Editor’s introduction: When he assumed the mantle of Lotte Duty Free CEO last December, Jang Sun-wook faced a number of stern challenges. At the time of his appointment, the Lotte Group subsidiary was reeling from the shock loss of its Lotte World Tower duty free licence a month earlier, following the controversial contest for the rights to operate four downtown stores.

Editor’s introduction: When he assumed the mantle of Lotte Duty Free CEO last December, Jang Sun-wook faced a number of stern challenges. At the time of his appointment, the Lotte Group subsidiary was reeling from the shock loss of its Lotte World Tower duty free licence a month earlier, following the controversial contest for the rights to operate four downtown stores.

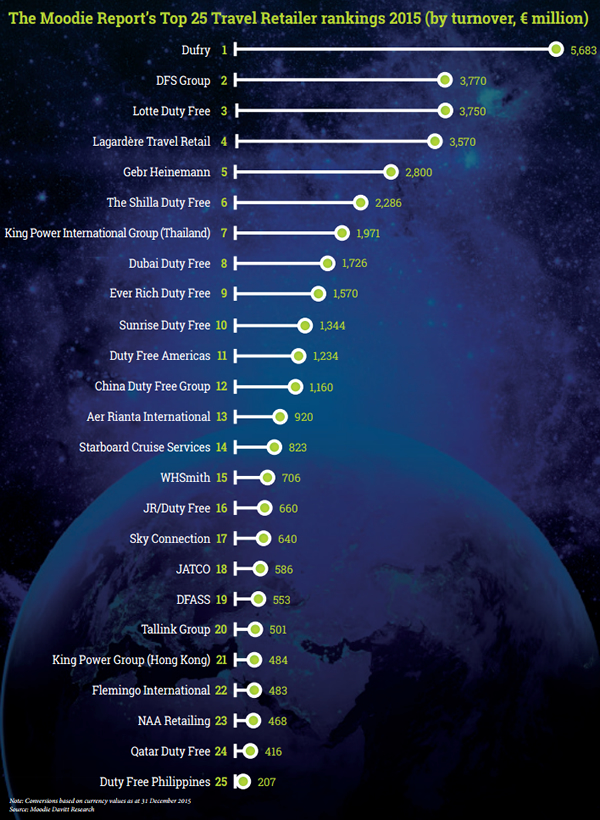

It seemed – and, to neutral observers, still seems – an inexplicable development. As reported, Lotte, Korea’s most successful travel retailer and the world’s number three operator, lost out to sector debutante Doosan Group (now trading as Doota Duty Free), despite having just spent US$256 million on the widely acclaimed rejuvenation of the Lotte World Tower store.

Remember, Lotte World Tower Duty Free was South Korea’s third-biggest store by sales with 2015 duty free revenues of KW611 billion (US$522 million) and an integral component of one of Korea’s and Asia’s newest, biggest and most compelling tourism attractions.

The Lotte defeat sent shock waves throughout the Korean duty free trade and came as a crushing morale blow internally. Outside the country, seasoned industry watchers (including The Moodie Davitt Report) reacted with disbelief to a decision that appeared to fly in the face of all business logic, let alone fairness.

We and others argued that if the government had wanted to increase competition then it surely should have created additional licences, not taken away those of two of Asia’s most successful travel retailers – Lotte Duty Free and SK Networks (WalkerHill Duty Free) – especially as they were so important in attracting Chinese tourists to Korea.

“Korea didn’t become the world’s number one duty free market by accident. Such a status is testament to the huge investment that retailers such as Lotte, Shilla, SK Networks (WalkerHill), Shinsegae and others have poured into the market” – The Moodie Davitt Report President Dermot Davitt speaking at Korea’s National Assembly in February

Pressure mounted for a reform of the system, notably via a key policy seminar held at the National Assembly in February. The Moodie Davitt Report, leading academics and tourism officials all urged a review of the five-year (previously ten) licensing scheme introduced in 2013.

As The Moodie Davitt Report President Dermot Davitt argued in his presentation at the National Assembly: “The Korean duty free retailers, especially pioneers such as Lotte Duty Free and The Shilla Duty Free, are among the world’s most professional, particularly in terms of selling to Chinese travellers; the use of social media (particularly relating to Hallyu marketing); the championing of local products and the quality, range and service of the downtown duty free shops in particular.

“Korea didn’t become the world’s number one duty free market by accident. Such a status is testament to the huge investment that retailers such as Lotte, Shilla, SK Networks (WalkerHill), Shinsegae and others have poured into the market, and the quality of the offer down the years to Korean, Japanese and, critically, Chinese travellers.”

With the government under fire, Korea Customs Service announced in June that it would offer four more downtown duty free licences amid burgeoning business with Chinese tourists, a move widely seen as an opportunity for Lotte and SK Networks to recover their lost business.

Progress then. But Jang and Lotte have had to face several other blows. A few days after the announcement of a new licence contest, the group revealed that its much-anticipated IPO, which had already received a major setback from the World Tower permit loss – would be delayed, following a scandal involving Shin Young-ja, a Hotel Lotte board member and part of the founding family. Within days, as the scandal gripped the nation, the group chose to withdraw the IPO until further notice.

Five months later and the outlook is improving for Lotte Duty Free. The retailer has enjoyed a banner year in its home market, with sales up by over +42% at its flagship Myeong-dong downtown Seoul store, buoyed by a stunning redevelopment of the 12th floor of the Lotte Department Store to create an additional 2,760sq m of duty free space. With its other Korean stores (Incheon, Gimpo and Gimhae airports, and Seoul Coex, Busan and Jeju downtown) also thriving, the company is emerging strongly from the most savage of storms.

In his first interview with international media, CEO Jang (who began his career at Hotel Lotte at the age of 28 and joined Lotte Duty Free from the group’s advertising arm where he was CEO), acknowledges the challenges but says the business is in strong and upbeat mood and optimistic about the future. He spoke to Martin Moodie at Lotte Duty Free headquarters in central Seoul earlier this month.

“This year has been one of the most challenging years ever, due to a lot of factors,” says Lotte Duty Free CEO Jang Sun-wook. “First of all, there has been an advent of new rivals, so competition has been fiercer than ever before. On top of that, we had to close down one of our biggest businesses. And thirdly, there have been many challenges for us in implementing our travel retail business policies.

“So we have faced many external challenges. But we have tried to be more dynamic and aggressive than ever and after losing the World Tower licence we worked hard to secure our market share. We managed to do that – and that’s something we will continue to do in the future.”

Jang describes the ultra-competitive Korean duty free environment as a “survival of the fittest”, a stern test of management ability and sector experience. “For those with less management capability, it’s really hard to survive,” he warns.

But Lotte has done more than survive. In fact, it has flourished, buoyed by a combination of booming Chinese visitor numbers (up +45.2% year-on-year over MERS-hit 2015 in the first nine months), a major, widely acclaimed expansion of the company’s flagship Seoul store, and rocketing sales of Korean skincare and fashion to young Chinese travellers.

One of the factors that made last year’s licence loss so baffling was the vital role that Lotte Duty Free (and Lotte Group) plays in attracting Chinese visitors to Korea. Jang emphasises that it’s not just Lotte that benefits from this influx but the economy as a whole.

“When the Chinese come to Korea, it is not just for shopping,” he says. “They want to enjoy the whole experience here. We [i.e. the flagship Sogong-dong store] are located in a very good place with many restaurants and shopping malls nearby. We also offer the Chinese a diverse collection of brands and products that they want at a very attractive cost.

“We’re also, as you know, very good at Hallyu [Korean wave] marketing. We have recruited several high-profile Korean stars. All these factors combined explain why Chinese customers want to visit Lotte Duty Free, and why we are the centre of tourism in Korea.”

Lotte Duty Free has its own YouTube channel. This video, featuring girl band Twice, was released on 18 October. It has already generated over 7.1 million views.

Jang mentions with pride the Lotte Family Festival, a twice-yearly concert featuring some of Korea’s biggest stars such as Kim Soo Hyun, Park Hae Jin, Hwang Chi-yeul, EXO and DEAN. The last Festival in October attracted some 20,000 Chinese tourists, plus 5,000 from Japan and Southeast Asia – all of whom contributed to the local economy on top of their shopping spend.

Jang reveals that Korea Tourism Organization research showed that the second-most sought tourism term on Chinese search engine Baidu is Lotte Duty Free (number one is ‘Korean movie’).

“During the recent national holiday in China, 0.25 million Chinese visited Korea and 0.12 million of them visited Lotte Duty Free,” he says. “So you could say that half of the Chinese who come to Korea visit Lotte Duty Free.

“Our location and our merchandising ability, together with our long experience in managing the stores has created a very powerful brand that makes the Chinese want to go to Lotte Duty Free when they visit Korea.”

In short, Lotte Duty Free is a driver of tourism, not simply a beneficiary of it, a national asset and drawcard that the company is keen to underline. “We started the business not just as a duty free retailer but also as a tourism enterprise,” Jang says. “In all our locations we try to accommodate not only our customers but also tourists in general. Our operations in Sogong-dong, Lotte World Tower, Busan and Jeju are all designed as multi-tourism complexes.”

In short, Lotte Duty Free is a driver of tourism, not simply a beneficiary of it, a national asset and drawcard that the company is keen to underline. “We started the business not just as a duty free retailer but also as a tourism enterprise,” Jang says. “In all our locations we try to accommodate not only our customers but also tourists in general. Our operations in Sogong-dong, Lotte World Tower, Busan and Jeju are all designed as multi-tourism complexes.”

One can read Lotte’s astonishing popularity with Chinese customers in two ways. Ostensibly, of course, it’s a triumphant success story. But as the MERS crisis showed last year, any downturn in Chinese tourism leaves the sector exposed. So how concerned is Jang that the Chinese authorities may try to seriously restrict the business into Korea in an effort to maximise domestic consumption – partly by cutting back on the group tour business as has happened in recent weeks? Put simply, is the business too reliant on the Chinese traveller?”

“It is true that at the moment we are heavily dependent on Chinese tourist customers,” he replies. “But if you look at the [overall Korean] market in perspective, where some 80% of business is coming from the Chinese, Lotte’s ratio is 60% – so relatively compared to the market average we have a better balance of nationalities. We have more Korean customers as well as other nationalities [notably the Japanese -Ed].

“We are fully aware that if we are overly dependent on a specific single nationality, and the market changes, we can be affected. So we have a two-way plan. First of all, we are diversifying our market presence by focusing on Japan and Southeast Asian countries. As you know, we have already opened our store in Japan [Lotte Duty Free Tokyo Ginza, opened in March -Ed] and we are planning to further expand in Southeast Asia.

“We are also open to M&A possibilities with other international retailers. Through this two-pronged approach, we aim to insulate ourselves from any Chinese government changes [that affect Korean duty free]. We’re well aware that the Chinese government wants to encourage domestic consumption but nonetheless the Chinese outbound tourism market will still continue strongly for many years to come.

“We are also open to M&A possibilities with other international retailers. Through this two-pronged approach, we aim to insulate ourselves from any Chinese government changes [that affect Korean duty free]. We’re well aware that the Chinese government wants to encourage domestic consumption but nonetheless the Chinese outbound tourism market will still continue strongly for many years to come.

“So, as one of the top travel retailers globally, we have to encourage the Chinese to come to Korea not just for shopping but also for other reasons.”

Jang says that Lotte is much less exposed than its rivals to the recent Chinese crackdown on cheap group tours due to a healthier mix of group v FIT visitors. “Only around 40% of our customers are group tourists compared with 60% FIT,” he points out. “So we’re much less affected than others by the Chinese government restrictions.”

While Korean downtown duty free’s revenues have boomed in 2016, profitability has been strained by the skyrocketing cost of commission to the Chinese tour agents. Driven by the rush of new retail players, commissions to the agencies have rocketed from their former base of 7-11% to 23-25% (and sometimes higher than 30%, sources say), prompting one senior international brand executive to tell The Moodie Davitt Report earlier this year, “The real winner in Korean duty free is the Chinese travel agent.”

“The percentage of group tourists visiting Lotte Duty Free is just 40%, so we are less exposed and our commission burden is lower than others”

How concerned is Lotte about the spiraling cost of doing business? Jang adeptly turns the question on its head, saying the escalating commission fees are a direct result of too many new competitors striving too hard to attract business. Because of disadvantageous locations and lack of brand allure, certain new entrants are having to fall back on heavy tour group incentives simply to get Chinese visitors into their stores, he points out.

“We think that this situation will be erased within one or two years as the burden of commissions will cause the industry newcomers a hard time,” Jang says. “Also, as I told you, the percentage of group tourists visiting Lotte Duty Free is just 40%, so we are less exposed and our commission burden is lower than others.

“You know, that by the end of this year there will be 13 downtown duty free shops in Seoul! But only three or four stores will have a full range of luxury brands so the others will lack competitiveness.”

It’s a perfect link to my next question. Within weeks, the new downtown duty free licence holders in Seoul will be revealed. How hopeful is Jang that Lotte Duty Free World Tower will be among them? It’s a direct question which he answers candidly, relating that he has just returned from an official meeting regarding the licence contest.

It’s a perfect link to my next question. Within weeks, the new downtown duty free licence holders in Seoul will be revealed. How hopeful is Jang that Lotte Duty Free World Tower will be among them? It’s a direct question which he answers candidly, relating that he has just returned from an official meeting regarding the licence contest.

“We are very positive about resuming our business [at Lotte World Tower],” he replies, citing Korea Customs Service scorecards, which underlined Lotte Duty Free’s capability across a range of disciplines.

“When completed, Lotte World Tower will be a great travel landmark,” he adds, saying that the wider business case for the duty free licence is very strong. “It will be a 123-storey building, some 555 meters high. It will be a major travel destination and attraction.”

Green light for IPO

Green light for IPO

Jang confirms that the Hotel Lotte IPO is now firmly back on track, with a release likely in the first half of 2017. By then of course the company will know the result of the Seoul licence contest, out of which a positive outcome would be a huge boost to any public float.

What will the IPO mean for Lotte Duty Free specifically? Jang replies: “The new funding we are going to generate from the IPO will directly support overseas business expenditures for our duty free operation.” While preparing for the listing, Lotte has been listening closely to potential investors, who have been delivering a consistent message that the company needs to “beef up” its offshore duty free business to complement (and spread the risk) of its Korean stronghold.

In fact, the greatest interest from investors – both from Korea and overseas – has been in Lotte’s duty free operations, rather than the hotel side of the business. Such investors will want to see a sustained growth story, of course. Will this come mainly from M&A or organic developments?

“We are more than open for any opportunity – regardless of their size”

“It’s going to be 50/50 from organic sales and mergers and acquisitions – very well-balanced,” Jang replies. “You know, every year we are seeing very big incremental sales organically. So with this growth on the one hand and M&A on the other, we believe we can reach our goal, which is to be global number one.”

That’s a lofty ambition. To achieve it, I suggest to Jang, a major acquisition would be required – even a top five operator in The Moodie Davitt Report’s Top 25 Retailers’ table [Lotte was number 3 in 2015, just behind DFS Group]. Is such an ambitious play possible? Jang’s reply is carefully worded but positive, “As we plan to invest our new funding from the IPO in M&A projects, we are more than open for any opportunity – regardless of their size.”

A key challenge outside Korea for Lotte Duty Free – as it is for all international travel retailers – is how to grow organically in an industry based on the tender model. Winning highly competitive tenders is one thing; winning them at a sustainable cost of doing business another. Given that seemingly eternal dilemma in the business, M&A must surely be the key to becoming global number one?

“It has become a universal consensus that airports are asking for too much in minimum annual guarantees”

Jang agrees and insists the company will only bid prudently on any future overseas airport contracts. “We’ve also noticed from world markets that the retail performance of many international airports is slowing down,” he comments. “If you’re paying really high fees and the business is slowing, then what’s the point? That is one of our real concerns when it comes to international airport bidding.”

That is of course precisely what happened to DFS, the incumbent for all three core category contracts at Hong Kong International Airport, which recently issued RFPs for two major concessions. Overall passenger numbers, to which the MAG was linked, went up (as did, therefore the MAG) but spending came down. The perfect storm.

“It has become a universal consensus that airports are asking for too much in minimum annual guarantees,” notes Jang. He says the company hopes that a more realistic industry-wide approach to bidding will become the norm in future. Certainly for Lotte Duty Free, financial discipline will prevail, he insists.

Will Lotte Duty Free bid on Hong Kong as it did last time around (on all three concessions)? Jang says the matter is under careful review, though no final decision has been taken.

Corporate Social Responsibility critical to the future

Lotte Duty Free has stepped up its Corporate Social Responsibility (CSR) programme considerably over the past year in an effort to highlight and advance its contribution to Korean society. Most notably, in April it opened Under Stand Avenue, the result of a KRW10.2 billion (US$9 million) investment in what is described as a “creative and cultural space” designed to help society’s most vulnerable groups and to support small businesses, artists and families.

Jang says the company is proud of its CSR efforts and understands the importance this carries in terms of both licensing approval and ongoing corporate reputation. “As a market-leading operator we take our responsibilities seriously and we plan to use 2-4% of our profits for CSR in future,” he explains. “But we want our CSR programmes to be related to what we do – to be linked to the duty free and tourism sectors. Internally we are regarded as a good company, we also want to be perceived that way externally and globally as well.”

Omni-channel success

Omni-channel success

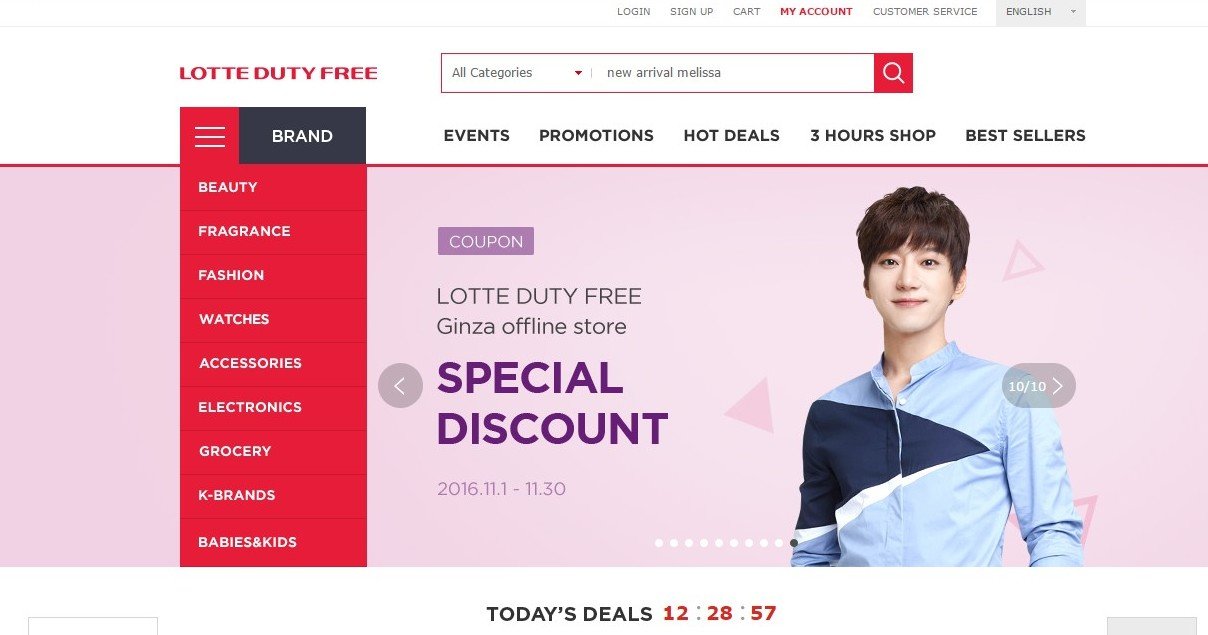

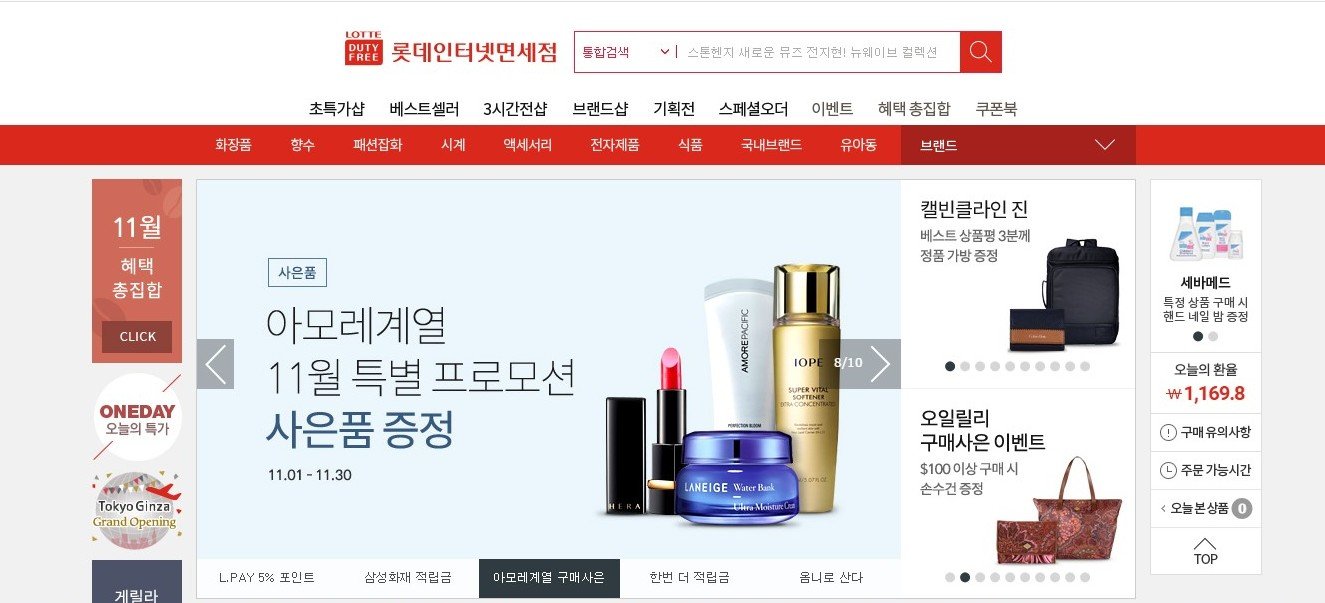

Jang and Lotte Duty Free are justifiably delighted with the company’s successful emergence as a diverse omni-channel retailer, its e-commerce business and social media presence increasingly core to its identity. What’s been the secret to that success?

“Online business is now 20% of our sales and is developing very well,” Jang notes. “We are the pioneer and the leader in online duty free shopping. We try constantly to rejuvenate our system and to introduce luxury brands. A lot of luxury brands have now been launched with us online so we’re ensuring that we also upgrade our online customer service.”

“The reason that we’ve been successful in online shopping is that we don’t simply sell products – we create a whole product package and provide rich content for our customers”

Lotte Duty Free plans that customers will able to be shop online not just in Korea but also at its overseas locations in future, allowing the company to become “a small kind of Amazon” as Jang puts it.

“The reason that we’ve been successful in online shopping is that we don’t simply sell products – we create a whole product package and provide rich content for our customers,” he says.

Jan cites the strong success of Lotte Duty Free’s SNS (social networking service) channel. “We have 7.2 million friends on Weibo. We upload music videos from our star models and other content each and every day. So even when Chinese customers aren’t using the duty free stores they come to our Weibo site and use the content.”

As an awareness tool, it is profoundly important. When those same consumers come to Korea, it’s almost a given that they will visit Lotte Duty Free and shop – especially as the retailer works so hard with its recently revamped Star Avenue concept to engage consumers with their idols.

“In both PC and mobile online shopping… we are paying a lot of attention to our omni-channel strategy,” says Jang. “That means we make a smooth connection between online and offline shopping. There is a synergy between both.”

The strategy appears to be paying off. “In terms of the offline market, we have a 50% share but with the online sector we occupy 60% of the market,” he points out

We see the IPO as a turning point which will give us new momentum and take us to the next level”

Jang says three prime areas will focus his attention over the next year. Firstly, he expects the intensely fierce competition in Korea to continue unabated. “So to secure our market share as we have done this year, we’re going to continue to adopt a dynamic and aggressive approach.”

Secondly, he intends to put an unprecedented focus on nurturing Lotte Duty Free employees, in an effort to build both confidence and loyalty. “We will be encouraging them by saying, ‘You are an employee of the number one retailer in Korea’,” he comments.

“Last but not least, there’s the IPO again. We see the IPO as a turning point which will give us new momentum and take us to the next level.”

It’s an upbeat note to close on. But before we wrap up, I ask Jang about his own management philosophy and his approach to leadership. “First of all, I really enjoy working with employees,” he responds. “I love to encourage them to develop and to build up loyalty within the company. Since I joined Lotte Duty Free, I have found there are so many capable staff here. I plan to encourage them even further. I also believe in continuing to stretch myself forward and to continue my own personal growth and development as a leader.”

He also has a burning ambition for the company and that is to replicate Lotte Duty Free’s brilliantly successful downtown model in Korea in overseas locations. “I would like this to be a global model for us,” Jang says.

If the IPO takes place successfully then Hotel Lotte and Lotte Duty Free will be well-placed – and certainly well-funded – to drive such ambitions, both organically and by acquisition. 2015 and 2016 have been seriously testing years for the Korean travel retail giant. While the storm has not blown over in the land of the morning calm, safer waters beckon and the future, Jang insists, is bright.