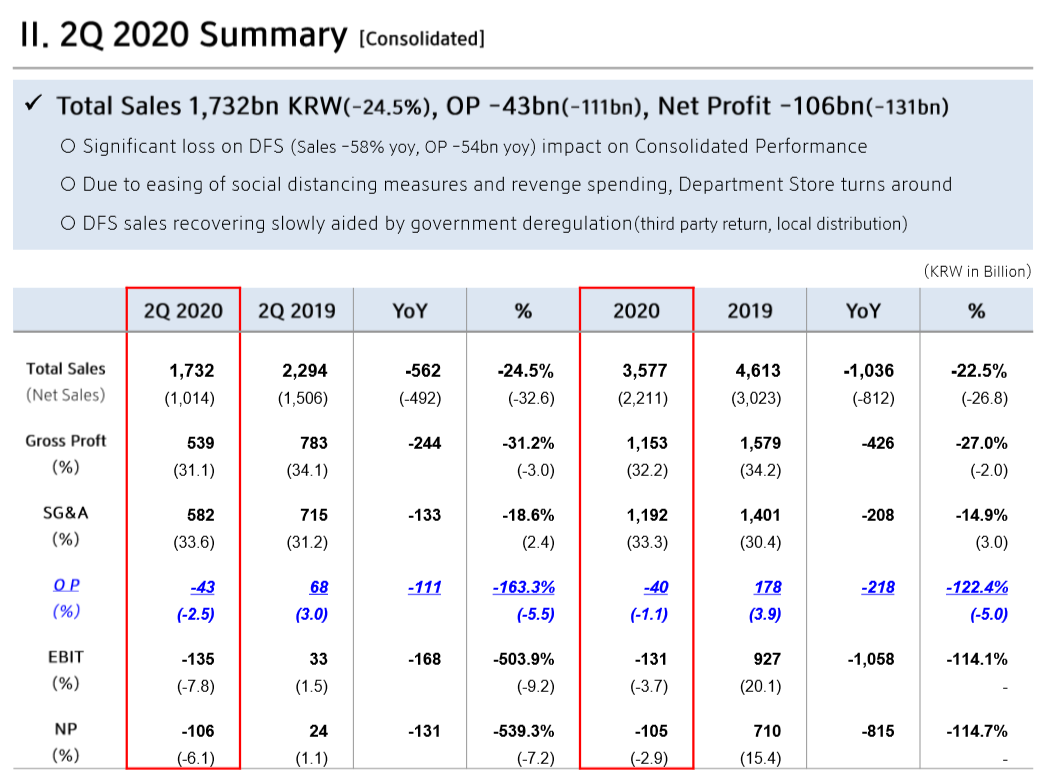

SOUTH KOREA. Shinsegae Duty Free posted a -47.5% fall in Q4 2020 (net) sales to KRW456 billion (US$412.7 million). Full-year revenues were down -45.9% to KRW1,693 billion (US$1.53 billion).

However Q4 operating performance turned into a small KRW3 billion (US$2.7 billion) profit due to a KRW90 billion (US$81.4 million) cut in airport rents and an additional KRW12 billion (US$10.8 billion) in cost controls. For the full year, the duty free division posted heavy losses of KRW87 billion (US$78.6 million).

Downtown duty free sales declined by -22% year-on-year in the quarter, spurred almost entirely by a resilient group daigou business. But airport duty free sales collapsed by -97% in the same period due to the almost total cessation of passenger traffic into the Republic.

The company suggests that duty free sales will grow by +30% year-on-year in 2021. However, much will depend on how tightly the Chinese authorities turn the screw on the crucial daigou business into the Mainland.

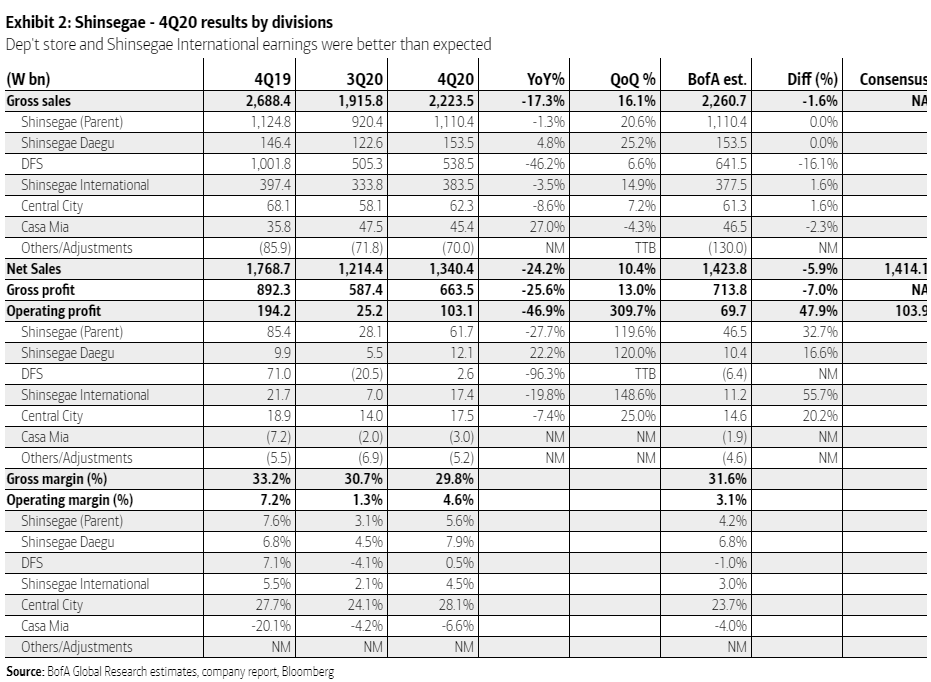

In a note, BofA said: “A meaningful recovery in duty free sales growth should take time, but we expect the division to turn to profit in 2021. Note that the company stated that its DFS daily average sales came in at W9bn, better than 4Q20 [market] average of KRW7bn, thanks to strong demand for cosmetics.

“Duty free OP came in higher than our KRW6bn OP loss estimate, driven largely by accounting treatment of airport rent cut. We had previously assumed that the rent cut will be amortized over the duration of the remaining lease term, but the company decided to reflect the rent saving in its entirety in each quarter. The company booked KRW15.9bn pre-tax profit and KRW20.4bn NP, both turning to black as KRW312.0bn impairment losses were booked in 4Q19, related to the duty free division.

“We rate Shinsegae a Buy, as we expect sequential improvements in its two key businesses – department store and duty free business. Return of customer traffic with reopening, coupled with a low base from 2020, should drive top-line growth in 2021. DFS sales recovering each quarter, with daigou activities supporting downtown activities, and more full-fledged recovery likely in 2H21.”