US/SWEDEN. Mulitinational tobacco and smoke-free products company Philip Morris International (PMI) yesterday raised its buyout bid for Swedish Match.

Announcing its financial results yesterday, PMI said: “We believe the best and final price in our revised offer for Swedish Match, announced earlier today, provides very compelling value for both sets of shareholders. Should the offer fail, we are well prepared to proceed autonomously to develop IQOS and the rest of our smoke-free portfolio in the US.” (Click here for the full financial results release, summarised below).

Reuters described the increased US$15.7 billion bid it as a “last-ditch effort” to get backing for its offer from Swedish Match shareholders. Although PMI has raised its bid by more than +9% to SEK116 (US$10.22 at current exchange rates) per share, the news agency said some Swedish Match shareholders appear to be holding out for more.

Swedish Match, which has stepped up its presence strongly in the travel retail market over recent times, manufactures snus, nicotine pouches, moist snuff, tobacco- and nicotine-free pouch products, chewing tobacco, chew bags, tobacco bits, cigars, matches and lighters.

The company has operations in Sweden, Denmark, the USA, Dominican Republic, Brazil, the Netherlands, and the Philippines.

Their concern, according to the news agency, is that the total value of the new offer is little changed from the original bid due to the appreciation in the US currency against the Swedish krona.

Earlier this year, PMI made an all-cash offer of SEK106 per share for Swedish Match. Since then, the company has been under pressure to increase the offer as hedge funds have raised their stakes in Swedish Match in anticipation of a higher bid.

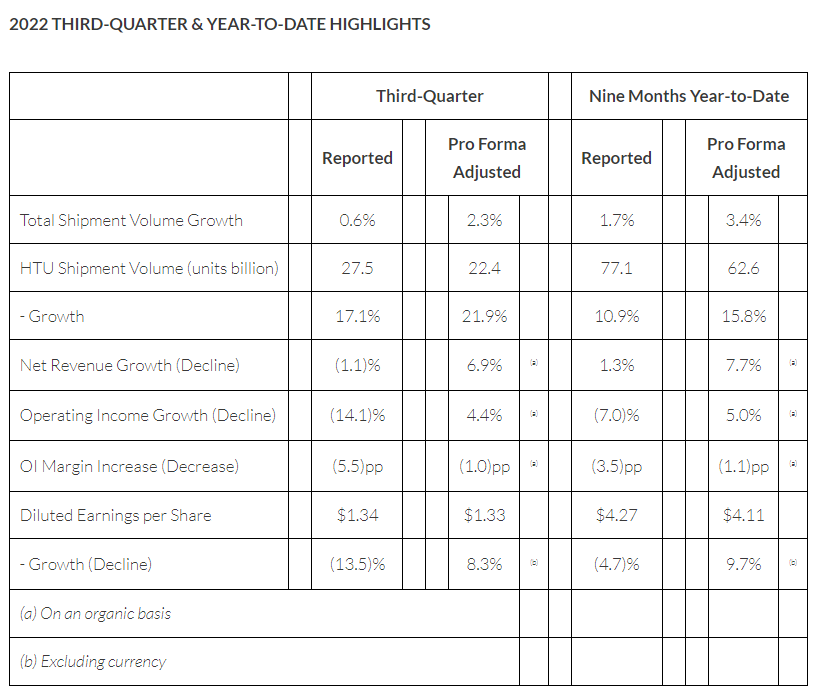

Reflecting on the latest financial results, PMI Chief Executive Officer Jacek Olczak said: “We delivered very strong performance in the third quarter, driving quarterly adjusted diluted EPS of US$1.53 per share despite pressures related to currency, the supply chain and inflation.

“IQOS’s excellent momentum continued in the quarter, with heated tobacco unit volume and share growth across all key geographies, driven in part by ILUMA’s strong performance in initial launch markets. This was complemented by the robust performance of our combustible tobacco portfolio, reflecting essentially stable shipment volume, encouraging international market share growth and accelerated pricing.

“As a result of our strong year-to-date performance, we are raising the low end of our full-year pro forma growth outlook for adjusted net revenues, resulting in a range of +6.5% to +8% on an organic basis, and continue to expect full-year pro forma adjusted diluted EPS growth of 10% to 12%, excluding currency.

“Importantly, our smoke-free transformation continues at a rapid pace, reinforcing our aim to become a majority smoke-free company by net revenues in 2025. Today’s exciting announcement regarding IQOS in the US [click here for full details] furthers this ambition, giving PMI full rights to commercialise IQOS in the largest smoke-free market globally as of April 30, 2024.”