|

Duty and tax free sales aided Manchester Airport’s revenue growth |

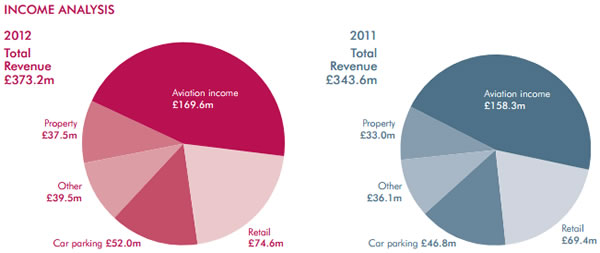

UK. Manchester Airport Group revenues hit £373.2 million for the year ending 31 March 2012, an increase of +8.6% on the prior year. The performance was buoyed by growth in both commercial and aviation income.

Retail income grew by £5.2 million to £74.6 million in the year. There was also a slight improvement in yield (£3.11 this year compared with £3.08 in the prior year), as well as passenger growth.

The company noted: “The increase is driven by strong performances from duty free and financial services as well as the successful extension of contracts to existing retailers.” Retail revenue also benefited from a focus on maximising space with short term lettings and “˜pop-up’ concessions.

In a challenging economic climate, the group said it had grown its share of the UK aviation market by 0.4% to 15.8%, increasing passenger numbers across the group by 1.5 million to 24 million in the year. This represents the first annual increase since 2008.

|

The largest airport in the portfolio, Manchester Airport, increased revenue to £282 million, up +9.5% on 2010-11, with passenger numbers growing 1.4 million to 19.1 million and representing 12 months of consecutive growth. EBITDA rose +13.5% to £126.9 million.

Retail income at Manchester benefited from the introduction of a number of new retailers, including Next, Jo Malone, and Bobbi Brown. New pop-up retailers during the year included Pandora, InStyler, Oakley, and Radley.

The airport saw continued growth in car park services, particularly from pre-book, meet and greet and valet products.

East Midlands Airport generated over £50 million of revenue, up +3.5% on last year with passenger numbers growing by +4.1% to 4.3 million. The group also completed the new £22 million Radisson Blu hotel at East Midlands Airport this year.

Trading conditions for Bournemouth Airport have been “particularly challenging over the past two years”, said the company, as airline operators have consolidated into larger airports.

But it said there were signs that market conditions are now strengthening and the airport is seeing positive indications that growth will return from both the full service scheduled and low cost sectors.

The group sold its 82.7% shareholding in Humberside Airport this month. The airport has been included as a “˜discontinuing operation’ in the 2012 results, and a one-off impairment loss of £15.6 million has been incurred relating to the write-down of the airport’s assets to the realisable value.

Group-wide, the improvement in revenue contributed to a strong increase in operating profit, before significant items, of £13.5 million to £65.5 million.

Manchester Airport Group Chief Executive Charlie Cornish said: “This year has been a period of transformation for M.A.G during which we have delivered strong performance against stretching targets in the context of tough global trading conditions for the aviation sector. It has been a great start on our journey towards becoming the premier airport services business.”

|