SOUTH KOREA. The Shilla Duty Free parent company Hotel Shilla posted a +10.3% year-on-year rise in fourth-quarter revenues to KW934.6 billion (US$803.7 million) and a +38.5% increase in operating profit to KW15.6 billion (US$13.4 million)), slightly below market expectations.

The key results for the hotel-to-retail group lay with those of The Shilla Duty Free, which accounted for 89.4% of group revenues and more than its entire operating profit (the hotel sector and other businesses lost money in the quarter).

The travel retailer, South Korea’s second-most powerful player (behind Lotte Duty Free) and number six in The Moodie Davitt Report Top 25 Travel Retailers’ worldwide ranking (based on 2015 sales), posted a +10.5% rise in duty free revenues on the Korean market to KW703.4 billion (US$604.9 million). However, operating profit on the Korean duty free market fell -7% year-on-year to KW25 billion (US$21.5 million) in the face of escalating tour commission costs in particular (see chart below).

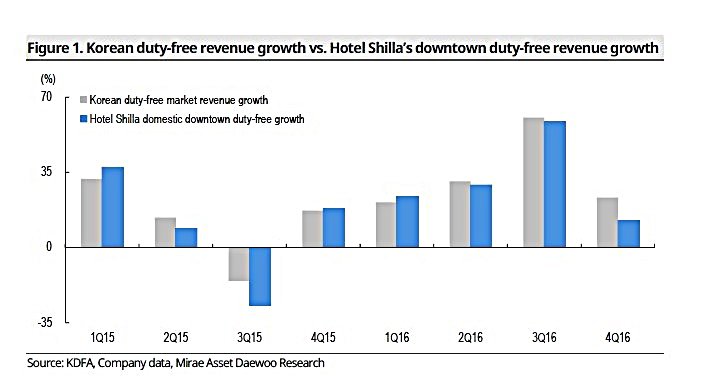

Downtown duty free sales in South Korea rose by +12.6% – well short of the sector’s +23.2% increase, a gap largely explained by the heavy proliferation of new competitors. Shilla’s Korean airport duty free revenues rose +4.9% year-on-year, according to Mirae Asset Daewoo Research the first gain in the six quarters since the retailer renewed its duty free concession at Incheon International Airport.

Downtown duty free sales in South Korea rose by +12.6% – well short of the sector’s +23.2% increase, a gap largely explained by the heavy proliferation of new competitors. Shilla’s Korean airport duty free revenues rose +4.9% year-on-year, according to Mirae Asset Daewoo Research the first gain in the six quarters since the retailer renewed its duty free concession at Incheon International Airport.

This was despite the company’s exit from Seoul Gimpo Airport, where it did not defend its contract that expired in May 2016.

Overseas duty free revenue (Singapore Changi and Macau International airports, Phuket downtown) increased by +9.9% year-on-year to KW133 billion (US$114.4 million) but losses remained heavy at KW8 billion (US$6.9 million). However, Mirae Asset Daewoo Research Center Equity Analyst (Cosmetics, Hotel & Leisure, Fashion) Regina Hahm noted that the foreign loss had eased quarter-on-quarter by KW1.5 billion (US$1.3 million).

The Shilla Duty Free is a certain bidder on at least one of the two core category contracts at Hong Kong International Airport currently out to tender (we’ll bring you a run-down on the likely field after bids close on 2 February).

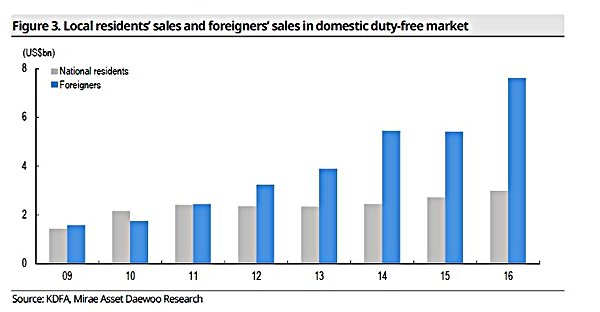

Ms Hahm commented: “Despite Korea’s limited endowment of tourism resources and the presence of a dominant market player [Lotte Duty Free -Ed], Hotel Shilla has emerged as the world’s sixth largest duty free operator [based on Moodie Davitt ranking].

“We attribute this unusual achievement to its strong fundamentals. We think the domestic market faces growing risks and discount factors, as a series of ill-advised regulations have caused serious damage that cannot be reversed anytime soon. Nevertheless, we think Hotel Shilla stands out from its peers, given its long-term growth momentum driven by overseas expansion.”

Ms Hahm, maintained a ‘Buy’ rating for Shilla stock with a target price of KW62,000. In mid-afternoon trading today (31 January) Hotel Shilla shares stood at KW43,350, down -1.37%).

Outlining her rationale, the analyst said: “We maintain our Buy call and target price of KW62,000 for Hotel Shilla. The Changi Airport duty free business in Singapore, which is still in the transitional stage, is delivering top-line growth and reducing losses. We expect it to generate economies of scale effects and enhance bargaining power upon the completion of Terminal 4 at end-2017, and this should enhance Hotel Shilla’s business portfolio.

“It is too early to quantify the fair value of the Phuket downtown duty-free store in Thailand, which became operational in November 2016, but it should raise expectations for Hotel Shilla’s business expansion across Asia.”