AUSTRALASIA/SOUTH KOREA. Lotte Duty Free and James Richardson Proprietary Limited will close the former’s purchase of JR/Duty Free’s Australian and New Zealand business at midnight tonight Melbourne time.

The closure timing was announced jointly by Lotte Duty Free and JR/Duty Free parent company James Richardson Proprietary Limited today.

The business consists of airport operations in Brisbane, Darwin, Wellington and Canberra and the Central Business District store in Swanson Street, Melbourne.

James Richardson Owner and Chairman Evelyn Danos advised that existing management and staff of JR/Duty Free are transferring to the new owners. She, together with James Richardson CEO and Director Milton Lasnitzki, will be consultants to Lotte assisting in its visions of growth in the region. Steve Timms will be CEO of the business and Sean Lee Vice President.

Lotte Business Development Managing Director Chang Young Park expressed his appreciation to Lasnitzki and his senior James Richardson Management team for their close co-operation. This had enabled all the necessary procedures and contractual approvals to be met before the planned completion date, Park said.

He added, “The involvement of senior Lotte personnel with senior James Richardson management in recent months has only strengthened our view that the expertise of the JR team is a strong foundation for Lotte’s planned growth in Australia and New Zealand.” He also thanked the various airports and customs offices for their assistance in expediting the process.

“This transaction launches an exciting new chapter in the expansion of Lotte duty free internationally.” – Lotte Business Development Managing Director Chang Young Park

Ms Danos reaffirmed her view that a regional business, such as JR/Duty Free in Australia and New Zealand, is better served as part of a strong multinational. “I am pleased that Lotte is committed to growth in our region, as the first Asian player to operate here,” she said. “It will provide enormous opportunities to all the stakeholders: employees, airports, suppliers and – most of all – customers.”

She continued: “This is the second time our family has exited from duty free in the region, so there is naturally more than a tinge of sadness not to be a continuing part of the industry in the region. Nevertheless, we continue to be committed to the duty free industry predominantly with our presence in Israel.” As reported, the Lotte Duty Free acquisition excludes JR’s businesses in Israel and Tahiti.

Park concluded, “This transaction launches an exciting new chapter in the expansion of Lotte duty free internationally and we are excited by the challenge ahead.”

Footnote: Evelyn Danos was named one of The Moodie Davitt Report’s People of the Year for 2018 for her contribution to JR/Duty Free. Click here to read further details and the full list.

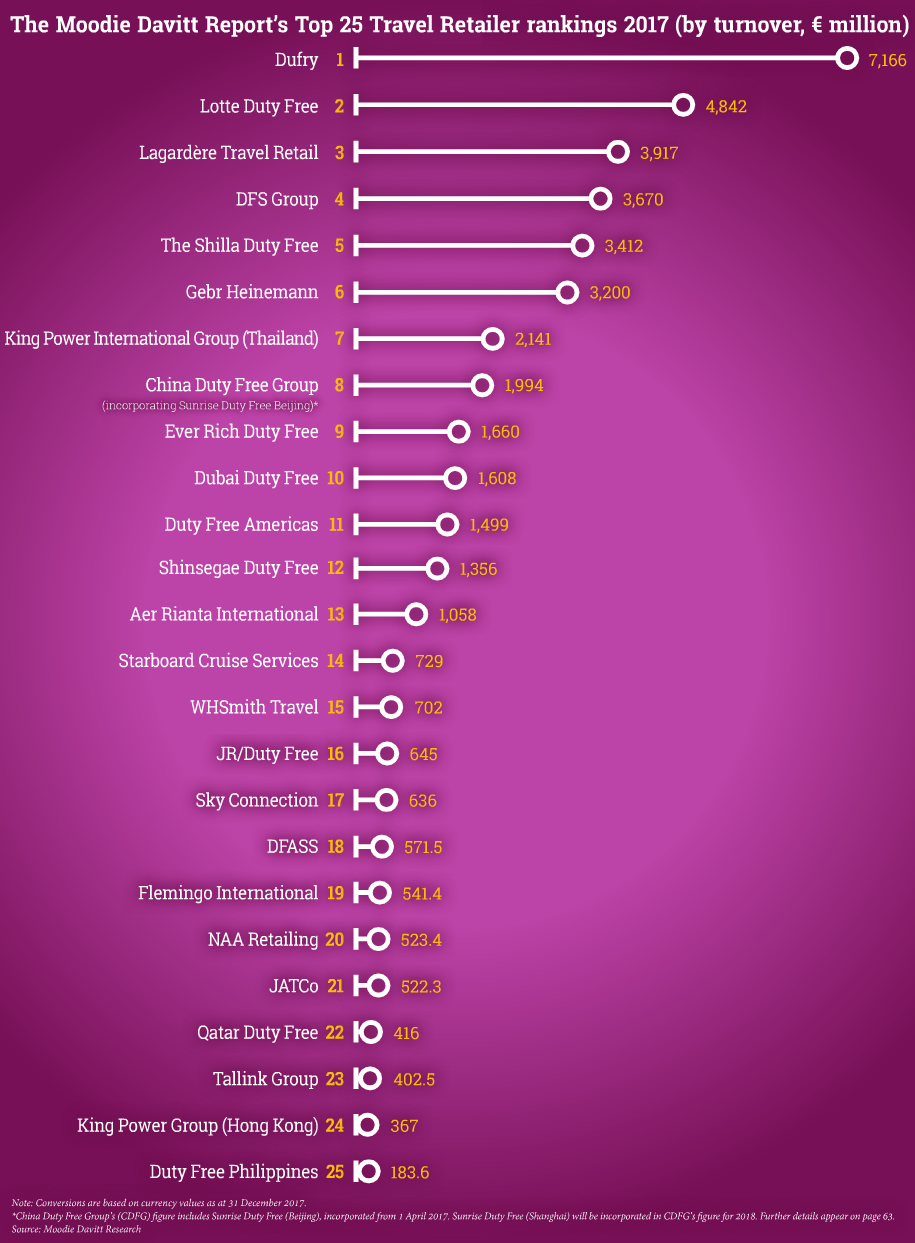

Comment: What will Lotte, the powerhouse of Korean duty free and the world’s second-biggest travel retailer, bring to the sector in Australia and New Zealand? That is the question being asked across the channel in the region as established international players Dufry, Gebr. Heinemann, Lagardère Travel Retail and Aer Rianta International weigh up a newcomer they will hardly welcome.

Will Lotte maintain JR/Duty Free’s conservative approach to airport bidding of recent times? That seems unlikely given the Korean company’s lofty ambitions, its bidding past and the desire to leverage its new geographic platform. What are its aspirations for the downtown business? After all, few retailers understand – or execute – that model better than the Korean number one. Don’t forget that Australian duty free is an increasingly Chinese-focused market. The Australian Bureau of Statistics reported in April that visitors from Mainland China now outnumber those from Australia’s near neighbour New Zealander. The difference in spending between the two nationalities is vast.

Expect Lotte Duty Free then to focus on both downtown and on-airport development. And, of course, expect it to sprinkle some of its social media stardust and hallyu (Korean wave) marketing over the region’s largely traditional travel retail sector.

Given the plethora of heavyweight competition in the region, one draws the inescapable conclusion that Ms Danos has timed her exit to perfection. The big question is, has Lotte Duty Free done the same with its entry? One thing for sure, it’s not going to wait around wondering.

Moodie Davitt Report backgrounder:

James Richardson, under the leadership of one of Australia’s most respected businessmen, Chairman David Mandie (OBE, FAIM), first entered Australian duty free in 1972 at Brisbane Airport. Under his leadership the company became one of the global industry’s leading players over the next quarter of a century.

The company sold its Australian duty free operation, including 23 off-airport shops (trading as City International Duty Free) to Swissair in 1995. That acquisition, together with the 1995 purchase of Downtown Duty Free and in 1996 Allders International, formed the basis of The Nuance Group, which was in turn sold to Stefanel and Gruppo Pam in 2002 and later to Dufry. After divesting its Australian operations in 1995, James Richardson focused its duty free activities mainly on its operations in Israel (where today it runs a thriving joint venture with Gebr Heinemann at Tel Aviv Ben Gurion Airport in Israel). It also has travel retail interests in Tahiti.

Since that unexpected but successful return to Australasia, the duty free world has changed markedly. Consolidation, led by duty free powerhouse Dufry has altered the competitive landscape and Australasian travel retail is now a competitive battlefield in which giants Dufry, Lagardère Travel Retail, Gebr Heinemann and Aer Rianta International all boast a presence.

Inevitably that has meant the cost of entry from a concession fee perspective has escalated, while both contract retention and new gains are increasingly hard-fought. JR/Duty Free is no minnow (it ranked world number 16 in The Moodie Davitt Report’s annual Top 25 Travel Retailers’ league based on 2017 sales) but it found itself surrounded by much bigger fish in a sea that could become increasingly voracious in coming years.