|

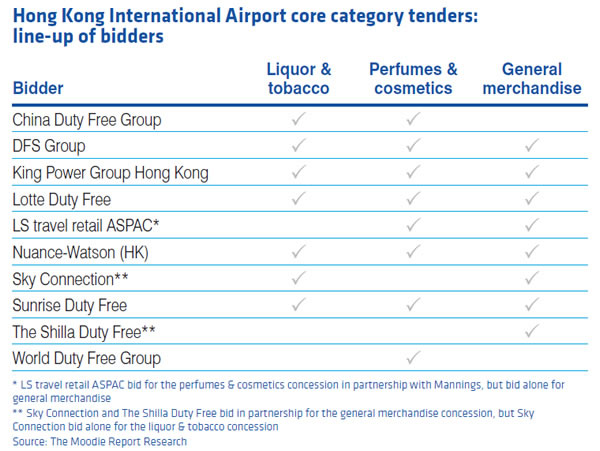

HONG KONG. In a stunning triumph, DFS is poised to be awarded all three core category concessions by Airport Authority Hong Kong after arguably the most hotly contested commercial tender in airport history, The Moodie Report can reliably reveal.

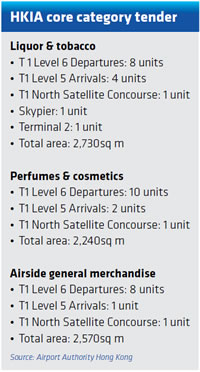

Airport Authority Hong Kong flatly declined all comment as did DFS but subject to final negotiations, DFS will become the new concessionaire for liquor & tobacco, replacing Sky Connection; and for perfumes & cosmetics and airside general merchandise, both currently held by Nuance-Watson (HK).

The result is a big blow for both incumbents, especially Nuance-Watson, which loses much of its retail footprint at HKIA. There will, rightly, be much industry sympathy for Nuance-Watson (HK) and Sky Connection, two excellent, much-respected retailers which have performed very strongly and innovatively at Hong Kong International Airport in recent years. For Sky Connection the news will have been partly offset by its recent successful retention of the key MTR Corporation railway duty free tender.

For DFS, the result is arguably as big as any contract gain in the retailer’s 52-year history. And the award has a poignant symmetry. For it is in Hong Kong (along with Hawaii) that the retailer’s airport retailing story began, when the company’s founders Bob Miller and Charles “˜Chuck’ Feeney were awarded (as Tourists International) the first duty free concession at the old Kai Tak Airport, where they began trading in 1962.

Based on 2010 sales the three businesses were worth a collective US$478 million, a figure that is certain to have grown significantly last year with a sharp rise in Chinese traffic in particular and overall passenger numbers (+5.9%) in general to 53.9 million.

In 2010, liquor & tobacco sales reached HK$1,553 million (US$200 million); perfumes & cosmetics were HK$1,320 million (US$170 million); and airside general merchandise HK$843 million (US$108 million). Given DFS’s expertise in key categories – notably luxury – and continued Chinese passenger growth those numbers are likely to be easily surpassed in coming years.

|

|

The three core category tenders represented the most hotly contested bid in industry history |

The company’s retailing expertise seems sure to have swayed Airport Authority Hong Kong, which will also have been impressed by DFS’s expertise and experience in selling to the Chinese consumer. DFS will also bring great synergies to play, thanks to its successful downtown Galleria business in Hong Kong.

DFS will have bid confidently but with a firm view on profitability and it appears that, in liquor & tobacco certainly and perhaps the other two bids, Airport Authority Hong Kong has rightly been swayed by qualitative and technical criteria rather than money alone. Despite misplaced criticism in some quarters over the long delay in awarding, the authority deserves congratulations for taking its time over such a crucial decision and for factoring in all aspects of the bid, not just the financials, in such a considered way.

To opt for a single company to run all three concessions is a very bold call. But it’s likely that Airport Authority Hong Kong believes that the critical mass this brings will result in enhanced revenues and a better final offer for the travelling consumer.

The perfume & cosmetics and airside general merchandise concessions are due to commence in August and liquor & tobacco will begin in November.

We’ll bring you full details soon and official confirmation as soon as we can.

NOTE: This week’s edition of The Moodie Report e-Zine will include a special cover story on this week’s news from Hong Kong International Airport.

[houseAd4]