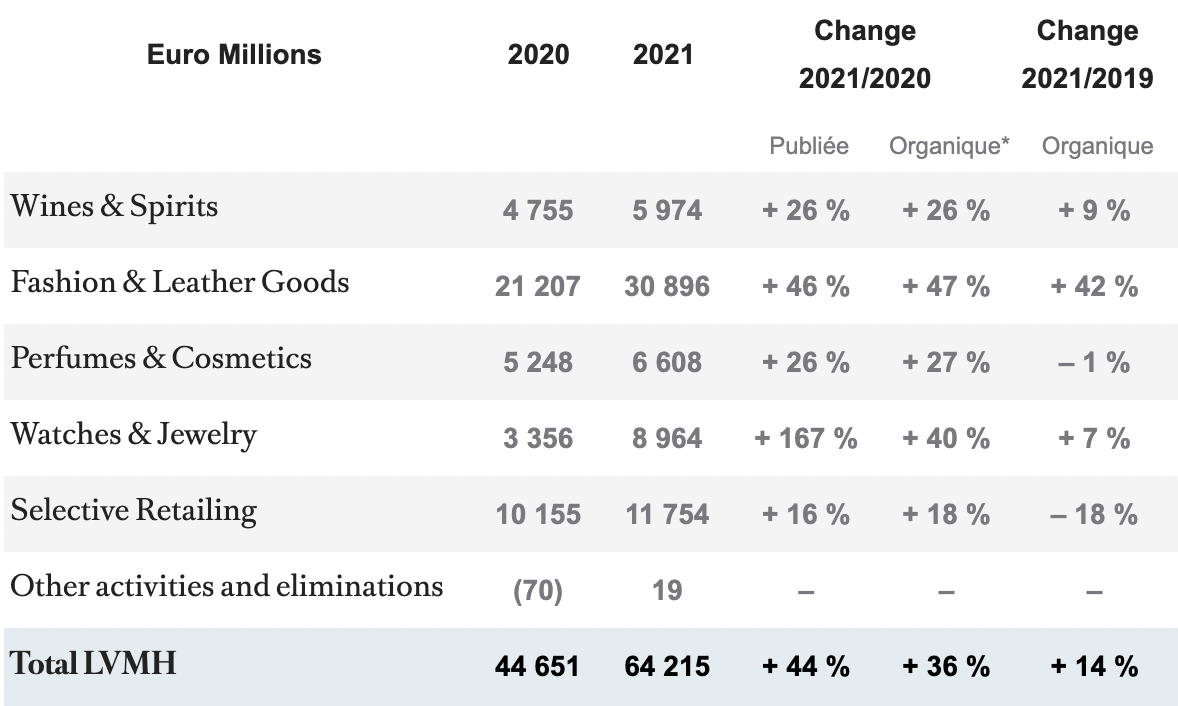

INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton posted record revenue of €64.2 billion in 2021, a leap of +44% year-on-year and up +20% compared to 2019.

Organic revenue growth climbed by +36% compared to 2020 and rose +14% compared to 2019. The performance for the year, said the company, “confirms a return to strong growth momentum following the severe disruption to the first half of 2020 resulting from the global pandemic”.

Profit from recurring operations stood at €17,151 million for 2021, more than double 2020 levels, and up +49% compared to 2019. Operating margin reached 26.7%, up 8 points compared to 2020 and 5 points compared to 2019.

Group share of net profit amounted to €12,036 million, up +156% compared to 2020 and +68% compared to 2019. Operating free cash flow, which exceeded €13 billion, was more than twice that of both 2020 and 2019.

In Selective Retailing, DFS continues to be affected by the limited recovery in international travel, noted the group. Organic revenue was up +18% in the division compared to 2020 and down -18% compared to 2019 “due to the impact of travel retail” though profit from recurring operations was back in positive territory in 2021.

LVMH stated: “The health crisis continued to weigh on the activities of DFS due to the persistent weakness in the numbers of travellers. The T Gallerias in Macau nevertheless performed well thanks to growing demand from local customers and DFS launched operations in Hainan. La Samaritaine, which reopened in Paris in June after an ambitious renovation, saw an encouraging level of customer traffic.”

The Wines & Spirits business group recorded organic revenue growth of +26% in 2021 compared to 2020 and +9% compared to 2019. Profit from recurring operations was up +34% compared to 2020.

Champagne volumes were up compared to 2019. Growth was particularly strong in the US and Europe, which benefited from the reopening of restaurants and the gradual recovery in regional tourism. The year marked the integration, from the third quarter onwards, of the Champagne house Armand de Brignac, in which LVMH holds a 50% stake. Hennessy Cognac performed well with an increase in volumes compared to 2019, despite supply constraints. China and the US experienced a strong rebound.

The Fashion & Leather Goods business group recorded organic revenue growth of +47% in 2021 compared to 2020 and +42% compared to 2019. With organic revenue growth of +51% compared to 2019, the fourth quarter showed a sharp rise compared to previous quarters. Profit from recurring operations was up +79% compared to 2020 and +75% compared to 2019.

The Perfumes & Cosmetics business group recorded organic revenue growth of +27% in 2021 compared to 2020. Organic revenue was stable compared to 2019. Profit from recurring operations was nearly nine times higher than 2020 and returned to 2019 levels.

LVMH noted: “In an environment marked by a limited recovery in international travel and the closure of many points of sale over a period of several months, LVMH’s major brands chose to maintain a policy of selective distribution, limiting promotions and growing online sales on their own website.”

Christian Dior benefited from the growth of of Miss Dior and Sauvage. The latter became the highest selling fragrance in the world (women’s and men’s lines included) which is a worldwide first for a male fragrance. Guerlain recorded “excellent performance”, driven by its Abeille Royale and Orchidée Impériale skincare lines.

The Watches & Jewelry business group recorded revenue growth of +167% in 2021 compared to 2020 thanks to Tiffany, consolidated for the first time. Profit from recurring operations was almost six times higher than in 2020 and up +128% compared to 2019.

Over its first year in the group, Tiffany posted record performance in terms of revenue, profits and cash flow. High-end jewellery sales in particular reached an all-time high. LVMH singled out the performance of and key launches at Bvlgari, Chaumet, TAG Heuer, Hublot, Fred and Zenith.

LVMH Chairman and CEO Bernard Arnault said: “LVMH enjoyed a remarkable performance in 2021 against the backdrop of a gradual recovery from the health crisis.

“Despite the uncertainties that remain at the start of this new year, which continues to be disrupted by health concerns, we approach 2022 with confidence and are convinced that LVMH is in an excellent position to further strengthen its lead in the global luxury market.”