AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity ecosystem, presents his latest commentary and figures on the gradual re-emergence of airport commercial activities in Australia and New Zealand. Favotto owns and runs The Mercurius Group, a consultancy focused on industry research, consultancy and benchmarking studies, as well as operating his own destination merchandise supply business.

AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity ecosystem, presents his latest commentary and figures on the gradual re-emergence of airport commercial activities in Australia and New Zealand. Favotto owns and runs The Mercurius Group, a consultancy focused on industry research, consultancy and benchmarking studies, as well as operating his own destination merchandise supply business.

This article marks the 14th in our monthly reports tracking the recovery of 832 travel retail outlets across Australia and New Zealand from COVID-19.

The pace of recovery is painstakingly slow. Perhaps it is even reaching a plateau as international borders remain resolutely shut and domestic borders open and close at the mere sniff of any cases of COVID-19 community transmission.

The good news is that a record number of travel retail outlets across Australia and New Zealand – 530 or 64% of the total – have now reopened since the nadir of the lockdowns 14 months ago. The bad news, of course, is that a staggering 302 (or 36%) remain closed, with some in prospect of never returning.

While that 64% figure in May is the best result since the COVID-19 crisis began, it is only a +1% improvement over April. The ponderous recovery may be levelling until both countries can reopen their non-Australasian international borders – an unlikely prospect save for some relatively fragile travel bubbles.

May 2021 saw yet another COVID-19 outbreak and subsequent lockdown in Victoria – the fourth in Australia’s second-most populous state since the start of the pandemic. With a reaction bordering on tiresome predictability, most other states closed their domestic borders to Victorians once again. This caused one senior airport commercial executive to shrug his shoulders and sigh “rinse, repeat” before trotting off to reopen the interstate traveller screening facility rather than reopen any retail.

The penchant of Australian state governments to shut down borders at the first sign of community transmission has undoubtedly saved the country from the material death tolls suffered by many other nations. While laudable, it is incredibly frustrating for the travel retail sector, which has borne a disproportionate financial brunt as a result.

Those frustrations are exacerbated by the relatively slow vaccine roll-outs in both Australia and New Zealand – around 15% and 12% of their respective populations – which contrasts with many countries where rates exceed 50%.

The slow vaccine roll-out – not expected to be maximised this year in either country – means that international borders will remain tightly shut and that the majority of stores in international terminals will remain closed or trade at just a fraction of their pre COVID-19 levels.

The trans-Tasman bubble reopening has resulted in the growth of specialty store reopenings, along with the opening of some new concept sites, including Lagardère Travel Retail’s impressive new Southern Providore outlet at Adelaide Airport. While the average of specialty stores reopened is now 63%, this is relatively even across the main categories of duty free (62%), travel essentials (60%) and others (65%).

The rate of total store reopening is higher in New Zealand (67%), where there are no state governments that can (relatively) arbitrarily shut down borders, than in Australia (62%). And, of course, the rate of store re-opening is higher in domestic terminals (71%) than international terminals (39%).

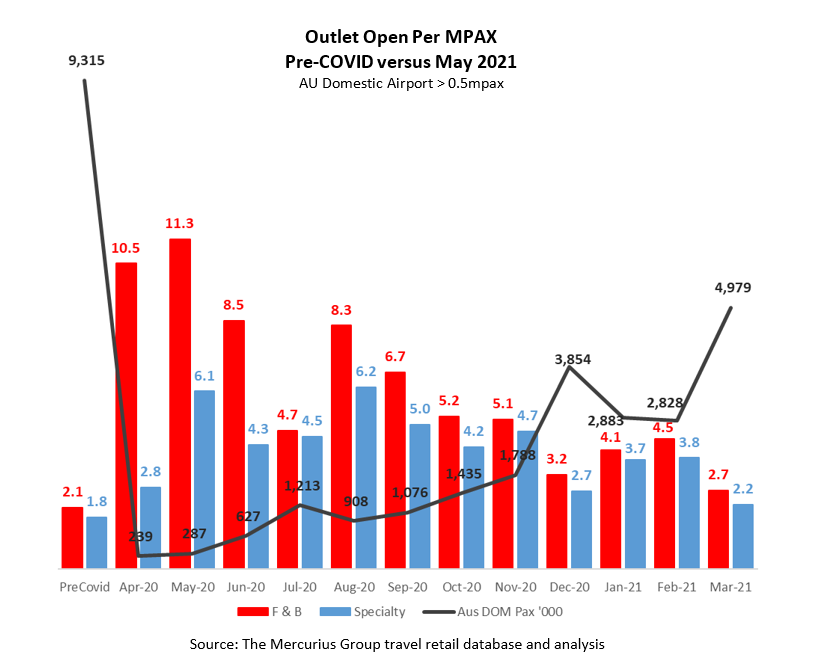

In terms of our store sustainability indicator – outlets open per million passengers – our analysis shows that as domestic passenger numbers for March start to grow towards 54% of pre-COVID-19 levels the indicator for both F&B and specialty is moving closer to pre-COVID-19 levels.

In March 2021 (the latest month for which official passenger figures are available in Australia), domestic passenger numbers rose to 54% of their pre-pandemic level, with 71% of domestic terminal travel retail sites open. With pre-Easter openings in March, the number of outlets open per million passengers increased and started to look more like pre-crisis levels.

In other words, in March 2021, 71% of the 2019 number of Australian domestic outlets were open and competing for business from just 54% of the 2019 passengers.

With direct government support now gone, an operator’s tool box for becoming cash flow positive is limited to operational efficiencies, such as reducing staffing through shorter, more focused operating hours, which can be at odds to an airport company’s desire to see their rapidly returning passengers wooed by the full array of offers.

Meanwhile, as periodic lockdowns are now becoming the expected norm, airport and operators continue to reprise their lockdown protocols. Rinse, repeat.

The Mercurius Group contact:

Tel: +61 423 564 057;

Email: ifavotto@themercuriusgroup.com;

Website: www.themercuriusgroup.com