“Having a supreme vision for our future is an important element of our life. But one must understand delivering many small tasks that make up each day is the shortest way to reach that vision.” – Ichizō Kobayashi, Japanese industrialist and founder of Hankyu Railway

“There are three creativities: creativity in technology, in product planning, and in marketing. To have any one of these without the others is self defeating in business.” – Akio Morita, Founder of Sony

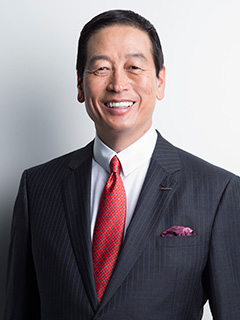

When Masahiko Uotani left his role as President and Chairman of Coca-Cola Japan in 2011 after 17 years with the company, he had his sights pinned not on another big corporate role but on the golf courses and beaches of Hawaii.

When Masahiko Uotani left his role as President and Chairman of Coca-Cola Japan in 2011 after 17 years with the company, he had his sights pinned not on another big corporate role but on the golf courses and beaches of Hawaii.

Together with friends he started a small marketing consulting company and soon afterwards Japanese beauty house Shiseido became one of its clients. “I was asked by the former President of Shiseido to help him transform the business to become a stronger global marketing company,” Uotani recalls, speaking to The Moodie Davitt Report during the TFWA World Exhibition in Cannes.

Having worked for multi-national giants such as Coca-Cola and Kraft, Uotani was intrigued by what he discovered at Shiseido. Drawn in, he started working part time for the business in April 2013 in an advisory capacity, a role that quickly became virtually full time almost without him realising. After months visiting the company’s branches and warehouses, Uotani gained a deep appreciation of Shiseido’s heritage, excellent reputation for technology, and quality of people.

But it wasn’t all good news. The business, domestically at least, had been in worrying decline for several years. After delivering a candid presentation on his findings to the Shiseido President and board, Uotani was informed a fortnight later that the company was poised to recruit a new leader, an outsider. “Who?” he asked. The reply was, “It’s you!”

Having asked for time to mull over the offer, he spoke to his wife, who said: “Don’t get involved with corporate life again, you’re going to spend 24-hours a day working.” It would turn out to be only a slight exaggeration.

Vexed about what to do, Uotani spoke to some long-time mentors at IBM in Japan. They described Shiseido as a venerable Japanese institution but one that badly needed globalising and modernising. Such was the group’s position in the national psyche, Uotani realised, that the challenge in many ways constituted a symbolic rejuvenation of Japan. His mind was made up. He told his wife he had to take the job.

When Shiseido announced the appointment on 24 December 2013, Uotani didn’t hold back on his commitment, or his ambition. “I will stake my life on this job to have wonderful Shiseido become a leading brand as the one of the greatest global companies for the next 50, and even 100 years,” he said. Rejuvenation became his watchword, revitalisation his obsession.

Some questioned whether Uotani’s beverage industry background was suitable for the needs of a leading prestige beauty house. “I agreed it was different, of course, but fundamentally it’s a consumer business creating value for consumers – the consumer comes first,” was Uotani’s reaction and he’s never changed that focus since.

“A company will get nowhere if all of the thinking is left to management” – Akio Morita

From his advisory period Uotani already had a strong idea about the challenges he and the company faced. But to confirm his views he went on the road, visiting offices, stores and factories in Japan, the USA, and Europe to better understand what the business was about. In the first 100 days he met 6,000 employees, urging them to talk frankly about their concerns. In such a traditional enterprise that was easier said than done, Japanese staff in particular being culturally reluctant to criticise the company.

Uotani wasn’t letting them off that easily. “I told them that until they spoke up I wasn’t going to leave!” he recalls with a laugh. “My philosophy, based on my experience over the last 30 years, is that water goes down from a higher place to a lower place. So you say to people, ‘Hey, you speak up! You just tell me whatever you want, whatever you think the issues are!’

“You can’t do that by standing in front of employees, and saying, ‘I’m your boss. I’m the President. So, you guys have to respect me. And by the way, tell me what the issues are.’ Nobody’s going to tell you.

“So, I had to say that I was really trying to help this company out and show that I was committed to it. I said: ‘Let’s work together. Let’s really come up with all the issues we have detected together. Don’t see me as a CEO, you don’t have to do that. I’m one of the team members.”

The two-way process found a touchpoint in research & development. For many years Shiseido had been regarded as a flagbearer for technical R&D in the cosmetics industry. But its reputation for innovation was exactly that, reputation, Uotani contended. He needed to focus on the future, not the past. After speaking to the company’s researchers and scientists, he vowed to commit time, people and money to an ambitiously enhanced innovation and research programme.

“When you’re trying to transform a company you have to realise what the strengths are, and clearly technology is one of Shiseido’s strengths” – Masahiko Uotani

“It didn’t take me long to make the decision to invest more money where we had strength, which was R&D,” he recalls. A freeze on research recruitment was lifted. He called his R&D leaders together and urged them to become disruptors and help take the company to the next stage. “I’m going to support you one hundred per cent,” he told them. “Tell me what you need.”

Uotani took the decision to invest US$400 million in a state-of-the-art research centre, due to be completed by 2018. “When you’re trying to transform a company you have to realise what the strengths are, and clearly technology is one of Shiseido’s strengths,” he says.

And the weakness? “The management structure of global business,” he replies. “I didn’t really get the impression we had solid organisational structures because we were managing the global business in a very Japanese, very traditional way. There was a disconnect between the management team sent abroad by Japan and local organisations.”

Uotani vowed to create a more decentralised model and devised a global matrix organisation, effective from January 2016, which meant common functions around the world now had to work together. The head of Human Resources, for example, was charged with connecting with personnel management in each region. “That’s the real global organisation that we’re going after, which is a huge challenge for a Japanese company,” Uotani notes. “It’s a complete departure from the traditional model.”

Early in his reign, Uotani came across travel retail. With a smile he recalls thinking “What the hell is this?” Very quickly he answered his own question, concluding that it was a great business that transcended borders and worked in a cosmopolitan way that epitomised his global ideals. “I asked if we were able to effectively see the travel retail business as one region,” he asks. The answer was yes, forming the genesis for the integrated global organisation announced this May.

“Travel retail is a consumer business and you need to create the brand awareness so customers will buy the products, use them and re-purchase them,” Uotani explains. “We invested in building a marketing model based on this.”

Time and again during the interview, he cites the word consumer. The group, he discovered, had been far too obsessed with controlling its P&L (largely through a lean approach to costs) rather than on consumer needs. He turned that on its head by saying, “Let’s see how we can really invest more and grow the top line – then we’ll get a better bottom line.’

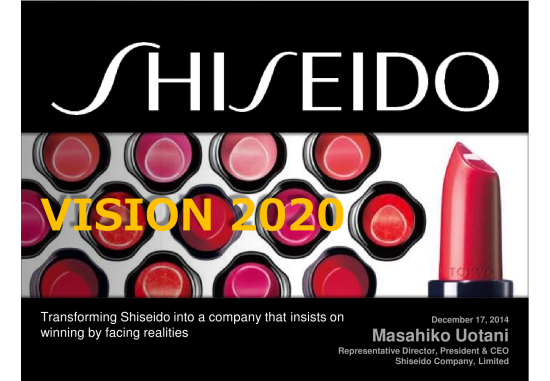

“Shiseido has not been growing because it refused to face and resolve the obvious problems that were halting growth” – VISION 2020

Out of his early conclusions a landmark document emerged in late 2014, called VISION 2020. The Uotani-inspired charter pledged to create the basis for Shiseido to remain ‘vital’ over the next 100 years; and to make the company number one in Japan and Asia. It would deliver those ambitions, it said, by increasing the value of the group’s brands to create a strong consumer-led portfolio.

By any standards it was a forthright mission statement. By the typically bland parlance of most corporate speak it was extraordinarily strong. “We can only grow if we win in the marketplace,” it said. “Shiseido has not been growing because it refused to face and resolve the obvious problems that were halting growth.”

It continued in equally blunt manner: “Shiseido failed to stay relevant to constantly changing consumers and markets and that inefficient organisation also diluted our brand portfolio with too many products and brands.”

“I talked to somebody in America and they said Shiseido was a brand their mother or grandmother used,” recalls Uotani with a half grimace, half smile. “It was obvious we needed the next generation of customers and to make the brand more relevant and make them realise that it was great.”

“Rejuvenation isn’t going to come from a Japanese traditional mindset” – Masahiko Uotani

He devised a deep-rooted but pragmatic rejuvenation formula, maintaining integral elements of the Shiseido success story but also injecting “a breath of fresh air” involving innovative new products, packaging, services, and marketing, all of which had been in the Shiseido DNA.

Again though, Uotani found the lack of global impact was partly due to the “Japanese-centric” approach. For example, when the company developed advertising copy it would do so in Japanese and then literally translate it for other international markets, losing impact and nuance in the process.

The company started to recruit global creators and now has seven non-Japanese creative people in Tokyo – one of whom developed the acclaimed advertising campaign ‘Red is the first color’.

“Rejuvenation isn’t going to come from a Japanese traditional mindset,” says Uotani openly. “It’s really achieved through the diversity of people. Diversity is a key word in Japan now, mainly referring to gender. The Prime Minister is promoting equality between men and women.

“Even in our company just 30% of managers are female. By 2020, we are going to make that 50%. In Japan, the overall percentage of female managers is 27% so we are leading other companies. We have 61 nationalities at Shiseido and we need to leverage that. The beauty of having people from different backgrounds, cultures and languages is what Japanese companies really need.

“Even in our company just 30% of managers are female. By 2020, we are going to make that 50%. In Japan, the overall percentage of female managers is 27% so we are leading other companies. We have 61 nationalities at Shiseido and we need to leverage that. The beauty of having people from different backgrounds, cultures and languages is what Japanese companies really need.

“The second thing we needed to get us rejuvenated was to pay attention to the younger generation, like the Millennials, who are digitally savvy.”

To address this problem, the company recruited Chief Digital Officer Alessio Rossi to set up what it dubbed the Digital Center of Excellence in New York. The Center supports all Shiseido’s business units through a consumer-centric, data-driven, digital approach, creating what the company calls “a community of digital talents”.

In September the group announced a partnership with global innovation agency Fabernovel to establish Shiseido+ Digital Academy. This company-wide training programme is designed to help all employees accelerate innovation from product design to customer service.

“We want to be the number one digitally advanced company in the beauty industry” – Masahiko Uotani

Each local organisation has focused closely on digitalisation; each has its own website to encourage stronger communication with the consumer, as well as an e-commerce site. Outside e-commerce retailers, notably in China’s burgeoning online channel, have also been targeted.

Shiseido’s own e-commerce site in its home market generates around US$100 million in revenue, still relatively small but by Japanese standards one of the bigger online success stories.

“We want to be the number one digitally advanced company in the beauty industry,” says Uotami firmly. “In terms of size we’re not number one as there are bigger companies out there. But we see the chance to be more digitally advanced [than others] – everybody is still kind of struggling and we see real opportunity there.

“We want to be the number one digitally advanced company in the beauty industry,” says Uotami firmly. “In terms of size we’re not number one as there are bigger companies out there. But we see the chance to be more digitally advanced [than others] – everybody is still kind of struggling and we see real opportunity there.

“Alessio has come up with a global vision of five or six initiatives. One is to understand the consumer journey much better. So, he has developed a model for each brand to understand consumer insights. The second is how are we going to really develop content, ideas and promotions which will be attractive to consumers. One good initiative we had was a movie featuring a high school girl – it got 10 million views [see YouTube link above].

“In China, currently 20% of our total business is done via e-commerce with several companies, including Alibaba. By 2020, we want one third or more of our business there via e-commerce. To realise this vision I spoke to Jack Ma [Founder & Executive Chairman] of Alibaba and we developed a strategic partnership with them. We are now working on the new contents which are going to be tested sometime later this year.

“Moving consumers’ hearts is really a kind of motto for marketing” – Masahiko Uotani

“I think my generation is not really familiar with e-commerce and digital unless they’ve had training. That’s why we launched the Digital Academy, where we are going to train all the managers globally. We’ve also put in place a diverse mentoring scheme; for example, I have two young mentors who teach me about digital.”

Uotani seems to have learned fast, talking knowledgeably and passionately about embracing artificial intelligence (AI), for example, to help generate new product ideas.

Travel retail’s star in the Shiseido ascendancy Masahiko Uotani’s attendance at October’s TFWA World Exhibition in Cannes underlined the Japanese beauty group’s absolute commitment to and belief in the travel retail channel. “This is a great opportunity for us to get our brands really connected with travelling consumers,” he says. “They don’t have to come to Japan to find Shiseido, they will find us in China, Europe and so on. The travelling consumer is part of a virtual community who want to see more and buy something special and be entertained. So, we want to be there. “I’m very optimistic about the travel retail business and I think we have to spend more time, energy and money in the channel.” How does the Shiseido CEO rate the quality of travel retail compared with the best domestic market doors? “I think travel retail is still in the transition period,” he replies candidly. “Airports are now being challenged to be more attractive places. It’s not simply just about having shops and counters, it’s about making a reason for travellers to visit us and creating great experiences. “Downtown duty free stores are a new challenge, particularly in Japan, where I don’t think they are there just yet. They are experimenting, experiencing new situations, and differentiating themselves from existing department stores and other channels.” Adds Shiseido Travel Retail President Philippe Lesné (also see extended interview below): “As a group we are now fully committed to travel retail and we’re working a lot on our point of difference versus other channels of distribution… to give a reason for consumers to buy a product in travel retail. “It’s a holistic approach. From a merchandising standpoint, for example, we want think as a traveller and be very travel-centric. And in terms of an assortment and the overall experience, we want to engage consumers every step of the way and give them a reason to buy in our channel as well. “Travel retail has always been very innovative and good at coming up with new ways of processing transactions in a fast and engaging way. Assisted self-select, for example, was born in travel retail. Now the stakes are so high for airports that they are seeing travel retail as a top priority. And more often than not, operators are included in the very conception of new airports.” |

I put it to him that until recently many beauty and luxury houses were fighting the Alibaba and wider Chinese e-commerce wave, fearing damage to their brand image, whereas now they are embracing it. Was it a case of ‘If you can’t beat them, join them?’

“It’s not like, ‘We can’t beat them’,” Uotani replies. “It is simply because consumers are going in that direction.”

Nor is it all about soulless digital interaction, at least not for beauty products, he insists. “Our industry at the same time requires the human touch. Our job is not just to sell cosmetics – I’m saying our mission is to get consumers to have happy beauty experiences.”

He continues: “So, the model we are building is not simply about saying ‘Hey, everybody’s going to use e-commerce/digital, therefore we’re going do the business there. No, it’s more comprehensive, particularly in the prestige business where there is still a very important value in our beauty consultations and diagnosis of skin conditions.”

Chinese consumers, for example, are suffering more and more from skin sensitivity (perhaps linked to pollution), making the human interaction between consultant and shopper ever more important, he points out.

Uotami cites the success of IPSA, a relatively small Shiseido-owned brand, which he noted was growing very fast in China and Japan. Intrigued about the success, he discovered that the brand’s consultants do a lot of work with consumers, analysng their skin with special machines and devising tailor-made, personalised treatment programmes. If the customer is happy with the programme – and it seems they usually are – they simply have to reorder the products next time.

Uotami cites the success of IPSA, a relatively small Shiseido-owned brand, which he noted was growing very fast in China and Japan. Intrigued about the success, he discovered that the brand’s consultants do a lot of work with consumers, analysng their skin with special machines and devising tailor-made, personalised treatment programmes. If the customer is happy with the programme – and it seems they usually are – they simply have to reorder the products next time.

Even Jack Ma hasn’t yet found a way for consumers to smell (or feel) a fragrance online

Shiseido also has online beauty consultants in Japan, allowing consumers to login and chat from the privacy of their home. “People are busy,” says Uotani. “You don’t necessarily have to come to the stores if you don’t have time. But that sort of human interaction is indispensable in this business.”

It’s a key point. After all, even Jack Ma hasn’t yet found a way for consumers to smell (or feel) a fragrance online. It’s a digital age alright but the human touch will always matter, Uotani insists.

He tells a lovely story about a Japanese couple in their 70s who recently visited Ho Chi Minh City in Vietnam. Having arrived at the airport long in advance of their flight home, they decided to go shopping at some local department stores. By the time they needed to return to the airport it was pouring with rain but they couldn’t get a taxi because the airport was deemed too close for any cab driver to assist. They were stuck. Deeply anxious, the elderly couple sought assistance from the Shiseido staff at one of the stores, figuring a Japanese brand might assist.

It did. The staff duly arranged for some friends to collect the couple and take them to the airport by private car. When they returned to Japan, the man and woman contacted Shiseido HQ and related the story, saying: ‘We are so touched and your people globally really practice omotenashi [the famed Japanese tradition of treating a guest with warmth, understanding, and respect -Ed]

When Uotani sent a thankful e-mail to the staff in Vietnam, they replied: “Omotenashi is something that we do every day. Don’t worry, it’s just part of our life.”

It’s a nice anecdote, whose spirit is echoed when I ask Uotani about his personal philosophy. “I think marketing should be done between a company and people’s hearts and minds,” he comments. “A business is defined in a mechanical way, such as B2B and B2C, but it should be very connected to people’s hearts. So, I call it B2H.

“Our job is not just to sell cosmetics – our mission is to get consumers to have happy beauty experiences” – Masahiko Uotani

“Why I like marketing is not simply to get people to buy my brands but to get the people to listen to me and then share their ideas, so we have an interactive and mutual relationship. Moving consumers’ hearts is really a kind of motto for marketing.”

When I ask if there is an individual who has inspired him more than any other, Uotani replies without hesitation. “Akio Morita, Founder of Sony Corporation.

“He believed in global business and diversity of background,” Uotani explains. “And he was very vocal. Whenever he had to stand up, he did, even against the US. He was trusted not just by the Japanese, but also people in the global community.”

Morita famously said, “Curiosity is the key to creativity.” When he was introduced to Shiseido Uotani was curious. The creativity has been flowing ever since.

On the record: Q&A with Shiseido Travel Retail President Philippe Lesné

The Moodie Davitt Report: A recent article in the Nikkei Asian Review said, “Shiseido aims to use its brand to capitalise on tourist demand outside Japan. The company expects sales in travel retail to grow faster than overall group sales”. What drives that confidence?

These trends will benefit Shiseido Travel Retail as we strive to become a leading growth engine for Shiseido Group, and a powerful showcase for our brands on the world stage. Our vision is to inspire one billion travellers around the world to become Shiseido Beauty Shoppers. The biggest opportunities in travel retail lie in China’s outbound tourism boom, which is being fuelled by a growing middle class and millennials. Improved affordability, easing travel restrictions and the increasing desire to travel are set to drive Chinese overseas trips to hit 200 million by 2020. With millennials making up half of China’s outbound tourists, they are definitely a key segment to watch, especially as they enter their peak earning years. What are the biggest threats? One of the biggest challenges of travel retail is its susceptibility to world events, due to its global nature. Threats to tourism and travel range from economic recession and terrorism, to natural disasters and outbreaks of diseases such as SARS and Zika, to tourism restrictions, e.g. recent policies that discourage mainland Chinese tourists from visiting Taiwan. Competition with the High Street and the e-commerce channel are some other challenges.

What more could be done to grow the beauty category in travel retail? To grow the beauty category, we have to drive conversion. According to research, the conversion rates in beauty are lower than that for liquor, confectionery or tobacco – this shows the huge amount of untapped potential in what is traditionally the biggest category in travel retail. Lack of awareness among shoppers about the value and exclusivity of the products has been highlighted as a barrier to purchase, and given the frequency of new beauty launches, it is important to clearly communicate the great value of our offers to customers. We do this in two ways: digital and data. About two-thirds of Chinese travellers plan their beauty purchases before travelling, and the same proportion look for information online before travelling. This means we have opportunities to engage them before their journey begins, and digital can play a big part in helping to grow brand awareness and to target this group before they even reach the airport. We are working to infuse digital into every aspect of our marketing, so that we can target consumers at multiple touchpoints along their travel journey. A key objective of our digital strategy is to create an omni-channel framework that seamlessly integrates the online and offline travel retail shopping experience. We are also strengthening our CRM capabilities to acquire, engage and retain customers, using a consumer-centric and data-driven approach. Collecting customer information at the various digital touchpoints and analysing this data will help us to segment and target travellers better with real-time marketing, tailored and localised offers, and more effective pricing. Besides driving sales, it can also help in forecasting trends and manage inventory levels. The creation of the new travel retail structure was lauded as the “rebirth” of Shiseido in travel retail. Tell us what drove this thinking. The Travel Retail division came into being as a regional entity in September 2015, when we set up our Global Travel Retail headquarters in Singapore. This was followed by the unification of our fragrances and cosmetics businesses in travel retail in May 2016, a move that gave new impetus to our momentum and ushered in a new era for us where all the different regions and cultures would now move forward as one, with the same values and ambitions – as ‘One Shiseido, One Travel Retail’. This ties in with the rejuvenation of Shiseido on the global level and is all very forward-thinking, but without losing sight of our origins. The travel retail market, as ever, faces many challenges right now – currency issues, e-commerce competition, changing consumer behaviour. How is the market performing for Shiseido? Like others in the industry, and as mentioned, we have been impacted by the challenges of an uncertain economic environment; the volatility of global currencies; a deteriorating Latin American market marked by political turmoil especially in Brazil; as well as terrorism threats and Brexit in Europe where the Russian economic downturn has had significant impact on Russian outbound travel. Closer to home, there is the customs crackdown at borders and airports in China, where the government is trying to localise consumption; the slump in Hong Kong; and China’s cutting of cross-strait travel quotas to Taiwan. Consolidation in beauty has also created stronger competition, on top of growing price competition between airports and with e-commerce, thanks to the increasing ease of price comparisons especially among younger, savvier consumers. Despite these challenges, our travel retail business has been riding a strong momentum since we set up our regional headquarters in Singapore last year. Asia Pacific is still the most dynamic region for beauty in travel retail, with sales for the category here growing +17% in 2015. It is also the region that is driving our travel retail business: our 2016 first-half sales in Asia are up +61.7%, driven by big increases in passenger traffic. Make-up and skincare were travel retail’s best-performing categories last year, with positive sales growth of +13% and +9% respectively, while fragrances declined -8%. This plays to our strengths in make-up and skincare, led by our core brands Shiseido, Clé de Peau Beauté and NARS.  We have also boosted our make-up portfolio with Laura Mercier, which will open new markets for us. The fragrance market in Asia Pacific is still underpenetrated but one of the fastest-growing with CAGR of +7.1%. In China, especially, there is strong potential for growth as only 1% of the population uses fragrance products. Dolce & Gabbana has a huge Chinese customer base, and we believe the development of the brand beyond fragrance into cosmetics will make it even more appealing to the Chinese.  According to the 2015 Pax Gloss Global Shopper Survey by JMG-Research, out of 100 travellers that entered a duty free store, 47 visited the beauty category. Of those, 40 purchased – that’s a decent conversion rate of 85%. Out of this 40, 29 purchased fragrances, 18 bought skincare while 12 got make-up. These results further outline the beauty opportunity with Chinese travellers. Following our May unification with Beauté Prestige International (BPI), we now have a strong three-axis portfolio that puts us in prime position to capture this opportunity. As such, we have revised our 2020 targets, which can be summed up by the numbers 2, 4, 8:

By 2020, we expect the ratio of skincare, fragrance and make-up retail sales to be 50:42:8 – as compared to 62:33:5 in 2016. In terms of regional breakdown, we anticipate Asia to contribute 56% of retail sales, EMEA 33% and Americas 11% by 2020 – as compared to 58%, 30% and 12% respectively in 2016. More precisely, how has Shiseido’s travel retail business performed in the year to date. Any plans you can reveal for 2017? Our travel retail business performance so far has been exceeding all our expectations. Asia led this growth as the top-performing region in the first half, with strong sales of Shiseido, Clé de Peau Beauté and NARS – our core brands making up 87% of total sales in the region – in Korea, China and Thailand. This was mainly driven by new door openings and Chinese travellers, who are the lifeline of our Asia business. The EMEA and Americas regions continue to be impacted by challenging market conditions, but EMEA was buoyed by bareMinerals’ UK and inflight business, as well as a decent performance in several key markets: France, Dubai, Germany, Switzerland and Italy. 2017 is an important year on the VISION 2020 roadmap, as it marks the end of the first three-year phase of Shiseido’s rejuvenation strategy. By the end of 2017 we expect our ‘One Travel Retail’ vision to be fully realised across all our regions and categories, and for us to be recognised as a key business partner for retail operators. We will sharpen the focus on our core brands in Asia, and pursue a selective expansion of bareMinerals in the UK and Nordics with an aim for above-market growth in EMEA. In the Americas, we plan to recapture business with a selective expansion of Clé de Peau Beauté and bareMinerals in North America.  We will invest strongly in marketing, with additional media advertising and high-profile promotional campaigns at key airports frequented by Chinese travellers. We have also launched the Global Design Center, our in-house creative and design hub that ensures a powerful and consistent expression of our brands in travel retail. We plan to grow our network of brand consultants, not just quantitatively in terms of numbers but also qualitatively, through enhanced training programmes tailored for travel retail. A top priority is the continued development of our travel retail exclusives product offering, which is a key driver of our business. We aim to create more travel retail icons and offer a unique value proposition for our consumers. We live in an age that has arguably seen the greatest revolution in human communication since the invention of the printing press. Shiseido aims to become “the most digitally advanced company in beauty”. What are the keys to achieving that goal? It starts with instilling a digital mindset in our people, not just in marketing but throughout the organisation. I attended a conference recently and one of the presentations highlighted that we are in the midst of a paradigm shift from ‘digital marketing’ to ‘marketing in a digital world’.

That really struck me as it underlined the importance of taking into account the digital context in which younger consumers grew up in. For those of us who grew up without the internet and digital technologies, it’s hard to think digitally whereas this comes naturally for the new generation. Building our digital capabilities is definitely a priority for Travel Retail, and we are 100% supportive of the SHISEIDO+ Digital Academy, which was launched recently to elevate the digital proficiency of Shiseido employees worldwide. We believe that strategy, not technology, is what will successfully drive the digital transformation of a company. But first, the culture has to be supportive of digital collaboration in order to foster innovation and creativity, and this is where Shiseido Group excels. Digital maturity is the product of strategy, culture and leadership. e-commerce – what’s your strategy here, both in-house and in terms of external e-commerce giants such as Alibaba? You expect e-commerce in China to generate 30% of China sales in 2020, a huge share. How and where are you investing to benefit? Many see e-commerce as a threat to travel retail, but they can complement each other well if properly harnessed through a targeted omni-channel strategy. We can see the two channels growing strongly together, compared to the domestic market. The two channels have different propositions: e-commerce offers convenience and ease of price comparison and information; travel retail offers an inspiring shopping experience, customer service and quality assurance. If travel retailers can integrate the two, it will take the industry to the next level. According to m1nd-set research, most travel retailers lag behind in their ability to leverage mobile and digital technology as a communications tool – nine out of ten global travellers are using their mobile devices to access the internet at the airport, but only three out of ten shoppers will consult duty free retailer websites. So the travel retail industry definitely has to work harder to stay exciting and relevant for a new generation of tech-savvy travellers who are used to buying everything they need online. Travel retailers and airports have been stepping up their game and steadily developing and improving their online pre-order shopping offerings – Fraport even won an award for its online shopping platform recently – and this is definitely a positive trend.  For the Rouge ‘Red’ campaign at Changi Airport, we worked closely with Changi Airport Group and Shilla to engage travellers at multiple digital touch points, from ads on travel sites, to social media placements to a dedicated a microsite, eventually linking to Changi’s iShopChangi product listing page, where travellers can purchase immediately. This is a showcase of how we can work closely with operators to establish an omni-channel framework to create a seamless online-to-offline shopping experience. Tell us about the unification with BPI, historically a pure-player fragrance company with a very different geographic profile in sales terms. How is this three-axis structure taking shape?  The unification in travel retail was officialised on 1 May 2016 and we expect the process to be complete by the end of the year. We will then be able to fully leverage the resulting synergies and potential opportunities of a three-axis offering in Travel Retail. The Dolce & Gabbana licence deal is an example of the powerful synergy effects that could result from a unified business. Fragrance brands can leverage Shiseido Group’s strong R&D to expand their skincare and make-up offerings, while our cosmetics brands can benefit from the fragrance expertise of BPI. Fragrance and make-up are expected to deliver the biggest growth in the run-up to 2020. Fragrances will represent 42% of our retail sales in 2020, up from 33% in 2016, while make-up will increase its proportion of retail sales from 5% in 2016 to 8% in 2020. Skincare will still contribute half of our retail sales in 2020. |

Philippe Lesné: Our confidence is bolstered by positive trends in global passenger traffic and the travel retail beauty market. International departing passengers are projected to double in the next 15 years and exceed one billion by 2030. The travel retail beauty market will see a CAGR of +7.2% up to 2020 – growing almost twice faster than the domestic beauty market

Philippe Lesné: Our confidence is bolstered by positive trends in global passenger traffic and the travel retail beauty market. International departing passengers are projected to double in the next 15 years and exceed one billion by 2030. The travel retail beauty market will see a CAGR of +7.2% up to 2020 – growing almost twice faster than the domestic beauty market