“Exceptional.” That was how US beauty powerhouse The Estée Lauder Companies described its second-quarter results released today for the period ended 31 December 2019. Travel retail again played a leading role. But President and Chief Executive Officer Fabrizio Freda said the company is updating its fiscal outlook in the wake of the worsening coronavirus crisis, which he conceded would hit financial results in the near term.

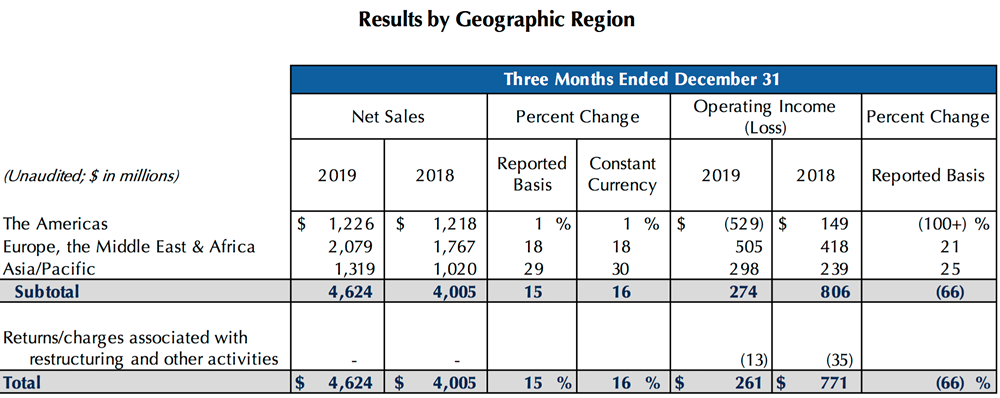

Net sales rose +15% year-on-year to US$4.62 billion and by +16% on a neutral currency translation. Net earnings were down -2.8% to US$557 million. Diluted net earnings per common share reached US$1.52, compared with US$1.55 in the prior-year period. Adjusted diluted earnings per common share* rose 21% to US$2.11.

Freda, said: “We delivered superb results in our second quarter, leading to an excellent first half. Our multiple engines of growth generated broad-based gains across all our regions and major categories, as our prestige brand portfolio was well received by global consumers during the Singles Day event and holiday season.

“Our sales growth came from all facets of our business, including the Asia Pacific region, the skincare and fragrance categories, the online and travel retail channels, and the Estée Lauder, La Mer and luxury fragrance brands. Our emerging markets continued to be vibrant and we made progress towards the stabilisation of our North American business despite continued softness in the makeup category.

“Additionally, we completed the acquisition of the Korea-based Dr. Jart+ brand at the end of the quarter, which strengthens our position in global skincare.”

“Global travel retail, localities most affected by the virus outbreak and destination markets favored by tourists are expected to experience the greatest negative impact in the coming months followed by a gradual recovery later in the fiscal year”

Coronavirus set to hit near-term results

Freda said: “In the wake of the recent coronavirus outbreak, we are first and foremost concerned about the health and safety of our employees, consumers and everyone affected in China and around the world. Our hearts and support go out to the many people working hard to mitigate the health risks of the coronavirus.

“The global situation will also affect our financial results in the near term, so we are updating our fiscal year outlook. With our results to date and our agility in allocating resources, we will strive to deliver full-year growth at least in line with our long-term goals, even in this challenging moment. We will be ready to return to our growth momentum as the global coronavirus outbreak is resolved.”

In its outlook for fiscal 2020 second half and for the full year, the company warned that it expects global prestige beauty to be adversely impacted over the next few months by the coronavirus.

Assessing the impact during a Q2 earnings call, Freda said: “It is difficult to anticipate [but] we expect the next couple of months will be very challenging. Chinese consumers in many big cities are staying home. And retailers are closing stores or limiting hours, in an effort to help contain the spread of the virus.

“Additionally, global travel is being restricted. And the effect is being felt beyond China, into major travel retail corridors and large tourist cities. Given what we know now and our experience with past epidemics, we believe our business will gradually recover towards the end of the fiscal year.

“We stand ready to invest and to facilitate the recovery as soon as the market supports it, leveraging the flexibility of our resource allocation and our multiple growth drivers. We remain committed to China and to the Chinese consumers for the long term.

“And we plan to increase our R&D investment in the market, in order to drive both breakthrough, prestige beauty innovation for China, the Asia Pacific region and the rest of the world.

“Reflecting China leadership in science, we will expand upon our existing in-market capability and build a new state-of-art innovation centre, complete with the latest technologies and tools.”

On travel retail in particular, Freda added: “In this moment travel retail is the most impacted channel. More than 60 airlines just closed their flights. So travel in and out of China is suspended in the large majority of cases. So there is a lack of traffic.

“Second, in general, tourism is more prudent, because it’s a global issue. The outbreak is a global concern. And so many people are concerned to travel and are postponing touristic travel.

“Then there is a third factor. Many companies have banned travel to any place where the virus [has been confirmed]. And so business travel is being reduced, not to mention that many companies are reducing business travel for cost containment reasons.

“For recovery in travel retail, it will be very important to push conversion. Travel retail is built by traffic and by conversion. Conversion is an area where we’re making many improvements. So in this period of transition where traffic will be low, we are reworking our plans to use conversion as a key mitigating element. And we are preparing for future recovery plans when the time will arrive.

“The last point I want to make is that we will try to tune the recovery to the recovery of the Chinese economy and the Chinese population. We don’t want to just look at this as a business. We want to look at this as a contribution to the recovery of the country and really support our employees [there]. The same will happen in travel retail where, for example, some of our customers and retail partners are Chinese.

“We are going to stay close to them to contribute to the recovery of the travel retail business to make sure that our long-term retail partners will benefit from the recovery as much as possible. [We will] regain momentum not only for us, but for the entire industry.”

Due to the evolving and uncertain nature of the risk related to the coronavirus, the company is only providing guidance for the second half of the fiscal year at this point instead of the quarterly guidance typically issued. The third quarter is anticipated to be the most negatively impacted by the coronavirus with sales declining versus the prior-year period.

*Adjusted diluted earnings per common share excludes restructuring and other charges, changes in contingent consideration, goodwill and other intangible asset impairments and other income.

| Travel retail highlights There were shout outs for travel retail in Europe, the Middle East & Africa (EMEA) where the company recorded “strong double-digit gains” in the channel (and in online and specialty-multi retail), helping to boost operating income. Net sales growth from travel retail in EMEA was broad-based, with double-digit increases for many of the brands, led by Estée Lauder, La Mer, Origins, Clinique and Tom Ford Beauty. Growth also reflected the rise in international passenger traffic, improved conversion and strategic investments to support new and existing products. In addition, successful innovations and targeted expanded consumer reach contributed to growth, the company said. In common with all major channels in Asia Pacific (led by online which more than doubled), travel retail did well. Greater China (overall) delivered strong double-digit net sales growth.

Moving to product categories and brands, within skincare Clinique’s growth was driven by increases in its hero franchises, including Smart and Moisture Surge, which also drove momentum in Europe and travel retail. In make-up Bobbi Brown’s double-digit growth across Asia Pacific and travel retail was largely driven by the continued success of its Intensive Skin Serum Foundation and the launch of Luxe Shine Intense Lipstick. |