“We have the privilege of being a family-owned company so we always take a long-term approach to brand building, value creation and sustainability.”

For Puig Chief Operating Officer Javier Bach and other senior management at the fashion and beauty house, riding out the storms created by economic crisis, war and even global pandemics, and eyeing opportunity as it does so, is built into the company’s DNA after 106 years in business.

In June, as COVID-19 raged in many parts of the world, the company concluded a deal to acquire a majority stake in the Charlotte Tilbury luxury makeup and skincare brand – a signal of its willingness to invest in building its brand portfolio, and to continue pivoting to meet new consumer demand.

Bach tells The Moodie Davitt Report: “Many of our strategic decisions had been taken prior to COVID-19 and they are proving to be right in this new environment.

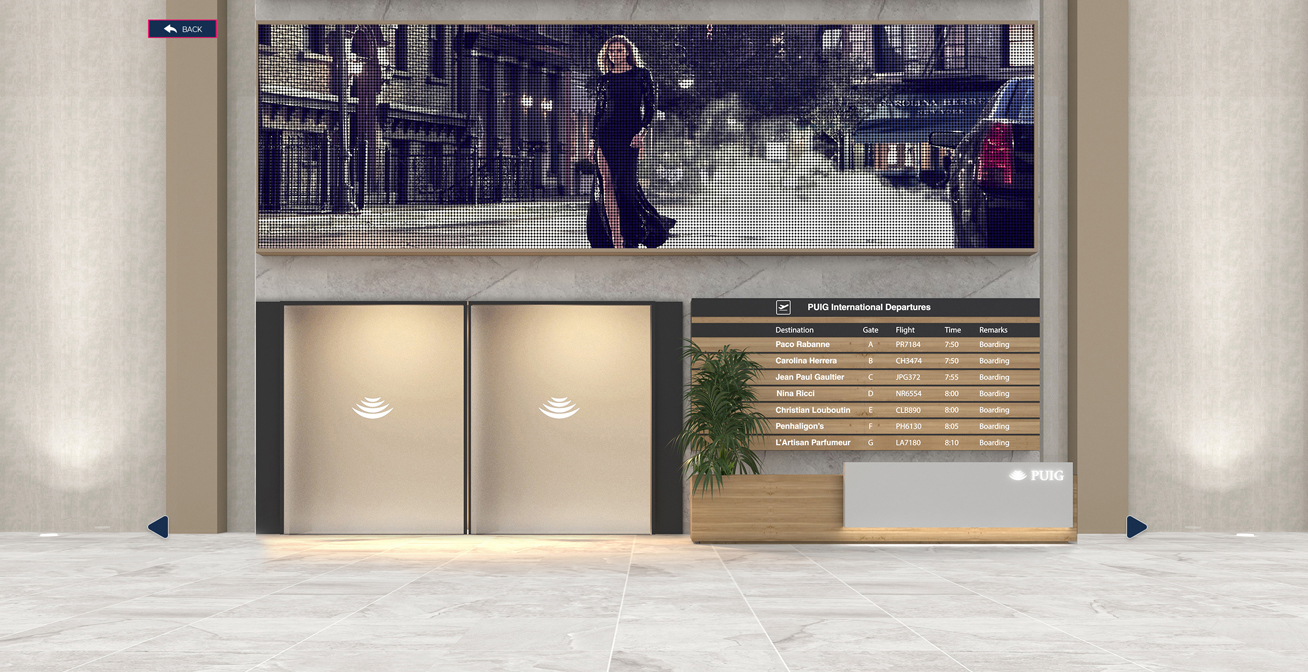

“We have consolidated our position in the fragrance industry, with brands like Paco Rabanne being top four worldwide, and Carolina Herrera and Jean Paul Gaultier having grown to top positions, gaining share year after year. This was reinforced also with the acquisition of Penhaligon’s and L’Artisan Parfumeur, strengthening our portfolio at the high end, which is developing very fast.

“Thanks to our consolidated position in fragrances we entered colour cosmetics and skincare. On the one hand with Christian Louboutin, which is developing very successfully and more recently with our participation in Charlotte Tilbury, which is a clear signal about our determination to develop unique brands in all axis: fragrances, colour and skincare.”

He says also that these moves are not just about expanding into new categories but about the business models behind them. That means “more direct to consumer, more digital, more Asia, which are areas and capabilities that provide both growth and resilience to our company”.

That focused but diversified approach helped push the company’s global sales past the €2 billion barrier for the first time in 2019. With such a broad brand offer, the identity of each must be appropriate, relevant and presented in a way that appeals to today’s consumer.

Bach says: “The ESG (environmental, social and corporate governance) agendas of companies and brands are very relevant in consumers’ eyes. For us, being a family owned company, these issues are extremely relevant. Another evolution is online. Consumers have higher expectations and this will force brands and retailers to evolve even faster. Also, consumers are increasing their expectations of retail experience.”

For travel retail, these dynamics mean that a redefinition of the sector is required, he says.

“We should see an increased focus on safety, sustainability, improved consumer experience both on- and offline and more channel-specific offerings.”

And these will come alongside other dynamics such as the importance of domestic travel in the long term, notably in China.

“The model needs to evolve to a more balanced one. Operators and brands need to be able to respond to increased consumer expectations. This requires a value structure that allows all parties to invest in a profitable way and sufficient time for the investments to return. Today we still see too much of a transactional approach which does not help fulfil what is required.”

How long the crisis lasts will also play into projections for recovery and how brands and retailers plan for the short and longer term.

“In travel retail specifically the question was how long this would last. We see most forecasts converging for a return to 2019 levels by 2023 or 2024. Moreover, the recovery will take place responding to different patterns. We see short-haul or domestic travel recovering first, then regional and international later. We also see different behaviour in business and leisure travel and also different passenger behaviours depending on their origin.

“We also expect a higher concentration and a different speed in bigger versus smaller airports. We are taking all of those factors into account when we are planning. In any case, we foresee a more gradual return to recovery than was first expected.”

While travel retail has struggled, Puig does not plan to reduce its commitment in the channel, insists Bach.

“When we think about the fundamentals, we are optimistic about the longer term in travel retail and our commitment to the channel is strong. Of course in the short term we have to be smart about how we allocate our resources and our investments among channels. In any case, we are closely monitoring what is happening in travel retail and we are working on the rebound with very clear bets.

“Many years ago we doubled down on travel retail being an early player establishing a Global Travel Retail Division. We have always seen the strategic relevance of this channel both for business and brand building. That continues to be our vision for the future and our key retail partners know they can count on us especially during this period. The challenge now will be managing the recovery together while transforming what travel retail stands for and this needs to be a joint effort.”

Telling brand stories in new ways will be part of that future, and indeed will be “mandatory” says Bach.

“You can do that in a COVID-free way. Our retail teams are trained to convey the messages in a new way and we have developed new protocols with all necessary safety requirements. Moreover, we have developed new technologies that allow shoppers test different fragrances in a touchless mode which is completely safe.

“Our research shows that people are willing to go back to the airport and back to the stores and are willing to be entertained. We have to be able to connect with them through the entire journey, before and after they reach the airports, and do that better than we did before.

“New regulations should take the above into account, otherwise the recovery might take even longer. We have seen some rulings that make no sense and that should be revised rather quickly.”

The industry has to be able to connect with travellers through the entire journey, and do that better than it did before. That also means deeper, more agile partnerships, Bach adds.

“We need to bring our partnerships to the next level since this is the only way to respond to increased consumer expectations. The industry has long ago defined the need to have the Trinity putting the consumer at the centre.

“This recovery requires a joint effort from all parties to be up to expectations. In that sense, our view is that the channel should not focus so much on price advantage but on the fact that it is a privileged platform for brands to express themselves and for consumers to enjoy the sense of place. This continues to be a huge opportunity. Our travel retail team is known for being able to reach new heights and we are working closely with our key partners in this transformational recovery.”

New kinds of partnerships, more equally weighted, he says, can help elevate the entire experience.

“The model needs to evolve to a more balanced one. Operators and brands need to be able to respond to the increased consumer expectations we just mentioned. This requires a value structure that allows all parties to invest in a profitable way and sufficient time for the investments to return. Today we still see too much of a transactional approach which does not help fulfil what is required. If that continues being the case, then there is a risk that other channels will win out.

“Take digital: for the fragrance industry this channel will soon represent close to 30% of sales. So what is your value proposition to consumers and how can you compete with online?”

The shift to digital has been playing out amid the crisis. Online has also helped compensate for some of travel retail’s losses, and even ensured the company had its “best ever” set of results in the US market in September.

That performance, a wider, more diversified offer and the experience of facing down crises over its 106-year history, means Puig faces the future with some uncertainty, but ultimately with belief.

Bach says: “Our brand portfolio is strong and unique, and it is also well balanced with global and regional brands. Moreover, our teams have developed the skills to connect with consumers in new ways, bringing our strengths in creativity and storytelling to the next level. This journey will continue and shall make our brands even stronger. We are very aware of the difficulties of the moment, but at the same time we feel very strong about our future and what we stand for.”

*Puig is a Platinum Partner at the pioneering Moodie Davitt Virtual Travel Retail Expo this week. Click here for more. Registered guests can access the Puig experience in the Beauty & Wellbeing Zone here.