SOUTH KOREA. New measures aimed at restricting the spread of COVID-19 in South Korea – amid a sharp rise in cases – are not expected to dampen duty free sales to foreigners, who are mainly corporate resellers, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung*.

A third wave of COVID-19 in Korea has seen a run of more than 600 new confirmed daily cases, with 629 reported on 3 December. The last time that new cases passed 500 a day was during the peak in February and March. Compared to that period, a higher portion currently falls in the Greater Seoul Metropolitan Area (50% of Korea’s population). With a large population base, there are fears that the recent spike could escalate and be sustained for a much longer period.

Seoul’s Acting Mayor Seo Jung-hyup announced on 4 December that the city logged a record high 295 new confirmed COVID-19 cases and said that emergency measures were required to curb the resurgence. In particular, he warned, Seoul does not have enough intensive care unit beds available to treat serious cases.

Seoul is operating under Level 2 restrictions (in a five-tier system) since 24 November. Given the rise in new infections, authorities are enhancing social distancing by closing stores, theatres, cafés and other public meeting areas from 9pm daily for two weeks.

Despite such measures, the impact on the duty free business will likely be limited. Downtown duty free stores already have limited operating hours to lower the risk of new infections and close by 5.30pm daily.

Given that most department stores are closed between 8pm and 9pm – those in the Dongdaemun area usually close at 10pm – the recent measures will also have limited impact on that channel.

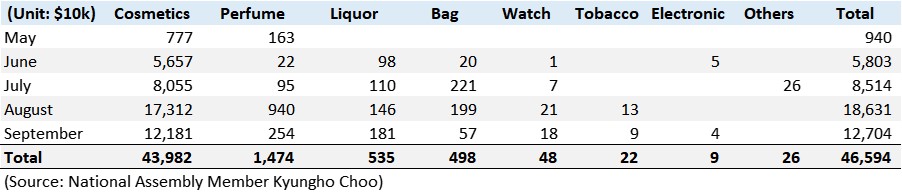

Foreigners remain the lifeblood of Korea’s duty free sector and there is no change in sight to the daigou buying spree that saw foreigner average spend per person increase by +1,786% year-on-year to US$16,393 in October. Foreigners currently account for 95% of total duty free sales and, in turn, downtown duty free accounts for 99.5% of foreigner sales.

Meanwhile, Korea’s travel retailers continue to urge Korea Customs Service (KCS) to extend permission for third party sales until the impact of COVID-19 is over rather than ending on 31 December, as planned. As reported, in relief measures introduced on 29 April, KCS temporarily allowed:

1) Local distribution through ecommerce and other channels of unsold duty free inventory (limited to items held by retailers for over six months)

2) The transfer of ownership of unsold imported foreign goods to another party

3) International shipping and sales of unsold imported foreign goods overseas.

On 27 October KCS announced an extension to relief measures allowing domestic sales of duty free goods (with relevant taxes and duties imposed) until further notice while third party exports were allowed until year end.

Retailers have pushed through high volumes of inventory through third party sales, which are now as high as 20% of the total duty free market, compared to 16.6% in August.

One leading travel retailer told The Moodie Davitt Report that KCS is reviewing the practice but there is concern that any decision may not come before the 31 December deadline.

*Note: Korean national Min Yong Jung, formerly based in London and now in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a previously unseen level of research and analysis for the travel retail channel.

Do you have research needs related to the Korean and Asia Pacific travel retail and luxury markets? Min Yong Jung can be contacted at minyong@moodiedavittreport.com