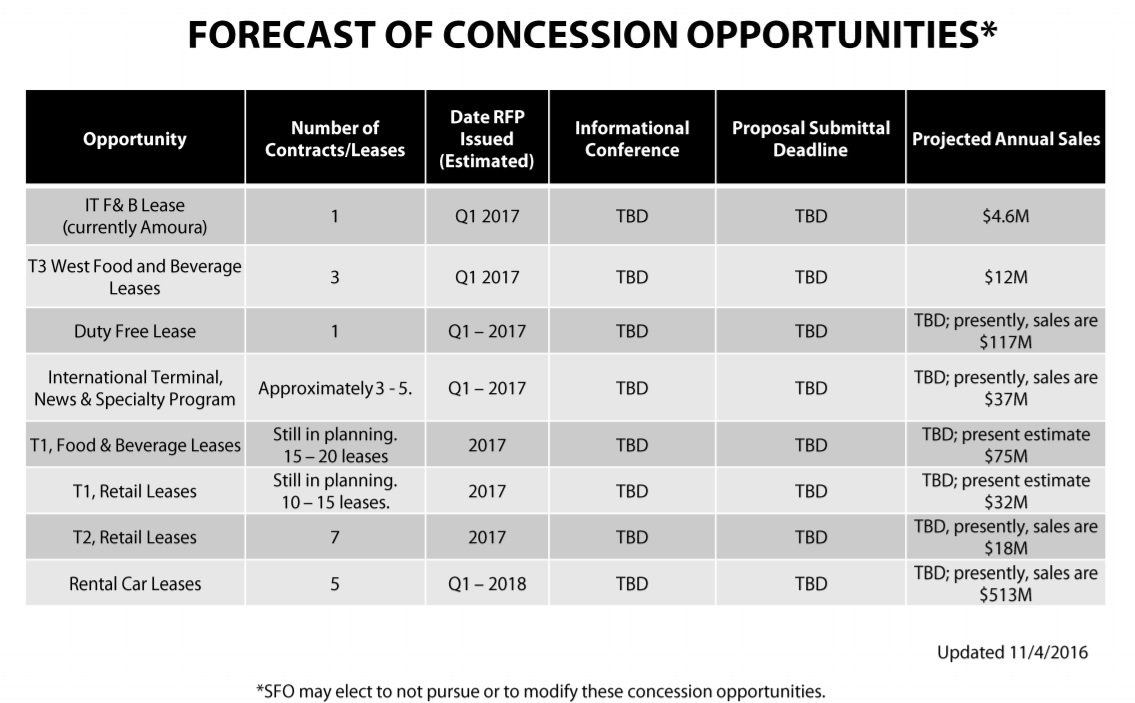

USA. San Francisco International Airport (SFO) will next week issue a Request for Proposals (RFP) for a much-expanded Duty Free and Luxury Stores concession. Further major retail and food & beverage opportunities will follow soon.

The Duty Free and Luxury Stores contract (in the shape of the Post-Security Master Retail/Duty Free Concession Lease) has been held since February 1999 by DFS Group, which generated sales of around US$117 million last year.

Given SFO’s status as a major gateway for Asian visitors , and the airport’s ambitious commercial expansion plans (see below) the bid is certain to attract strong interest from multiple retailers. SFO first unveiled its plans for the tender at The Trinity Forum in Taipei in 2015, where it hosted a packed meeting for interested parties.

DFS Group’s current master lease expires on 31 December 2017. It comprises not only duty free stores and duty paid luxury boutiques but also newsstands, speciality retail and an electronics store.

In an effort to create additional business opportunities, SFO has developed a new contractual plan which consists of six separate leases – the duty free and luxury store contract and five additional concessions for newsstands and speciality retail stores.

Last week the San Francisco Airport Commission approved the Directors’ recommendations on the proposed minimum qualifications and lease specifications (see below). The Commission also gave the green light for the RFP and an “informational conference” as part of the process.

“Our Airport Commission has authorised us to do a tender. The actual RFP package will be issued in the middle of next week,” SFO Chief Business & Finance Officer, Business and Finance Leo Fermin told The Moodie Davitt Report.

Central security checkpoint and 30,000ss ft of new concessions space touted

Central security checkpoint and 30,000ss ft of new concessions space touted

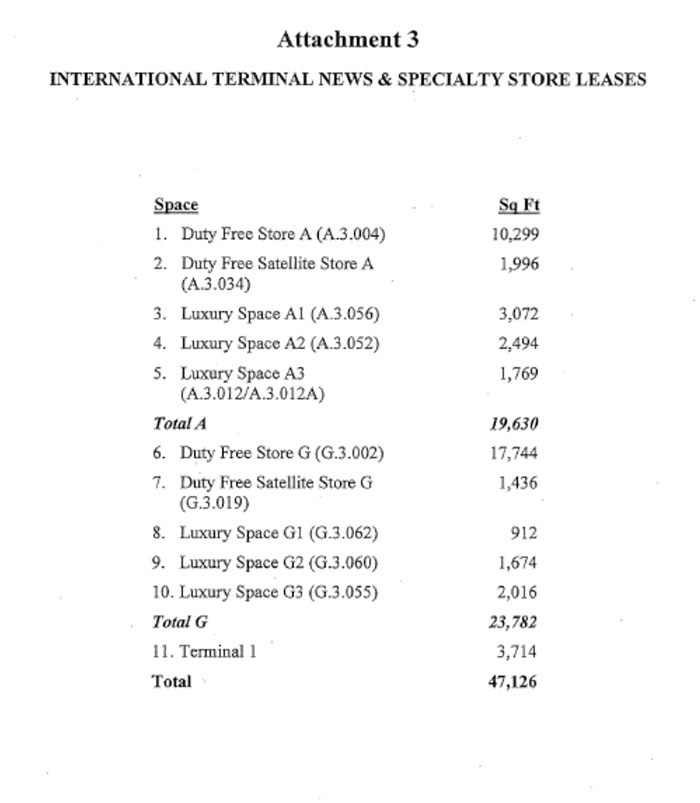

The duty free and luxury stores lease includes ten locations in International Terminal Boarding Areas A and G and one location in Terminal I, Boarding Area B.

SFO said it may also construct a single, central security checkpoint with a retail plaza located immediately post-security in the International Terminal during the next six to eight years. This new retail plaza is currently anticipated to include up to 30,000sq ft of concessions space, most of which would become duty free stores and luxury boutiques and be added to the premises under the Duty Free and Luxury Stores lease.

SFO serves more cities in China than any other airport in the Americas

The impact of this airport renovation is that the duty free and luxury stores tenant would build out its initial 47,126sq ft of premises over a 12-month period commencing in mid-2018 and later be required to add an additional “sizable” duty free and luxury store footprint in the central retail plaza.

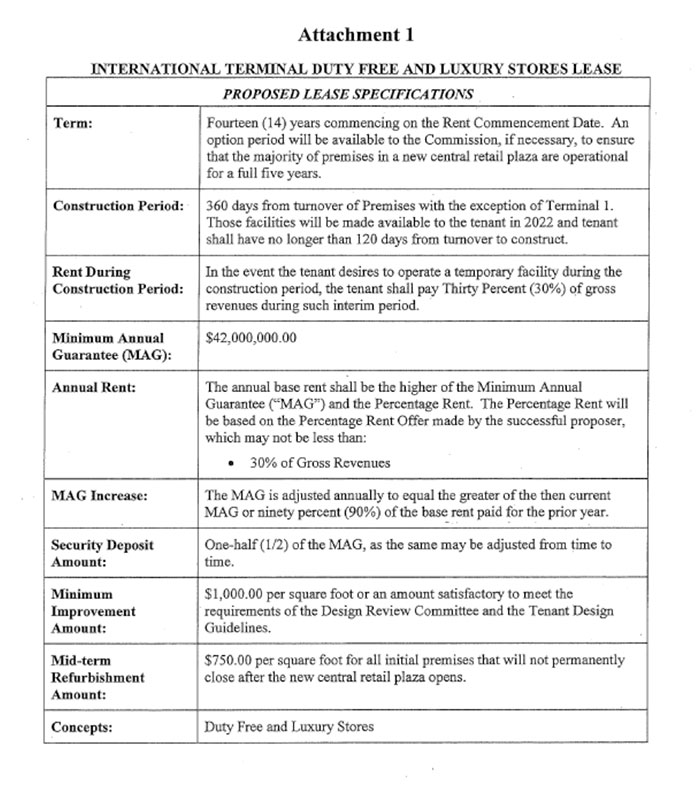

Due to the unknown schedule for this substantial renovation and to allow for the duty free tenant to plan the new retail plaza along with the airport’s designers, a fourteen-year term is being recommended for the new Duty Free and Luxury Stores Lease.

The term also adequately allows for the amortization period needed for what may be two full build-outs of the duty free programme, SFO said.

Chinese traffic grows

In 2016, SFO posted record passenger numbers of 53.1 million, a growth rate of +6.1% year-on-year, with international traffic performing even better at +10%.

Importantly from a duty free and travel retail perspective, the airport gained two new destinations in China: X’ian and Hangzhou, while China Eastern also added the first non-stop service to Quingdao. These additions mean that SFO serves more cities in China than any other airport in the Americas.

Minimum annual guarantee and annual rent details

The minimum annual guarantee (MAG) will be US$42 million. The annual base rent shall be the higher of the MAG and the percentage rent. The percentage rent will be based on the offer made by the successful proposer, which must not be less than 30% of gross revenues.

The MAG will be adjusted annually to equal the greater of the then-current MAG or 90% of the base rent paid for the prior year.

The minimum capital investment is US$1,000 per square foot, which includes both the initial construction and any future construction related to the central retail plaza.

The mid-term refurbishment requirement is US$750 per square foot for all initial premises that will not permanently close after the new central retail plaza opens.

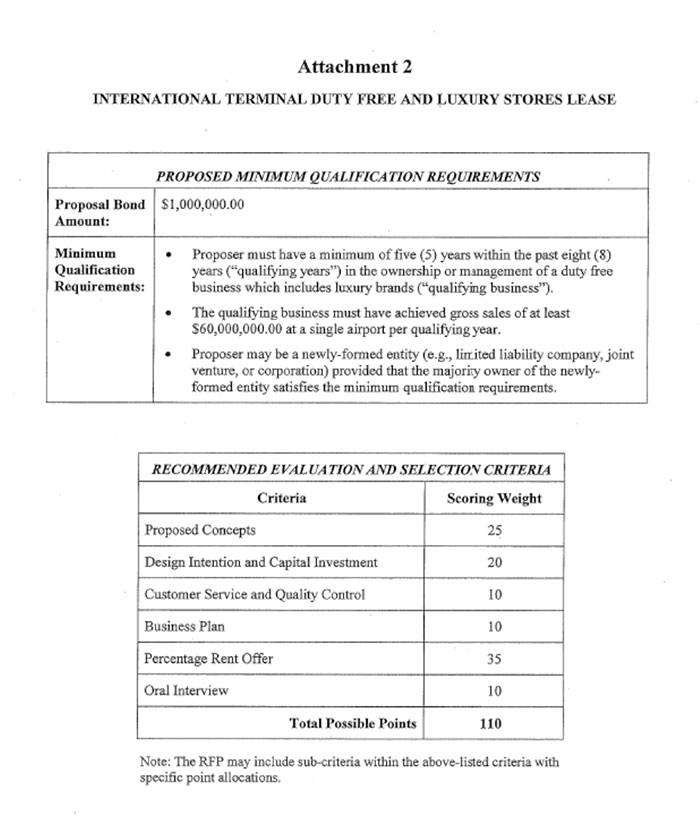

Proposals will be a scored by a ‘Blue Ribbon Evaluation Panel’ and the top three proposers will be invited for oral interviews.

Qualifying criteria

Qualifying criteria

- Qualifying proposers must have a minimum of five years within the past eight years in the ownership or management of a duty free concession which includes luxury brands.

- They must have achieved gross sales of at least US$60 million at a single airport per qualifying year from the qualifying

- They can be a newly formed entity (for example a limited liability company, joint venture of corporation) , provided that the majority owner of that entity satisfied the minimum qualification requirements.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.