SOUTH KOREA. Hotel Lotte reported a 10% year-on-year increase in duty free revenue in the first quarter of 2019, to KRW1,396.5 billion (US$1.18 billion), with overseas revenue growing group-wide from a small base by 59.1%.

Group operating profit turned positive to KRW84.7 billion (US$71 million). Recovery continues following the crisis that endured after the group’s decision to cooperate with the South Korean government’s decision to deploy the US anti-missile system THAAD in early 2017.

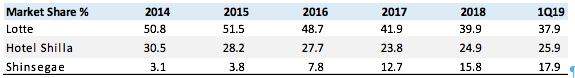

However, Lotte’s duty free performance underperformed compared to competitors Hotel Shilla and Shinsegae. Buoyed by growing sales from daigou and overseas stores, Hotel Shilla’s Q1 duty free sales grew 23% and Shinsegae’s new store additions (downtown in Gangnam and at Incheon International Airport) resulted in 107% sales growth. The performance of the three main players in South Korea’s duty free market over recent years sees Lotte losing market share in the face of its own contract decisions and aggressive competition (see table below).

Lotte’s decision to return three licences at Incheon T1 last year played a key role in lower sales growth and reduced share, though with higher operating profit due to the exit from these loss-making licences. Lotte is now behind its competitors in sales terms at Incheon International Terminal 2 (H1 2018 sales Lotte KRW86.5 billion, Shinsegae KRW93.9 billion, Hotel Shilla KRW138.6 billion).

Will Korea Customs revoke Lotte World Tower’s licence?

With new entrants eager to scale their duty free business and the government willing to support such a heated business environment by issuing new licences (as reported), Lotte Duty Free faces stern challenges. Crucially, it could have its duty free licence for Lotte World Tower stripped by Korea Customs Service (KCS) due to former President Park Geun-hye’s bribery scandal.

Lotte Duty Free World Tower is the only store among the duty free players in Gangnam to house all three key luxury brands Hermès, Louis Vuitton and Chanel. Commissioner Kim Yung-Moon commented in a recent interview that the licence could be revoked depending on the Supreme Court ruling on Lotte Chairman Shin Dongbin. The commissioner did, however, note that KCS will act with prudence as it affects the lives of over 1,400 Lotte employees.

Hotel Lotte IPO

The Korean media continues to speculate on the timing of Hotel Lotte’s IPO. According to local experts, the key to a successful listing on the Korean stock market will depend on Lotte scaling its overseas stores and maintaining the current growth rate in Korea, a point confirmed by Lotte Duty Free CEO Kap Lee in a recent interview with The Moodie Davitt Report (pictured right).

Lotte targets KRW1 trillion (US$850 million) in sales from overseas stores by 2020 and with the recent addition of the JR/Duty Free stores in Australia and a burgeoning Vietnamese business, the company expects to gross KRW700-800 billion (US$590-674 million) in sales from overseas stores this year.

At the Grand Opening ceremony for its Brisbane Airport stores, CEO Lee underlined the company’s ambition to become the world’s largest travel retailer. He said that becoming the leading operator in Oceania by 2023 would be a foothold to achieving this ambition.