SOUTH KOREA. Lotte Duty Free’s flagship store in Myeong-dong, Seoul, maintained its position as the number one business in the South Korean duty free market – the world’s biggest – last year, posting sales of just under US$2.8 billion. Almost 82% of sales were made to foreign shoppers. That’s according to new figures from the Korean Duty Free Association [look out for a full analysis of the results in tomorrow’s edition of The Moodie Davitt e-Zine]

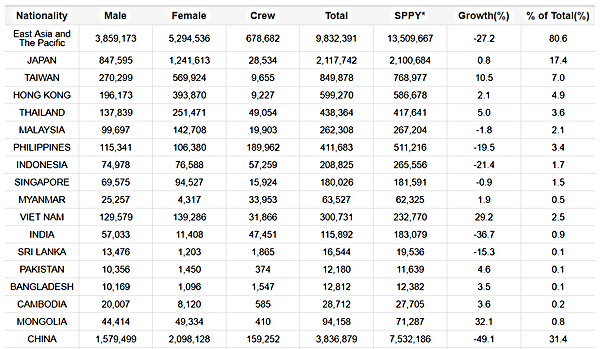

That result, up +2.4% year-on-year, came despite the political crisis between South Korea and China over the former’s deployment of US anti-missile system THAAD. The dispute drove a -49.1% slump in Chinese visitors during the first 11 months of 2017.

As reported, the whole Korean duty free channel (excluding Korean Air, which, as revealed by The Moodie Davitt Report, recorded sales of just over US$150 million and Asiana Airlines) rose by +20.7% year-on-year to US$12.8 billion. Lotte Duty Free’s total business reached almost US$5.4 billion.

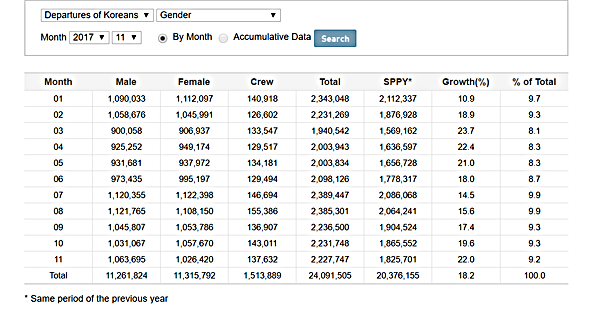

Given the collapse of the all-important Chinese tourism sector, the broadly positive top-line results underline the two key dynamics of Korean travel retail in 2017 – the soaring (some would say out of control) daigou (shuttle trader) market and the strength of the South Korean spend.

What the numbers don’t show is the intense squeeze on profitability that retailers faced, confronted by a dangerous combination of intensifying competition, onerous airport concession fees and soaring travel agency commission rates.

The Shilla Duty Free’s flagship Seoul store was the next most successful downtown business, generating sales of just under US$1.9 billion, up +25.2% year-on-year. Almost 82% of sales were to foreigners.

Lotte’s much more modest increase was almost certainly related to the fact that it bore the brunt of the THAAD backlash from China, having agreed to site the anti-missile system on company land.

Shinsegae Duty Free came in third among downtown duty free retailers, its Seoul store posting revenues of just under US$1.2 billion, up +293% (it only opened in May 2016, hence the distorted comparison). Nearly 88% of sales were to foreign shoppers.

HDC Shilla (which soft opened in December 2015 before its official opening in March 2016) ranked fourth with sales of around US$738 million, a gain of +113.54%. Next was Shilla’s Jeju downtown store, which posted revenues of almost US$512 million, up +12.9%. Lotte World Tower, which reopened on January 5, posted sales of US$507.4 million. The store had been closed since 26 June 2016 due to the controversial loss of its licence in a competitive tender.

Lotte Jeju Duty Free recorded sales of US$422.5 million, down by -0.24%. Historically, that business has been overwhelmingly dominated by Chinese shoppers. Mainland visitors to the island slumped last year, though sales held up, suggesting that daigou business offset what would have otherwise been a huge shortfall.

In Seoul, Doota Duty Free posted revenues of over US$393 million, up by +305% (due to the retailer only having opened on 20 May in the comparison year of 2016).

Another sector newcomer (since July 2015), Galleria Duty Free, posted an intriguing +50.77% increase to US$293.1 million, despite almost 93% of its sales being to foreigners. Dongwha Duty Free’s sales fell by -9.6% to around US$277 million, while Lotte Duty Free Coex, almost 76% dependent on foreign shoppers, saw a -43% slippage to US$190 million.

In Busan, Lotte Duty Free was the leading player with sales of US$288.2 million, down -3.7%. Shinsegae Duty Free also posted a decline (-18.6%) to US$237.7 million.

Total downtown duty free sales reached over US$9.8 billion, up +27.8%, with foreigners generating 84.65% of revenue and Koreans 15.35%.

Airport sales growth modest

The airport business was considerably more muted, with sales growing by just +1.69% to US$2.44 billion. As Incheon International Airport noted recently, the mix of the business is very different to that of downtown retailers, with Koreans generating the majority (53.9%) of sales.

Lotte Duty Free’s Incheon business was the most powerful in the airport channel with sales of just over US$991 million, flat at +0.23%, comprising roughly equal sales to Koreans (51.3%) and foreigners. The Shilla Duty Free posted US$660 million in sales at Incheon, up +9.62% on a similar mix. Shinsegae’s sales reached almost US$190 million, ahead by +9.4% with Koreans generating over 64% of revenue.

Lotte Duty Free achieved sales of US$106 million at Busan Gimhae Airport, broadly in line with its full-year projections of US$100 million when it assumed the contract on 1 September 2016. Sales of Gimhae’s other retailer, Dufry ThomasJulie were not revealed but are believed to have been up by around +10%.

Of the offshore (domestic) duty free businesses on Jeju Island, the biggest was JDC Jeju Airport Duty Free with sales of US$474.7 million, an increase of +3.5%.