ASIA PACIFIC. Pi Insight has announced the key findings from a new study it has conducted into the Asian duty free arrivals business.

The recently established research agency has conducted over 5,200 15-minute quantitative interviews with recent Asian arrivals shoppers, supported by qualitative interviews, to provide a detailed understanding of the channel across the liquor, beauty, confectionery and tobacco categories.

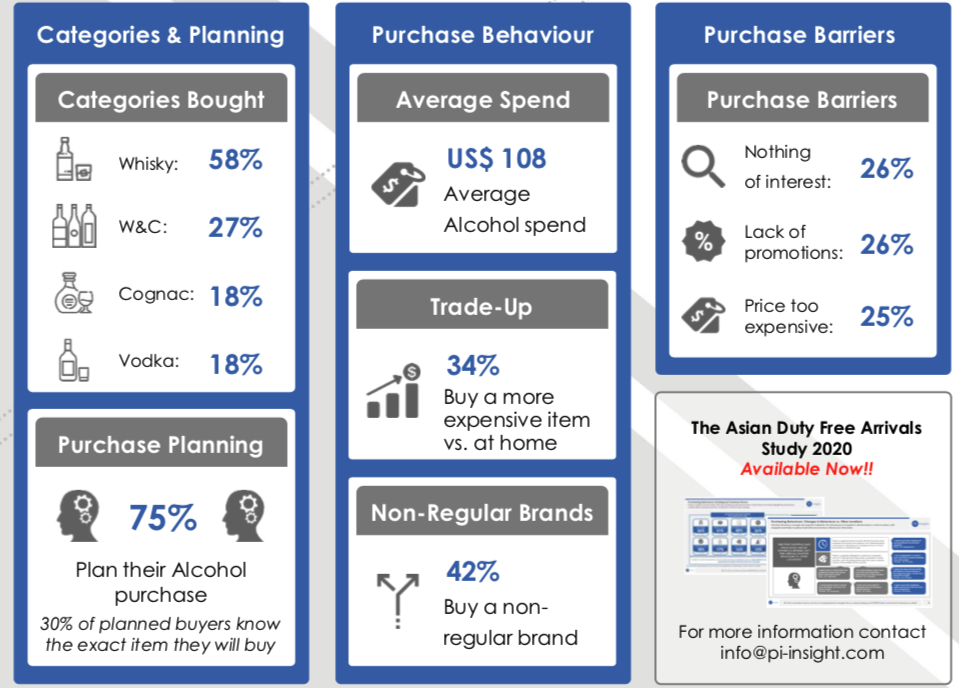

Pi Insight has first released its findings for the alcohol category through The Moodie Davitt Report. Whisky is by far the most purchased sub-category, the research agency found; it featured in 58% of purchases, wine/Champagne in 27%, Cognac/brandy in 18% and vodka in 18%. Pi Insight said this shows how whisky can be used to drive interest in other sub-categories.

Of the four categories researched by Pi Insight, alcohol has the second highest average spend level in Asian duty free arrivals at US$108, behind only beauty. The research agency added that 34% of shoppers traded up to a more expensive item than they would normally buy at home and 42% of customers purchased a non-regular brand, giving an opportunity to introduce shoppers to new brands and variants.

Much like the wider Asian arrivals business, a high number of customers plan to make an alcohol purchase; the research agency has reported that 75% of customers know they will make an alcohol purchase before entering the category. However, only 30% of those planning to purchase know the exact item they will buy.

Of those who browsed the alcohol category in arrivals but did not buy, not finding anything of interest (26%), a lack of attractive promotions (26%) and pricing (25%) were identified as the main purchase barriers, Pi Insight has said.

Stephen Hillam, former Research Director at Counter Intelligence Retail (CiR), who founded Pi Insight in 2019, said: “The Asian duty free arrivals alcohol category presents significant opportunities for both brands and retailers alike, with high levels of trade-up behaviour providing increased basket sizes compared to alternative purchase locations and shoppers being open to influence in-store. This lends to the clear potential for brand uptake and experimentation.

“However, clear barriers to purchasing also exist and stakeholders need to consider an exciting shopping experience underpinned by clear value if the Asian arrivals duty free alcohol opportunity is to be taken full advantage of.”

As well as the category-specific research, Pi Insight has released overall findings from the Asian arrivals study.

The study has found that 66% of visitors made a plan to visit arrivals duty free before reaching the airport. Pi Insight said this illustrates the potential to shape shopper behaviour through pre-trip communications.

The main visitor drivers, according to the study, are always visiting the duty free (identified by 43% of shop visitors), to take advantage of airport prices (identified by 42%) and to look for good deals (identified by 35%).

The primary purchase driver is that the item is of good quality, which was identified by 36% of shoppers. This shows the importance of driving perceptions of high quality, particularly with Indian and Chinese buyers, Pi Insight said.

Meanwhile, the main barriers for visiting the store were the passenger not needing anything (identified by 29%), not having time (27%) or visiting the departures duty free before the flight (21%).