SOUTH KOREA. Shinsegae DF Global*. Remember the name. The merged entity, formed on 5 June, has continued its impressive rise of recent years by being awarded two concessions at Incheon International Airport Terminal 1. [Look out for the next edition of the new-look Moodie Davitt e-Zine, which profiles one of Asia’s fastest-growing travel retailers.]

Shinsegae DF Global, South Korea’s third-largest player, headed off strong competition from The Shilla Duty Free in the final two-company showdown for the concessions vacated by Lotte Duty Free.

Shinsegae DF Global reacted with delighted to the dual success. “Shinsegae’s efforts to make Incheon International Airport the global travel destination and our combination of content, creation and capability contributed to the licences at Incheon international Airport,” a spokesperson told The Moodie Davitt Report. “As we grow and expand our duty free business we will take on more responsibility to lead the market.”

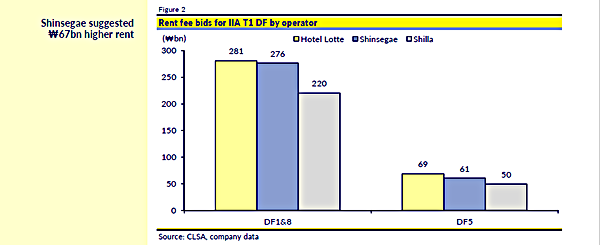

In a huge boost for the fast-growing travel retailer, Shinsegae outscored Shilla by 879.57 points to 815.60 out of a potential 1,000 for the perfumes & cosmetics concession (DF1). For the luxury boutique concession (DF5) it won by 880.08 points to 807.51.

“Without question, the most powerful factor in Shinsegae’s success was its intrepid financial offers”

The 1,000 point evaluation was based on Incheon International Airport Corporation’s 500 point rating and the same by Korea Customs Service’s panel of experts.

Shinsegae’s financial bid was the key differentiator between the two propositions. For its DF1 bid it scored 473.55 points out of the combined 500 on offer for the financial pledge (400) and business plan (100) to Shilla’s 397.10. For DF1 it won out by 433.82 to 373.13.

“Without question, the most powerful factor in Shinsegae’s success was its intrepid financial offers, encouraged by the big growth in sales and profit from the company’s Seoul downtown store and new Incheon T2 store,” commented a leading Korean travel retail executive, speaking on the grounds of anonymity. “I expect in two to three years that Shinsegae will catch up with Shilla in sales volume if they keep running at the current pace.”

REACTION ROUND-UP – MOODIE DAVITT RADAR

In the duty free industry, the bid upended a market long dominated by Lotte and Shilla. Shinsegae is a relative newcomer in the game, entering in 2012 after acquiring the duty free business of Paradise Hotel. – Korea Joongang Daily

“This is different from what we expected; we believed Shilla would win the DF1 concession and Shinsegae would win DF5. However, the KCS and IIAC awarded Shinsegae both concessions as it suggested a ₩67 billion (US$60 million) higher rent fee than Shilla.” – CLSA

The latest selection could be a game changer for the country’s duty free industry, currently led by the retail giant Lotte. – Yonhap News Agency

The rent may be a double-edged sword. Shinsegae, which has spent more than 60% more than the airport’s stipulated minimum bidding amount, has to pay huge rent. – KDF News

Once finalised, Shinsegae’s success means it is likely that there will be a change in the future industry landscape. – TRNDF.com

*About Shinsegae DF Global: Shinsegae Duty Free Global, which formally operated Shinsegae Duty Free Busan, Shinsegae Duty Free Incheon International Airport (Terminal 1), and Shinsegae Duty Free Busan Online, was merged with Shinsegae DF Global on 5 June. The purpose of the merger was to strengthen the competitiveness and efficiency of Shinsegae Duty Free Global’s business operations and provide better services for customers.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.

The Moodie Davitt Report will continue to bring you details on this important tender process as they are announced.