SINGAPORE. Singapore’s government has announced a reduction in the duty free alcohol allowance for returning travellers, from three to two litres . It will also bring into force a smaller allowance on tax-exempt overseas shopping from 12am on 19 February 2019.

The new duty free alcohol allowance regulations come into effect on 1 April, and represent a considerable blow to DFS Group, which runs the arrivals duty free liquor stores at Singapore Changi Airport.

The current allowance options allow travellers to purchase either 1 litre of spirits, 1 litre of wine and 1 litre of beer; 2 litres of wine and 1 litre of beer; or 1 litre of wine and 2 litres of beer upon their return to Singapore.

With the revision, they will be able to purchase either 1 litre of spirits and 1 litre of wine; 1 litre of spirits and 1 litre of beer; 1 litre of wine and 1 litre of beer; 2 litres of wine; or 2 litres of beer.

The allowance is applicable to travellers who have spent 48 hours outside of Singapore immediately before arrival, who are not arriving from Malaysia, and who are buying alcohol for personal consumption.

Minister for Finance Heng Swee Keat announced the new allowance rules in his Budget Statement for the 2019 fiscal year, as well as tightened relief limits for tax-exempt overseas shopping.

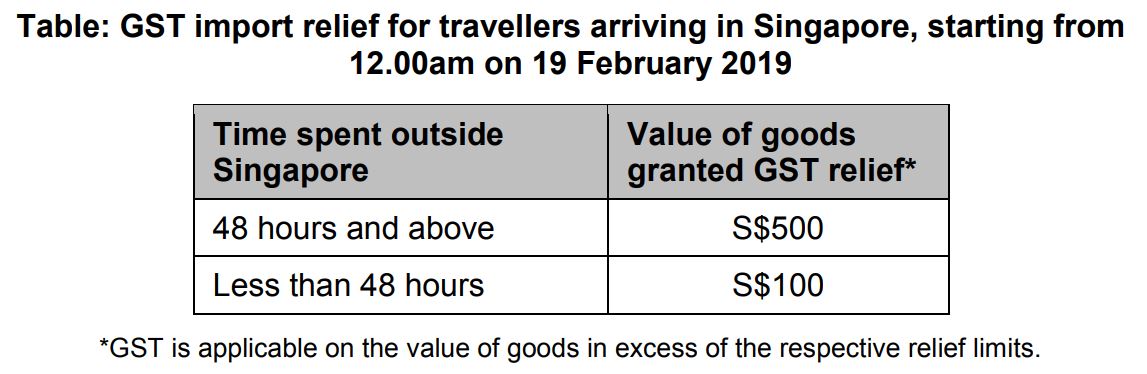

Travellers who spend less than 48 hours outside Singapore will get Goods and Services Tax (GST) relief for the first S$100 (instead of S$150 currently) of the value of goods. Travellers who spend at least 48 hours outside Singapore will get GST relief for the first S$500 (instead of $600 currently) of the value of goods.

GST is a tax on domestic consumption of goods and services supplied in and imported into Singapore.

Heng Swee Keat said the revision in relief limits was necessary to ensure that Singapore’s tax system remained resilient amid rising international travel.

GST relief is applicable to Singapore citizens, permanent residents and tourists. It is not applicable to crew members and holders of a work permit, employment pass, student’s pass, dependent’s pass or long term pass. The relief also does not apply to intoxicating liquor and tobacco, as well as goods imported for commercial purposes.