Make no mistake, COVID-19 is and will be the single biggest change the travel retail industry will face in a generation. Airports are empty, sales are virtually non-existent and companies large and small have been decimated. It is a very sad state of affairs. But, is it the ‘burning bridge’ we ‘had to have’? Is COVID-19 the perfect catalyst to take a completely fresh look at all this?

Is the Industry still Viable?

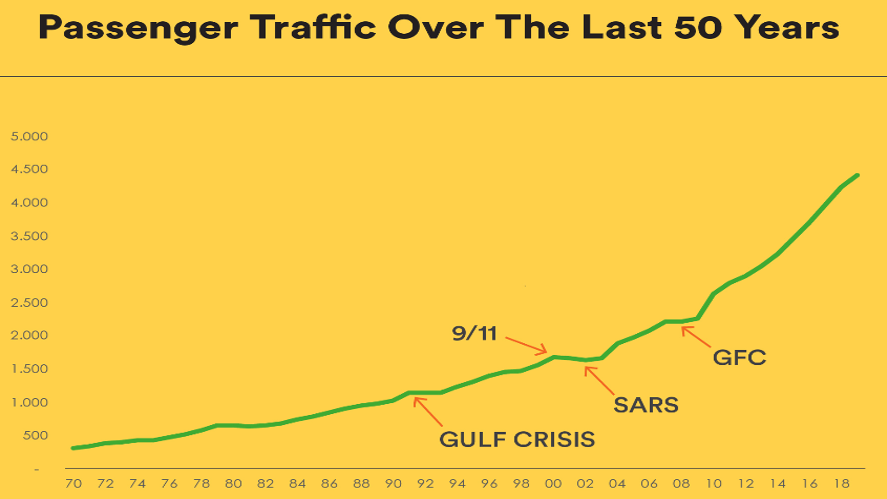

Over the past 50 years, airport passenger CAGR is 5.5%. Incorporating significant ‘blips’ (9/11, SARS, Conflict and Global Recessions), the figure is just shy of the 6-7% advocated by the great Warren Buffet as the long-term target range for investors and just behind both the Dow Jones and MSCI World Index over the same period. Resilience and recovery are hallmarks of this industry.

However, even the most staunch industry supporter cannot disagree with me – retailing and dining inside the airport has not evolved and innovated at the same levels as outside the airport. Referring to the above chart, there hasn’t really been a ‘burning bridge’ or a need to be truly innovative.

A decent offer, simply reliant on passenger growth, was typically enough to keep shareholders and stakeholders happy. High barriers to entry, challenging rents & commercial terms and complicated operating conditions provided sufficient ‘protection’ for the existing players and whilst there were always murmurings about changes needed with the concession model, ultimately, everyone was relatively content with their slice of the pie.

Right now, there is no pie. What we have instead is that ‘burning bridge’.

How to Survive

Most businesses in our industry are now in survival mode – understanding what is immediately required for that business to remain a going concern. This will include stripping-out cost, deferring capital, applying for government support packages as well as looking for new ways (delivery, online, partnership) to generate sales. All to answer the question “how long, if the situation continues as is, is it before we have no money left?”

This process should be relatively quick.

In parallel, businesses will be engaging in negotiations – be that with their lenders, their landlords, their suppliers, the Government. In fact, with anyone that can help with their survival. Deferring payments, capitalising interest repayments, extending lines of credit, requesting discounts or waivers.

This process will take longer, but the actions and desired outcomes should be relatively clear.

Now for the (more) challenging part.

When will this crisis end? When will the travel industry be ‘back to normal’? What must our business look like when we start again to either limit the bleeding or accelerate through the recovery?

The answer to the first question is an unknown. The answer to the second question is therefore unknown. The answer to the third question can be worked on right now!

If you search online, there are plenty of opinions on the first two questions. But let me summarise what appears to be the general consensus amongst industry experts.

- The post COVID-19 recovery will take (much) longer than we’ve seen in previous crises.

- Short Haul will recover faster than long-haul / international.

- Holiday Travel will recover faster than Business Travel.

Now, let me overlay two more factors

- For a period of time, the importance of safety, sanitation and trust will be the #1 concern for most travellers.

Businesses right now need to be revisiting their Standard Operating Procedures to not only take into consideration likely government-imposed sanitary measures, but more importantly the psyche of their consumers. In the past, consumers (particularly for F&B) simply expected nothing but the highest standards of safety. Even if only for a limited time, there will be heightened sense of awareness at all levels. If you don’t believe me, go into your local supermarket and sneeze.

- The two key medium & long-term industry drivers remain the rising Chinese middle-class and the importance and influence of Millenials and Gen Z.

Three Global F&B trends Earlier this year, pre Covid, I published an article outlining three global trends airports and airport F&B operators must take advantage of. The article also outlined cost-effective solutions to take advantage of those trends. In the post Covid19 world, these do not change. In some respects, they become even more important. |

How to Flourish

It may be difficult to envision right now, but I believe tremendous upside remains in this industry. Whilst figures will vary across the globe, on average, only one-in-five people moving through our airports (as a passenger) consume food or drink, or purchase retail, as part of their journey. When we, the industry, have self-coined the term “captive market” and then watch 80% of those ‘captive’ individuals walk straight past our door, have we really done enough?

Growing the Pie must be the #1 priority for everyone. Step-Changing ‘capture rates’ is the only way forward. If we believe some estimates (that even 12 months from now, passenger traffic will still be 20-30% down on pre-COVID-19 levels), capture rates will need to improve from one-in-five to at least one-in-four, pushing towards one-in-three to simply keep the pie at the same level.

Great companies emerge from crises. You only need to wind back the clock to the 2008/9 Global Financial Crisis to draw on a couple examples. Neither Uber or WhatsApp existed before 2009. The former now generates $US50 billion in gross bookings and sits #1 on Forbes’ 2020 Midas List; the latter was purchased for a cool $US22 billion by Facebook.

Areas that have perhaps previously been seen as ‘nice-to-haves’ by the industry are now a necessity. Whilst I understand the pressures of cash-flow right now, failing to invest in the future so that you are at least on the curve, if not ahead of it, defers the inevitable – just ask Blockbuster, Toys R Us or Kodak – all very successful businesses at one time.

There will be many different opportunities to drive success, and to grow the pie. In my mind they come under 4 key headlines. I outline these below as well as provide insight into some projects I am currently working on with airports, airport operators, and some players who have never considered working in an airport … until now!

1. Consumer-First Mindset

Whilst most CEOs and CMOs will proclaim a customer-first mindset, many of them fall short in one single respect – they talk about their existing customers, ignoring the ones that don’t actually shop with them … dangerous in an environment where 80% of shoppers or consumers are not purchasing.

Most budget exercises, and therefore mindset throughout the organisation, are focused on driving just enough growth to improve on prior year and keep shareholders happy.

COVID-19 gives us all an opportunity to throw out the “how do we beat last year” mentality. Use this “new start” as an opportunity to really hone in on what your potential customer will look like and whether what you do will satisfy their needs.

Post COVID-19d, we can all expect that the older generation (and, for many in the industry, the ‘cash cow’) will be more reluctant to travel. It follows, therefore, that the younger generation will become even more important to target. What are they looking for?

Gen Y and Gen Z were already focused on health and well-being. Undoubtedly, COVID-19 will only have increased this self-awareness around keeping healthy. F&B operators in particular have a great opportunity to step-change in this area. It is frequently the number one thing consumers say airports need more of. A place for burgers and fries still remains and, for now, it will still dominate. But Gen Y and Gen Z are looking for choice.

The same can be said for the environment. My favourite quote of 2020 (so far) is “It seems like Mother Nature has sent us to our rooms to think about what we have done” (Sarah Ferguson). There is not one person I have spoken to who hasn’t reflected on the implications of their own actions. Operators, brands and airports need to double-down on their efforts here. They need to be honest and transparent, even admitting how they will improve if they are not moving fast enough.

Blending localisation and personalisation. The ingoing trend into 2020 was very much about personalisation. This will no doubt continue. But COVID-19 could be the crisis that defines the younger generation. To one degree or another, groups of people are having to come together to engage in the ‘fight of their life’ in getting through this. Expect for clusters to really support local and, in particular, those who supported them during these times.

2. Collaboration beyond Operator and Airport

In order to deliver a consumer-first mindset, businesses will need to collaborate. It is likely that operators, airports and brands will find ways to come together better and share information. Sadly, this is only a small piece of the jigsaw. Arguably the richest consumer information actually comes from outside these stakeholders – the Airlines and the Online Travel Agencies (OTAs).

Imagine what we could do, collectively, if we had information on every single passenger travelling – their demographics, their specific flight details, their purpose for travel, their preferences.

Whilst this does exist, because the information has rested with Airlines and OTAs, this has always fallen into the “too-hard” basket. On top of the current financial challenges, the removal of in-flight duty free, and questioning the value of expensive lounges, tell me an airline that wouldn’t give up some information for a commercial return right now – for very little effort on their part.

Recent changes in the world of data privacy and protection have made the challenge more difficult, but if it’s important enough, then these obstacles need to be overcome.

3. Re-Purposing of valuable Real Estate

As described earlier, in the short term, no doubt there will be restrictions and requirements on space – be that with customer flow, customer interaction, queuing or seat spacing. The extent (level and length of time) is not yet known.

Beyond that, the issue is much broader – Have airports appropriately allocated space to all services?

Airports have traditionally been functional buildings – the primary focus to facilitate people getting from A to B. We have definitely witnessed improvements in the last 10 years, with many airports retro-fitting and creating space, but even the best new developments are still not purpose-built for commercial activities – if you don’t believe me, simply speak to any airport Commercial Head.

You are probably expecting me to say more space needs to be dedicated to F&B and Retail. On the contrary, I believe too much valuable real-estate has been allocated to the non-value-added part of F&B and Retail.

I am currently working on a very exciting project that eliminates / shifts non-value-add space, freeing up opportunities for new retail and new experiences, driving customer experience and increased spend. In the short term it also creates space for important CoVid-related requirements, like social distancing.

4. Digital and Artificial Intelligence become “the norm”

Approximately 2 billion people across the globe purchase online. In the US last month 42% of people bought online, double prior year figures. Online Grocery (historically slow to penetrate e-commerce) is up c40%. Zoom Users have soared from 10 million to >200 million in 3 months. Singapore, where I live, and so long regarded for it’s ‘eating out’ culture, has seen an increase in over 20% use of Food Delivery Apps.

Whilst there is clearly a massive mitigating circumstance, namely we are relatively confined to being at home, it all points in one direction. The more comfortable and familiar people become with technology and online channels, the more frequently it will be used.

With the exception of a few operators, digital has either largely been ignored or been executed poorly. Using one example – Amazon-Go has been in place for over two years now. Maybe I’ve missed it, but it seems only now that it’s “Just Walk Out” technology has made it’s way into travel retail, by an F&B operator (OTG) no less. Note, I’m not suggesting Amazon need to be entering the travel retail environment (although that could be a consequence down the road). I’m suggesting the systems and processes need exploitation in the airport environment.

Similarly, whilst airports are already using AI and autonomous robots to interact with passengers, enhance security, improve efficiency and collect data, retailers have not been quick to adopt.

Traditional F&B operators and retailers have always latched on to the human element – ironically, the ‘customer touchpoints’. Whilst I personally place tremendous importance on staff engagement, many customers don’t, instead preferring efficiency and speed of service.

Further, whilst great customer service typically results in repeat business, when it goes the other way, customers very often don’t return. In an environment where our people are required to work in 24×7 environments, on a basic wage, and for F&B in particular, a relatively high turnover, sadly it’s often 50/50 as to whether you’ll be delighted or disappointed.

Appropriately designed, automation and AI can improve this. I was fortunate enough to work pretty closely on the launch of technology that brought together a consortium of the world’s leading businesses (think Xbox, think Ferrari) to produce a simple cup of coffee. The end result – a quality, consistent experience each and every time … and by the way, you can converse with the machine in 9 different languages!

For both digital and AI, what previously may have been pushed away as ‘gimmicky’ or ‘cool, but not practical’ now has a very real application in the post-COVID-19 world, even if all it does it simply eliminate human contact.

5. Flexibility remains Key

We can be confident that passengers will return. Growth may be slow, but growth will come. There will be sufficient opportunity for the industry to thrive. In a world that was becoming increasingly complex via changing consumer preferences and industry pressures, businesses already needed to be flexible.

What CoVid19 has done, in addition to wreaking a path of chaos and destruction, is force us to bring forward our thinking and to improve our flexibility and agility. How we react, respond and restart will be the key to success.

I have said previously that airports, airport operators and brands have a choice. They can, as many have done for years, wait for trends to inevitably filter into the airport. Or, they can be drivers of change. They can be leaders of change. Perhaps that choice now becomes necessity.

In the words of Margaret Thatcher – “don’t follow the crowd, let the crowd follow you”.

Ground Control is a leading F&B advisory for airports, stadiums and brands Spearheaded by Adam Summerville and Kevin Zajax, the team provide solutions to increase Return on Investment and award-winning F&B experiences. Services include concession planning and selection, business streamlining, crisis management and strategies to grow brands. Email: kevin@groundcontrolglobal.com |