Major challenges in the key North Asian duty free markets of Hainan and South Korea were the key driver of a -6% fall in net sales at US beauty powerhouse The Estée Lauder Companies for the year ended 30 June.

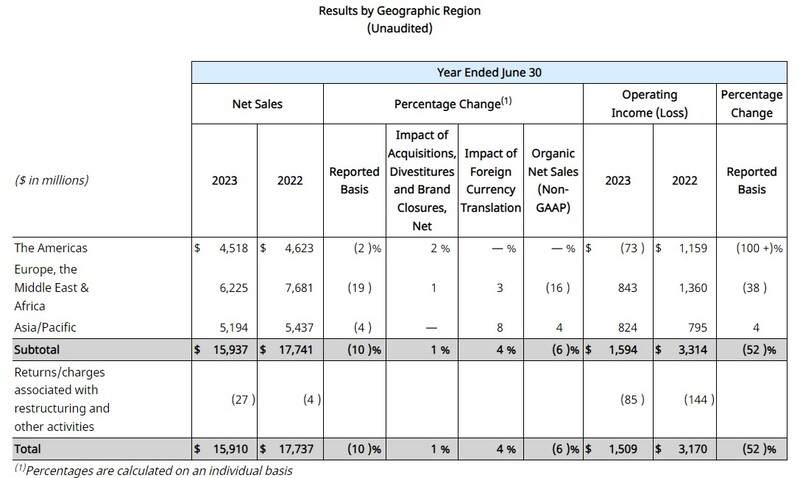

The group’s net sales, revealed today, reached US$15.91 billion with the fall driven primarily by Asia travel retail, specifically in South Korea – the world’s biggest duty free market – and Hainan province, China.

Total organic net sales in the company’s emerging markets* and in fragrance each rose double digits. The group reported net earnings of US$1.01 billion down -57.7% year-on-year.

Global travel retail net sales decreased by double digits (revealed in a subsequent earnings call as declining -34% organically), reflecting challenges that led to lower product shipments primarily to retailers in Hainan and Korea. As reported at the time of the group’s Q3 results, those challenges have been driven by the official crackdown in recent months on daigou trading in Hainan and Korea Customs Service pressure on the same unofficial channel through 2023.

More positively, net sales in travel retail grew by strong double digits in EMEA and The Americas. This was driven by the increase in domestic and international travel compared to the prior year as well as increased activations, in-store staffing, and advertising.

Groupwide the softening in the key Hainan and South Korean travel retail channels was partially offset by growth in nearly every market in Asia Pacific and Europe, the Middle East and Africa.

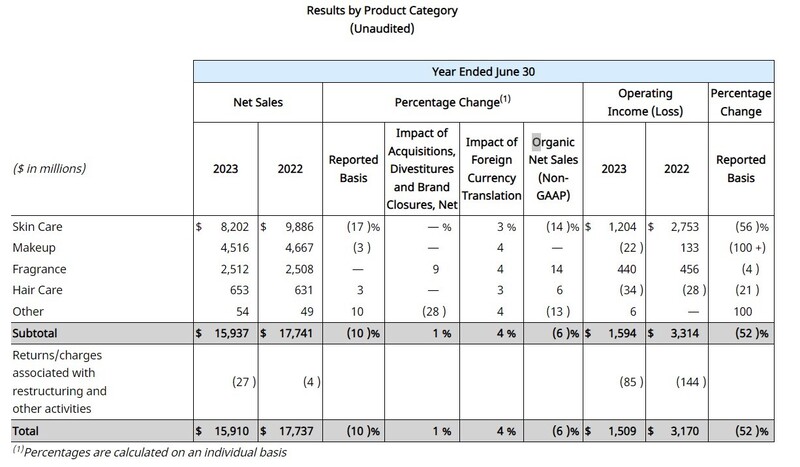

Skincare hurt by travel retail issues

Net sales of skincare, key to the Hainan and South Korean duty free markets, fell -14% year-on-year, primarily reflecting the challenges in those two locations, while also reflecting a slower than anticipated recovery from the COVID-19 pandemic.

Estée Lauder, La Mer and Dr.Jart+ net sales declined, again primarily due to the Asia travel retail issues.

Makeup, too, was hit by those dual market challenges with net sales from Estée Lauder and La Mer unfavourably impacted as was Tom Ford.

Even fragrances saw a hit from Hainan and South Korea, a testament to the earlier success there for Jo Malone London. Although the category grew +14% worldwide, Jo Malone London’s net sales declined reflecting the challenges in Asia travel retail, the group noted.

Net sales in Europe, the Middle East & Africa decreased -16%, primarily due to the challenges in Asia travel retail, including the slower than anticipated recovery from the COVID-19 pandemic, which partially offset by net sales growth in nearly all markets.

Reducing inventory in Hainan and South Korea

President and Chief Executive Officer Fabrizio Freda, said, “We returned to organic sales growth in the fourth quarter, delivering our outlook. Momentum continued in the markets of EMEA and Latin America, and accelerated strongly in Asia Pacific led by Mainland China and Hong Kong SAR.

“For full-year fiscal 2023, we delivered organic sales growth and prestige beauty share gains in many developed and emerging markets, but Asia travel retail pressured results, particularly in skincare, and we continued to experience softness in North America.

“Fragrance excelled, up double digits in every region, and makeup improved sequentially to double-digit growth in the fourth quarter as more markets emerged into the post-pandemic era.”

Commenting on the inventory issues facing the business in Hainan and South Korea – driven by crackdowns on the daigou sector in both markets, Freda said, “In Asia travel retail, we are taking actions to capture demand from the returning individual travellers and continuing to reduce inventories in the trade as we navigate the current market headwinds.”

He added: “For fiscal year 2024, we expect to return to organic sales growth and deliver sequentially improving margin throughout the year, leveraging the strong equity and desirability of our brands.

“We are focused on driving momentum in markets that are thriving and re-accelerating growth in North America. In this new fiscal year, we also intend to set the stage for a stronger fiscal year 2025 acceleration, with a very robust innovation pipeline planned across the two years and progressive margin rebuilding plans.”

Looking at the fiscal year as a whole, the company said, “The operating environment continued to be disrupted by the impact of the COVID-19 pandemic. Most notably, the pace of recovery in Asia travel retail and Mainland China was slower than anticipated.

“In Hainan, prolonged store closures [in August and September 2023 -Ed] initially presented a headwind and, thereafter, low levels of conversion occurred when travel resumed. This was compounded by inventory tightening by certain retailers.

“In Korea, the travel retail business slowed during the transition to post-COVID regulations. In addition, the slower than anticipated resumption of international flights, granting of visas, and organised group tours further challenged the Asia travel retail recovery.

“As a result, the company’s Asia travel retail business was challenged throughout the fiscal year by the slower than anticipated recovery.

“In Mainland China, the Company’s performance in the first half of fiscal 2023 was hindered by low retail traffic as a result of COVID-related restrictions and the rise in COVID-19 cases.”

Elsewhere, the recovery from the COVID-19 pandemic progressed across markets globally over the course of the fiscal year as restrictions lifted. In the West, the Company’s recovery from the pandemic continued with strong organic net sales growth in nearly all markets in EMEA and in Latin America. In Asia/Pacific, the Company’s markets emerged strongly into recovery across the fiscal year, to deliver broad-based organic net sales growth throughout the region.

In the United States, organic net sales growth was unfavourably impacted by the slower than anticipated pace of the Company’s improvement at retail and the tightening of inventory by certain retailers in the first half of fiscal 2023 due to inflationary pressures and recession concerns.

Finally, the Company’s business was also pressured by the strong U.S. dollar, inflation and recession concerns globally.

Skincare softens in Q4 due to Hainan and Korea travel retail challenges

In the fiscal 2023 fourth quarter, net sales returned to growth, increasing +1% on a reported basis and +4% organically, reflecting growth in makeup, fragrance and hair care as well as double-digit growth in the company’s emerging markets globally.

The decline in skincare net sales primarily reflected the ongoing challenges in the Asia travel retail markets cited earlier.

Net sales grew in nearly all markets in Asia Pacific and EMEA as they continued to progress in recovery from the COVID-19 pandemic. Overall performance benefited from the group’s strategic investments in advertising and promotional activities, innovation and targeted expanded consumer reach. ✈

*Note: The company’s emerging markets are India, the Middle East, Turkey, South Africa, Central Europe, Israel, Russia, Kazakhstan, Thailand, Malaysia, Vietnam, Indonesia, the Philippines, Singapore, Brazil, Mexico, Chile, Colombia, Panama, Peru and Argentina.