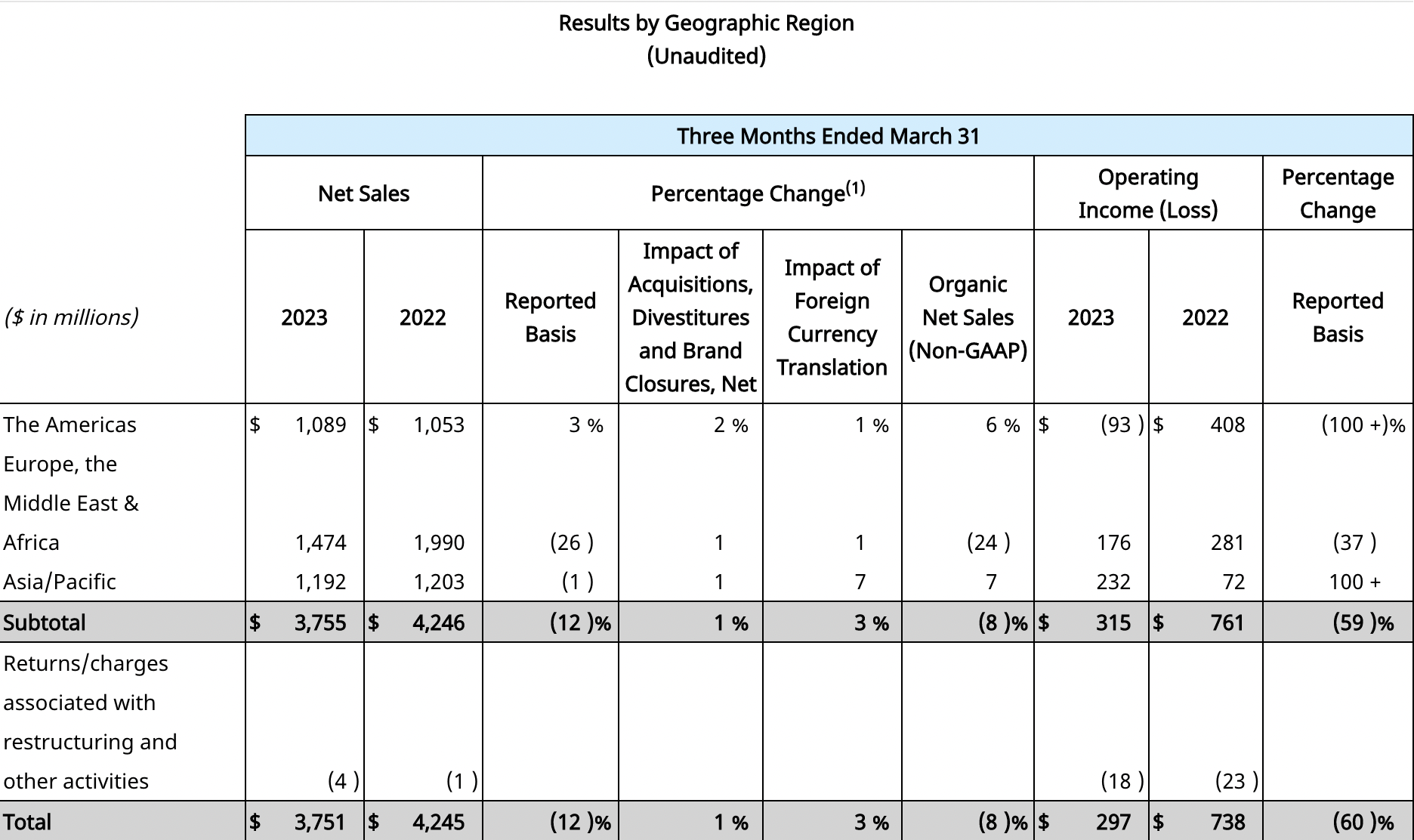

The Estée Lauder Companies today reported net sales of US$3.75 billion for the third quarter of its financial year ended 31 March. This marked a -12% decline year-on-year, including the negative impact from foreign currency. Organic net sales fell -8%, primarily driven by declining travel retail sales in Hainan and South Korea.

Global travel retail net sales decreased by double digits, despite strong growth in Europe, the Middle East & Africa and the Americas, which benefited from the increase in domestic and international travel compared to Q3 a year ago. These performances by region were offset by the slower than expected recovery from the COVID-19 pandemic in Asia, led by Hainan and Korea.

Of regional travel retail in Q3, the company said: “Specifically, in Hainan, while traffic into the island exceeded prior year levels, conversion of travellers to consumers in prestige beauty lagged. This led to the slower than anticipated depletion of elevated levels of retailer inventory and, therefore, lower replenishment orders.

“In Korea, the shipments to duty free retailers were pressured owing to the transition to post-COVID regulations as travelling consumers gradually return. In Korea, as well as in Asia more broadly, the travel retail recovery was challenged by the slower than anticipated resumption of international flights, granting of visas, and organised group tours.”

Elsewhere organic net sales grew in nearly every market to partially offset the impact of pressures on regional travel retail in Asia. Strongly performing markets included the US, UK and Hong Kong, and emerging markets worldwide. The fragrance category grew by double digits year-on-year.

President and Chief Executive Officer Fabrizio Freda said, “In the context of a quarter which we anticipated to be challenging, we are pleased to have delivered the high-end of our outlook for the third quarter of fiscal 2023. Our developed and emerging markets grew strongly and exceeded our expectations to offset an even slower-than-expected recovery in Asia travel retail.

“Each of the Americas and Asia Pacific returned to organic sales growth, bolstered by increases in the United States and China, while the markets of EMEA continued to prosper. Moreover, we continued to grow our prestige beauty share in many markets, including a sequential acceleration in gains in China and Western Europe.”

He added: “As the shape of recovery from the pandemic for Asia travel retail comes into better focus, it is proving to be both far more volatile than we expected and more gradual relative to what we experienced in other regions. We are, therefore, lowering our organic sales and EPS outlook for fiscal 2023 to reflect significantly greater headwinds in our fourth quarter than we expected in February.”

Freda concluded, “While we work through the serious but we believe temporary headwinds facing Asia travel retail, we are encouraged by the strong momentum in the rest of our business. Indeed, consumer demand is robust for our diverse portfolio of brands in developed and emerging markets around the world, evidenced in both organic sales growth and retail sales trends, which drives our confidence in the long-term. What is more, we are thrilled to have acquired the Tom Ford brand last week and are optimistic about its promising growth opportunities.” In Mainland China, organic net sales grew in the third quarter. While January 2023 was pressured by low retail traffic and retailer destocking from the rise in COVID cases that began in November 2022 and continued into January 2023, organic net sales returned to growth, rising by double digits in February and March 2023. Prestige beauty growth was slower than expected.

In Mainland China, organic net sales grew in the third quarter. While January 2023 was pressured by low retail traffic and retailer destocking from the rise in COVID cases that began in November 2022 and continued into January 2023, organic net sales returned to growth, rising by double digits in February and March 2023. Prestige beauty growth was slower than expected.

By category, skincare net sales declined -17% in the quarter, primarily reflecting the slower than anticipated recovery of Asia travel retail, as noted above. Net sales declined from La Mer, Estée Lauder and Dr.Jart+, partially offset by growth from The Ordinary and MAC.

Makeup net sales were virtually flat compared to the previous year period, reflecting growth in most markets as they continued to evolve in recovery and as usage occasions increased, offset by the challenges and the slower than anticipated recovery of Asia travel retail. Net sales declined from Estée Lauder, partially offset by growth from MAC, Clinique and Tom Ford Beauty.

As noted, fragrance net sales grew double digits, reflecting strong growth in every region and double-digit growth from Tom Ford Beauty, Le Labo and Estée Lauder.

Haircare net sales increased +3%, reflecting growth from The Ordinary’s hair care products, but partially offset by a decline from Aveda.

Net earnings fell to US$156 million compared to US$558 million a year earlier.

The company said it expected organic net sales to return to growth in the fourth quarter, reflecting the momentum of post-COVID recovery growth in nearly all markets globally. The impact of pressures in Asia travel retail, driven primarily by risks associated with the volatile and slower than originally anticipated pace of recovery, are expected to partially offset the growth in other markets.

ELC said it “Notwithstanding this difficult environment, the company plans to continue to invest in its business to support recovery, share gains and long-term growth, including strategic investments in advertising, innovation, support of the retail acceleration of its travel retail business, the growth of its emerging markets, targeted expanded consumer reach and in its new manufacturing facility in Japan.”

The full year outlook reflects the assumption of a slower than expected return to growth in Asia travel retail, due to:

- The progress towards the rebalancing of inventory levels in Hainan, given the disruptions from the COVID-related impacts throughout fiscal 2023 and the tightening of inventory by retailers.

- The temporary pressure to the company’s travel retail business in Korea due to retailers transitioning to post-COVID regulations as travelling consumers gradually return.

- A slower pace of resumption of Asia travel retail net sales than previously anticipated given the more gradual return of international flights, granting of visas, availability of organised group tours, and consumer conversion in the beauty category. It now expects the return of traffic and conversion to build gradually over the fiscal 2023 fourth quarter and the first half of fiscal 2024.