AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity ecosystem, presents his latest commentary and figures on the gradual re-emergence of airport commercial activities in Australia and New Zealand against the backdrop of a global pandemic now stretching into its third year.

Favotto owns and runs The Mercurius Group, a consultancy focused on industry research, consultancy and benchmarking studies, as well as operating his own destination merchandise supply business.

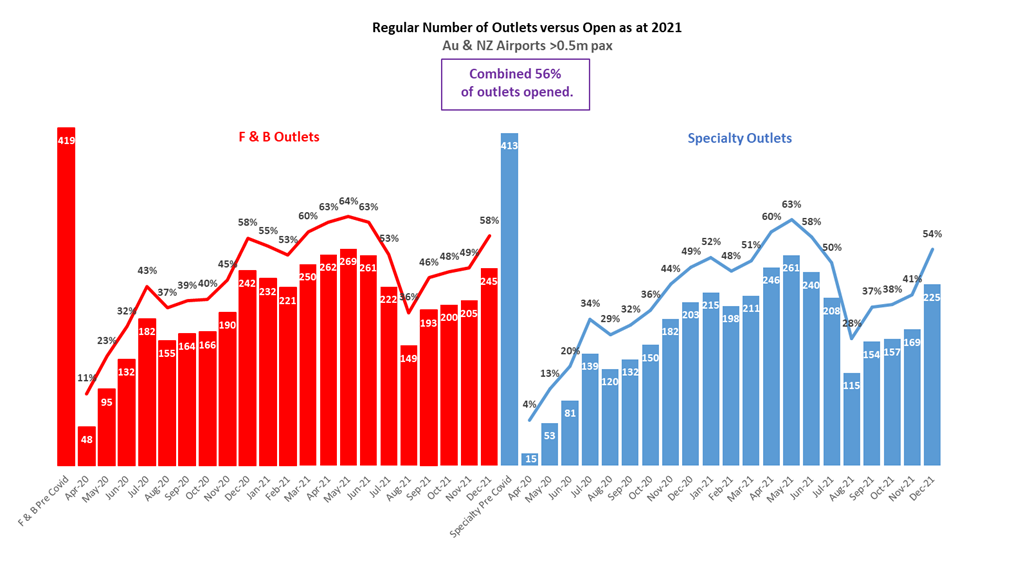

In the latest edition of his unique monthly report tracking the recovery of an initial 832 travel retail outlets across Australia and New Zealand, Favotto addresses the impact of the omicron variant on what until its emergence had been a promising revival.

December 2021 was meant to be the month when things started to return to normal in travel retail down under.

After all, double vaccination rates for all adults over 16 finally reached the government’s 90% target in both Australia and New Zealand. Both the Australian and New Zealand governments promised a relaxation of international border closures and state governments in Australia (except Western Australia) promised to re-open their borders so that travel could resume – if not as normal, then at least close enough to normal. Many airports in both countries were reporting that airlines had scheduled a return of capacity in excess of 2019 levels.

So it was with an air of optimism that travel retailers approached December 2021 – expecting a Christmas gift of resurgent travel on the back of pent-up demand. And by all accounts, air travel booking reports from airlines for November went with the script.

And then we all learnt a new letter in the Greek alphabet – Omicron – as a new variant of COVID-19 led to a resurgence of infections, just a few short months after some cities in the region had endured some of the longest lockdowns in the world. While by most accounts the Omicron variant appears a milder form of disease than its predecessors, its highly infectious nature – even within highly vaccinated populations – has dampened travel demand once again.

Although the surge in Omicron infections has not (yet) resulted in the re-introduction of border closures or lockdowns (except in New Zealand where some international border re-openings have been delayed), large elements of the population have nevertheless self-imposed restrictions on travel.

In Australia, the sheer volume of new Omicron infections has also seen an almost complete breakdown of all the tools governments had previously relied on to manage the pandemic – PCR testing, rapid-antigen testing, contract tracing and close/casual contact monitoring. The breakdown in the very systems from which the population has derived some degree of comfort that COVID-19 was coming under control appears to have seriously undermined the explosion of pent-up demand for travel that the industry was expecting.

The dampening of travel demand also softened the rate of travel retail store re-openings across Australia and New Zealand. According to The Mercurius Group’s 20th monthly report tracking the recovery of travel retail in Australia and New Zealand from the pandemic, 56% of travel retail stores were open in December 2021. While this is good news in that it is up materially from the 45% in November 2021, it feels like bad news because the industry was hoping for so much more.

Nevertheless, an 11-point increase in the number of outlets opened in just one month is positive, although re-openings have not yet reached the highs experienced in May 2021 – just before the Delta variant wave that started in June/July 2020.

In terms of outlet type, December 2021 saw total F&B outlets open increase to 58% and total specialty outlets increase to 54% – specialty’s biggest surge in re-openings since the pandemic began.

Although 56% of outlets have re-opened across the board, this masks a material difference between international terminals and domestic terminals. Around 71% of outlets in domestic terminals have re-opened but the figure is just 25% in their international counterparts.

The 71% comprises 76% for F&B outlets and 66% for specialty outlets. By contrast, the 25% of outlets open in international terminals is comprised of 41% for duty free shops, 22% for specialty stores (mostly travel essentials) and 20% for F&B.

A less material difference exists between the proportion of locations re-opened in Australia versus New Zealand. In Australia, 53% of outlets are open compared to 57% in New Zealand.

While Omicron might be the grinch that stole Christmas for travel retailers, several airports are reporting an uptick in travel over the down-under summer holiday period during which borders have largely remained open which is giving travel retailers renewed hope that we are learning to live with COVID.

While Omicron might be the grinch that stole Christmas for travel retailers, several airports are reporting an uptick in travel over the down-under summer holiday period during which borders have largely remained open which is giving travel retailers renewed hope that we are learning to live with COVID.

While nowhere near 2019 level yet, an uptick in air travel is nevertheless good news against a backdrop of depressingly low travel levels experienced by many airports over the past two years.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com