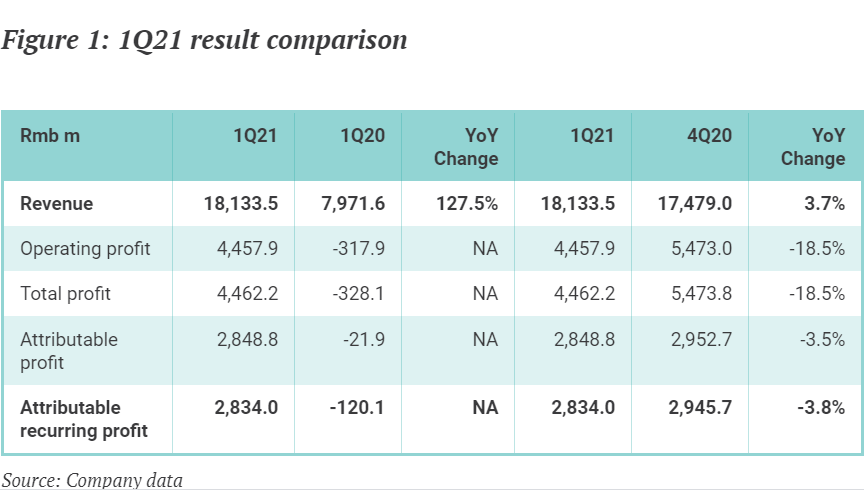

CHINA. China Duty Free Group (CDFG) parent company China Tourism Group Duty Free Corp (CTG Duty Free) yesterday unveiled its first-quarter 2021 preliminary results, saying that it expects Q1 net profit of RMB2.85 billion (US$435.8 million) compared with a RMB120 million (US$18.3 million) loss in 1Q20.

Revenue surged +127.5% over the COVID-hit same period last year to RMB18.1 billion (US$2.8 billion), driven by the enhanced duty free shopping policy introduced in Hainan last July.

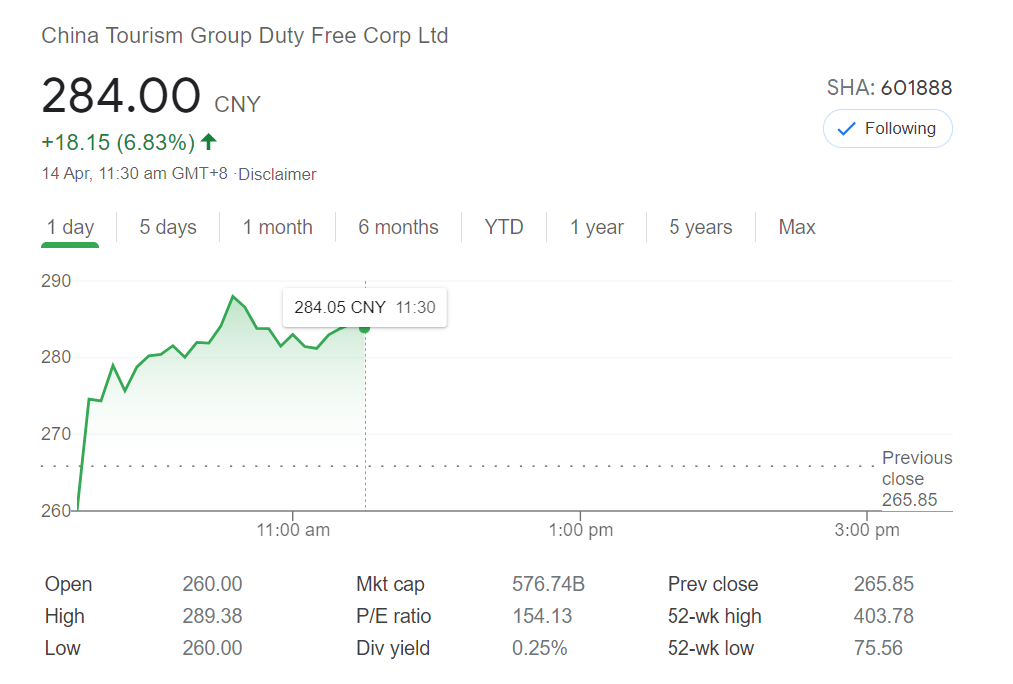

Markets and analysts reacted positively to the news. After a sharp -10% fall yesterday (see comments below), CDF Duty Free’s share price rose +6.83% in early trading today (see charts) and maintained their progress through the day.

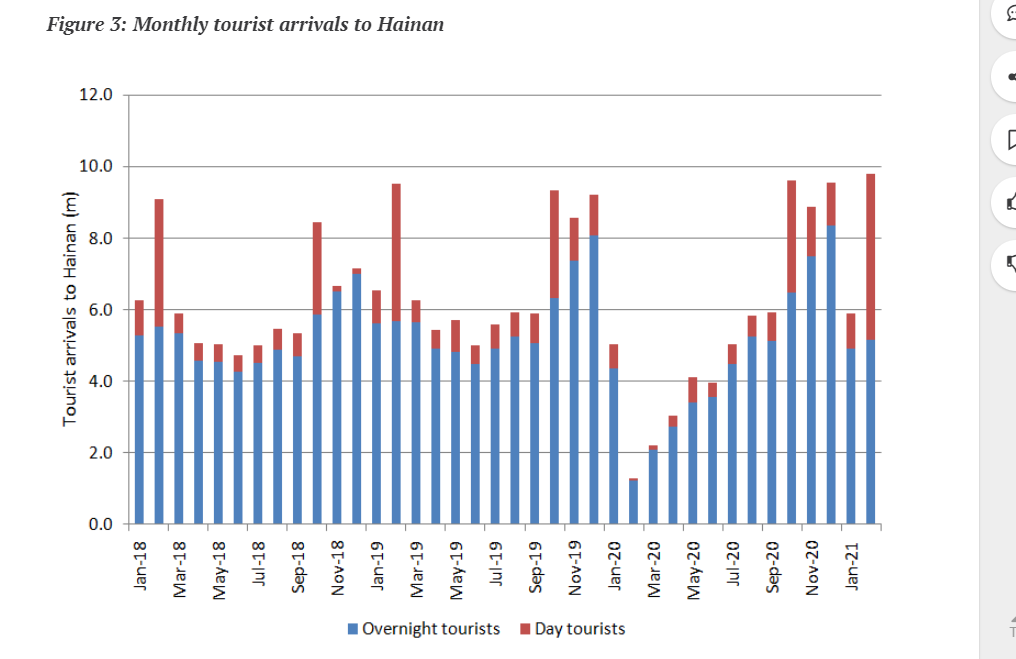

Quoting the Customs and Statistical Department, Goldman Sachs reported that Hainan’s overall market duty free sales grew +22% quarter-on-quarter in Q1 to RMB13.9 billion (US$2.13 billion).

The company estimated that CTG Duty Free still captured over 90% of market share on Hainan in the quarter despite the flurry of new competitors introduced in late December and early January. It said that CTG Duty Free posted a +329% revenue increase year-on-year in Hainan to RMB12.8 billion (US$1.96 billon), a rise of +12% quarter-on-quarter.

Goldman Sachs said that it was not overly concerned about the near-term impact of heightened competition or rival discounting on CDG Duty Free’s profitability given its much greater product and brand variety and prime store locations.

“CTGDF carries lot more SKUs and product variety,” Goldman Sachs said. “Take cosmetic and beauty products as examples, CTG Duty Free sells over 7,000 items, vs. 300-400 for other stores. The company does not have to offer the same degree of pricing discount for all items to stay competitive.”

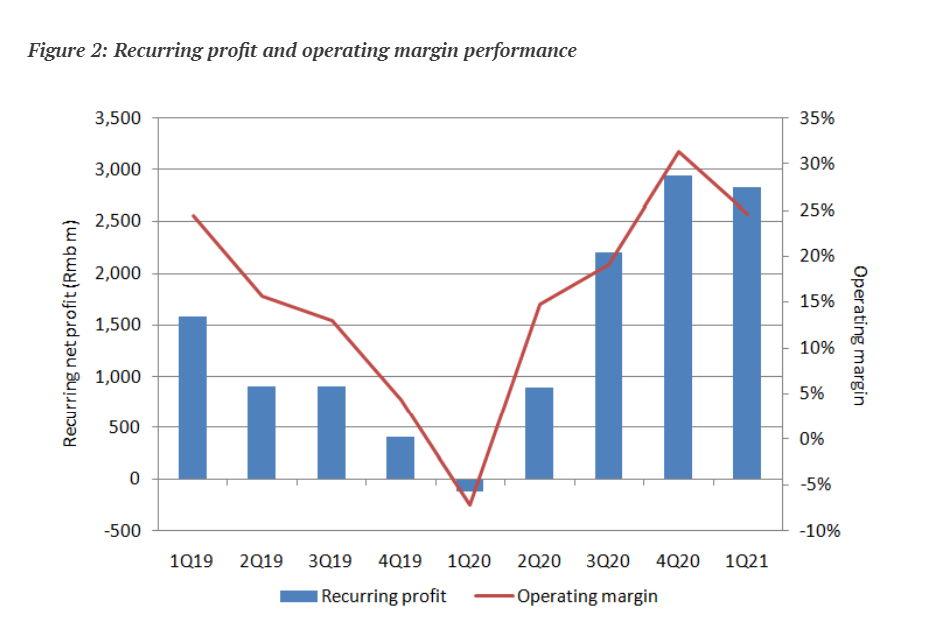

Consensus forecast now points to a FY profit of RMB11.5 billion (US$1,758,194,750) according to Analyst/Insight Provider, Osbert Tang who publishes on Smartkarma. He said: “This means that 1Q21 profit equals to 24.8% of this full-year projection. We consider the result as reasonably solid, especially given the local COVID-19 outbreak in January 2021 which led to local governments’ recommendations for no-cross province travels and Chinese New Year celebrations.”

Smartkarma estimated that first-quarter tourist arrivals to Hainan were down by -10% quarter-on-quarter (March 2021 figures are not available yet). “This shows that the company is still doing decently with a +3.7% QoQ increase in revenue despite a larger drop in tourist numbers.”

Commenting on the sharp dip in CTG Duty Free’s share price yesterday before the preliminary results were unveiled, Smartkarma said, “The share price of CTG Duty Free was off 10% yesterday before the earnings announcement, with various concerns including border-opening in Hong Kong, anti-trust risk and clamp down of the duty free grey market, among others. We, however, think that fundamentals stay solid and these concerns are overplayed. With share price already fallen by 34% from the peak, value starts to emerge for this duty free leader in China, in our view.”

“Although Mainland visitors to Hong Kong will not be required to undergo quarantine (provide that they have a negative COVID-19 test result) in mid-May, there is no news from the Mainland that mandatory quarantine requirement on their return will be lifted. Until this happens, we still see Hong Kong as unattractive to Mainland visitors.

“As for rising competition, the introduction of more players into the duty free market has been an ongoing process. Also, given that its parent, China Tourism Group, is one of the centrally owned SOEs, it is unlikely that CTG Duty Free will face anti-trust measures similar to the internet and ecommerce giants. Lastly, we are positive towards 2Q21 market demand as pent-up demand is released in the Labour Day holiday since travel appetite has been restrained during the CNY vacation.

“We believe concerns on sales diversion and domestic competition are overplayed. We are positive on the release in pent-up demand in 2Q21,” the independent investment research network concluded.

Goldman Sachs reached a similar conclusion, believing that the recent sharp decline in CTG Duty Free’s share price (off by 20-25% since reaching an all-time high in mid-February) may be driven by forced selling by certain funds rather than being explained by fundamentals.

Goldman Sachs said the recent price correction creates a good buying opportunity for the stock. “For CTG Duty Free, we believe government policies will remain supportive to China’s duty-free market by further repatriating overseas consumption back onshore, e.g., policy relaxation allowing Hainan’s local residents to purchase foreign-imported daily necessity products tax-free.”

Although the peak November-March shopping season in Hainan is over, Goldman Sachs said it did not foresee a sharp decline in duty free sales in the second quarter, due to the positive impact of the China International Consumer Products Expo (7-10 May) coupled with gradual resumption of domestic travel from a low base.