because it’s not as simple as it was, but more and more people will travel.

{On the eve of The Trinity Forum this November, Platinum Partner Pernod Ricard Global Travel Retail produced this video that underlined its premium approach to category recovery and wider industry growth}

When we talk to the retailers, wine and spirits seem to be leading the recovery in travel retail. And that means the salience of wine and spirits in travel retail is starting to grow. And therefore the attention that retailers will pay to wine and spirits will also start to grow.

The third reason is that the capacity of a traveller to pay is not driven by the size of his wallet but by the quantity restrictions on how much alcohol you can buy in duty free. And, therefore, a big lever is not to get more bottles sold – which is always a challenge – but how can you maximise the value of each bottle sold?

So we’re seeing this mindset of being the cheapest offering changing to being the most value-centric offering. That’s a reason why I place another bet on this. We are seeing travellers buying more and buying better. So again, I place my bet.

And then if you look at how parts of the western world engaged with spirits historically, most of them engaged only when they went out to a restaurant or to a bar and had a drink. The concept of consuming spirits at home was not something that you did on a regular basis. What the pandemic did was to bring the spirits consumption home and, therefore create moments of consumption that did not exist earlier.

So a large number of travellers who never saw the need to buy, to stock up at home, now see that need. You’re going to get a lot of first-time buyers of spirits, because a new need has been created as a consequence of a new consumption moment at home. And that will drive travel retail forward.

The last point I want to make is that with the supply chain complexities, retailers have realised that… the number of suppliers that they need to deal with has to be smaller. So, again, that is the reason why I place my bet in a much stronger way today than I would have before the pandemic.

Trinity roots thriving

What do you think of the state of the Trinity post the height of the pandemic?

ML: The one thing that the crisis has taught us is if the Trinity did not exist a lot of people would have gone out of business. So, yes, it was stressed, and it didn’t necessarily have all the momentum that it needed to work in the synchronised fashion that it is meant to, but it was there. And when the crisis hit, you did see that collaboration and solidarity start to come back.

Whether the industry reverts to type, I suppose will be the challenge.

ML: Yes. The key issue is that previously no-one was willing to drive that dialogue of a tough nature when the times were good. There was no hesitation to drive it when the crisis happened. So, people have got used to talking about hard topics, which earlier they were very uncomfortable to talk about.

What the industry needs to learn is that the capacity to talk and discuss the hard topics exists – the courage that you got to do it during the crisis is courage you should not lose now. And, therefore, I believe that the capacity of the Trinity to drive much greater dialogue now is also a lot more possible than I would say it was before.

So, the Trinity is alive and well. That’s a good message.

ML: I would say that the roots of Trinity are alive and well and thriving. We’ve got to now build on the fact that we’ve tested the roots and realised that they’re very strong. Capitalise on those roots to build what we want on top of it.

Roots that were put under immense stress.

ML: Yes, under the greatest stress test possible.

Too many variants (and we’re not talking COVID)…

Let’s change tack to some industry specifics. I did a very interesting interview with Dubai Duty Free Chief Operating Officer Ramesh Cidambi recently and one of the key points he made was that too many spirits companies had introduced an excessive number of variants. He thinks there is a danger of killing the golden goose in certain categories. Do you think there’s any validity in that?

ML: There’s validity in it. However, it depends on what you are doing and what your motivation for doing it is.

Number one is when you look at travel retail and, let’s say, the P&C category, shoppers are going to those sections because that’s where they find new products.

Newness is something that travellers expect from travel retail. So, if you’re not going to evolve your portfolio of brands, then you’re going to create a multitude of brands. Is that the right thing to do?

We can look at what happened to the gin category in airports, where suddenly from 20 brands you had 100 and travellers started to get frustrated because they didn’t know how to navigate the category.

If we look at newness and at what the key motivators are for people to shop in duty free and you begin to design your offerings around those needs, then you’re not in any way driving the traveller away. If you build those so the portfolio enhancements keep the core of your brand intact, there is nothing that will take away from it.

I don’t believe that you always will get to the same answer, but let’s go back to, let’s say, the vodka flavour revolution. At one time you had one new flavour every week and the purpose was just to try to get that incremental sale. It wasn’t driven out of the key need and it wasn’t driven out of keeping your portfolio reasonably compact. So, the new flavours were being brought in without taking the old flavours out.

There are brands in the US – and I don’t want to name names – that were doing this in a big way and it was fuelling growth. Then at one period, it started to flatten out and consumers got completely distraught with it.

We have to understand need states. There’s a need state for premiumisation. Travel retail is the perfect example of premiumisation. Take Jameson Triple Triple. It’s a huge success. Consumers get the opportunity to upgrade to a better product. Retailers get the opportunity to get more revenue per bottle. It’s not diluting the equity of Jameson in any shape or form. So, that’s what I call the premiumisation of a brand.

Then let’s take the gifting opportunity, where we bring out a limited edition – so it’s not a variant – where the packaging is city-centric. So, when you travel to a place, you want to take that place back home as a souvenir. The souvenir aspect is going strong, but your core product is the same. You’re just giving it the impression of a souvenir or at times you are creating a limited edition that’s linked to Christmas or Chinese New Year because occasions drive gifting.

So long as you’re addressing this through the architecture, staying true to what your brand is and addressing the key need states of brands, you’re doing the right thing.

In travel retail, innovation is a big growth driver. It’s also the path to eventual portfolio expansion in domestic markets because if you’ve tried it in travel retail and it works, then you can put it into the domestic market. So we have to use this and we don’t need to shy away from the fact that sometimes it may go wrong. But if you take out newness from travel retail, a lot of the lustre goes away.

Luxury packaging and the sustainability dilemma

During your TFWA press conference, you said the company was at the starting line in terms of sustainability. However, premiumisation as you just mentioned is key to what you’re doing. Packaging is so key to that premiumisation, beautiful tubes for example that have been long been part of the single malt category.

I remember when the first tubes came out – I think from Glenfiddich – and everyone said “Wow, these are amazing.” And they’ve become part and parcel of the single malt revolution. So, the packaging is integral to the allure, which in turn drives the premiumisation. But the packaging is one of your biggest challenges in terms of sustainability. Is there a tension? And if so, how do you manage it?

ML: There is a tension, but there’s also tension between what I call the preconceived perceived state of mind versus wanting to shift paradigms. So, let’s look at Absolut Vodka, a big success in travel retail for years. Where is the secondary packaging? There is none. Never been any.

But could you do that with, say, The Glenlivet?

ML: No. But there are success stories that are driven without the use of secondary packaging. You have to see what role secondary packaging plays and ask how you can get that role to be played without secondary packaging. And you will not get one answer that fits everything.

Absolut is an interesting example because the bottle itself was always iconic. Remember when they brought it out in the US? It was a revolution. It was an old fashioned, Swedish-style medicine bottle. So, you’ve had that working for you, but for one of your single malts it’s much harder, isn’t it?

ML: I’ll give you examples of products that seem to do well without too much packaging. Take Jameson, for example. Where is the secondary packaging? It’s a whiskey brand. I’ll even talk about a competing brand, which doesn’t have secondary packaging – Monkey Shoulder [from William Grant & Sons -Ed].

What I’m saying is that we tend to get our mindsets fixed on the fact that certain brands need secondary packaging and certain brands don’t. Whereas we have to understand what value the secondary packaging is delivering to the consumer. The moment we are willing to shift that mindset and take some courageous decisions, you will begin to see the changes that you want.

There’s one aspect, however, that is extremely important for us to understand, which has come through our research. When you buy a bottle of spirits that costs US$20 or US$25 to U$30 and there’s a risk of breakage when you carry it, that’s a risk that people are willing to take. But if you’re buying a US$500 bottle of spirits and you need to carry it and put it into the overhead compartment inside an aircraft, it’s a completely different story. And therefore, we have to understand to what extent the elimination of secondary packaging is a barrier to carriage rather than a barrier to purchase.

The last thing you want is to take the box off and have retailers putting a plastic sleeve around the bottle because then the whole purpose of taking the box off is gone. You could say “I did my job, now the retailer is messing it up.”

But equally our objective is to make sure we’re making the channel sustainable. So there is research that we’re carrying out where we are trying to understand what the need states are, what the role of secondary packaging is, and how can we if not completely eliminate secondary packaging, then minimise it to the greatest extent possible?

LZ: We are very committed to this agenda. We did this research and looked at the role of the packaging in the occasion of consumption or gifting and asked what the role is of the purchasing and transportation. So that we can understand what is necessary to keep and what is unnecessary that we can remove.

But really, there is no clear answer, where we can simply say in one step “Okay, done.” In the end, this is a topic we will be pitching to the retailer and the group brands to find a responsible answer.

And, of course, you’re not working in isolation. If we take single malt or ultra-premium blended whiskey Scotch, you’re in a very competitive category. So, you might go with the naked bottle approach, but most of your competitors will not. And if you do, that offers a pretty easy brand switch to one of your competitors if consumers want a fancy box, right? I’m not sure how you get over that challenge because you can’t win over a whole industry at one time.

ML: Every business that you run is based on arbitrage – the choices that you make. There’s never something that you do that only has a win and doesn’t have a potential give. So to get, you have to give. From a Pernod Ricard standpoint what we’d like to try to lead initiatives in areas that we believe are right for the industry and that deliver to us long-term credibility and trust.

If short-term success may therefore need sacrifice, then it’s something that we will definitely consider because one of the key things about leaders is courage. If you don’t have courage, it doesn’t matter which position you hold, how big you are, you’ll never be the leader.

If sustainability is able to be led, it has to be led by the leaders and you then have to have the courage to do what’s right.

Maybe it has downsides… rather than to say, “Let’s sit and play safe.” I liken this to something I saw the other day where we are all sitting in a cage, but the door of the cage is open. It’s our willingness to step out of the cage that’s the challenge. The cage is not keeping us in. The door is open. We are not willing to get out of the cage. When it comes to sustainability, the stance that we wish to take as an organisation is that we want to be the first ones flying out.

The role and value of the travel retail ecosystem

To close Mohit, let’s say I have managed to extend my powers and anointed you Czar of global duty free. I think you will be a benign kind of Czar and a kindly one, but what’s your first edict going to be?

ML: My first edict is going to be that individually we can’t even size the opportunity that we are missing. Whereas collectively, we will be surprised by the opportunity that we are seeing.

Therefore, if I had my way, I would make sure that the Trinity, as you call it, Martin – or the travel retail ecosystem that I call it – begins to realise its collective ability to drive opportunity and benefit for all elements of the ecosystem.

You heard me talk in Doha a couple of years back at The Trinity Forum about how important this ecosystem is to the world. I said what would happen to Dubai if it didn’t have a viable airport and what would happen to Changi if it didn’t have credible retail?

What would it do to the economies of those countries? We sometime think our industry is only linked to travel and leisure and stuff of that sort. In fact, there’s a much deeper connection to how the world economic order works, to how this industry in many ways works for the betterment of so many people. For example, the employment opportunities that it creates; and how it adds value to us individually by opening us up to experiences as we visit different lands.

But the fact is that as an industry we have never been able to leverage all these aspects together. There is so much that can be done. So I would just say that the ecosystem needs to be the fundamental driver of how the industry works rather than it being about the individual components.

Very well said. Look what happened when a Singapore was stripped of its airport as largely happened during the height of the pandemic. And Dubai, which actually was stripped of its airport for 45 days. Look at what happened to Incheon during the crisisic. The airport role…

ML: … Is huge. Yeah. When airport viability comes into question – and we’re seeing Doncaster in the UK start to shut down because it’s not viable – what tends to happen is the first domino falls and you don’t know what the chain reaction will be.

The fact that you’re shutting an airport down because it’s not viable is not a good sign and it will force other airports to say “Oh, there’s a possibility that we can shut down” because, again, you’ve always been in the cage to say we can’t shut down. But the door is open now, sadly, and someone has flown out.

We have to recognise that the COVID crisis created huge stress and unless the ecosystem nurtures this back to health, we will see more dominos fall. When more dominos fall, it will not be good for the geographical area nor the countries they’re in and they will then need to take reactive steps.

But I think the ability of us to broadcast the proactive steps that are required, to nurse the industry back to health and then to capitalise on the opportunity are phenomenal.