USA. A pre-bid briefing for the San Francisco International Airport (SFO) duty free and luxury stores concession last week attracted many of the industry’s leading retailers.

As reported, SFO issued its long-awaited Request for Proposals (RFP) for the concession on 21 March. Bids close on 15 September (see timeline below).

Besides long-term incumbent DFS Group, the meeting on 4 April attracted representatives from ATU Americas, DFASS, Dufry, Duty Free Americas, Gebr Heinemann, Hotel Shilla, Hudson Group (Dufry), Lotte Duty Free and Setur, plus a number of specialist concession companies.

The contract’s base term is approximately 14 years, plus up to 365 days for construction of tenant improvements. An automatic extension period will be available to the tenant, if necessary, to ensure that the majority of premises in a new central retail plaza* (if constructed) are operational for a full five years.

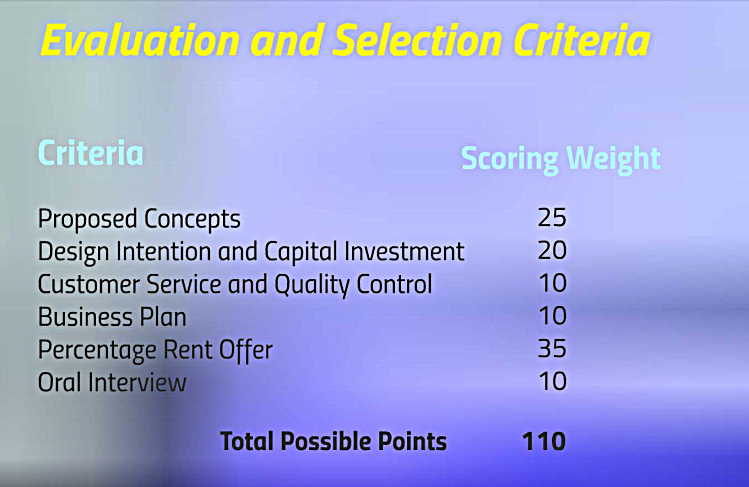

The lease is for the management and operation of ten duty free and luxury store locations in the international terminal and one in T1. The proposed minimum annual guarantee is US$42 million and the minimum acceptable percentage rent offer is 30% of gross revenues.

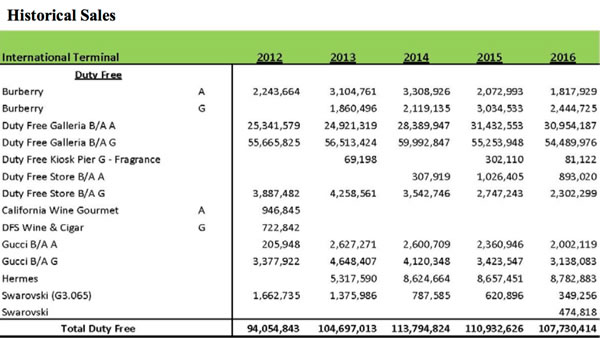

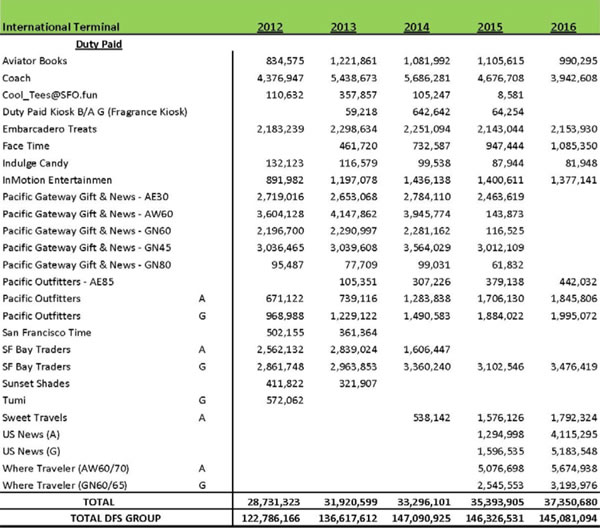

Sales reached around US$107 million last year.

*TERMINAL EXPANSION TOUTED

As reported, SFO said it may also construct a single, central security checkpoint with a retail plaza located immediately post-security in the International Terminal during the next six to eight years. This new retail plaza is currently anticipated to include up to 30,000sq ft of concessions space, most of which would become duty free stores and luxury boutiques and be added to the premises under the Duty Free and Luxury Stores lease.

The impact of this airport renovation is that the duty free and luxury stores tenant would build out its initial 47,126sq ft of premises over a 12-month period commencing in mid-2018 and later be required to add an additional “sizable” duty free and luxury store footprint in the central retail plaza.

Due to the unknown schedule for this substantial renovation and to allow for the duty free tenant to plan the new retail plaza along with the airport’s designers, a fourteen-year term is being recommended for the Duty Free and Luxury Stores Lease.

The term also adequately allows for the amortization period needed for what may be two full build-outs of the duty free programme, SFO said.

Chinese traffic grows

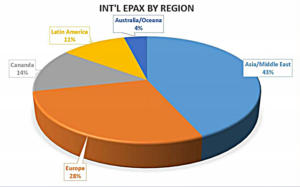

In 2016, SFO posted record passenger numbers of 53.1 million, up +6.1% year-on-year, with international traffic performing even better at +10%.

Importantly from a duty free and travel retail perspective, the airport gained two new destinations in China, X’ian and Hangzhou, while China Eastern also added the first non-stop service to Quingdao. These additions mean that SFO serves more cities in China than any other airport in the Americas.

Click on images to enlarge

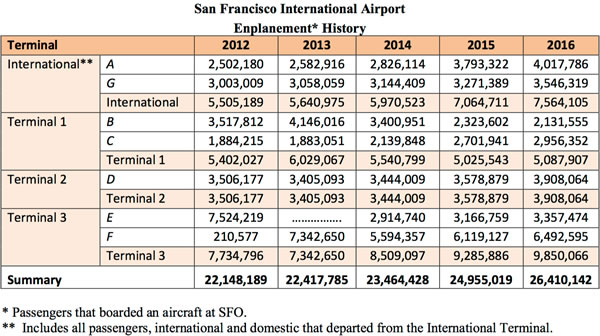

Click on images to enlargeThe following tables show historical sales and passenger numbers at SFO

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.