SOUTH KOREA. Shinsegae Duty Free is planning to enter the downtown duty free market in Jeju Island.

The company said that if it is successful in obtaining a duty free licence, the sales floor at its earmarked location will be around double that of existing downtown duty free stores operated by Lotte Duty Free and The Shilla Duty Free in Jeju.

Shinsegae plans to knock down an existing ten-storey hotel and build a 38,000sq m facility, with 15,400sq m of floor space, spread across seven floors above ground and seven below. As well as retail floor space, the store will have 303 parking spaces and room for other amenities.

Although Korea Customs Service (KCS) has not confirmed whether a tender for new duty free licences will take place in 2020, Shinsegae said it expected the process to occur as early as May. It said preparations are being made now because winners of new duty free licences must begin operations within one year of the licence award.

A Shinsegae duty free representative confirmed to The Moodie Davitt Report a quote given earlier to local media: “The Shinsegae Group has only recently begun duty free operations and expanding them to strive for growth is important. Jeju is one of the areas of growth.”

Jeju Island, renowned for its natural wonders, has long been a popular destination for Chinese tourists who visit the island to enjoy the tea plantations and white sand beaches, climb the dormant volcano, and shop. Both Lotte Duty Free and The Shilla Duty Free have downtown stores in Jeju that target these visitors.

There has been considerable media speculation about Shinsegae’s potential Jeju market entry in the Korean press of late.

The company’s decision to front an education foundation to obtain a traffic impact assessment for a new duty free store sparked controversy, as observers questioned whether Shinsegae was angling to gain a licence as a small to medium-sized operator. However, Shinsegae representatives have since confirmed that the company’s involvement in any new duty free tender run by Korea Customs Service will be on the basis of being a large conglomerate.

Shinsegae has provided KRW6.86 billion (US$5.97 million) as a loan to the owners of the land on which the proposed store site sits for the traffic assessment, with measures in place for the retailer to purchase the land and facility.

As noted above, it is not yet certain that KCS will tender a new downtown duty free store in Jeju this year. In July 2019, KCS did not proceed with the Ministry of Economy and Finance’s plan to allow more duty free stores in Jeju, after local government rejected the entry of a new large conglomerate duty free retailer on the island.

The Jeju government heeded the advice of Jeju Tourism Organization (itself a travel retailer), which forecast a decrease in sales as a result of a dramatic fall in Chinese tourists in the wake of the THAAD anti-missile system row between China and South Korea. While FIT Chinese tourist volumes are recovering, cruise ships carrying Chinese tourists are still absent and there are no forward bookings for Chinese cruise visits at the Port of Jeju.

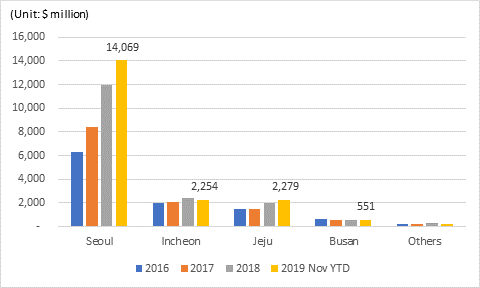

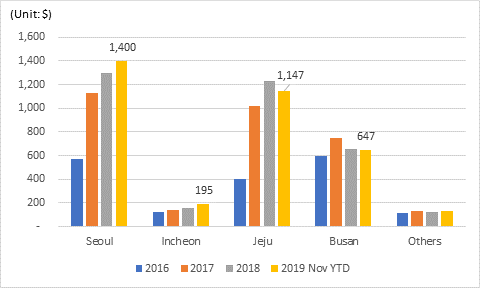

Jeju Island was the third-largest market within Korea for duty free sales in 2018. As a result of a decline in spending at airports last year, Jeju was propelled into second place (in the year to November), ahead of Incheon International. The recovery in package tours and cruise ships to Korea could widen the gap with Incheon in the future.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.