ASIA PACIFIC. The realities of doing business in the booming offshore duty free sector in Hainan were exposed in a compelling APAC Dialogue webinar on Thursday, hosted by the Asia Pacific Travel Retail Association (APTRA) in association with The Moodie Davitt Report. An edited video of the session appears below.

Alongside The Moodie Davitt Report Founder & Chairman Martin Moodie (event moderator) and APTRA President Sunil Tuli, four speakers shared their candid views on the emergence of the market in Hainan, along with its challenges and opportunities.

Star Brands Travel Retail CEO Rob Robertson spoke about creating and nurturing business in Hainan, protecting brand image, managing human resource dynamics and team training, plus merchandising and communication.

Paccaya Resources Limited CEO Andrew Ford (a former CEO of TFWA and President of APTRA), addressed Hainan’s commercial landscape, with analysis of current dynamics and future direction.

Stephen Peng, Senior Partner at leading Chinese law firm Jincheng Tongda & Neal, covered the regulatory landscape in Hainan and assessed how changes will shape the market. And Harry Kartasis, Managing Director Global Drinks Limited, spoke to the many questions put by audience participants about supply chain, logistics and product labelling requirements in Hainan.

Click on the video above to watch the APAC Dialogue webinar

Opening the session, Martin Moodie put the Hainan business in context. “From a standing start in September 2011, offshore duty free shopping Hainan-style had grown to an approximate US$5 billion channel by the end of last year,” he noted. “And despite a -22.2% fall in Hainan visitor numbers due to the impact of COVID-19 early in 2020, sales rose by a startling +127% last year.

“That result was driven by two key factors – firstly the introduction of a much-enhanced duty free shopping policy last July which saw the annual allowance tripled; new categories such as cellphones and alcohol added; the single purchase value cap removed (very important for luxury items), and the number of cosmetics SKUs that could be bought raised from 12 to 30.

“Secondly, of course, most of the world was closed to international travel, making Hainan – COVID-free from April 2020 and both a shopping and natural paradise – a magnet for Chinese holidaymakers.

“Sales are projected to climb to at least $9 billion this year and $15 billion by the end of 2022. And recently Hainan Free Trade Port suggested that revenues could climb to $46.5 billion by the end of 2025. That’s a lot of growth, especially if you put in the context of, say, the South Korean duty free market, the world’s biggest, which in the pre-COVID year of 2019 reached US$21.3 billion. Are we seeing a long-term tilting of the balance of the power in North Asia’s duty free industry? Or is this an interim rebalancing?

“In the global duty free shopping industry, all roads lead to China and the main highway runs straight into Hainan. Everyone, brands, retailers, distributors, want a slice of the action. Today we look beyond the slightly superficial headlines that simply paint Hainan as some kind of 21st century El Dorado. And that’s because such rapid development of an industry, especially with a regulatory framework that is changing regularly, inevitably means growing pains and complexity. This webinar is all about understanding the Hainan opportunity better, mapping out the landscape in terms of players, issues, challenges, opportunities and changes.”

Sunil Tuli also highlighted the vast opportunity that Hainan represents, while noting the challenges facing incumbent players and newcomers alike.

“This is a market that will dominate travel retail for a long time to come,” he said. “However, before we get too carried away, any new, fast evolving market has its own set of teething issues. There is regulation coming with a focus on more affordable and fast moving consumer goods.

“After 2025 normal retailers will pay a much lower tax rate than they do now, meaning more competition. Luxury brands have voiced their concerns over maintaining brand integrity. Discounts are pushing prices and margins down. The sheer volume of shoppers can make it hard to control the handling of stocks in-store. Registering products is tricky and time-consuming. Cosmetics set to expire within a year are being deeply discounted to as much as one-tenth of the regular retail price. There is no doubt that this is a very different landscape to other travel retail markets, and one that can be hard to fathom.”

Andrew Ford put the development of the domestic duty free business in a global context, adding that there was a big opportunity to develop further markets, both in Asia and further afield.

He said the rise of Hainan offshore duty free shopping would have a big impact on traditional airport duty free sales elsewhere over the next five years as travel recovers and as China repatriates more and more luxury sales on-shore.

“The airports that have relied on the Chinese shopper for a lot of their spend are going to have to think much more cleverly in the future about how to generate this spend,” he said. “These airports will have to resize and reshape their business models, because it is going to take international traffic about five years to get back to 2019 levels.”

On key developments that will influence the Hainan market, Ford said: “There will be an introduction of a duty free scheme for local inhabitants, which is fairly sure to happen soon. Secondly, we’ll see an introduction of spending limits for locals and probably an increase of the spending limit for visitors to the island.

“Thirdly, there is the development of ecommerce, particularly as one can spend the allocation from home if you visited the island. An interesting point here is that between the beginning of February and the end of March, over half a million parcels were shipped to people’s home addresses as they used up their allocations.

“The fourth development between 2023 and 2025 will see several large scale premium mall developers enter the island in the key shopping and hotel districts.

“Finally in 2025, what is supposed to happen is that the privileged position of domestic duty free will disappear as all retail on the island becomes tax and duty free, just like Hong Kong and Macau.”

On the appetite among brands to invest, Ford added: “We should note that some top-end luxury brands are watching to see how the island and its retail landscape develops before entering, and some of them may not enter at all.

“For the moment, the market is perceived by some as a little bit of a frenzy, mainly for beauty items at discount prices, and not really a brand-building opportunity. Luxury brands and luxury commercial developers are watching to see when will be an opportune time to enter with a travel retail concept shopping mall with premium restaurants, outdoor cafes, cinemas, high end luxury boutiques and so on.”

Looking ahead to 2025, Stephen Peng said that the authorities were likely to use the licensing system to retain close control of the offshore duty free business – ensuring the long-term value of the licence holders.

“Everyone loves the duty free licence because the licence is gold,” he said. “There are only ten licences issued [to date] and all the licences holders are state-owned companies. The issuance of those licences is subject to very strict examination by the Chinese government.”

Rob Robertson offered some powerful insights from a brand perspective, as he assessed the biggest challenges in Hainan today from the viewpoint of a regular visitor. [Note: Newly formed Star Brands Travel Retail is an alliance between Star Brands Asia and Bluebell Group designed to unlock the potential for global brands entering Asia travel retail’s modern-day hotspot].

He said: “We are entering a new era now in which the density of luxury Chinese shoppers is just becoming so big that brands need to pay attention and really step up their efforts to become world class in every way at the point of sale. But there are quite a lot of challenges in this area.

“The first is recruitment and talent development by the duty free operators. You might have hired 1,000 people and are preparing to hire another 1,000. Many of those are in the onboarding process, trying to learn the basics. Recruitment and training is a monolithic challenge for the operators and it will continue to be so especially since we expect more licences to come on board and new space will continue to open. From a brand point of view, that creates a bigger need to manage and train the staff inside the operator, using brand resources.

“So then, the challenge for the brands is, who is going to do that? Even up until recently, most of the major groups didn’t have their own subsidiary in Hainan but that is changing rapidly. Until last year, even quite large brands would have had one sales manager rotating around through the market, largely unsupervised, and the quality of the work was not well controlled.

“So from the brand point of view, how am I going to solve that challenge? How am I going to get into the duty free operator, train the staff, identify the talent, get the talent onto the team, and create continuity and stability in the organisation? There has not been much opportunity for development, not much opportunity for learning. So now what I see brands needing is to establish a team and structure that can facilitate growth and development, so they can retain the talent and improve capabilities.

“There is a different challenge too in the increasing gap of knowledge about trends and new brands. I have met a lot of very talented people recently. But when you ask them about Drunk Elephant or Charlotte Tilbury or Huda Beauty, they have never heard of them. Meanwhile, your shoppers are coming in from Shanghai, Beijing or northeast China or Chengdu and they do know these brands, are more and more aware, and more and more savvy. And you see clearly from the online business in Mainland China that there’s a lot of very deep knowledge about global trends and new products, new categories, driven by influencers and social media.

“One more challenge is that the dual duty free operator structure adds additional complexity and challenge to brands. So you have Lagardère Travel Retail with HTI, you have Dufry with HDH you have DFS with Shenzhen Duty Free. Brands cannot assume that there’s perfect transmission from what you sell in at headquarters and what’s aligned at the point of sale. And most brands are not well familiarised with the local side so far.

“If you want to create and maintain first class performance at the point of sale, you really need to be interacting with both sides of that equation to guarantee the success and make sure that your brand is protected. We are happy to be part of this process and see what we can do to help our brands meet these new challenges.

“But in the end, I wouldn’t overlook the opportunity that is there and why it is all worth it. I come from a consumer marketing background and for me it comes back to how you reach your target consumer in China today. So if you are a luxury or prestige brand, you are talking about a specific and narrow group of people. And in Mainland China, it’s becoming more and more difficult to reach these people.

“China is a huge market that is fragmenting in terms of ecommerce, in terms of retail, in terms of social media. And it’s impossibly expensive for brands to do broad scale advertising. So it’s really critical to hit that target consumer. This is a place where your consumer is. So there’s discounting and there’s promotion, but if you want to reach that target consumer, this is a great place. And so it is worthwhile to really focus on improving the performance there.”

Harry Kartasis lent his expertise about getting product to market to the discussion. He said: “Four things I am generally asked are about supply chain, labelling, costs and paperwork. Right now the labelling laws in Hainan are very similar or exactly the same as in Mainland China. These labelling laws have been in effect since 2005. What we found out today is that next year in 2022, the Chinese government is going to be publishing a new document on pre-packed and alcoholic beverages. It’s the first one in a couple of decades and hopefully, that may give us some clarity on Hainan and labelling.

“The other question we get asked around labelling is, is it possible to use regular duty free labelling, as in most locations around the world? Right now it is not. Unfortunately, we have to stay with the labelling that is used across Mainland China.

“The other big issue is routing. How to get stock into China? The majority of stock comes via Hong Kong and it has to have two types of stickers, for duty not paid in Hong Kong and duty not paid in China. Those stickers can cost anywhere between three up to six Hong Kong Dollars so it can be costly.

“In terms of actually getting stock in, it can be challenging, and you need to buffer your timing in case of Customs hold-ups.

“The paperwork required for all of this includes general packing lists, ingredients reports, bottling dates, certificates, invoices, Certificate of Origin, age certificates, health certificates, so there is quite a lot of paperwork involved. But make sure you’ve got everything ticked off or it holds things up.”

*We will bring you more comment on this vital session about the detail of working in the Hainan market soon, with a major feature coming up in the June edition of The Magazine.

Event partners for this session included Diageo Global Travel, Pernod Ricard Global Travel Retail, Bacardi, Distell Global Travel Retail, Jaidee Spirit Co and FILTR.Qingwa.

Footnote: Every fortnight The Moodie Davitt Report publishes Hainan Curated, in association with Foreo, a selection of all recent stories from the offshore duty free sector in Hainan province.

Click here to view all back issues. Please email Sinead@MoodieDavittReport.com to subscribe.

ABOUT APTRA

The Asia Pacific Travel Retail Association (APTRA) is a membership organisation whose vision is to represent all members of the association and to strengthen, nurture and protect the duty free and travel retail industry in the Asia Pacific region. APTRA’s membership comprises landlords, retailers and brands, a unique base which adds richness to the association’s work. APTRA’s territory spans over 45 countries in Asia Pacific.

APTRA strengthens the knowledge base of the industry by supporting members through meaningful research, knowledge sharing, networking opportunities and advocating for the industry when facing regulatory challenges. Commissioning relevant market research is one of the quality outputs of APTRA, the results of which are disseminated exclusively to members through private seminars, networking workshops and the Association website.

ABOUT THE MOODIE DAVITT REPORT

ABOUT THE MOODIE DAVITT REPORT

The Moodie Davitt Report is the world’s leading information source for the travel retail sector, covering all aspects of travel-related commercial activities and consumer services from shopping to food & beverage, airport advertising to foreign exchange to car parking.

The company owns leading industry events The Trinity Forum (run in association with Airports Council International), The Airport Food & Beverage (FAB) Conference & Awards; The Moodies Social & Digital Media Awards; and the Virtual Travel Retail Expo.

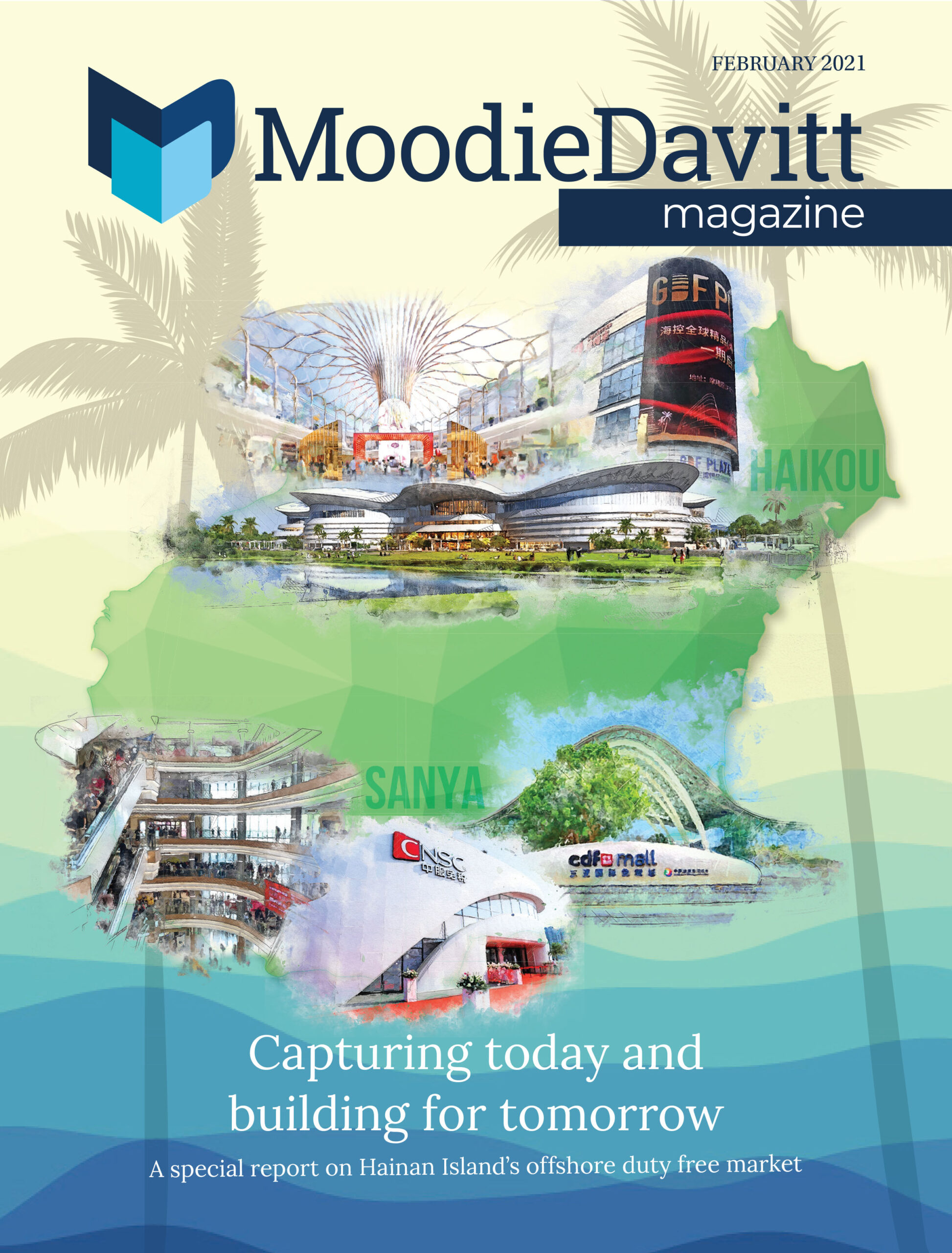

The company is a particular authority on China and Hainan’s travel retail sectors and recently produced a White Paper related to Hainan’s offshore duty free sector in partnership with KPMG China. The report was published at the inaugural China International Consumer Products Expo in Haikou, Hainan (7-10 May).