INTERNATIONAL. Global indices rose last week and are gaining in the fourth week since global investors were spooked by the spread of COVID-19 on the weekend of 17 January, writes Senior Retail and Commercial Analyst Min Yong Jung.

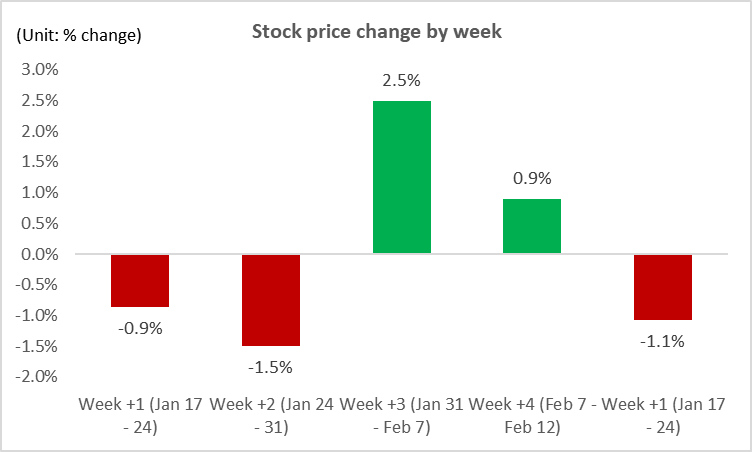

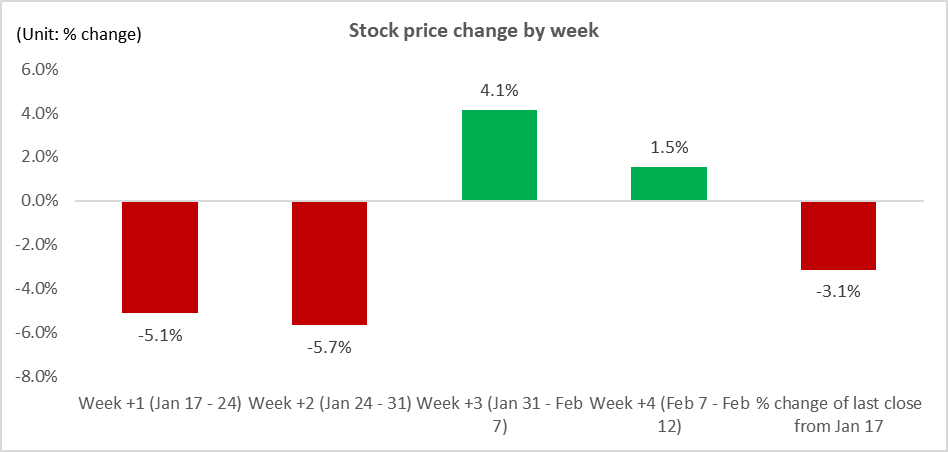

The median of key benchmark indices rose +2.5% in week 3 and 0.9% in week 4. The recent gains in stock markets globally means stocks are close to levels prior to the strong declines witnessed during the crisis weeks.

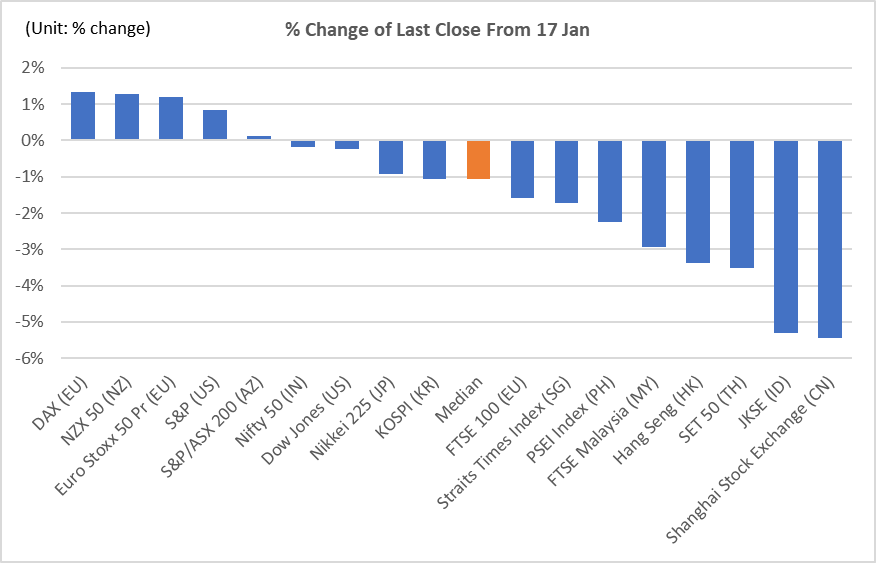

Several key benchmark indices in Europe and the US have recovered to levels prior to 20 January but Asian stocks in countries still seeing the spread of the virus remain lower.

Investors have turned positive on the stock market in week 3 and week 4 and are focusing on the lower number of new confirmed cases, a decrease in new suspected cases and a reduction in medical observations in China. Despite the continued spread of the virus and negative economic impact (supply chain disruption, store closures etc.) to follow, investors experienced with previous outbreaks are aware the stock market and economy is quick to recover.

In order to aid the recovery of the economy, China’s policy makers are expected to sign off on more fiscal stimulus (direct spending, tax relief and subsidies). Although the economic recovery may take longer than SARS (which shaved 1% off China’s economic growth in 2003), investors remain hopeful the Chinese government will soon announce measures that will help in the recovery.

China’s decisions to apply tariff cuts on some US goods, part of the US-China ‘Phase 1’ deal also buoyed markets in week 3. Chinese authorities remain busy battling the virus and their US counterparts are focused on the 2020 US Presidential primary elections, which means conflict from trade is unlikely and de-escalation in the trade war between the two biggest economies in the world is expected to continue.

Chart: Median price change of major global indices by week since mid-January when the spread of the coronavirus in China began to impact the stock market

The median of global benchmark indices remains below the level recorded in mid-January prior to the wide spread of the virus but recent gains now mean that they are close to those levels.

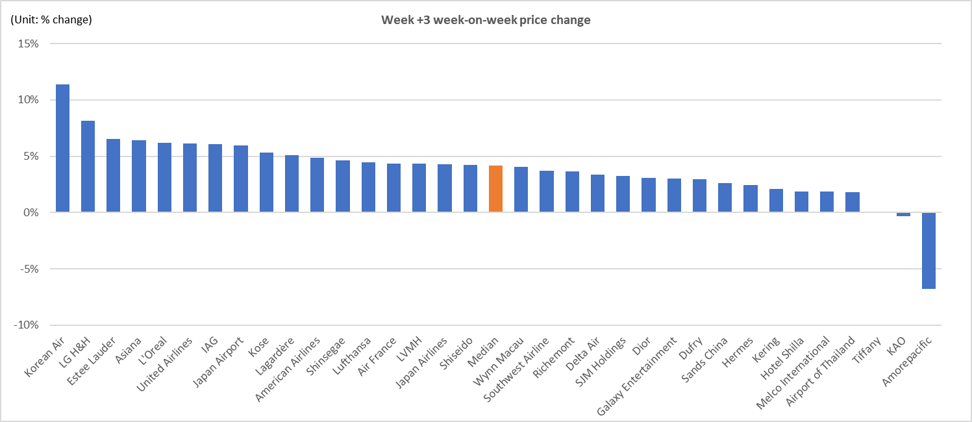

Chart: Median price change of major global indices last week

Investors remain upbeat and have been buying into markets most negatively impacted by the virus. The Shanghai Stock Exchange Composite Index was up 4.7% in week 3 and 1.8% so far in week 4. The Hang Seng Index is also recovering, up 4.0% in week 3 and 1.5% in week 4.

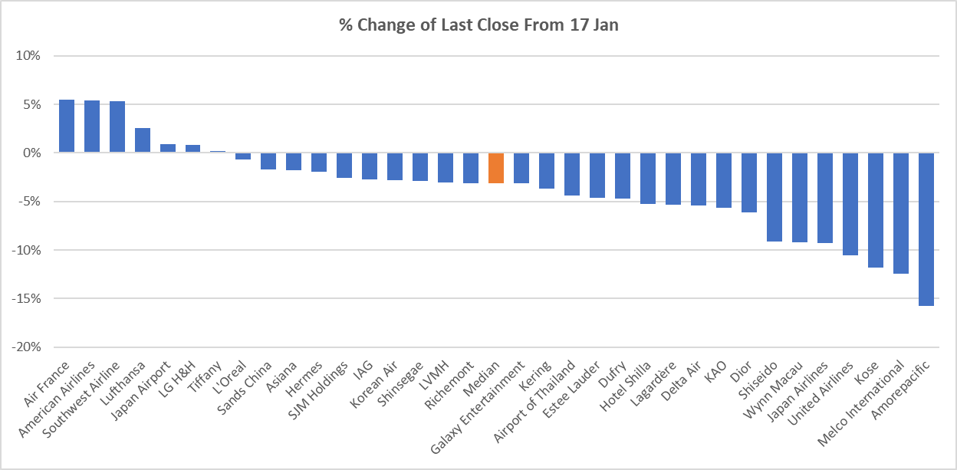

Chart: Median price change of major global indices from 17 Jan to last close

Asian markets most impacted by the virus remain below the levels prior to mid-January with the Shanghai Stock Exchange Composite Index still -5.5% lower in its last close compared to 17 January. Several key indexes have recovered to the pre-COVID-19 levels. The DAX index, a blue chip stock market index consisting of 30 major German companies trading on Frankfurt Stock Exchange; and the NZX 50 Index, New Zealand’s main stock index, are both up by +1.3%. The Euro Stoxx 50 Pr and S&P 500 Index are up by +1.2% and +0.8%, respectively.

Chart: Median price change of individual tourism-related stocks monitored by the Moodie Davitt Business Intelligence Unit

The share price of stocks monitored by the Moodie Davitt Business Intelligence Unit outperformed their benchmark in gains for week 3 and week 4. These shares underperformed the benchmark in week 1 and week 2; the net impact remains far below (-3.1%) from pre-COVID-19 levels in mid-Jan. Good results posted by industry leaders such as The Estée Lauder Companies and L’Oréal helped to buoy the positive mood.

Chart: Share price change of stocks in tourism sector last week (Jan 31 – Feb 7)

Korean Air outperformed the list of stocks monitored by the Moodie Davitt Business Intelligence Unit last week. News of the company deciding to sell non-core assets (land bank for hotel development) was positively received by investors. Korean beauty house Amorepacific, however, underperformed last week as 4Q19 earnings missed market expectations by 35%.

Chart: Share price change of stocks in tourism sector from pre-COVID-19 impact (Jan 17 – Feb 12)

Several airline stocks in Europe and the US have recovered to pre-COVID-19 levels (Air France, American Airlines, Southwest Airlines and Lufthansa). Korean cosmetics company LG H&H is also up by 0.8% – the company’s consistent run of results and higher exposure to luxury cosmetics are differences that have prompted investors to buy back shares at the expense of close competitor Amorepacific which is the worst performer in our watch list, down by -15.8%.

Covid-19 Update: What investors are looking at

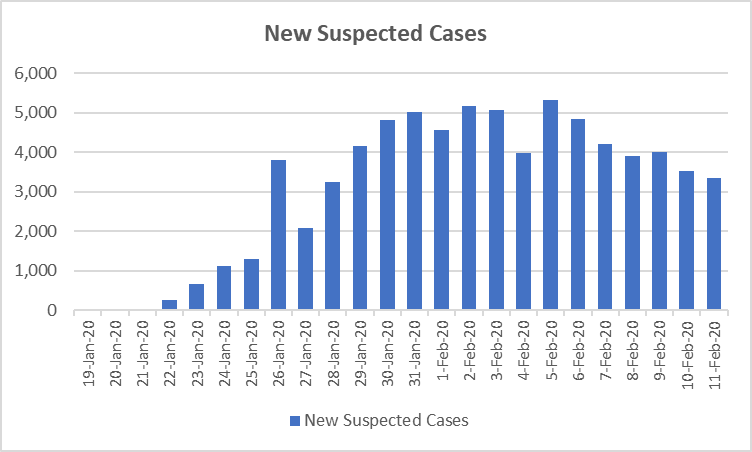

The steady decline in the number of new confirmed cases in China has provided investors with hopes that the virus can be contained soon. The virus is continuing to spread in China, but new confirmed cases have slowly come down from the peak of 3,983 new cases on 4 February. The number of new cases on 11 February was 2,022. The new confirmed cases may not be indicative of a slowdown in the virus spread but investors, constantly mindful of the daily announcement in China, remain hopeful that the numbers will continue to decline.

New suspected cases have also come down from the 5 February peak and have trended lower in recent days.

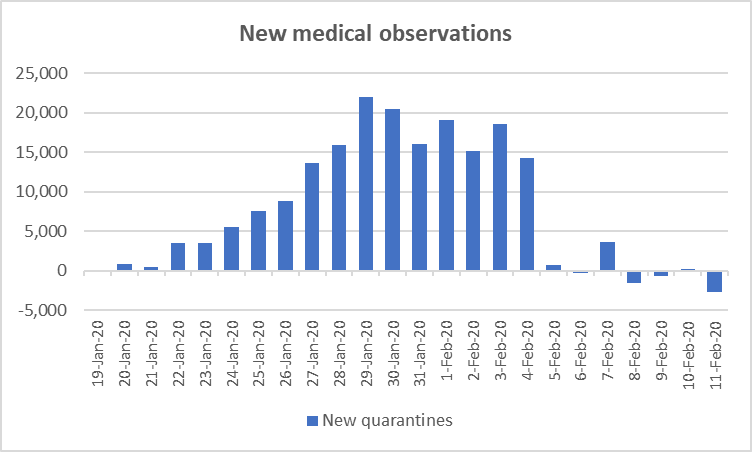

The number of new medical observations (which deducts the latest medical observation figure announced by China’s Center for Disease Control & Prevention from the previous day), has recorded negative numbers recently. While new suspect cases are increasing and are still adding to the overall total under medical observation, the number of recoveries has also increased.

The increasing number of recoveries and low case fatality rate outside of Wuhan (0.09%) in mainland China may be viewed as reasons to suggest that the Covid-19 is not as lethal and disruptive to the society as previously feared.