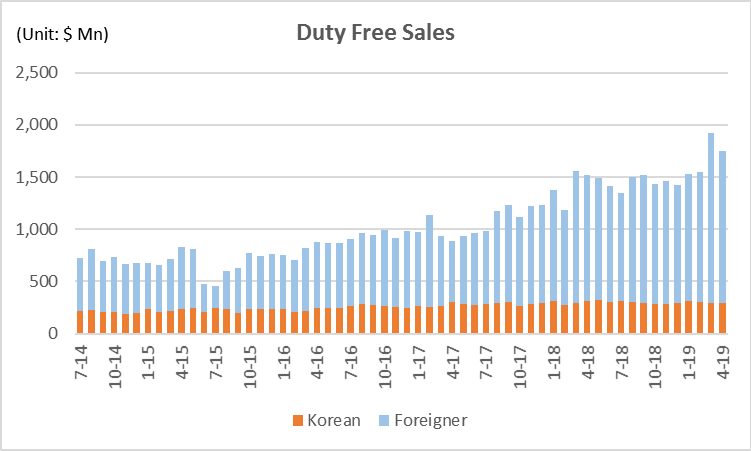

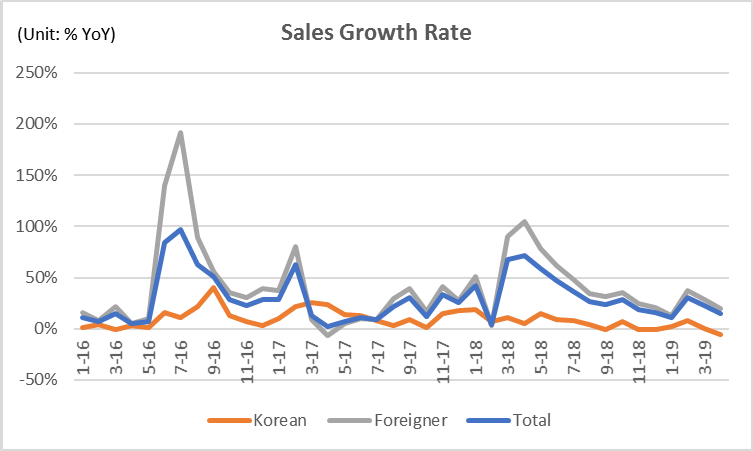

SOUTH KOREA. Duty free sales climbed by 14.7% year-on-year in April to US$1.7 billion, buoyed by overseas visitor traffic (up 20.1%) and spend per person (up 12.5%). April was the second highest grossing month ever for sales (behind only March 2019) and follows on from the strong increase in the first quarter of this year (21%).

Due to the Korean Won depreciating by almost 4% in April, the total market growth rate was higher in local currency, up 22.5%.

The growth rate alleviates previous concerns about gains compared to the high sales base from last year when the duty free business grew 104.9%, with industry experts suggesting daigou resellers are continuing to stock up to prepare for the 618 Shopping Festival in China.

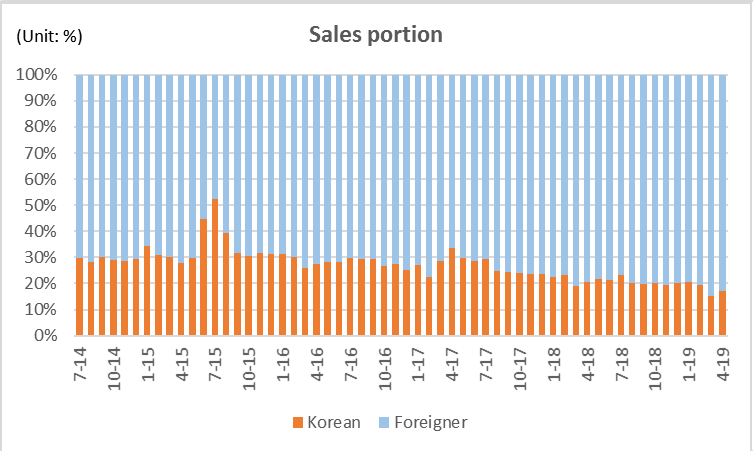

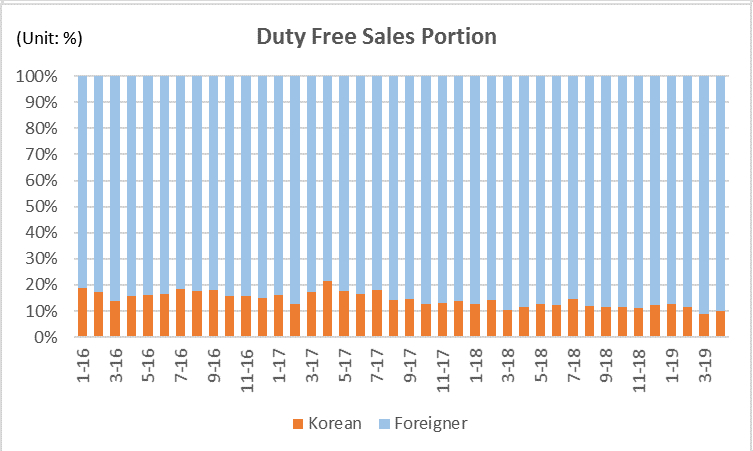

Sales growth could have been even higher but the extended Labor Day holiday in China saw many travellers, including daigou, on extended vacation, selling off inventory they had stocked up over recent months. Foreigners accounted for 83% of April duty free sales, up from last year’s 79%, with both traffic and spend per person increasing.

Koreans continue to spend less (spend per person was down 1%) and their traffic was down 5.1% year-on-year, with total sales to home nationals falling 6% year-on-year in the month.

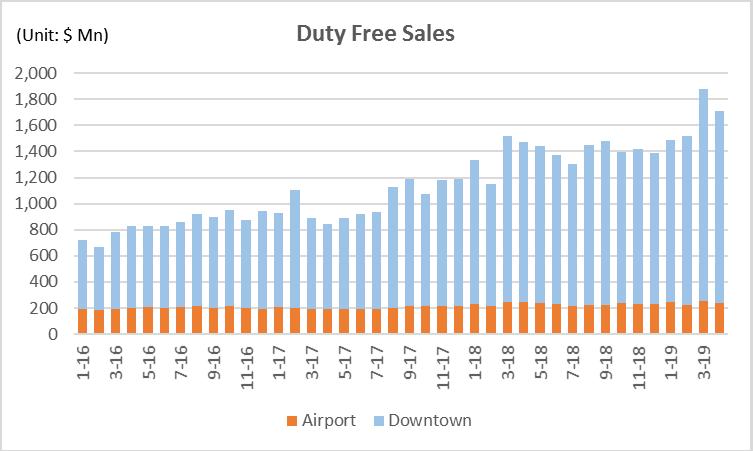

Sales to Koreans in downtown duty free rose 2.2% in April and has shown healthy growth levels since the start of the year (Q1 up 12.2%), but this contrasts with the 11.7% fall in airport duty free sales to Koreans.

Overall, downtown duty free sales surged by 19.5% compared to a fall of 2.8% at airports, with Koreans, who account for 45% of sales, less inclined to shop in airports, as noted above.

The Korean duty free market’s dependence on foreigners continues to increase with sales to foreigners accounting for 83% of the total market. The dependence on foreigners in downtown duty free is even higher at 90%. These statistics suggest one reason why duty free operators in the major stores in Korea often communicate in Chinese instead of local language.

Note (I): % of foreigners accounting for downtown duty free sales: 2015 (79.2%), 2016 (83.5%), 2017 (84.7%), 2018 (87.9%).

Note (II): % of Chinese accounting for downtown duty free sales: 2015 (68.3%), 2016 (77.3%), 2017 (79.1%), 2018 (83.7%).