CHINA. Mainland China’s offline retail market should bounce back to pre-pandemic levels by June if the recovery trend continues at the current pace, according to a new report by offline behavioural technology company Cosmose AI.

The report, based on data gathered from 360,000 stores, also suggested that the recovery of airport duty free will be slower than that of domestic retail as other countries struggle with the COVID-19 outbreak and international travel remains limited.

In its report, Cosmose AI analysed offline retail traffic, including more than 600 luxury and beauty brands in major shopping malls in Mainland China, Hong Kong and Macau.

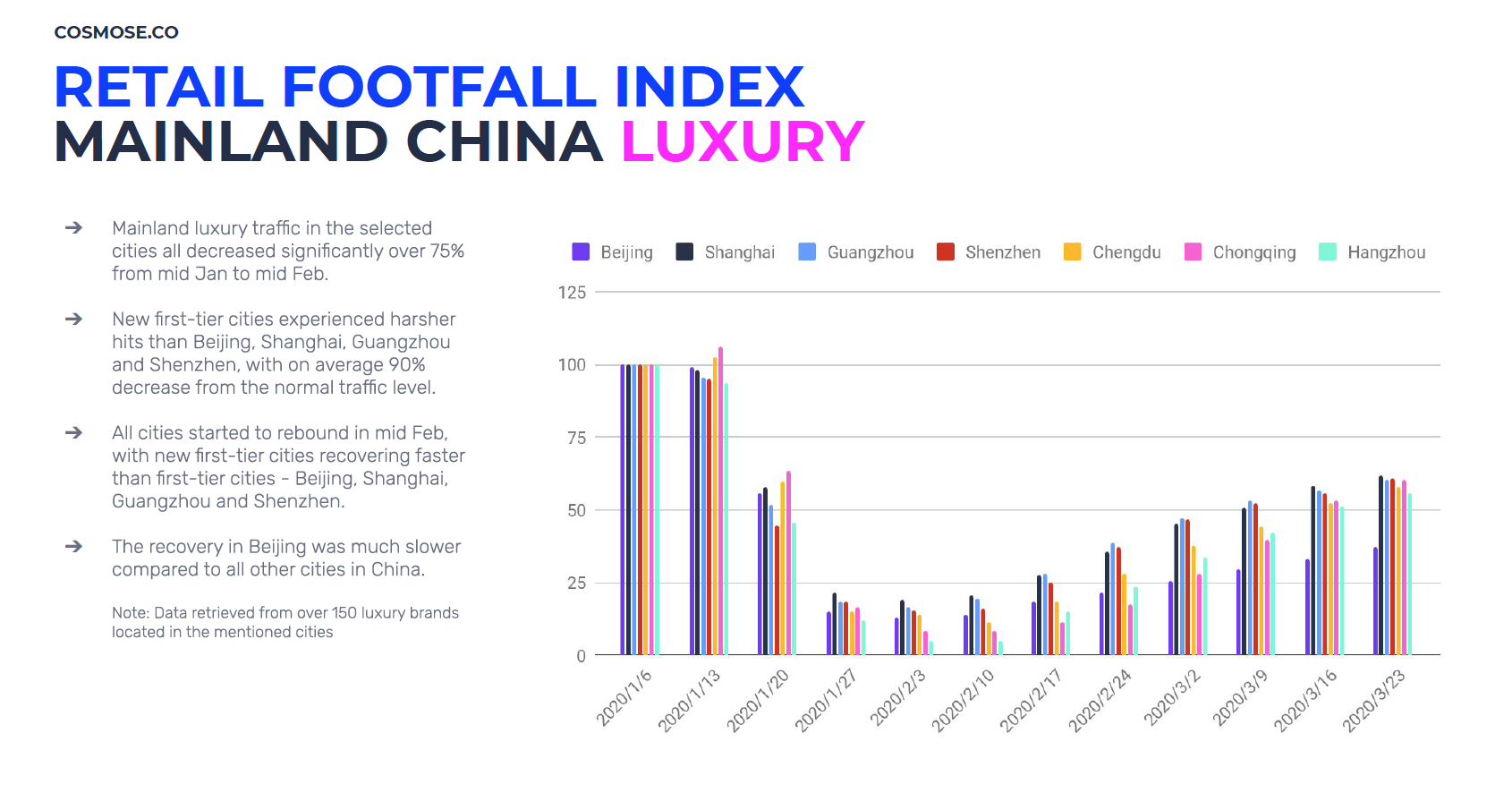

It found that, while retail traffic in Mainland China suffered a downturn from mid-January, the rebound started a month later.

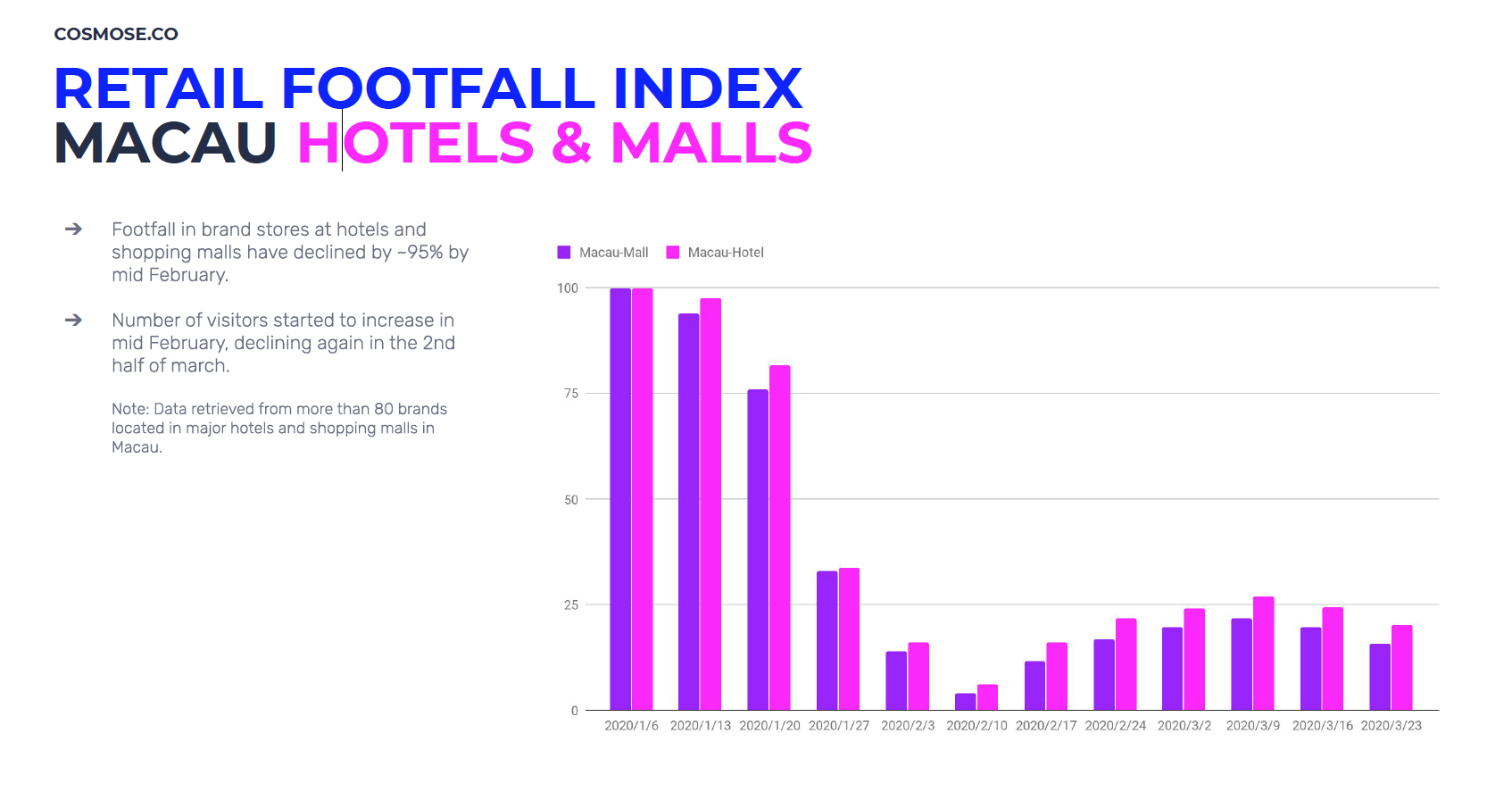

The report points out that Macau hotels and malls, which were hit heavily by declining visitors from Mainland China because of the pandemic, will recover relatively quickly thanks to returning Chinese consumers. Macau is reopening schools in May, and Mainland travellers are expected to return in early H2.

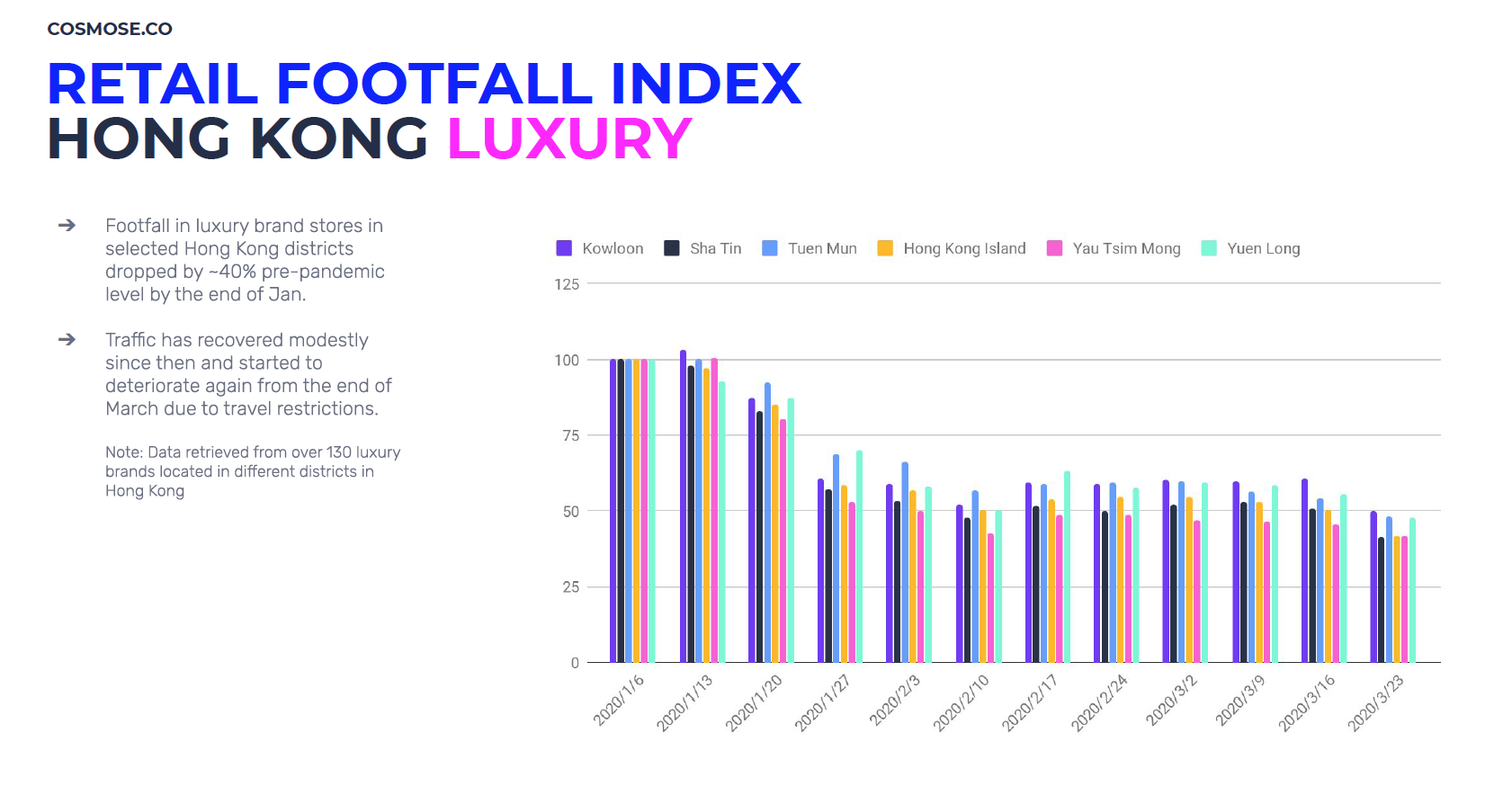

Meanwhile, the report finds that footfall in luxury brand stores in selected Hong Kong districts dropped by -40% against pre-pandemic levels by the end of January. Cosmose AI notes that traffic has recovered modestly since then but started to deteriorate from the end of March due to travel restrictions.

Other findings include that beauty stores are recovering faster than luxury boutiques, and, while new first-tier cities such as Hangzhou, Chengdu and Chonquing were more sensitive to changes during the outbreak, they recovered faster than longer established Tier 1 cities such as Beijing, Shanghai, Shenzhen and Guangzhou.

Cosmose AI urges brands to pay attention to the growing shopping appetite of consumers in these new first-tier cities.

The data also shows that luxury and beauty retail traffic was at least 60% of pre-pandemic levels by the end of March for all selected cities apart from Beijing.