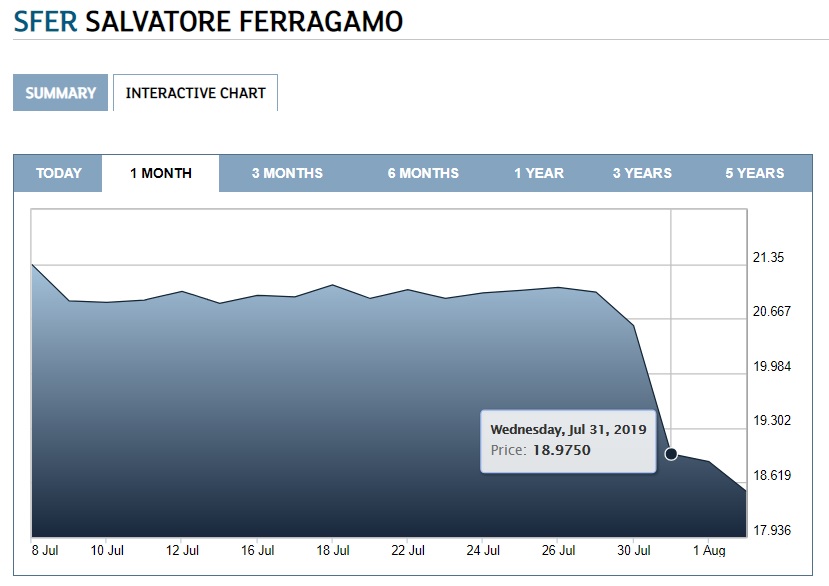

Italian luxury fashion house Salvatore Ferragamo posted a +4.4% increase (at constant exchange rates) in first-half revenues to €705 million and a +2.1% EBITDA increase to €119 million. However, the share price fell on the news of the results, and the decline continued to the end of the week (see chart).

The wholesale business, which includes travel retail, rose at twice the rate of retail: +7.7%* to €236.9 million versus +3.2% to €441.7 million. The wholesale channel also accelerated in the second quarter by +8.3% “mainly due to a different timing in the deliveries of fragrances versus the same period last year”, said Ferragamo.

The company reduced its points of sales to 661 in the six months to June 2019 from 672 in December 2018 continuing a trend seen last year. Cuts were across all regions, but the biggest were in Europe, Middle East & Africa (-8), and Japan (-4).

As a result, the company currently has 397 directly-operated stores (down by 12) and 264 third party-operated stores in the wholesale and travel retail channel (up by one).

China stays strong while leathergoods and handbags outperform

The luxury brand’s biggest region of Asia Pacific saw good growth of +8.4% to reach €277.2 million led by China. The company noted that “consumption in Mainland China is expected to grow (in) high double digits thanks to solid consumer confidence, particularly for younger generations, with the digital channel gaining relevance”.

According to Ferragamo, government initiatives, the brand’s own strategies and lower price differentials should continue to boost local demand in China “while shopping abroad should decrease, yet remaining significant in Europe”.

However the luxury house cautioned that “Hong Kong and Macau were suffering from lower tourist spending (especially Chinese) and geopolitical uncertainties” such as the recent street protests.

In EMEA, Ferragamo has benefited from tourist demand with sales growing +3.0% to €177.6 million, which was good compared to flattish results in North America and Japan. Latin America had the best growth, up +10.3% to €38.3 million.

By product group, leathergoods/handbags and fragrances saw the best growth at +6.8% and +6.4% respectively, while shoes, the biggest product segment, rose by +4.0%. Leathergoods/handbags sales of €280.9 million now contribute 40% of total revenue at the company, almost on par with shoes.

*All financial percentages shown are at constant exchange rates for 1H2019 unless stated.