SOUTH KOREA. The duty free market is set for its first annual sales decline in 14 years, driven by a slump in Chinese tourism caused by the THAAD political dispute between South Korea and China.

As reported, the decision by since-impeached Korean President Park Geun-hye to deploy the US anti-missile system deeply angered the Chinese authorities, prompting a consumer backlash against Korean companies and tourism to the country.

“It is not easy to manage with this terrible THAAD inferno”

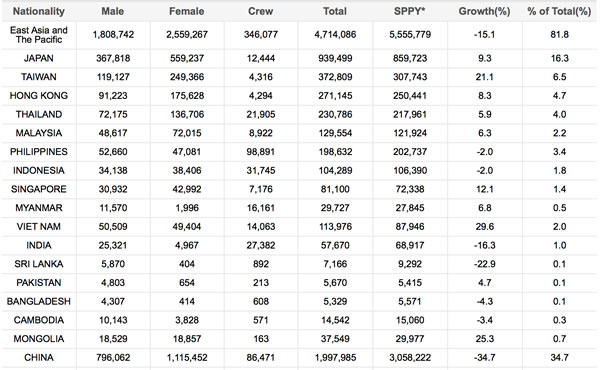

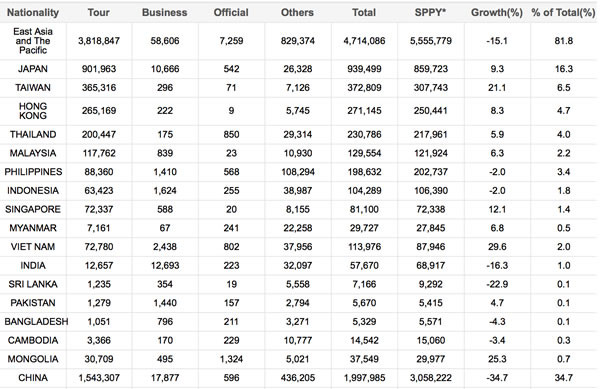

On 15 March China imposed a ban on group tours to South Korea, leading to a -40% year-on-year fall in Chinese arrivals in March, a calamitous -66.6% decline in April, and a -64.1% decrease in May. The number of Chinese group tourists in May collapsed by -71.9% to 172,527.

Total Chinese arrivals in May reached just 253,359, representing 25.9% of total visitors, compared with 705,844 in May 2016, or a 47.3% share. For the first five months of 2017, Chinese arrivals decreased by -34.7% to 1,997,985.

The Korea Herald quoted Korea Investment & Securities Analyst Choi Min-ha as saying he believed the duty free market will fall by around-3% this year to KW10.5 trillion (US$9.3 billion).

Strong growth in outbound Korean travel (up +18.9% in the first five months to 10,522,636) and Japanese arrivals (+9.3% to 939,499) has failed to offset the fall in Chinese spending, a leading travel retailer told The Moodie Davitt Report. “It’s a gloomy season for duty free in Korea,” he said.

Overall, he said, Korean duty free sales for the first five months still showed a strong increase – up +20% year-on-year (downtown ahead +28% and airports/seaports by +2%). But those figures were driven by a strong (pre-THAAD) start to the year and a proliferation of retailers compared with the first half of 2016 (Shinsegae Duty Free and Doota Duty Free both opened in Seoul during the second half of last year).

“The sales trend is very bad,” the source added. “Lotte’s main downtown store, for example, showed a -6% decrease in May while I expect the June sales [across all retailers] to be much worse.” The overall Korean duty free market rose by +7% in May, he said, adding that “the declining slope is very stiff”.

“It is not easy to manage with this terrible THAAD inferno.”

Shuttle trader market escalates

The source noted that many Korean duty free retailers are now overly reliant on “parallel sales with unbearably high discount rates”. That’s a reference to the ‘shuttle trader’ or ‘Daigou’ market, individuals buying large volumes of cosmetics (especially) and reselling them on the Chinese mainland. The Korea Herald claimed last week that for the recent duty free start-ups such traders account for up to two-thirds of foreign revenue. Even for major operators such as Lotte and Shilla, they represent up to one-third, it said.

“This is a sick unhealthy business and they are biting the hand that feeds everyone by disrupting the China market”

The phenomenon is causing mounting concern among international brand companies. “The organised Daigou market is well publicised and their [retailers’] newest form of the parallel market,” one of the industry’s most senior brand executives told The Moodie Davitt Report. “There are estimates that it is possibly half the business now for categories like cosmetics. The retailers are paying special commissions to Daigou tours.

“This is a sick unhealthy business and they are biting the hand that feeds everyone by disrupting the China market.”

In an article headed ‘Korean duty-free shops woo Chinese shuttle traders’, The Korea Herald noted: “The informal cross-border traders are stocking up on the merchandise and pushing up the figures. These so-called ‘daigongs – mostly individual merchants – usually purchase genuine cosmetics and take them to the Mainland, explained an industry source. They also partner with Korean small and medium travel agents to strengthen their leverage.

“They [the Daigou tour specialists] are now getting hefty commissions and discounts – up to 30 percent – more than double what they got before the THAAD row. They are the only option for now, and duty free stores need to maintain a certain level of revenue lest major brands decide to ditch the store, said another industry source.”

Such tacit agreement certainly won’t be the case with all brands, however. The Moodie Davitt Report has spoken to several leading beauty and luxury brand executives over the past week, all of whom expressed concern over what they see as a deteriorating situation. They say it is accentuated by a combination of the THAAD dispute and too many retailers scrapping over a diminishing Chinese pie.

“We are increasingly concerned about the way the market is evolving in the face of the crisis,” said one beauty brand executive. “The reputation of the sector is being hurt, let alone of our brands.”

“We are in the process of shutting it down,” added another leading brand representative. He said that his company is taking an aggressive position and insisting Daigou tour commissions be removed from sales of its products. “At some point others will wake up,” he said. “This is a function of too many licences and people trying to figure out how to stay alive.”