SOUTH KOREA. The Shilla Duty Free parent company Hotel Shilla posted a heavy KRW35 billion loss (US$31.3 million) in its fourth-quarter results released Friday, much worse than market expectations (Bloomberg consensus KRW8 billion/US$7.15 million).

The travel retail division – comprising downtown and airport shops in South Korea and stores in Thailand, Japan Singapore, Macau and Hong Kong – plunged from an operating profit of KRW70 billion (US$63 million at today’s exchange rates) last year to an operating loss of KRW16.7 billion (US$14.9 million), on sales of KRW742.3 billion (US$663.7 million), which represented a-4% quarter-on-quarter revenue decline. Q3 had seen a KRW14.2 billion (US$12.5 million) operating loss.

South Korean downtown duty free sales (driven almost entirely by the daigou sector) fared best, declining -27% year-on-year to KRW689 billion (US$616 million). But revenues from The Shilla Duty Free’s airport stores, home and abroad, slumped by -88% year-on-year to KRW57 billion (US$51 million). Sales in the Korean airport business fell by -96% and in overseas stores by -81%.

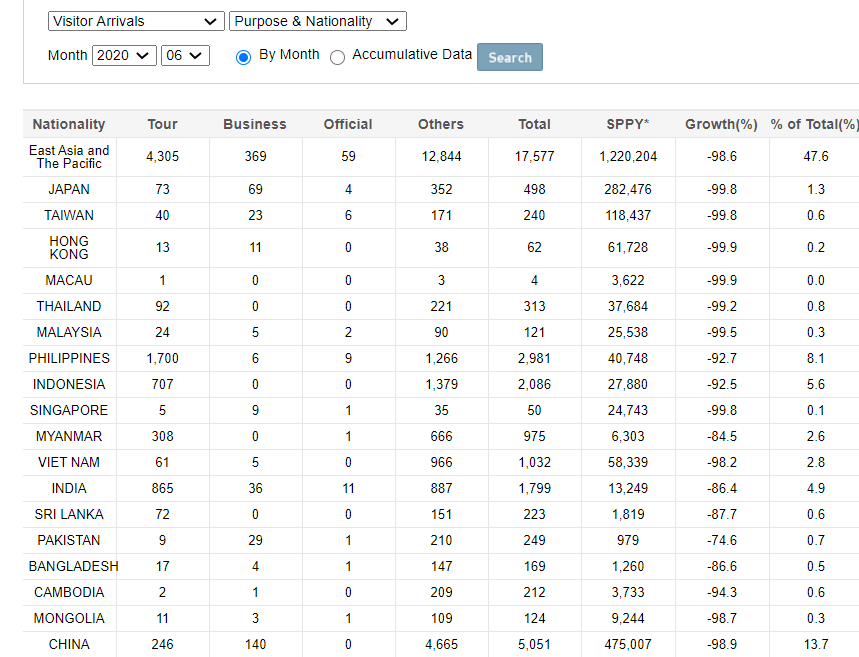

The increase in the commission rate to 20.9% in Q4 2020 from 16.1% in Q3 2020 illustrates the changing landscape of the Korea duty free market. The Shilla Duty Free was forced to compete with overseas markets for daigou sales by increasing discounts (commission rates). The company explained to analysts covering the stock that the commission rate increased because of enhanced discounts for stock depletion and because of an increase in small guest daigou – individuals rather than corporate daigou. [According to Korea Tourism Organization around 7,000 Chinese arrived into Korea in December 2020 – Ed].

The allocation of best-selling brands in Korea declined in the fourth quarter with key brands enhancing their product availability to the fast-growing Hainan market. Korean retailers shifted gear by promoting domestic brands at heightened discounts but daigou demand remains heavily dependent on best-selling product availability. A leading Korean retailer remarked to The Moodie Davitt Report that the key to beating their competitors and the market is by procuring as much of the best-seller stock as possible and tie in the rest of the products at competitive prices.

Hotel Shilla said that for Q1 2021 it would focus on overcoming the effects of COVID-19 and improving profitability by “pro-actively responding to changes in the business environment”.

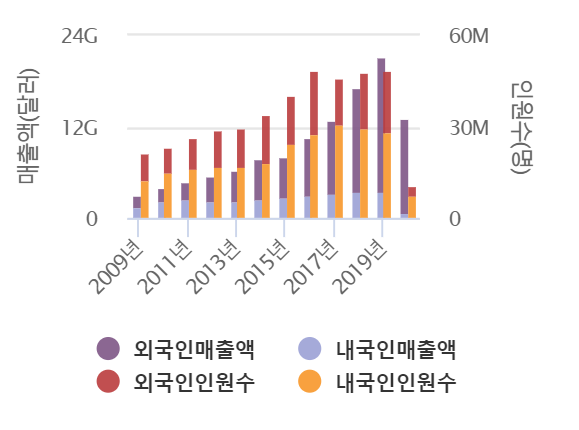

The Korean duty free market overall fell by around -38% from US$21.3 billion in 2019 to US$13.2 billion last year, according to the Korea Duty Free Shops Association.

Shenzhen daigou crackdown a concern

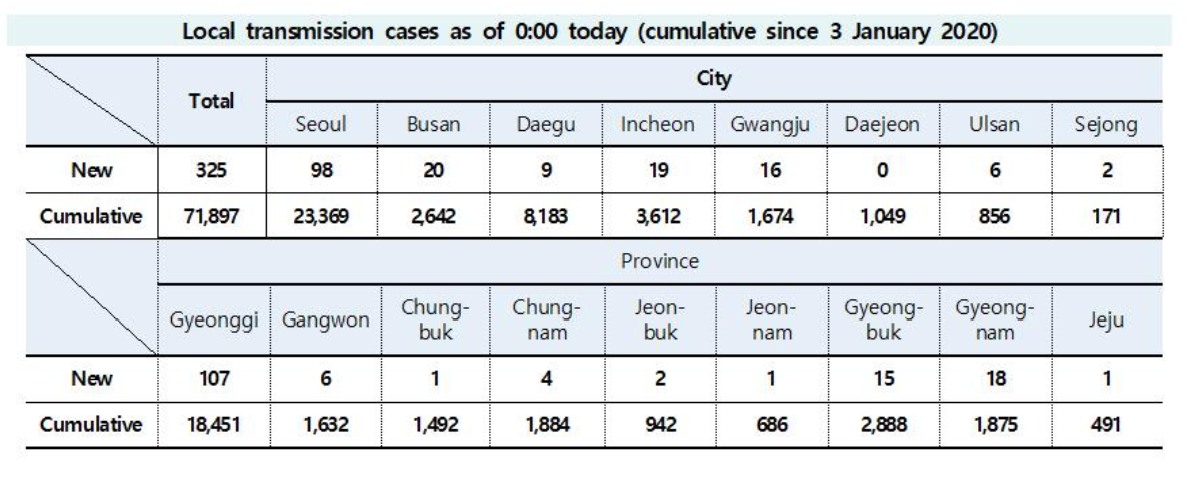

Prospects for 2021 are mixed. The Republic remains largely closed to international travellers and the COVID-19 pandemic continues to rage. 355 confirmed new cases were reported on Sunday, 325 of them locally transmitted. In a note, BofA Global research said that it expected a slowdown in duty free sales in H1 2021 due to the 31 December expiry of a government policy that had allowed daigou traders to buy directly without travelling to South Korea.

Informed observers are also deeply concerned about the potential for a prolonged crackdown by Chinese authorities on daigou imports to the Mainland through Shenzhen (ex-Hong Kong). While there have many periodic crackdowns in the past, the latest – a major swoop on Mingtong Digital City Market in Shenzhen’s Futian district last month – has particularly alarmed Korean retailers and sector investors. Sources say the market is being heavily policed to stop the unofficial business in advance of the peak Chinese New Year period.

Informed observers are also deeply concerned about the potential for a prolonged crackdown by Chinese authorities on daigou imports to the Mainland through Shenzhen (ex-Hong Kong). While there have many periodic crackdowns in the past, the latest – a major swoop on Mingtong Digital City Market in Shenzhen’s Futian district last month – has particularly alarmed Korean retailers and sector investors. Sources say the market is being heavily policed to stop the unofficial business in advance of the peak Chinese New Year period.

One informed source told The Moodie Davitt Report that the development – if sustained – was a potential “disaster” for Korean duty free, as during the pandemic an estimated 85-90% of the shuttle trader business has been conducted through Hong Kong.

“Our industry is facing an historical turning point,” the source said. “I believe that Korean duty free will lose a huge amount of its business thanks to the Chinese government’s support of Hainan [offshore duty free] and this latest crackdown. Our industry has been relying too much on the wholesale trade.” [More details to follow in a coming report]

According to Korean trade media title TRN&DF, the crackdown was triggered by the discovery of a near US$100 million cosmetics smuggling case by the Shenzhen Customs and Public Security and Commerce-related authorities in late December. A resultant crackdown on the famed market has also spread to other nearby shopping centres dealing in daigou cosmetics business.

The report noted a Ming Tung Market and Shopping Association announcement on 22 January, which declared that no unregistered business entity can now trade large quantities of duty free goods without paying taxes. “In fact, the duty free trade in the Mingtong market, which originated in Korea, seems to have become difficult to continue as in the past unless a new exit is found for the time being,” wrote editor Kim Jae-young.